Buying a home is as thrilling as watching the season finale of your favorite TV series, and just like that big reveal, there’s plenty of drama involved in choosing the right mortgage. Today, we’re going to iron out the crinkles and delve deep into the difference between FHA and conventional loans. Picture the scene: two paths in the woods, one paved by government support, and the other by private enterprise. Which trail leads to the home of your dreams? Buckle up; we’re about to explore the nitty-gritty that could change the course of your homeownership journey.

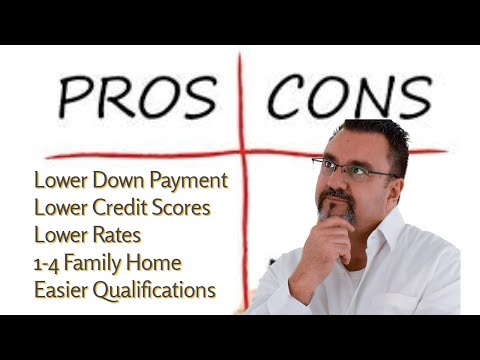

FHA vs. Conventional Loans: What Sets Them Apart?

You might think a loan is a loan, right? But when we peek under the hood, the difference between FHA and conventional loan types is as distinct as a classic episode of Peaky Blinders compared to a high-octane superhero flick. Let’s zoom in on the real juice that separates these two heavyweights of the mortgage world.

Fact 1: Minimum Down Payment Requirements – The Startling Contrast

Suppose you’re eyeing a cozy $300,000 pad. With an FHA loan, you could be securing the keys with $10,500. The conventional route might see you forking out $60,000. Over time, that upfront cash can sizzle or freeze your financial flexibility—Different strokes for different folks!

Fact 2: Credit Score Standards – A Tale of Flexibility vs. Rigor

Fact 3: Mortgage Insurance Nuances – Breaking Down the Long-term Costs

Fact 4: Loan Limit Variances – Understanding the Boundaries

Fact 5: Property Standards and Restrictions – Surprising Details Buyers Must Know

An In-Depth Look at the Appraisal Process: Dissecting a Key Difference Between FHA and Conventional Loan

| Feature | FHA Loans | Conventional Loans |

|---|---|---|

| Backing Agency | Federal Housing Administration (FHA) | None (Private Sector) |

| Down Payment | As low as 3.5% | As low as 3% but typically 5%-20% |

| Mortgage Insurance | Mandatory Mortgage Insurance Premiums (MIP) | Private Mortgage Insurance (PMI) required under 20% down |

| Mortgage Insurance Cancellation | MIP required for the life of the loan in most cases | PMI can be canceled after reaching below 80% LTV ratio |

| Interest Rates | Typically lower rates, but offset by MIP fees | Rates vary based on credit, may be higher than FHA rates |

| Credit Score Requirements | Minimum score around 500-580 (depending on down payment) | Higher minimum score, typically around 620 |

| Loan Limits | Set by the FHA, varies by region | Conforming loan limits set by FHFA, higher in some areas |

| Seller’s View | Seen as less preferable due to strict appraisal guidelines | Often preferred due to higher down payment and credit |

| Closing Costs | Can be higher due to FHA fees | Generally lower than FHA loans, but less flexibility |

| Flexibility | Lower credit and down payment requirements offer flexibility | Less flexible, requires better credit and higher down payment |

| Loan Types | Primarily for owner-occupied primary residences | Available for primary, second, and investment properties |

| Loan Duration | 15-year and 30-year terms common | 10, 15, 20, 25, and 30-year terms available |

Potential Borrowers Beware: The Pitfalls and Peaks of Each Loan Type

Conclusion: A Calculated Decision – Navigating the Difference Between FHA and Conventional with Confidence

And there it is, the closing credits of our deep dive into the difference between FHA and conventional. These facts aren’t just a bunch of boring stats—they’re the dramatic and sometimes shocking revelations that will shape your real estate odyssey.

