Analyzing the Downward Trend in Current Conventional Mortgage Rates

Remember the days when mortgage rates seemed only to travel north? Let’s trot down memory lane: before 2024, we witnessed fluctuations that could send jitters through any potential homebuyer’s spine. Now, whispers of change are in the air; current conventional mortgage rates are taking a gentle dive. So what’s nudging this downward tick?

Firstly, a bouquet of factors contributes to this trend. Global economic dynamics, domestic policy changes, and market sentiment blend together, influencing these rates. If we pull up a chair and look at the rate cards, we’ll see that current conventional mortgage rates are playing a more appealing tune than they did last quarter.

Ever had the sneaky suspicion you’re riding a seesaw when tracking mortgage rates? Well, you’re not alone; this comparative analysis shows just how much they can jump or drop even over a concise window, and right now, they’re heading towards the low-6% range, a relief from the previous spikes.

The Driving Forces Behind Lower Conventional Mortgage Rates

Honey, let’s talk federal policy. It’s no secret that when the Fed speaks, mortgage rates listen. So as the U.S. economy shows signs of wanting to hit the snooze button and inflation decides to cool its jets, the Federal Reserve cuts the rate ribbon, and current conventional mortgage rates coyly follow suit.

Of course, we can’t forget the housing market’s nimble dance with the rates. When fewer folks are hunting for homes, rates tend to take a little breather. Plus, like best buddies, the bond market and mortgage rates share a bond that’s tighter than jeans after Thanksgiving dinner. Investors craving those safe-haven bonds means lower yields, and voila, mortgage rates often slide down alongside them.

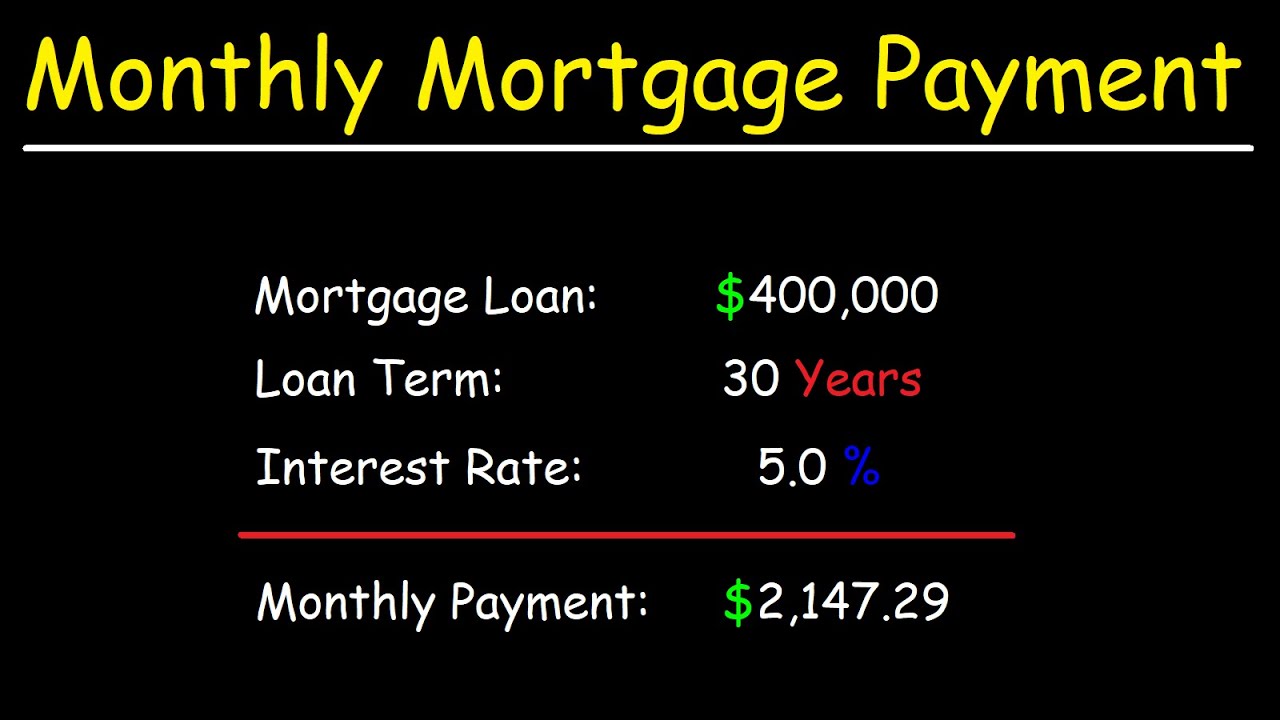

| Mortgage Type | Rate Term | Current Rate (%) | Predicted Rate by End of 2024 (%) | Predicted Rate by Early 2025 (%) | Pros | Cons |

| 30-Year Fixed | 30 Years | Approx. 6.25%* | Low-6% | High-5% | -Predictable monthly payments -Stability over the long term -Good for budgeting |

