Evaluating Your Credit Report: Why Accuracy and Detail Matter

Imagine you’re all geared up to buy the house of your dreams, but your credit report has a big, fat error smack dab in the middle of it—what a nightmare, right? Your credit report is your financial passport; any smudge, any incorrect entry can be the difference between those magical words “approved” or “declined”. It’s pretty much the mortgage lender’s go-to guide to decide if you’re as good as gold or if they’re going to give you a pass.

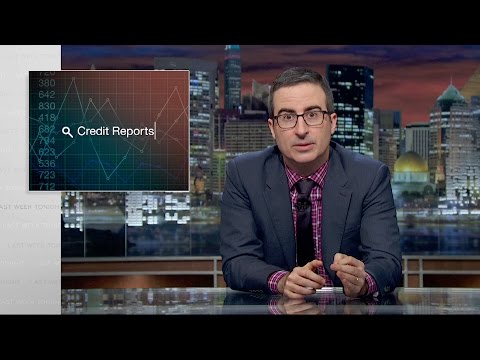

The stats aren’t super reassuring; reports suggest that a lot of us are strolling around with mistakes in our credit reports. Now, if you spot an inaccuracy and you get it fixed, that’s like buffing out a scratch on a shiny new car – it makes a whole lot of difference. Just think about it, fixing those errors can boost your credit score, which can quite literally save you thousands in interest – music to anyone’s ears!

So, let’s not mince words here: a sparkling clean credit report is your ticket to financial stability. Whether it’s a small blemish or a full-on error, rectifying it should be at the top of your to-do list. And with the law on your side, you get to peek at your credit report for free every year from the big three credit bureaus – Equifax, Experian, and TransUnion through AnnualCreditReport.com. Go ahead and take advantage of that, will you?

Comprehensive Reviews: Scrutinizing Credit Report Coverage

Credit reports come in all shapes and sizes. Some are as detailed as a meticulous autobiography, while others, not so much. It’s all about the what and how of credit report coverage, and believe me, the devil is in the details.

Let’s break it down: all three credit bureaus pull data like it’s no one’s business, but they might not all be singing the same tune. One might have exclusive info that the others don’t – there’s no “best” credit bureau, after all. Crunch time: you’re applying for a mortgage, your lender looks at your credit report and decides to play it cautious because there’s just not enough detail there. On the flip side, someone with a report as thick and detailed as a Barron Hilton ii biography might just sail through.

Ever read a case study that made you go “huh, so that’s how it works”? Much like discovering the intricacies of Gordon food services, a deep dive into credit report scenarios can be surprisingly enlightening. This understanding can, and does, sway lending decisions, so you want your report to be a veritable treasure trove of your financial journey.

| Category | Details |

|---|---|

| Definition | A credit report is a detailed record that outlines an individual’s credit history, including personal information, credit accounts, and payment behavior. It’s used by lenders to assess creditworthiness for loans, credit cards, mortgages, and sometimes employment. |

| Accessing Your Report | – Online: Visit AnnualCreditReport.com – Phone: Call (877) 322-8228 – Mail: Complete the Annual Credit Report Request form |

| Availability | Free annual report available from each bureau; weekly checks also free via AnnualCreditReport.com due to extended program. |

| Credit Bureaus | – Equifax – Experian – TransUnion None of the three is considered better than the others, and a lender might use reports from any or all of them. |

| Error Dispute | Contact each bureau separately to dispute errors, except for fraud alerts—one bureau will communicate the alert to the others. |

| Report Contents | – Personal information (name, address, social security number) – Credit accounts (types, age, payment history) – Credit inquiries – Public records (bankruptcies, foreclosures) – Credit score range (fair: 580-669, good: 670-739, very good: 740-799, excellent: 800+) |

| Uses | Credit reports are utilized for a variety of financial decisions, including applying for credit cards, mortgages, personal loans, or sometimes employment screening. |

| Cost | Accessing credit reports through the approved channels is free. There may be fees for additional services such as credit monitoring or obtaining credit reports more frequently. |

| Consumer Rights | Federal law entitles consumers to one free credit report every 12 months from each bureau, along with additional rights like placing fraud alerts and disputing inaccuracies. |

Timeliness in Your Credit Report: Updating Frequency and Its Significance

Ever played a game of telephone? The message starts out one thing and ends up completely different, right? Well, your credit report is a bit like that – it needs fresh updates, or it’s just old news. That’s why the updating frequency of your credit report matters a heck of a lot.

