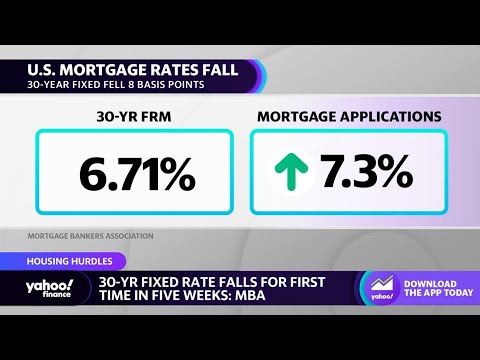

Navigating The Landscape Current Interest Rates For 30 Year Mortgage

As we chart our course through the choppy waters of the economy in 2024, it’s evident that the gusts of inflation and the ebb and flow of Federal Reserve policies are leading the charge in sculpting the current interest rates for 30-year mortgages. These macroeconomic headwinds guide which way the sails turn for prospective homebuyers.

A little history lesson for you: The golden era of sub-3% mortgage rates that we saw as recently as during the pandemic wave goodbye, faster than a hint of a smile from a seasoned poker player. Flash forward to 2024, and here we are, keeping our fingers crossed as we eye the low-6% range, beckoning us with promises of a possible drop into the high-5% realm by early 2025.

Historically, these rates are moderate, but compared to the rock-bottom levels of yesteryear, they sure make our wallets feel lighter. Think of it as the financial equivalent of Charles Lindberghs monumental flight; we’ve embarked on a journey over an ocean of fluctuations, hoping to land safely with a decent mortgage rate in our pocket.

Unveiling the Best Current Interest Rates for 30-Year Mortgages

Having said hello and goodbye to sky-high mortgage rates, let’s lay our eyes on the best current interest rates for 30-year mortgages. Starting with the big players, the national banks are flexing their muscles, offering rates that might not make your jaw drop but are certainly attractive enough to make you stop and stare.

On the other hand, the online-only lenders are out to make waves with competitive rates that are sure to catch your attention. With lower overhead costs, they can offer cuts that could feel like a soothing balm on your finances. It’s akin to finding that coveted Bleu de Chanel parfum at a price that doesn’t make your eyes water.

And let’s not overlook the shining stars of the lending world: credit unions and community banks. Often tucked away like precious gems, they’re frequently offering some of the most favorable rates around. The lesson here? Don’t just walk past these hidden treasures.

| Lender | Current 30-Year Fixed Rate (APR) | Expected Rate End of 2024 | Notes |

| Lender A | 6.5% | 6.0% | Rates could fall due to forecasted economic conditions |

| Lender B | 6.375% | 6.0% – 6.25% | May see gradual reductions pending economic developments |

| Lender C | 6.25% | 5.95% – 6.25% | Predicting a dip into high-5% range by early 2025 |

| Lender D | 6.625% | 6.0% – 6.375% | Suggests competitive rates with anticipated 25-basis-point cuts |

| Lender E | 6.4% | 6.0% – 6.3% | Maintaining higher rates compared to pandemic lows |

Regional Variations in the Current Interest Rates for 30-Year Mortgage

Now, let’s get regional and think about how the ‘current interest rates for 30 year mortgages’ can change, depending on where you plant your roots. From the sun-kissed beaches in the South to the crisp air in the North, mortgage rates take a ride on the regional rollercoaster.

Some of the most competitive offers are found in regions where the economic drivers are as dynamic as a Captain Lee navigating through a storm. You might find a bank in the Midwest offering rates that make you want to high-five the banker, or a southern institution that has you clicking your heels with joy.

The Impact of Credit Scores on Securing the Best Current Interest Rates

Amigos, let’s talk credit scores — those three digits that hold the power to turn your mortgage rate dreams into reality or nightmares. In the realm of current interest rates, your credit score whispers secrets about you to the lenders, and the higher your score, the sweeter the whispers.

Imagine two neighbors, Julie And Julia, both eyeing the current interest rates 30 year fixed. Julie boosts her credit score and watches her rate dip lower than a limbo stick at a Caribbean party. Julia, with her so-so score, is left envying Julie’s savvy moves. The difference can tally up to more than a night out at a fancy restaurant. It’s real money, folks.

How Federal Policies Are Shaping the Current Interest Rates for 30-Year Mortgages

As we play spectator to the Federal Reserve’s chess moves, it’s critical to see the board from their perspective. The Fed’s recent actions are akin to a careful game of operation — one wrong move, and the patient jumps. With delicate 25-basis-point cuts here and there, the Federal orchestra tunes the economy, influencing our mortgage rates in the process.