-Higher interest rate compared to shorter terms -More interest paid over the life of the loan |

| 15-Year Fixed | 15 Years | Approx. 5.75%* | N/A | N/A | -Lower interest rate than 30-year -Build equity faster -Less interest paid over life of loan |

-Higher monthly payments compared to 30-year term |

| 5/1 ARM | 5 Years | Approx. 5.50%* | N/A | N/A | -Lower initial rate -Flexibility |

-Rates and payments can increase after initial fixed period |

The Impact of Lower Mortgage Rates on Buyers and Refinancers

Imagine being a first-time homebuyer when the rate dip is as refreshing as a lemonade stand on a sweltering day; those dollars saved can turn dreams into deeds. Flip through case studies, and you’ll find giddy new homeowners who grabbed the bull by the horns, thanks to current conventional mortgage rates.

Now picture homeowners with mortgages feeling like they’ve been given a second shot at prom – refinancing can feel that good. Swapping out their old rates for these gleaming, lower ones, they’re sidestepping thousands over time. From the financial planning desk, I’ll tell you, honey, leveraging these rates could mean a fatter wallet for you in the long run.

Geographic Variations in Current Conventional Mortgage Rates

Don’t be fooled, darling—mortgage rates don’t play the same across the map. From New York to California, the numbers zigzag. For instance, the new jersey tax rate plays a catchy number with the local economy, shaping the mortgage rates residents see.

Some states are singing hallelujah with significant rate dips. Peeking into the secret sauce of fluctuations, we discover that local factors like supply-demand balance and even state regulations can make all the difference. Listen to those experts who’ve got their ear to the ground—they’ll tell you where to find the sweetest deals.

What Experts Are Saying About the Dip in Mortgage Rates

Economist whisperers hint that this dip could be a temporary tryst or might settle in for a longer stay. Meanwhile, savvy mortgage brokers advise riding the wave quickly and snapping up these inviting rates. Real estate gurus? They’re peering into their crystal balls, forecasting gentle sways rather than wild swings in the current conventional mortgage rates as we tread through 2024.

Pros and Cons of Locking in Current Conventional Mortgage Rates

Grabbing a fixed-rate mortgage right now could be a smart move; you’re locking arms with predictability. The thought of consistent payments can bring a sigh of relief, potentially saving you a bundle compared to the ebb and flow of adjustable-rate mortgages.

However, don’t leap without looking. Some homebuyers might wager on rates nosediving further and playing the waiting game, although it’s a bit of a gamble.

How to Secure the Best Rate in Light of Current Mortgage Rate Trends

Okay, ready for the championship round? To snag the lowest rates—do your homework! A seasoned financial advisor might suggest a few smart moves: negotiating with lenders, not putting all your eggs in one basket (shop around!), and using all the current housing interest rates tools you can find.

Forward-Looking Strategies for Potential Rate Hikes

Let’s face uncertainty with a game plan: prepare for possible rate hikes. Deciding between fixed-rate and adjustable-rate mortgages is key—weigh them thoughtfully. Investing in financial tools such as rate locks might be your ace in the hole if rates decide to climb again.

Final Thoughts on Making Informed Decisions Amidst Variable Mortgage Rates

Sweethearts, the mortgage road is never a straight line. It twists, it turns, but your best compass is staying informed and prepared. It’s an art, really, to tailor your mortgage decision to your unique financial tapestry. And in this game, strategies count, so keep your eyes on the prize and make those savvy moves with confidence.

Here’s to informed decisions, a sturdy financial future, and snatching up opportunities like those current conventional mortgage rates that seem ripe for the picking. Cheers to your home-buying adventures and may they be as fruitful as a well-tended orchard!

Taking a Dive into Current Conventional Mortgage Rates

Have you ever wondered why people are always buzzing about the ups and downs of mortgage rates? Well, hang onto your hats, because you’re about to find out some tantalizing trivia about the world of current home mortgage rates, which definitely has more twists and turns than a season finale of your favorite TV drama on Iyf tv. Who needs soap operas when you’ve got the real-life roller coaster of conventional mortgage rates keeping us all on the edge of our seats?

Now, let’s skate into some facts that might surprise you. First off, did you know that the historical context of mortgage rates can be as gripping as the underdog story of an Adidas skate shoes spokesperson? It’s true! Rates have been through more highs and lows than an epic skate park session, giving financial analysts enough material to fuel decades of conversations. So, the next time you’re about to doze off thinking about interest rates, remember: there’s probably a captivating story waiting to be told about them.