In these ever-converging lines of small print and big dreams, remember, while the house you choose becomes your home, the loan you choose becomes your journey. Ensure a tailor-made fit by considering your financial fabric—does it stretch to conform to conventional contours or does it need the comforting embrace of an FHA?

Lastly, my friends, keep your finger on the pulse of the mortgage heartbeat. With change being the only constant, staying in tune with the latest dance of rates, rules, and real estate rhythms is the best way to waltz through the world of mortgages with savvy and poise. Whether you prefer the FHA waltz or the conventional tango, may you step confidently onto the floor of homeownership.

Unveiling the Surprises: The Difference Between FHA and Conventional

When it comes to mortgages, folks often think they’ve got it all figured out—you know, an interest rate here, a payment schedule there. But hold your horses! The devil’s in the details, and when we’re talking about the deets of FHA versus conventional loans, oh boy, do things get interesting. So let’s lift the veil on some shockingly cool trivia that’ll make you the smarty-pants at your next dinner party.

A List That’s More Star-Studded Than the “Peaky Blinders” Cast

1. Holy Matrimony of Costs and Benefits!

Let’s talk about weddings for a second. Imagine your own celebrity-style dream wedding, like the one “Chris Evans” might have. In the mortgage world, an FHA loan is like the big wedding bash—more inclusive, easier to get into with lower down payments, just like a-gathering-full-of-A-listers affair. Conventional loans? They’re more like a destination wedding—costly up front and exclusive, reserved for the ones with the hefty savings and stellar credit scores.

2. Points for Creativity

Ever heard of “discount points on a mortgage”? Well, imagine them as the tactical play on the “Saints’ schedule”—a strategic move that can save you a bundle over time. Both FHA and conventional loans can use these points, but it’s the conventional crowd that typically takes a swing at the riskier plays to score more in the long-run with lower interest rates.

3. The “Rockstar” Flexibility of Conventional Loans

Alright, you know the drill, Rockstar sign in, and you’re in control, ready to rock the stage. Well, in the mortgage world, conventional loans are the rockstars! They strut on stage with more property type options, jiving with investments and second homes, unlike FHA loans which mostly stick to the harmonious melodies of primary residences.

4. The Foreclosure Boogie Monster

Getting cold feet thinking about How To stop foreclosure? FHA loans are like the reassuring buddy who knows all the right dance moves. They come equipped with the backing of Uncle Sam, who steps in like a choreographer to ease the foreclosure blues should your financial rhythm go awry. A conventional loan, by contrast, leaves you to freestyle your way out of the foreclosure funk.

5. The Red Carpet Premiere of Your Home Purchase

Flashbulbs pop, and there’s Renee Elise goldsberry, dazzling the crowd with her smile. That’s the glitz of a purchase agreement, folks—the star-studded moment sealing the deal on your home buying saga. Whether you’re signing with the FHA or shacking up with a conventional loan, that moment feels like winning an award. But remember, get every scribble right, or you might as well be signing autographs, not a purchase agreement!

And there you have it, five fun-filled facts about the difference between FHA and conventional that could give any peaky Blinders cast reunion a run for its money. So the next time someone brings up mortgages, you can bet your bottom dollar that with these tidbits in your pocket, you’ll be the life of the party—mortgage-style!

Which is better an FHA loan or conventional?

Oh boy, it’s like picking between chocolate and vanilla—both have their sweet spots! An FHA loan’s easier to snag with lower credit scores and a smaller down payment. But conventional loans? They’re the bees’ knees if you’ve got a solid credit line and can cough up more cash upfront. So, which is better? Depends on your wallet and credit score.

What are the disadvantages of the FHA loan?

Now, if we’re talking disadvantages of an FHA loan, hold onto your hats! We’re talking steeper insurance costs with those pesky mortgage insurance premiums that stick around like unwanted party guests. Plus, there’s a limit on how much you can borrow, letting pricier homes slip through your fingers.

Why do sellers prefer conventional over FHA?