In this landscape, it’s the government-backed loans dating conventional loans that have us holding our breath for what comes next. Their dance on the rates floor often spells promise for those seeking a harmonious financial future.

Fixed-Rate Vs. Adjustable-Rate Mortgages: A 2024 Perspective

“Oh, should I pick fixed or adjustable?” That’s the question that has many a homebuyer pacing the floor. In this corner, we have the fixed-rate mortgages, standing stoic like a steadfast sentry. And in the other corner, the adjustable-rate mortgages (ARMs), ready to pivot like a tango dancer under the 2024 disco ball.

Comparing the current offerings, fixed-rates offer that warm blanket of predictability, while ARMs might start off cool but could give you a chill when the rates begin to climb. Expert opinions are leaning towards the fixed-rate corner for those who favor a long-term, no-surprise relationship with their mortgage.

Locking in Current Interest Rates for 30-Year Mortgages: Strategies and Tips

Strategy is key in locking in these elusive rates. Wise industry veterans, with their battle-scars from markets past, whisper of the golden window for mortgage rate locks. The secret sauce? Watch the market like a hawk and lock in before the winds change — because when they do, you might find your rate flying away, and not in a good manner.

Peering into our crystal ball, if you’re toying with locking in a rate, think strategic, not frantic. With the expected seesaw of rates through the end of 2024 and into 2025, timing is everything, and patience might just be your most lucrative investment.

The Future of 30-Year Mortgage Interest Rates: Predictions and Trends

Alright, folks, time to put on our future-telling hats. The oracles of finance are peering into the mist and seeing the current 30 year mortgage rates hovering in a more pleasant range than we’ve been accustomed to in recent times. They’re not diving back into the days of 2.65%, but hey, this isn’t a time travel show.

Predictions flutter about like nervous butterflies, yet the consensus is a gentle landing into more hospitable rate territory. Adding a sprinkle of technological advancements into the mix could very well streamline the process, making for a smoother ride towards your mortgage destination.

Navigating Refinancing Options in Light of Current 30-Year Mortgage Rates

Refinancing can be as tempting as a second helping of dessert — but is it worth the calories? With the current interest rate For 30 year mortgage in the low-6%, turning your back on a juicy refinance offer can be tough. Crunch the numbers, scrutinize the break-even point, and make an informed choice resembling more a calculated chess move than a game of luck.

It’s about timing, precision, and understanding that while today’s rates might look like a siren call, they don’t always signal calm seas ahead. Consider the long-term impact, and don’t get swayed by the seductive whisper of short-term gains.

Unpacking the Best Current Interest Rates for 30-Year Mortgage

Boy, oh boy, have current interest rates for a 30-year mortgage been on a rollercoaster ride lately! Now, you might be wondering what in the world historic fighter aircraft have to do with mortgages, but hear me out. Just like the agile and powerful Hispano 20mm used during World War II, current interest rates are a formidable force impacting home buyers. Think of it this way: rates can rapidly ascend and descend, directly affecting your wallet—pow, right in the kisser!

Diving into the nuts and bolts, folks often find the whole mortgage process as perplexing as trying to decipher Morse code. But here’s a quirky nugget for you: if mortgages were a symphony, the current interest rates for a 30-year mortgage would be the lead maestro—a game-changer that conducts the affordability and rhythm of your monthly payments. Whizzing by like a fighter jet, a rate change of even a quarter percent can mean thousands over the life of your loan.

Rapid-Fire Facts: 30-Year Mortgage Rates Trivia

Alright, let’s shimmy away from the dry facts and sprinkle in some trivia zest. Did you know that the idea of a 30-year mortgage is younger than the concept of sliced bread? That’s right, the 30-year mortgage made its grand entrance in the 1930s, while pre-sliced bread hit shelves in 1928. And just like that, the hispano 20mm( revolutionized aerial combat, the long-term mortgage transformed the American dream of homeownership.

Another jaw-dropper is the current interest rates for a 30-year mortgage have occasionally dipped and danced around numbers lower than your grandma’s age. Picture this: it’s as unexpected and delightful as finding a rare, mint-condition comic book at a garage sale. But remember, low rates can be as fleeting as a cameo in a superhero movie—blink and you might miss your chance to lock it in.

