Owning a home is much more than just a roof over your head – it’s a financial cornerstone that requires savvy navigation. The term ‘equity’ is tossed around a lot in the real estate world, but not everyone grasps its true gravity. In this deep dive, we’ll unlock the door to understanding equity and share the must-know tips to maximize this financial goldmine.

Unveiling Equity – Understanding Your Stake in Home Ownership

Equity

$12.99

**Equity: Personal Finance Management Software**

Equity is a sophisticated personal finance management software designed to help individuals gain complete control over their financial life. It offers a comprehensive suite of tools that enable users to track their income, expenses, investments, and overall net worth in real time. With its intuitive dashboard and customizable categories, Equity allows for a personalized approach to budgeting and financial planning, ensuring that users can quickly identify areas for economic improvement and growth opportunities. The software’s security features also ensure that personal financial data is encrypted and kept private, giving users peace of mind.

The software’s standout feature is its investment tracking module, which provides detailed analysis and insights on portfolio performance, asset allocation, and market trends. Equity’s automated alert system notifies users of significant changes in their investments or financial status, allowing for timely adjustments and strategic decision-making. Users can also benefit from the scenario planning tools, which simulate various financial outcomes based on different market conditions and personal choices. This allows individuals to make informed decisions that are aligned with their long-term financial goals.

Equity goes beyond mere number crunching; it offers educational resources and financial advice tailored to the user’s financial situation. The platform includes access to a library of articles, webinars, and expert advice that can help guide users through complex financial decisions, such as purchasing a home, investing in the stock market, or planning for retirement. Additionally, by integrating with numerous financial institutions and employing real-time data syncing, Equity’s users enjoy a seamless and comprehensive view of their finances that empowers them to build wealth and achieve financial independence.

Defining Home Equity and Its Importance in Real Estate

Let’s cut to the chase—equity is the difference between what your home is worth and what you owe on your mortgage. Picture this: if your home is like a piggy bank, equity is the savings you’ve accumulated inside. It’s a simple concept, but it’s a powerhouse in the game of real estate. Why? Because it measures your piece of the property pie—it’s what you truly “own.”

The Power of Equity: A Gateway to Financial Flexibility

When folks chat about their homes, it’s often about square footage or the quirky neighbor. But the real buzz should be about equity. Why? It’s your ticket to financial flexibility. Dreaming of a modern contemporary house? Equity can help set the stage for that upgrade. Or, for something as simple as a new Jones Road Beauty makeup palette, equity can be your tough-as-nails financial backer.

Maximizing Equity Build-up – Strategic Mortgage Payments

Extra Mortgage Payments: Accelerating Equity Growth

Think of your mortgage like a marathon—not a sprint. By tossing a few extra bucks into your payments, you’re not just paying down the loan; you’re also sprinting towards building more equity. It’s like hitting the fast-forward button on your financial future, and who wouldn’t want that?

Mortgage Types and Their Impact on Equity Accumulation

Now, let’s talk mortgages. A Fixed-rate Mortgage might sound like plain vanilla, but it’s the steady Eddie of the home loan world. Locking in that rate ensures your equity build isn’t knocked off-kilter by unexpected interest spikes. On the flip side, an Fha loan might be your best bud if your credit’s shaky or your savings are slim.

Loan Amortization: How Principal Payments Increase Equity

Ever hear of loan amortization? Sounds like a snooze fest, but trust me, it’s the secret sauce to growing your equity stash. Each time you chip away at that principal, you’re fattening up your equity. It’s the unsung hero of the mortgage world, working undercover to bulk up your financial muscle.

| Aspect | Description | Example | Relevant Dates | Key Points |

| Financial Equity | Value of ownership in an asset after liabilities are subtracted. | Home equity | N/A | Calculated as: Asset value – Liabilities |

| Equity in Real Estate | Ownership interest in property, often building home wealth. | $400,000 house value – $300,000 mortgage = $100,000 equity | N/A | Important for refinancing, home equity loans, or selling property |

