As a compass for navigating the vast sea of financial decisions, the current 30 year fixed mortgage rates are akin to a beacon in the dark, guiding potential homeowners and investors towards secure financial shores. Recently, these rates have taken a dip, sparking conversations and predictions about the future landscape of the housing market. In this comprehensive exploration, we’ll dive deep into this topic, offering education, advice, and a speculative glance into what the coming months and years may hold.

Understanding Current 30 Year Fixed Mortgage Rates

First things first, let’s break down what a 30 year fixed mortgage rate is. This is the interest rate you’ll pay on a mortgage loan for a term of 30 years, and it won’t change during that period, no matter how the market ebbs and flows. It’s a promise of stability in an otherwise unpredictable financial world.

Taking a step back, the past decade has seen its fair share of turbulence in mortgage rates. We’ve played witness to the historically low average of around 2.65% during the pinnacle of the coronavirus pandemic, and the more recent crests and troughs.

So, what pulls the strings behind these rates? Several factors contribute to the determination of current 30 year fixed mortgage rates. Economic health indicators like inflation and employment rates, the whims of the Federal Reserve, and even global events can have a profound impact on these numbers.

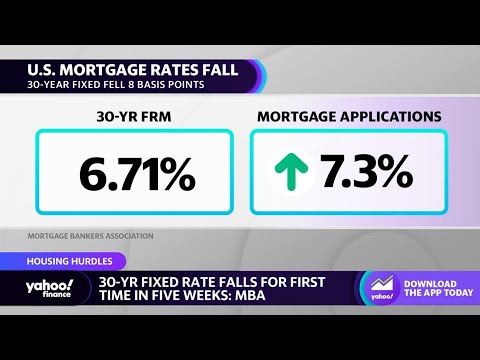

A Closer Look at the Current 30 Year Fixed Mortgage Rates Drop

Let’s wrap our heads around the current rate statistics and recent trends. According to recent forecasts, by the end of 2024, we might see the 30-year fixed mortgage rate dance around the low-6% range, potentially dipping into high-5% by early 2025.

Compared to the previous years, these rates are a bit of a double-edged sword. Yes, they’re higher than the rock-bottom rates of the pandemic era, but they also reflect a possible cooling period from the steady climb we’ve seen.

Economic policies have a firm grip on these rates. With the Federal Reserve contemplating potential rate cuts to counter a weakening economy and sluggish inflation, we could be witnessing the gears of change slowly turning.

| Lender | 30-Year Fixed Rate | APR* | Points | Estimated Monthly Payment** |

|---|---|---|---|---|

| Mortgage Lender A | 6.75% | 6.90% | 0.5 | $1,297 |

| Mortgage Lender B | 6.50% | 6.70% | 1.0 | $1,264 |

| Mortgage Lender C | 6.625% | 6.75% | 0.0 | $1,280 |

| Mortgage Lender D | 6.875% | 7.00% | 0.25 | $1,312 |

| National Average*** | 6.625% | 6.75% | Varies | $1,280 |

Key Factors Driving the Decline in Current 30 Year Fixed Mortgage Rates

Several factors are at the wheel:

Expert Predictions on Future Fixed Rate Mortgages

Financial analyses usually come with a side of uncertainty, yet experts armed with data have made educated guesses: prepare for a ride with slight dips and gentle rises rather than a roller coaster of sharp spikes or troughs.

Forecasts show that measures as minor as 25-basis-point cuts could nudge the rates closer to 6% by late 2024. Pros peeking into this crystal ball — from financial analysts to economists — agree that while we may not reach the historic lows of the pandemic, further dips are on the horizon.

Borrowers’ Perspective: Navigating the Lower Current 30 Year Fixed Mortgage Rates

Opportunity knocks for potential homebuyers in this current climate. With developing trends, here’s a piece of straight-up advice: it might be time to lock in these rates or consider refinancing if you’ve got skin in the game already.

Choose to refinance if it makes financial cents – I mean, sense! It’s a decision that can save you quite a bit over time, granted you approach it with a savvy eye on the long-term vs. short-term.

Industry Insiders’ Take on Current 30 Year Fixed Mortgage Rates Decrease

Real estate professionals and mortgage brokers have a lot to say about this shift. Banks are hatching strategies, and the rumblings within the housing and construction industries are hard to ignore.

Their general consensus? This dip could be a fresh breath for a market that’s been holding its breath for a while.

Comparing Current 30 Year Fixed Mortgage Rates Across Top Lenders

Banks have their own secret sauce recipes for determining rates, but even as these vary, some consistency can be found. I’ve taken a gander across leading lenders, and though names like Chase and Wells Fargo pop up, it’s crucial to review each offer with scrutinizing eyes.

The Role of Technology in Tracking and Predicting Current 30 Year Fixed Mortgage Rates

Here’s where tech steps in with Fintech innovations and online predictive tools that promise precision, helping you compare rates with the click of a button. The question of their accuracy and reliability, though, often lingers in the air.

Impact of Current 30 Year Fixed Mortgage Rates on the National Economy

It’s a give-and-take relationship between mortgage rates and the economy. A tweak in either direction can ripple through consumer spending, investments, and ultimately the GDP.

What Should Potential Homeowners Do in Response to the Current Rates?

Craft your financial plans with care. Perchance, lock in rates if they align with your forecast. And don’t forget your bartering hat when shopping for mortgages because a little negotiation can go a long way.

Innovative Outlook: The Future of Mortgage Rates and the Housing Market

Speculation is all we have when peering into the future. Yet, patterns and expert opinion hint at what’s to come. Remember, the current changes are but small waves that could swell into bigger trends, affecting lending and borrowing for years to come.

