The maze of mortgage rates can often seem as intricate as a Richard Simmons headband—full of twists and turns that can either tighten or ease the financial load on prospective homeowners. As we gear up for another year, the current 30 year interest rates are becoming a topic hotter than a big mosquito in July. So, folks, if you’re looking to nestle into a new home or considering refinancing, it’s time to pull out your magnifying glass and play deranged detective with the numbers.

Evaluating Current 30 Year Interest Rates: Market Overview

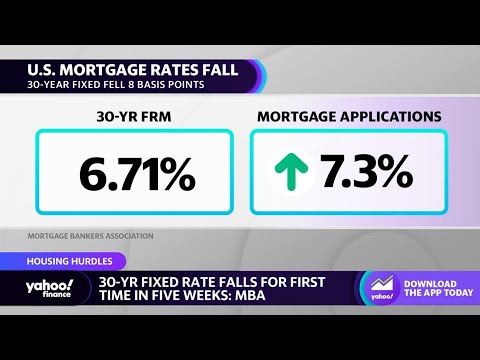

Alright, listen up: current 30 year interest rates are sitting pretty steady since July 2023, a relief to many out there grappling with the notion of buying or refinancing a home. But what does this mean for you? Well, as of 2024, we’re seeing the 30-year rates behaving more like a silver chain—strong and less prone to wild fluctuations. However, to understand today’s rates, we gotta flip the pages back for a bit of historical context.

Back in the whirlwind days from March 2022 to July 2023, the rates were as volatile as a stock market during an espresso binge—up and down, up and down. The Federal Open Market Committee (FOMC) took on inflation with the tenacity of a bulldog, hiking rates 11 times. That’s a big ouch for folks with loans. But after their December 2023 huddle, they’re talking about nudging the rates down by three quarter-points by the end of our current loop around the sun, landing the federal funds rate at a cozy 4.6%.

But before you put that house listed as For sale by owner NJ on the back burner, here’s another breadcrumb. Compared to the ghosts of interest past, current 30 year mortgage rates are shaping up to be a little friendlier. Shifts in these rates over the years have been like watching a dance—sometimes you’ll want to join in, and other times it’s best to sit this one out.

Key Factors Influencing Current 30 Year Interest Rates

| Parameter | Information |

| Current Rate Trend | Steady since July 2023 |

| Historical Context | Raised 11 times between March 2022 and July 2023 |

| Fed’s Past Action | Increased federal funds rate to combat inflation |

| FOMC’s December 2023 Outlook | Predicted three quarter-point cuts by end of 2024 |

| Expected Federal Funds Rate | Target of 4.6% by end of 2024 |

| Current 30-Year Mortgage Rate Outlook | Expected to decline to low-6% range through end of 2024 |

| Future Forecast | Predicted to dip into high-5% territory by early 2025 |

| Factors for Rate Decline | Weakening U.S. economy, slowing inflation, Fed rate cuts |

Expert Predictions on Current 30 Year Interest Rates

Cue the experts! The crystal ball gazers, numerologists, and Tarot card flippers are all saying the same thing: current 30 year fixed mortgage rates are expected to cool their heels and slip down to the low-6% range as 2024 unwinds its calendar pages. Why should we trust these forecasts? Because they’re not just plucked from thin air; they’re built on predictive models and past performances, kind of like betting on a derby horse with a history of wins.

But remember, the correlation between these soothsaying sessions and real-world outcomes can be as unpredictable as a cat on a skateboard. So, while we’re busy analyzing market sentiments and expert opinions, it’s best to keep one foot grounded in reality.

How Current 30-Year Interest Rates Affect Homebuyers

Banks and Lenders: Comparing Current 30 Year Interest Rates

Let’s peek at the buffet of rates from the big names—think Wells Fargo, Quicken Loans, and their kin. Each financial feast offers a slightly different flavor of rates, APRs, and fees, all while you’re trying to snag the best deal like a fly on a poolside snack.

Speaking of snacks, it’s worth nibbling at the difference between credit unions and traditional banks. Credit unions can sometimes offer lower rates to their members, like offering a secret menu to the regulars.

And while we’re dissecting this financial frog, let’s not forget that your credit score is like your high school GPA—it can really open doors. A stellar score can sweep you into the VIP section of current 30 year mortgage rates, snaring a deal that’s the envy of your block.

Mortgage Rate Forecast: What’s Next for Current 30 Year Interest Rates?

Comb through the tangled mane of current fiscal policies, and the path forward starts to clear up. Employment, wages, and how freely we’re all spending our cash play a part in shaping the mortgage rate landscape of tomorrow. And, just like a twist in a gripping novel, the roller coaster of elections or fresh-off-the-press legislation can pivot the direction of rates quicker than you can say, “Plot twist!”

We’re also tech curious, aren’t we? In the mortgage world, tech advancements might just streamline lending faster than you can say “digital signature,” impacting how easily rates can adjust.

Strategies to Capitalize on Current 30 Year Interest Rates

Navigating the Future: Preparing for Interest Rate Changes

Staying updated on mortgage rate shifts is as essential as knowing the weather before a hike. Use tools like financial news apps, market analysis reports, and maybe even a broker with an uncanny instinct for rate patterns.

Financial planning, in this ebb and flow of interest rates, is your life jacket. It keeps your head above water when the tide rises. And real estate pros? They’re your captains, steering you past the currents of change.

Community programs chip in too. They offer a helpful boost over rate hurdles, like a father teaching his kid to ride a bike—supportive, steadying, and there when you need a push.