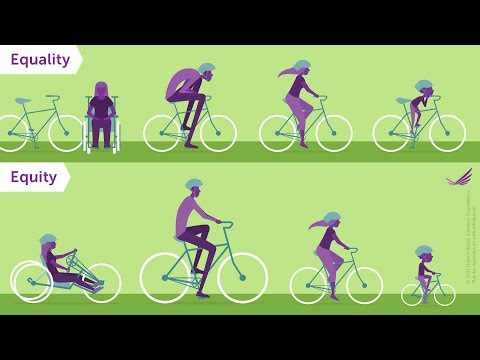

| Equality vs. Equity | Equality is uniform distribution, equity is tailored to individual need. | Equal resources vs. adjusted resources based on need | N/A | Equity seeks to level the playing field by considering starting points. |

| Business Equity | Ownership interest in a company. | Shares in a corporation | N/A | Often reflected in stock ownership |

| Equities as Securities | Stocks or other securities that signify an ownership stake. | Stock market investments | Jun 9, 2023 | Can be bought, sold, or transferred |

Value-Adding Home Improvements – Invest Wisely for Greater Equity

Identifying Home Improvements with the Highest Return on Investment

Let’s talk about home improvements. Turning your pad into a showstopper is more than just eye candy—it’s a savvy investment. But hold your horses! Don’t just throw cash at any old renovation. Focus on the spots that promise a hefty return on investment, think kitchens and baths – that’s where the real money’s at.

Balancing Personal Preferences with Market Trends for Equity Advancement

Alright, so you want to jazz up your digs. Do you go for marble countertops or a decked-out backyard? Well, consider this: it’s all about striking a nifty balance between what makes you tick and what the market digs. This way, you’re not just indulging in personal whims; you’re also giving your equity a good old-fashioned boost.

Budgeting for Renovations: Sustaining Equity While Enhancing Value

Let’s get real; renovations can burn through cash faster than a season finale of “Curb Your Enthusiasm.” The key is to budget like a pro. Stay on top of your funds and protect that equity while you polish your humble abode to perfection. Remember, it’s not just about making your home look snazzy—it’s about smart economics, too.

Fix Injustice, Not Kids and Other Principles for Transformative Equity Leadership

$29.54

“Fix Injustice, Not Kids and Other Principles for Transformative Equity Leadership” is a compelling guidebook for educators, policymakers, and leaders in various fields who aspire to enact systemic change and cultivate equity within their organizations. With a focus on shifting paradigms, the book argues against the misguided tendency to ‘fix’ children to fit inequitable systems, advocating instead for transforming the systems themselves. It provides readers with a thought-provoking collection of principles, strategies, and real-world examples that illuminate how to recognize and dismantle injustices embedded within educational and social structures. By challenging conventional norms and emphasizing the need for collective responsibility, this book serves as a beacon for leaders seeking to create inclusive environments where all children can thrive.

Each chapter in the book dissects a different aspect of equity leadership, ranging from understanding power dynamics to fostering an environment that promotes diversity and inclusivity. The text is enriched with reflective questions and action steps that encourage readers to apply these principles in their daily practices. Through a mix of theoretical frameworks and actionable insights, readers are equipped to identify biases, challenge discriminatory practices, and implement equitable policies. The author emphasizes the importance of empathy and understanding in cultivating a culture that truly values each individual’s unique contributions.

The final section of “Fix Injustice, Not Kids and Other Principles for Transformative Equity Leadership” is dedicated to sustaining the movement towards transformative equity. It addresses the inevitable challenges and resistance leaders may face and offers advice on maintaining resilience and staying committed to the vision of systemic change. The book is not just a roadmap but also a source of inspiration, urging leaders to become agents of change who empower future generations to dismantle barriers and build a more just world. By highlighting the urgency of equity leadership, it calls upon readers to take courageous steps toward creating a society that upholds the principle of fairness for all.

The Market’s Influence: Understanding How External Factors Impact Equity

Local Real Estate Market Trends and Equity Fluctuations

Truth bomb: the local real estate scene can play yo-yo with your equity. When the market’s hot, your equity sizzles. But if it’s not, you might find your equity cooling off. Keep a sharp eye on trends, because in the land of property, knowledge isn’t just power—it’s profit.

Economic Indicators and Their Long-Term Effects on Home Equity

Now, let’s chew over the economic indicators. Interest rates, job stats, and even that pesky inflation can jostle your home’s worth and your equity along with it. It’s a seesaw ride where being clued-up can mean clinging on to your valuable stake.