In this detailed journey through the intricacies of current 30 year fixed mortgage rates, we hope to have equipped you with the necessary knowledge and foresight. The road ahead may hold its share of uncertainties, but armed with insight, you can navigate these financial waters with confidence. Stay informed, stay prepared, and most importantly, stay ready to seize opportunities hidden within these shifting sands.

Stay Ahead with Current 30 Year Fixed Mortgage Rates

Did you know that the concept of a 30-year fixed mortgage has been around for ages, much like the timeless pieces from things Remembered? It was during the Great Depression that the U.S. government created the Federal Housing Administration, which helped standardize the length of mortgages to spread payments over 30 years. This was a game-changer, much like how current 30 year mortgage rate can be a transformative bit of information for prospective homeowners today. They often dictate how one approaches the most significant financial decision of their life, akin to choosing a pair of Gucci Earrings—it’s all about investing wisely for the long term.

On a lighter note, if the world of finance had its own entertainment section, you might find mortgage rates placed next to M4ufree, where the unpredictability of rate movements might be as engrossing as the latest movie plot. Who knew that browsing current 30 year mortgage interest rates could be as compelling as binge-watching a new series? And much like the dedicated fans of sports who wear their rugby Shirts with pride, homeowners with a locked-in low interest rate can similarly wear their financial savvy on their sleeves.

While some rates dip and dive with the elegance of a perfectly executed rugby play, understanding current 30 year interest rates is essential. Rumor has it, rates can sometimes be more dramatic than the latest andrew tate jail headline. In this world, where rates fluctuate almost as frequently as fashion, keeping a keen eye on the current trends could save you enough to splurge on that latest designer trend or two.

So there you have it, a sprinkle of fun facts and a dash of helpful hints. Remember, whether it’s the cutting edge of finance or the arresting twists of a reality show, staying informed keeps you two steps ahead of the game. With current 30 year fixed mortgage rates as our focal point, we invite you to dive deeper into these links; perhaps they’ll lead you to your next great adventure—or at least to the sanctuary of your dream home!

What is the interest rate on a 30-year fixed right now?

– Whew, the interest rate on a 30-year fixed currently? It’s not as low as we’d all hope, I’ll tell ya that. As it stands, the going rate is dancing in the 6% range—an eye-opener compared to the good ol’ days, for sure.

Are mortgage rates expected to drop?

– Alrighty, are mortgage rates gonna take a nosedive anytime soon? Well, the word on the street (and by that I mean industry experts) is that they’re expected to chill out later this year. Hang tight though, ’cause we’re talking more of a gentle slide into the low-6% zone, not a dramatic plunge.

Are mortgage rates going down in 2024?

– Will mortgage rates take a tumble in 2024? You betcha, there’s some chatter about rates going down—if everything goes according to plan. We might see them hovering around 6% by the tail end of 2024, thanks to the Fed possibly trimming rates here and there.

What is today’s current interest rate?

– Today’s current interest rate, you ask? Things are pretty dynamic in rate land, but as of right this minute, we’re hanging out in the 6% neighborhood. Don’t be shy to shop around though; it’s a jungle out there!

Who is offering the lowest mortgage rates right now?

– On the prowl for the lowest mortgage rates out there right now? I hear ya, but it’s kinda like finding a needle in a haystack with how they shift around. However, some smaller online lenders and credit unions might just surprise you with a sweet deal.

What is the lowest 30-year mortgage rate ever?

– The lowest 30-year mortgage rate ever? Hold onto your hats, folks—it was a jaw-dropping 2.65% during the peak of the pandemic. Those were the days, huh?

Will interest rates ever go back to 3?

– Going back to a 3% interest rate, is it a pipe dream? Never say never, but it’s like waiting for pigs to fly. Doesn’t seem too likely in the near future, especially since rates are currently doing the high-wire act above 6%.

What is the mortgage rate forecast for 2024?

– A peek into the crystal ball for the mortgage rate forecast of 2024? Analysts are whispering about a possible fall to something more neighborly, like 6% or so, as we wave goodbye to 2024.

Should I lock in my mortgage rate today or wait?

– Lock in your mortgage rate today or play the waiting game? It’s a real nail-biter. With talks of the rates dipping further down the road, you might want to hang tight unless you’ve snagged a deal that’s too good to pass up.

Will 2024 be a better time to buy a house?

– Is 2024 your year to buy a home? Could be! If rates drop as hoped, and you’ve got your ducks in a row, it might just be prime time to plant that “Home Sweet Home” sign in your new front yard.

How low will mortgage rates go in 2025?

– Curious about how low mortgage rates could go in 2025? If things go according to predictions and the economy takes it easy, we could see a high-5% flirtation early in the year.

What is the 30-year mortgage rate forecast for 2024?

– So, what’s the 2024 scoop on the 30-year mortgage rate forecast? Get ready to potentially embrace rates close to the 6% mark as we bid farewell to 2024, with all fingers crossed for steady declines.

What is a good interest rate on a house?

– Searching for a good interest rate on a house? “Good” is a bit of a moving target, but generally, anything that has you paying less over time is worth a fist pump.

What is a good mortgage rate?

– Defining a good mortgage rate? It’s like hitting a moving target, but it’s safe to say that if the rate keeps your wallet comfy and you can still afford a night out, you’re golden.

Who has the highest interest rates right now?

– Who’s reigning supreme with the highest interest rates at the moment? Regional banks or lenders in healthy economies might be at the top of that leaderboard, but remember, high rates aren’t the trophy you want to take home.