An Innovative Wrap-Up: Synthesizing the Current 30 Year Interest Rates Outlook

Let’s circle back like a boomerang to where we started: the current 30 year mortgage rate and its effect on your mortgage strategy. Different strokes for different folks, but this much is crystal clear—leveraging current 30 year mortgage interest rates can be your ticket to financial benefit and stability. What’s on tap might not be the same tomorrow, so staying proactive and engaged is your best bet. We aren’t just talking about getting a loan; we’re talking about crafting a future-oriented mortgage plan that’s tougher than a two-dollar steak.

Now, as the sun dips and we bid adieu to this analysis, remember: the current mortgage landscape is like a river. It’ll keep flowing, whirling and twisting, but with the right approach, you’re not just a leaf caught in the current—you’re the one steering the raft.

The Fascinating World of Current 30 Year Interest Rates

Hold on to your hats, finance enthusiasts, because we’re about to dive into some delightful trivia about current 30-year interest rates that might just knock your socks off! For instance, did you know these rates can trace their ebbs and flows to economic shifts as subtle as a butterfly’s wingbeat in Brazil? It’s true! The financial world is deeply interconnected, and changes across the globe can cause ripples that affect your mortgage rates.

Now, let’s chew the fat about the history of these rates. Back in the roaring ’80s, they were sky-high, with some peaks that could make your hair stand on end—imagine paying double-digit percentages! Fast-forward to today, and you’ll see the numbers have mellowed out, bobbing around in a much more manageable zone. That’s music to the ears of homebuyers! But hold your horses—it’s not always a smooth ride. Even with current rates, economic turbulence can create waves that make your monthly payments more of a roller coaster than a serene sailboat voyage.

And here’s a juicy nugget: the long-term mortgage rates aren’t just pulled out of thin air! They often shadow the yield on Treasury securities, particularly the 10-year Treasury note. This relationship is like a dance, where each step of the Treasury yields leads the twirls and dips of mortgage rates. So, before you lock in on a 30-year rate, maybe take a gander at these government securities—they might just give you a sneak peek at the mortgage market’s next move.

Well, alright, let’s take a breather and switch gears for a sec. Did you know that when it comes to these rates, the Federal Reserve plays hard to get? They don’t directly set mortgage rates, but boy do their policies play Cupid, setting the mood for how lenders and borrowers interact. They’re like the conductor of an orchestra, subtly guiding the tempo (read: interest rates) with their economic policy wand.

Alright, let’s wrap this up with a bang, shall we? Remember this: even though current 30-year interest rates can feel as unpredictable as a game of pin the tail on the donkey, they have historically been a surefire way to lock in lower monthly payments compared to shorter-term loans. Long-term loans offer the stability of a fixed payment during tumultuous economic times. So if you’re in it for the long haul, these rates might just be your ticket to a happy ever after with your new home.

What is the 30-year interest rate right now?

– Oh boy, talk about stability! The 30-year interest rate is holding steady, folks—just like it has been since last July. No ups and downs here, just a flat line of predictability.

What is the federal interest rate for a 30-year mortgage?

– Now, drumroll, please… the federal interest rate for a 30-year mortgage? It’s cozy and stable, too. Hasn’t budged since our friend, the FOMC, put the brakes on hikes last July.

Will interest rates drop in 2024?

– Will interest rates drop in 2024? Bet your bottom dollar they might! The wise owls at the FOMC are eyeballing three cuts by the end of 2024. Fingers crossed, right?

What are projected interest rates for 30-year fixed?

– Projeccted interest rates for that good ol’ 30-year fixed? Word on the street is they’re headed south to the low-6% range by the end of 2024. Dive into the high-5% pool come early 2025!

Are mortgage rates expected to drop?

– Are mortgage rates expected to drop? Well, whispers are they’ll take a little tumble later this year, like leaves in the fall. And hey, we’re all for a softer landing.

What is the Fed interest rate today?

– What’s the Fed interest rate today? It’s like a song on repeat—just where it’s been since that last hike in July 2023. Like your grandma’s wallpaper, ain’t changed a bit!

Will interest rates fall?

– Will interest rates fall? Lean in close—I’ll let you in on a secret. They just might, with the Fed hinting at cuts in 2024. So, keep those fingers crossed!

Are interest rates higher on 15 or 30-year mortgage?

– Are interest rates higher on 15 or 30-year mortgages? You guessed it right, the 30-year ones are the long-haul truckers, chugging along with a bit more weight in the rate department.

Are interest rates lower on a 15 or 30-year mortgage?

– Are interest rates lower on a 15 or 30-year mortgage? Short and sweet gets the treat, the 15-year mortgages tend to sport lower rates. Nice and nifty, right?

Will mortgage rates ever be 3 again?

– Will mortgage rates ever be 3 again? Ah, nostalgia! While dreaming is free, the realist hat says those golden 3% days are a photo in our memory album for now.

How high could interest rates go in 2025?

– How high could interest rates go in 2025? It’s no crystal ball affair, but the vibe right now isn’t about sky-high rates. So, less “to the moon” and more “steady as she goes.”

What will mortgage rates be in 2025?

– What will mortgage rates be in 2025? If the tea leaves read true, we might be snuggling in the high-5% by early 2025. Comfy, right?

Will 30-year interest rates go down?

– Will 30-year interest rates go down? Signs say yes, with a soft drumroll leading to lower rates by late 2024. Start the countdown!

What are interest rates expected to be in 2024?

– What are interest rates expected to be in 2024? Grab your party hats, because rates might be getting a trim, aiming for 4.6% by the time we’re singing Auld Lang Syne for 2024.

Are 30-year interest rates going up?

– Are 30-year interest rates going up? Nope, they’re hanging out, no big moves. But hey, if they do, you’ll be the first to know!