How Rates Impact Your Story

Now, don’t get bamboozled by the mere percentage points; the impact is more significant than a pinch of salt in a stew. Imagine this: the current interest rates for a 30-year mortgage are the silent ninjas in the shadows of your monthly budget. They sneak up, nudge your payments higher or lower, and have you either singing hallelujah or crying into your cornflakes. In the grand story of your financial life, securing a low rate is like stumbling upon an Easter egg in your favorite video game—oh-so-satisfying!

And hey, don’t forget that the housing market, much like a mysterious crime novel, is full of twists and turns influenced by, you guessed it, current interest rates for a 30-year mortgage. It’s a wild, unpredictable world out there, and understanding the ins and outs of rates is as crucial as knowing the secret handshakes in an elite club.

To wrap it up, folks, jumping on the best current interest rates for a 30-year mortgage is like snagging the golden snitch in a heated game of Quidditch—it could make all the difference. So keep your eyes peeled, do your homework, and maybe, just maybe, you’ll score the deal of a lifetime.

What is the 30-year interest rate right now?

– Well, buckle up! As of now, the 30-year interest rate is doing a bit of a high-wire act, hovering in the low-6% range. It’s got us all watching with bated breath, wondering where it’ll land next.

Are 30-year mortgage rates dropping?

– Yep, you’ve heard the chatter, and it’s true—30-year mortgage rates are starting to feel the pull of gravity. We’re on the lookout for them to take the plunge later this year, especially as the economy cools off its jets and inflation chills out.

What is the federal interest rate for a 30-year mortgage?

– For a 30-year slice of the American Dream, the federal interest rate is playing coy in the low-6% neighborhood. But don’t get too comfy—this finicky number is set for a slow dance downward, taking its sweet time.

Are mortgage rates going down in 2024?

– As sure as the sun’ll rise, mortgage rates are anticipated to mosey on down in 2024. Think less of a nosedive and more of a gentle slide into that comfy 6% couch by year’s end.

Are mortgage rates expected to drop?

– Are mortgage rates expected to dip? You betcha! The buzz is all about a cooldown, with whispers and winks suggesting we might start flirting with the high-5% zone as early as 2025.

Who is offering the lowest mortgage rates right now?

– Okay, so who’s the belle of the ball with the lowest mortgage rates right now? It’s a competitive scene, and the answer changes faster than a chameleon on a disco floor. Best bet? Shop around and compare—banks and online lenders are duking it out daily!

Will mortgage rates ever be 3 again?

– Will mortgage rates ever hit that sweet 3% mark again? Woah, don’t hold your breath—those days are like a comet, rare and unpredictable. With rates currently strutting in the sixes, a trip back to threesville seems like a long shot.

What is the mortgage rate forecast for 2024?

– Peering into the mortgage rate crystal ball for 2024, it’s looking like rates will take a leisurely stroll downhill to somewhere around the 6% mark. But remember, forecasts are a bit like weather predictions—take ’em with a grain of salt.

What is the lowest rate ever for a 30-year mortgage?

– The lowest rate for a 30-year mortgage was like catching lightning in a bottle—a jaw-dropping 2.65% during the pandemic’s peak. That record’s gonna be tough to beat, like hitting a hole-in-one on a windy day.

What is current Fed rate?

– What’s the current Fed rate, you ask? It’s the number that’s got everyone from Wall Street to Main Street chattering. Though it’s a shifty character, best to keep an eye on the Fed’s moves for the latest play-by-play.

What is a good debt to income ratio?

– A good debt to income ratio? Think of it as your financial street cred—it tells lenders you’ve got your act together. Aim to keep this number below 36%, and you’re golden (or at least looking pretty solid to those money-lenders).

What are interest rates today?

– What are interest rates doing today, you’re wondering? Well, they’re doing a little dance, changing from day to day. For the play-by-play, it’s best to do a daily check-in—think of it as your interest rate weather report.

Will 2024 be a better time to buy a house?

– Wondering if 2024 is your year to jump into the housing pool? If rates keep their promise and dip, you could score a better deal on your mortgage. But remember, home prices and your fave avocado toast could throw a curveball in your plans.

What will mortgage rates be in 2025?

– Forecasting ahead to 2025, some mortgage rate oracles are seeing visions of rates potentially dipping their toes in the high-5% pool. But as they say, don’t count your chickens—financial forecasts are slippery fish.

How can I get a lower mortgage interest rate?

– Wanna snag a lower mortgage interest rate? Start by polishing up that credit score till it shines. Then, shop around like it’s Black Friday—lenders are itching to give you reasons to love ’em. Lastly, don’t forget to flex those negotiation muscles—you’ve got more power than you think.