Anticipating Market Movements to Preserve and Boost Equity

A little birdie in the know is worth two in the bush. Staying ahead of the curve with market movements isn’t just smart—it’s essential. Whether it’s a buzz about a new development or a chill in the investment climate, keep your ears peeled and your equity plan ready to pivot.

Leveraging Equity for Financial Gain – When to Cash Out or Invest

Home Equity Loans vs. Lines of Credit: Optimal Equity Utilization

Thinking of tapping into that equity? You’ve got options. Home equity loans are like your straight-up cash infusion, while lines of credit are the flirty cousins letting you withdraw on a need-to basis. Each has its charm, but choosing wisely can mean the difference between financial triumph and a facepalm moment.

The Pros and Cons of Tapping into Equity for Investment Purposes

It’s tempting—using your home equity to join the investment bandwagon. But hold your horses. While it can be a shrewd move, weigh the risks against the rewards. It’s a game of balance, played best with eyes wide open and a solid understanding of what’s at stake.

Timing the Market: Strategic Equity Release for Maximum Benefit

Releasing equity is like playing double-dutch—you want your timing to be spot-on. Know when the market’s ripe for the picking and when it’s best to keep that equity card close to your chest. It’s not just about making a move; it’s about making the right move.

Safeguarding Your Equity – Protecting Your Investment Long-Term

Insurance and Equity: The Role of Adequate Coverage

First things first, get that home of yours wrapped up tight with insurance. Think of it as your financial safety net, keeping your equity snug as a bug in a rug against life’s curveballs. In a world where anything can happen – trust me, you’ll sleep better at night.

Keeping Up with Maintenance: Mitigating Depreciation and Safeguarding Equity

Next up, maintenance. Keep your home in tip-top shape, and your equity will thank you for it. Let things slide, and you can kiss goodbye to your home’s value (and your equity) quicker than you can say “leaky faucet.”

Legal Awareness and Equity Protection: Understanding Liens and Foreclosures

Oh, and let’s not forget about the legal mumbo jumbo. Liens and foreclosures are the boogeymen of the equity world. Keep those eyes peeled and those payments punctual, and you’ll stay on the sunny side of equity street, my friend.

From Equity Talk to Equity Walk Expanding Practitioner Knowledge for Racial Justice in Higher Education

$12.24

“From Equity Talk to Equity Walk: Expanding Practitioner Knowledge for Racial Justice in Higher Education” is a pivotal guide designed to bridge the gap between conversations about race and the concrete actions needed to promote racial equity in academic environments. Crafted by renowned experts in educational equity, this resource empowers university administrators, faculty, and staff with the tools and insights necessary to transform their institutions into inclusive spaces that actively work against systemic racism. Through a rich compilation of research-based strategies, case studies, and actionable recommendations, the book offers a grounded and practical approach to dismantling barriers to racial justice on campus.

The book begins by laying a foundational understanding of the historical and contemporary landscape of race relations in higher education. It examines the persistent challenges and complexities that practitioners face when addressing race and equity, providing a comprehensive analysis that moves beyond mere acknowledgment of the issues. The authors skillfully navigate through the nuances of institutional culture and the often-unseen forces that perpetuate inequality, enabling readers to identify and address these elements within their own contexts.

Moving forward from analysis to action, “From Equity Talk to Equity Walk” presents a roadmap for institutional transformation. The clearly outlined steps encourage a shift from performative measures towards genuine systemic change. Each chapter is enriched with evidence-based practices, reflection questions, and illustrative examples that facilitate deep engagement and learning. By the end of the book, educators and administrators will not only understand the critical nature of their role in achieving racial equity but will be equipped with the knowledge to lead their institutions toward more just and inclusive futures.

Conclusion: Fortifying Your Financial Future Through Home Equity Mastery

Well, we’ve been on quite the journey, haven’t we? Home equity isn’t just another buzzword—it’s the cornerstone of your financial fortress. From smart mortgage moves to savvy market maneuvers, it’s all about keeping one step ahead. Equity isn’t just a nice-to-have; it’s your silent partner in the financial dance of life.

Recap of Home Equity Tips and Their Impact on Long-Term Wealth

Here’s the 411: bump up those mortgage payments, strike the right reno balance, and keep a hawk-eye on the market. Use equity to your advantage, but don’t get sloppy—protect it like it’s your baby.

