The Magic of an E Schedule in Acquiring Mortgages

Welcome to the seemingly complicated world of mortgages! Thankfully, understanding the importance of an E Schedule could go a long way in making the mortgage approval process quicker and easier. You might wonder, “Why are we talking about e schedules when discussing mortgages?” Well, let’s untangle this mystery and discover the magic of an E Schedule in acquiring speedy and smooth mortgage approvals.

What is an E Schedule and How is it Different from an A and E Schedule?

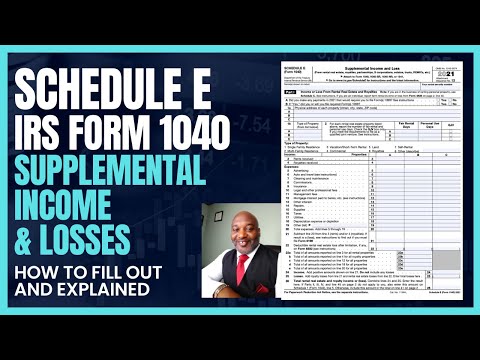

Let’s start with the basics. An **E Schedule, or “Schedule E” as it’s otherwise known, is a part of your tax return that details supplemental income or loss from real estate, royalties, partnerships and trusts. Simply put, it’s documentation of your income from your real estate investments.

But wait, what about this ‘A and E Schedule’ we mentioned earlier? Well, just like the E Schedule, an A and E Schedule, or ‘Activity and Expense Schedule’, serves a different purpose. It’s essentially used to detail real estate transactions. So, while there may be some overlap, it’s crucial to remember that they aren’t interchangeable.

Why is an E Schedule Crucial in the Mortgage Approval Process?

The importance of an E Schedule in the mortgage scene can’t be overemphasized. This little piece of document sums up your real estate holdings and income. This validation will help mortgage lenders assess your repayment ability, thus accelerating your mortgage approval process.

Top 7 Tips for Quick and Easy E Schedule Mortgage Approvals

Eager to dive into this exciting journey of unlocking quick E Schedule mortgage approvals? Let’s put our best foot forward with seven tried and true tips:

Tip 1: Understanding Your Financial Profile

Just like you’d stretch before a run, understanding your financial profile is an essential warm-up before securing mortgage approvals. Be sure to check out these glute Stretches to make the best out of your exercise regimen!

Tip 2: Organizing Essential Documents

Everyone loves a good organizing squad. Assemble your financial documents, such as 1098 mortgage interest statements, which showcase how much interest you have paid towards your mortgage in a year. Trust me; lenders love organized clients!

Tip 3: Performing a Credit Check and Repairing Credit Score

The credit score is king in the mortgage world. Regular credit check and score repair not only ensures that you’re financially healthy but also boosts your chances of quick approval. It’s like investing in the best coffee burr grinder for the ideal brew!

Tip 4: Deciding on Your Budget

Be a smart homeowner by deciding on a budget that suits your needs. After all, you wouldn’t want to bite off more than you can chew!

Tip 5: Choosing the Right Mortgage Option

Walking through the mortgage landscape can be tricky! But fear not, spend time researching, and select the mortgage type that fits your financial canvas like a glove!

Tip 6: Getting a Pre-approval

Getting pre-approved for a loan is like buying a fast-pass to quick mortgage approvals. It showcases your financial readiness and the maximum loan amount you may receive.

Tip 7: Seeking Assistance from a Mortgage Broker

When in doubt, seek professional help. Mortgage brokers are your partners in this journey who can provide tailored advice and fast-track your application process.

How Can a Well-Prepared E Schedule Improve Your Chances of Quick Mortgage Approvals?

A well-prepared E Schedule is the key to quick mortgage approvals. The E Schedule, along with the answer to How Is rental income Taxed, can reinforce your financial health by showcasing your steady rental income. Therefore, a rock-solid E Schedule helps in substantiating your repayment capacity, improving your chances of quick approvals.

‘E Schedule’ Paving the Way for Hassle-Free Approvals

A well-prepared E Schedule won’t just make your mortgage provider smile but also pave the way for hassle-free mortgage approvals. Remember, the easier it is for lenders to understand your financial profile and stability, the smoother the approval process will be.

So there you go! A comprehensive guide to untangle the complexities of E Schedule and secure quick and easy mortgage approvals. Happy house hunting!