In a world that moves faster than super Mario Bros wonder levels, stale information on your report could be the bad guy that’s keeping your credit score lower than it deserves to be. But when your report is fresh as a daisy, with all the latest deeds of financial derring-do, that’s when you see your score soar—in a good way!

A study showed that folks who had their credit reports updated regularly saw their scores grow faster than Jack’s beanstalk. It’s like updating your social media; you wouldn’t want your profile to show you’re still into Lauv when your music taste has evolved, would you?

Credit Report Accessibility: Navigating User Interfaces and Support

Let’s face it, not everyone is tech-savvy. Accessing credit reports should be as easy as pie, not some Herculean task that’d take a leonardo Dicaprio dating history expert to navigate. If the interface is as cluttered as my teenage son’s room, we’ve got a problem.

Comparing user interfaces is telling. Some are sleek, efficient, and so user-friendly they could be your best friend. Others? Well, let’s just say they’re about as easy to fathom as rocket science. And when you hit a snag, good customer support can feel like a godsend. It’s as comforting as warm chocolate chip cookies straight out of the oven when you know there’s an actual, breathing human ready to leap to your aid.

Each reporting agency has its own style. Some have dashboards that are as intuitive as they come, while others could do with a little more heart – and clarity. The bottom line? It’s gotta be easy for everyone, from your 18-year-old sister to your 80-year-old grandma.

Privacy and Security Measures: Safeguarding Your Credit Report Data

Hold onto your hats, folks! We’re diving into the realm of privacy and security – the guardians of your financial fortress. In today’s digital era, where data breaches are more common than rain in London, the last thing you want is for your sensitive credit report info to be open season for all the hackers out there.

Financial institutions, they’re all about the latest and greatest in encryption and cybersecurity tools. These technologies are as cutting-edge as anything you’ll find in the security systems at Conforming Loan vaults. Cybersecurity mavens are the knights in shining armor of our times, consistently ensuring our data is sealed tighter than a drum.

A robust shield of privacy protocols and security measures is non-negotiable. We’re talking digital locks that’d challenge Houdini and surveillance that’d give Big Brother a run for his money. It’s all about keeping your credit report as secure as a secret agent’s briefcase.

The Impact of Analytical Tools and Resources on Credit Report Comprehension

Ever wish you had a decoder ring to make sense of your credit report? Well, you can hang up your detective hat because many reporting agencies are now offering tools that can do the deciphering for you. These are not just fancy bells and whistles; they’re the trusty sidekicks, the Construction Loan blueprints that help you understand and workshop your credit score until it’s in tip-top shape.

Imagine a world where your credit report isn’t some cryptic code but an open book you can read like a bedtime story. These analytical gizmos can turn you into a bit of a credit score guru, showing you how your financial habits shape your score. It’s like having a financial Contingency plan up your sleeve – a strategy to keep you on the straight and narrow credit path.

We’ve seen real people, like Joe from down the street, take a gander at his credit toolkit and not only do the math on his scores but also get actionable insights. It worked out so well for him, his credit score improved faster than a souped-up sports car.

Unveiling the Future Landscape of Credit Reporting

Predicting the future is a bit like trying to nail jelly to a wall – it’s slippery. But one thing’s crystal clear, the future of credit reporting is shaping up to be an almighty revolution. We’re talking about customization that’d make a tailored suit look off-the-rack and technology so shiny and new it would make sci-fi writers giddy.

Artificial intelligence isn’t just about robots that clean your floors; it’s poised to change the game of credit report analysis too. Imagine AI that can predict your credit behavior or suggest ways to embellish your credit score. And machine learning? That’s the smart cookie that’ll learn your patterns and offer advice like a personal credit whisperer – call it the personalized financial planner you never knew you needed.

Sure, there will be growing pains – hello, Skynet and HAL 9000 – but the potential for technology to make credit reporting smarter, faster, and more tailored to individual needs is as tantalizing as the last slice of pizza.