Equity as a Financial Tool: Embracing Opportunities and Navigating Risks

We’re talking home equity here, but remember, equity is also about fairness and balance. Understand the weight of what you have, and treat it with respect and savvy. With equity as your trusty sidekick, the financial world is your oyster – just make sure you shuck it wisely.

The Continuous Journey of Home Ownership and Equity Accumulation

Your home ownership saga is an ongoing tale of peaks and valleys. Keep padding that equity cushion and you’ll not only enjoy the ride, you’ll also disembark with a pocketful of financial security. And isn’t that the real dream?

So, there you have it, folks. A grand tour of the equity landscape with all the tips and tricks to make it work for you. Remember, your home is more than a dwelling—it’s the backbone of your financial future. Treat it right, and you’ll be laughing all the way to the bank—or wherever your financial dreams take you!

Unlock the Potential of Home Equity with These Tips

Put Your Equity in the Game

Homeownership isn’t just about having your own spot to hang your hat. It’s about upping your financial game, too. Think about it: every mortgage payment is like rolling the dice in your favor, as a portion builds up your equity. Now, equity is the slice of the home pie you actually own, and trust me, you want that slice to be as big as a Sunday roast beef.

Making Moves with Equity

If you’ve been upping your payments like a pro, you might be sitting on a nice pile of equity without even knowing it. It’s kinda like discovering you’ve been sitting on a lottery ticket—cha-ching! But here’s the thing: it’s a bit more complicated than cashing in those lucky numbers. You gotta be smart.

For instance, tapping into your equity with a home equity loan can be a savvy move. Before you jump in, think of your house like Pam oliver—an all-star home player with a lot of value on the team. You wouldn’t just trade her away on a whim, right? Dive into what you need to know before leveraging that equity.

Equity’s Secret Handshake: Escrow

Heard of escrow? Let’s just say it’s like the secret handshake between buyers and sellers. It’s where your dough hangs out before the deal seals, ensuring everyone plays fair. Got extra equity and thinking about refinancing or selling? Knowing the ins and outs of Escrow is like having the home field advantage.

Amp Up Your Equity with Curb Appeal

Want to boost your equity? Think curb appeal. Seriously, it’s like a nip and tuck for your house. Maybe you’re not planning for a curb Your enthusiasm season 12 kinda hype for your home, but sprucing up the old façade can seriously jack up its value. We’re talking paint jobs, landscaping, the whole nine yards!

Get Inspired: Equity Boosting Chatgpt Prompts

Lastly, don’t get stuck in old ways when brainstorming ways to increase your home’s equity. Why not try sparking your creativity with chatgpt prompts? Who knows, a little nudge might just ignite an equity-boosting bonanza idea!

Remember, your equity isn’t just a number—it’s the key to unlocking your financial future. So, keep these tips close to your tool belt, and watch your home’s value—and your equity—soar!

Equity How to Design Organizations Where Everyone Thrives

$15.84

Equity: How to Design Organizations Where Everyone Thrives is an insightful guide for business leaders, managers, and human resource professionals who are committed to creating a workplace that fosters fairness and inclusivity. This book provides a comprehensive overview of the principles of organizational equity, presenting actionable strategies to dismantle systemic barriers and build a culture that values the contributions of all employees. Drawing from real-world examples and the latest research in organizational psychology, readers will discover the critical role that equity plays in enhancing employee engagement, driving innovation, and ensuring competitive advantage in an ever-evolving business landscape.

The author delves into the nuances of intersectionality, highlighting the unique challenges faced by individuals at the crossroads of multiple marginalized identities, and the importance of nuanced policy design to address these complexities. Each chapter of the book is structured to offer practical recommendations, from conducting equity audits and implementing bias training initiatives to redesigning performance evaluation systems that mitigate discrimination. The book encourages leaders to go beyond mere diversity and inclusion rhetoric by offering a roadmap to institutionalize equity in every organizational policy and practice.

“Equity: How to Design Organizations Where Everyone Thrives” is not just a tactical manualit’s a transformative journey for organizations seeking to advance social justice within the workplace. It equips readers with the tools to create empathetic leadership approaches, establish transparent communication channels, and promote allyship among team members. By reading this book, organizational decision-makers will be empowered to lead with empathy and integrity, fostering a thriving workplace where every employee feels respected, valued, and positioned for success.