Mortgage Rates: More Than Just Numbers

Moving on, here’s a delightful little tidbit: some of the key players in setting the trends for bank rates mortgage could very well be the trendsetters in their own right, akin to the strategists at company 3 who are all about the avant-garde in their field. These financial mavens analyze and forecast economic conditions with such precision, they could probably predict what color will be the new black next season!

But wait, there’s more! Ever heard of Shirley Jones? Aside from being a talented actress, she also shares a name with countless others. It’s a common phenomenon — like how mortgage rates often share similar patterns across different banks. Sometimes, a name isn’t just a name, and a rate isn’t just a rate; there’s often an enthralling narrative or an interconnected web of decisions and events behind them.

So next time you hear that current conventional mortgage rates are taking a dip, don’t just think of it as another yawner finance update. Imagine it as the pulse of the economy, a fascinating saga of supply and demand, or even the unseen force that might decide if you’re getting leather seats in your new car or sticking with the cloth ones. Fun facts aside, knowing about these rates could be just the financial savvy move you need to skate your way to a budget-friendly future.

What is the going interest rate on a conventional loan?

– Well now, ain’t this the million-dollar question? The going interest rate on a conventional loan changes quicker than a hare in a dog race, but it’s hovering in the territory that’ll have you forking out around low-6% at the moment. Mind you, it’s a fickle beast, so keep your eyes peeled for any shifts.

What is the conventional 30-year fixed rate?

– As for the conventional 30-year fixed rate, it’s like a rollercoaster lately—up and down and all around—but as we speak, it’s expected to settle down in the low-6% range. Don’t hold your breath though, since like the weather, it could change.

What is the interest rate on a 30-year fixed right now?

– You’re looking for the skinny on the 30-year fixed rate now, right? Well, it’s kicking around in the low-6% neighborhood. But hey, don’t take my word as gospel—it can flip-flop faster than a pancake on Sunday morning.

Are mortgage rates expected to drop?

– Are mortgage rates expected to drop? Well, wouldn’t you know, the word on the street (and from those in-the-know economists) is a resounding ‘yep!’ Later this year, when the economy starts dragging its feet and inflation chills out, rates might take a little snooze. Keep your fingers crossed!

Do conventional loans require 5% down?

– For a conventional loan, 5% down? You betcha! It’s like the unwritten rule of thumb. But remember, if you can cough up more dough up front, it might just sweeten the pot in the long run.

Will interest rates go down in 2024?

– Will interest rates go down in 2024? Oh, if only we had a crystal ball, right? But all signs point to yes, with predictions they’ll shimmy down into the high-5% disco by early 2025. Time to start that savings dance!

What is the lowest mortgage rate ever?

– The lowest mortgage rate ever? It’s like spotting a unicorn! Once upon a time, back in the good ol’ days of 2020, we saw them dip as low as about 2.65%—talk about a fairy tale!

What will interest rates be in 2024?

– What’ll interest rates be in 2024, you ask? The forecasters are singing tunes about rates trending down, maybe even hitting the high-5% stage by the time we’re popping fireworks for New Year’s 2025.

Which Bank gives lowest interest rate for home loan?

– The bank with the lowest interest rates for home loans changes more often than a chameleon on a rainbow, but shop around! Some folks play favorites, so it’s worth getting your Sherlock Holmes on to sniff out the best deal.

Should I lock mortgage rate today?

– Should you lock your mortgage rate today? Well, it’s tougher to call than a game of bingo with too many cards. If you’re as nervous as a long-tailed cat in a room full of rocking chairs about rising rates, then locking in might just be your golden ticket.

What is the interest rate for a 700 credit score FHA loan?

– So you’ve got a 700 credit score and you’re on the prowl for an FHA loan, huh? Interest rates for you could be as cozy as an old sweater—think somewhere in the fair-to-middling 5% range. But credit scores and loans pair up like socks—never one-size-fits-all.

How do you buy down interest rate?

– Buying down your interest rate’s a bit like bargaining at a yard sale—you pay more now to save a few bucks down the line. Toss a little extra moolah at the lender at closing and wham, bam, thank you ma’am—you’ve got yourself a lower monthly payment.

Will mortgage rates ever be 3 again?

– Mortgage rates hitting 3% again? While it might feel like waiting for a rainy day in the Sahara, don’t put all your eggs in one basket. With rates swinging like a pendulum, it’s a maybe, just not a sure shot.

What is the interest rate today?

– What’s the interest rate today? Hold your horses—it’s a bit of a moving target, but it’s lounging in the low-6% range. Check the latest before you leap; it changes faster than a kid grows out of shoes.

What is the interest rate forecast for the next 5 years?

– Peering into the crystal ball for the interest rate forecast for the next 5 years, eh? Hopes are pinned on a gradual slide down the interest rate slide, dropping to a snuggly high-5% by 2025. But let’s not count our chickens before they hatch; the market’s got a mind of its own.