An Innovative Wrap-Up: Moving Forward with Your Credit Report Insights

Alright, let’s wrap this up with a bow on top. Your credit report isn’t just a piece of paper (or a string of pixels); it’s a snapshot of your financial soul. Understanding those five key elements – the detail, the coverage, the updates, the accessibility, and the security – is essential.

Get all chummy with your credit report. Check it yearly, fix the goofs, and use those nifty tools to steer it in the right direction. Knowledge is power – wield it like the financial maestro you can be. And keep an eagle eye on the horizon. The evolving credit report landscape is an exhilarating ride, and you’ve got a front-row seat, my friend.

So, there you have it. It’s the end of our credit report odyssey, but remember, this isn’t just about dry numbers and stale facts. It’s about empowering yourself to take control of your financial future, to make informed decisions, and to stride into that bank with the unshakeable confidence of someone who knows their credit report inside out. And hey, it might just be the difference between that sweet set of house keys and another year in your old digs. Happy house hunting!

Fun Trivia and Interesting Facts About Your Credit Report

Did you ever wonder about the nitty-gritty of your credit report? This little record of yours is like the report card for your financial history (remember those from school?), and boy, does it have some stories to tell! Let’s dig into some fascinating tidbits and must-know facts as we dissect what makes your credit report tick.

The Origin Story: A Blast from the Past

Okay, you might think a credit report seems like a dry topic, right? But hold on to your hats—this stuff dates back to the 1800s! That’s when the first credit reporting agencies took the stage, acting as financial gossip columns about whether Mr. Smith or Mrs. Jones were good for a loan. Imagine that!

The Magical Number: FICO Score Shenanigans

Now, everyone’s heard about credit scores, but did you know the granddaddy of them all, the FICO score, was created way back in 1989? Talk about a blast from the past! It’s like the OG of credit scoring, and lenders absolutely adore it. It’s almost like a secret club and your score’s the password to get in. Want to buy a house? “What’s your score?” Want a car? “Let’s see your score!” Want to start a business? You get the idea.

The Big Three: An Exclusive Club

Enter the arena of the Big Three credit bureaus—Experian, Equifax, and TransUnion. These folks are the gatekeepers of your credit history. And get this, they don’t always play nice! Sometimes, they have different info, so your score can do a little dance between them. Juggling your credit report among this trio can feel like a complicated relationship status on social media—it’s complicated!

“Peekaboo! I See You!”: Inquiries on Your Credit

You know how it feels when someone’s peeking over your shoulder? Well, every time a lender takes a gander at your credit report, it’s called a “hard inquiry”. Too many of those, and your credit score does the limbo—how low can it go? But hey, not all glances are equal. There’s also the “soft inquiry,” like when you check your own report. That one’s like a secret admirer—no harm, no foul.

Protect Your Castle: Guarding Against Identity Theft

Heads up! Did you know identity theft can give your credit report a black eye? As you’re sipping your morning coffee, some sneaky thief could be galivanting around town, opening accounts in your name. Don’t fret, there are ways to arm your financial fortress. Keeping an eagle eye on your report can help you spot these villains before they splurge on a tropical vacation with your hard-earned credit!

Life Happens: The Credit Reporting Time Capsule

And get this—negative info doesn’t stay on your report forever. Late payments, bankruptcies, they’re like bad haircuts; eventually, they grow out. Typically, the bad stuff falls off after about seven to ten years. So, if you’ve hit a financial snag, it’s not the end of the world. There’s a light at the end of the tunnel, and it’s shining on a cleaner credit report.

Speaking of fun facts, did you ever think about how your digital savvy can impact your credit report? In the modern maze of financial know-how, being on top of your game can save your bacon when it comes to that crucial credit snapshot. So, whether you’re a credit newbie or a seasoned money maestro, keep your eyes peeled on that report—it’s more interesting than you think! And hey, who doesn’t love climbing that credit score ladder all the way to the top?

How do I get my credit report for free?

Ah, diving into the world of credit can be quite the adventure, eh? Here’s the skinny on getting your credit report for free: Simply head on over to AnnualCreditReport.com. Yup, you can snag your report from each of the three major credit bureaus once a year at no charge. It’s like your credit’s annual check-up, and it doesn’t cost you a dime!

Are credit reports still free?

