I. Engaging Overview of State Taxes in Connecticut (CT)

Welcome to the world of Connecticut CT state income tax, where life can sometimes feel as complex as calculating the right foot size for your Badgley Mischka shoes! Before we dive in, however, it’s good to understand the context. Connecticut’s state income tax system is progressive, meaning higher earners pay a larger percentage in taxes. This aligns with many other states throughout the country that use similar formats.

II. Unveiling the CT State Income Tax

Now for the main act: the CT state income tax. What is it exactly? Simply put, it’s a designated percentage of your annual income that goes to support the state’s budget and public essentials, like education, infrastructure, and healthcare. The amount you owe yearly depends on your income bracket. Not fabulous with math? Not to worry! The CT income tax calculator can make estimating your dues a walk in the park.

III. Your Ticket to Exemption: Understanding the CT State Tax Exemption

Next stop on our tax tour: exemptions. There are certain groups who are exempt from CT state income tax. Yippee, right?! If your Connecticut adjusted gross income is equal to or less than the max exemption amount for your filing status, you owe zilch in Connecticut income tax. For single filers or those married filing separately, that magic number is $12,000. Best to check your personal exemption levels and CT tax rate to see if you qualify for this tax break.

IV. A Comparative Look: How Does the CT Tax Rate Compare?

Now, let’s pit Connecticut against its competitors. How does the CT tax rate stack up against other states? It’s a bit of a mixed bag. On one hand, CT’s graduated income tax, ranging from 3.00% to 6.99%, aligns closely with the national average. The standard 6.35% CT sales tax rate, with no local sales taxes, also sits comfortably within the norm, giving your budget just a little more room to breathe, similar to the spacious double wide manufactured Homes.

V. Light at the End of the Tunnel: Recent Changes to CT State Income Tax

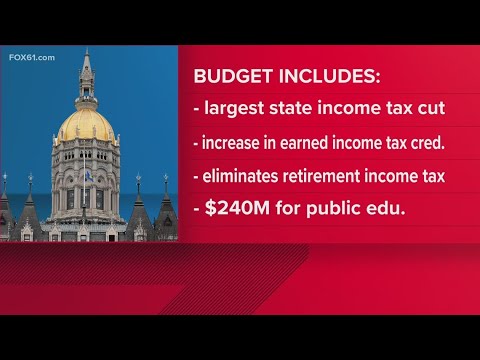

And for some good news! Recent changes to CT state income tax might just have you perking up. Did you hear about Governor Ned Lamont signing a state budget bill for the fiscal years 2024 and 2025? This includes some juicy tidbits, like the personal income tax cut, an extended corporate surcharge and making the pass-through entity tax optional. Not a bad start, eh?

VI. Insider Look: How to do Taxes for the First Time in Connecticut

Looking to navigate the tax maze for the first time in CT? Then you’re in the right place! Filing your CT state income tax might seem as complex as the maryland income tax, but with helpful tools like the CT income tax calculator, the process couldn’t be simpler. Here’s another tip: make sure to keep submission timelines in mind and file your taxes timely to avoid any penalty.

VII. The Lucky Nine: States Without Personal Income Tax

Ever wonder why some states seem to have more than average retired folks? It could be their sunny weather, but it’s likely their lack of personal income tax! A total of nine states, including Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming, don’t levy a state income tax. Keep in mind though, states like Washington still tax certain high earners via a capital gains tax.

VIII. Maximise your Refunds: 5 Easy Tricks

Let’s get those CT state income tax refunds! Here’s how:

1. File early: The early bird not only gets the worm, but also their tax refunds faster.

2. Use your CT income tax calculator: This magic tool can help you determine deductions and credits.

3. Report accurately: Any mistakes can slow down your refund process, so cross-check your data.

4. Opt for e-filing: Ditch the paper trail for a quicker, more secure filing method.

5. Direct deposit your refund: This method is faster and more secure than opting for a paper check.

IX. The Final Take: CT State Income Tax Made Clear

Like journeying to your dream double wide manufactured Homes, understanding and filing CT state income tax may seem daunting but once you’ve had your spin in the saddle, it’ll be a breeze! Remember, preparation is half the battle. Use helpful tools like the CT income tax calculator, remain proactive about legislative changes, and always compare with others, like the Oregon tax Brackets or Tax calculator Illinois, to ensure you’re ahead of the curve. Here’s to making CT state income tax filing an enjoyable, informative, and stress-free experience.