Sellers and conventional loans go together like peanut butter and jelly—they just make sense. Sellers get the warm fuzzies from conventional loans because they suggest buyers are on solid financial ground, meaning fewer hoops to jump through and a quicker, smoother ride to closing day.

What is the downside of a conventional loan?

The downside of a conventional loan? Well, it’s like batting in the major leagues—you’ve gotta have your ducks in a row. A higher credit score, bigger down payment, and a thicker financial portfolio are part of the package, or you might strike out.

Why is a conventional loan better?

Conventional loans strut to the front of the line because they’re the whole package for buyers with a rock-solid credit game and a wallet that’s not afraid to open wide. Plus, without that pesky upfront mortgage insurance fee that FHA loans love, your wallet doesn’t feel as light.

Why would a seller not accept an FHA loan?

Why would a seller give the cold shoulder to an FHA loan? It’s all about the extra baggage—tougher inspections and a risk of the deal falling apart if the home doesn’t measure up or the FHA’s red tape gets too sticky.

What happens if I put 20% down on an FHA loan?

What happens if you put 20% down on an FHA loan? Well, it’s not a magic wand, but it does give your monthly payments a diet and slims down your insurance costs. Still, unlike with conventional loans, you can’t totally ghost your mortgage insurance—it sticks around for the long haul.

Why are FHA closing costs so high?

Why are FHA closing costs akin to a mountain hike? They’re a pinch higher ’cause you’re footing the bill for the FHA’s upfront mortgage insurance premium. And let’s just say, it’s not a molehill!

Is there a catch to an FHA loan?

Is there a catch to an FHA loan? You betcha! Those lower down payments and credit scores come tied up with a bow of mortgage insurance premiums that stick to you like glue—for the entire loan if you don’t put enough down.

Why would a buyer switch from conventional to FHA?

Buyers switch from conventional to FHA when their wallets are feeling the pinch. An FHA loan’s like a helping hand, cutting them some slack with a lower down payment and credit score requirements when their finances are playing hard to get.

Are FHA closing costs more than conventional?

As for closing costs, yeah, FHA can have more bite than conventional, mostly ’cause of the upfront mortgage insurance. So, you might feel the pinch a bit more with FHA.

Why would a house only go conventional?

A house that goes “conventional only” is kinda like a club with a strict dress code—it’s looking for buyers who fit a certain profile, usually meaning those who have enough cheddar and creditworthiness to walk the conventional loan runway.

Can I switch from FHA to conventional?

Can you pivot from FHA to conventional mid-game? You bet! It’s like trading up cars. Once you’ve got enough equity or your financial situation’s done a 180, refinancing to a conventional loan can say “sayonara” to mortgage insurance.

Who benefits from a conventional loan?

Who’s living the dream with a conventional loan? Those with money in the bank, great credit, and a steady income—they’re the prom kings and queens of the mortgage world. It’s like they were born to go conventional.

Who should use a conventional loan?

Should you go conventional? If your bank account’s healthy, your credit score’s looking hot, and you want to avoid extra fees—yep, you’re the poster child for a conventional loan.

What is the biggest advantage of an FHA loan?

Oh, the biggest advantage of an FHA loan? That’s easy peasy! It’s like the welcome mat for first-time homebuyers, with easier credit score requirements and a down payment that’s not through the roof.

Are FHA closing costs more than conventional?

With FHA closing costs, you’re looking at a bit more dough since you’ve got that upfront mortgage insurance premium nipping at your heels, unlike with conventional loans.

What is the greatest advantage of using FHA?

And the greatest advantage of using FHA is its big-hearted approach to buyers who aren’t rolling in dough or who have credit scores that don’t sparkle—it’s like the fairy godmother of loans.

Do conventional loans appraise higher than FHA?

Do conventional loans appraise higher than FHA? Not necessarily. The appraisal is like the ultimate poker face—it’s all about the property’s value, no matter which loan type you’re dancing with.