Is the rumor true? Can you still nab credit reports for free? You betcha! AnnualCreditReport.com remains your go-to spot for a free annual copy of your credit report from each of the three major credit bureaus. No strings attached, no hidden fees—just the good stuff.

Which credit report is best to request?

When it comes to choosing the best credit report, it’s like picking your favorite flavor of ice cream—there’s no one-size-fits-all. Each of the three major bureaus—Experian, Equifax, and TransUnion—may have slightly different info. For a full picture of your credit health, it’s wise to glance at all three.

Do you have to call all 3 credit bureaus?

Picking up the phone and calling all three credit bureaus? Not necessary! Conveniently, you can request your credit reports online at AnnualCreditReport.com. Bingo! Saves you from playing phone tag and gets you the info you need with just a few clicks.

Is AnnualCreditReport com a legitimate site?

Now, about AnnualCreditReport.com—legit or not? Drumroll, please… Yes, it’s the real deal! The site is authorized by federal law, making it the legit, official source for your free annual credit report. No worries, no scams, just the facts.

How can I get my credit report fast?

Craving your credit report in the fast lane? Hop online to AnnualCreditReport.com. If all your details are correct and you answer the security questions like a pro, you’ll get your report quicker than you can say ‘instant noodles.’

How can I check my credit score without hurting it?

Worried about checking your credit score taking a nosedive? Fear not! Using tools like Credit Karma or other free credit score services lets you peek at your score without doing a dance on your credit’s toes—meaning, it won’t hurt it. Phew!

Does getting a free credit report hurt your credit?

Talking about free credit reports, you might wonder if it’s like poking a bear—does it hurt your credit? Nah, checking your credit report is actually a soft inquiry, which is credit-speak for ‘no harm done.’ So, go ahead and check without a fret!

Is it safe to use Credit Karma?

Is Credit Karma safe? Mate, I know the name might sound like a new-age band, but it’s actually pretty safe for a quick credit score check and credit monitoring. Still, always good to be cautious with your personal info, you know?

Who has the best free credit report?

So, who’s the king of the castle in free credit reports? Well, AnnualCreditReport.com is the official source sponsored by the three big credit bureaus. They’ve got the royal seal of approval for supplying you with each of your reports annually, for zero bucks!

Which credit report do banks use most?

When it comes to the nitty-gritty of banking decisions, banks often use FICO scores pulled from all three bureaus. But they might play favorites with one, depending on their internal policies and the type of loan.

What is a good FICO score?

Good FICO score? Well, it’s like the grade on your financial report card. Scores above 670 are generally seen as ‘good,’ with 740 and above considered ‘very good’ to ‘excellent.’ Aim high, and you’ll have lenders rolling out the red carpet for you!

Who do I call about my credit score dropping?

Yikes! If your credit score took a nosedive and you’re scratching your head wondering why, you might want to touch base with the credit bureaus or peek at your recent credit report. If that doesn’t clear things up, a credit counselor can be your detective in shining armor.

Which credit report is free from the government?

Free credit reports from Uncle Sam? You got it! AnnualCreditReport.com offers you a report from each of the big three bureaus once every year, courtesy of the government. It’s like your annual financial check-up but without the cold stethoscope.

Is TransUnion free?

TransUnion free? Kind of! You can snag your TransUnion report for zilch once a year through AnnualCreditReport.com. If you want more frequent peeks or additional services, you might have to shell out some cash.

What is the best free credit report website?

Hunting for the best free credit report website? Many folks tip their hats to AnnualCreditReport.com. It’s the officially authorized site to pull your yearly free reports from each of the three major bureaus. Can’t beat that with a stick!

Can Credit Karma be trusted?

Trust in Credit Karma? Most folks can say aye, as it’s known for offering free credit scores and reports that are pretty on point. Just remember, it’s always smart to cross-check with official credit reports for the full picture.

Can I get a free credit report from Equifax?

Looking to snag a free credit report from Equifax? Roll on over to AnnualCreditReport.com, where you’re entitled to one free report from Equifax, plus the other two bureaus, every year. No wallet needed!

What is a good FICO score?

What’s a good FICO score? Deja vu! As mentioned, a FICO score over 670 is smiling at you, saying ‘I’m good,’ while something over 740 is giving you a high-five for ‘very good’ to ‘excellent’ credit status. Keep those numbers climbing!