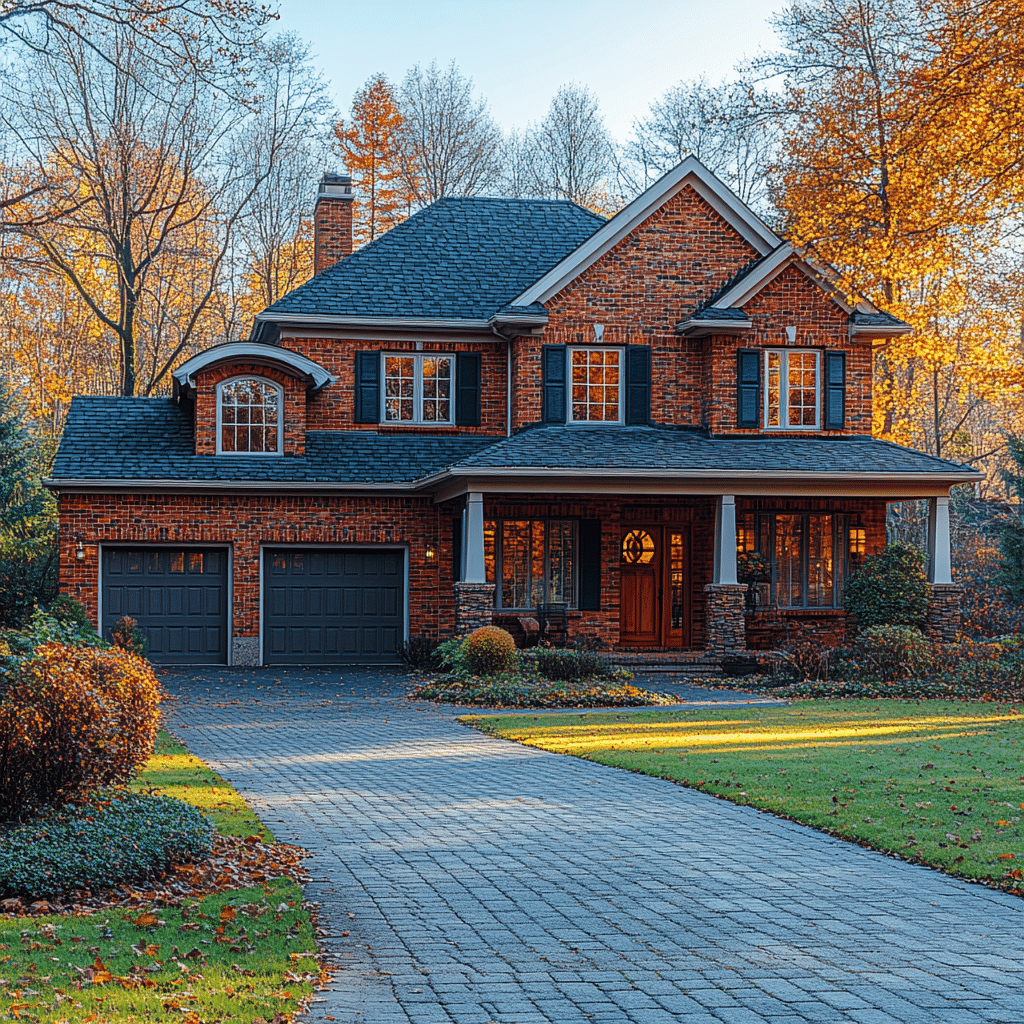

Owning a home has long been synonymous with financial stability and growth. But what most homeowners may not realize is how tapping into their equity home can significantly expand their wealth, beyond just the value of their property.

Top Strategies to Leverage Your Equity Home for Wealth Building

1. Understanding What is Equity on a House

Before diving deep into leveraging, it’s essential to comprehend what is equity on a house. Simply put, home equity is the current market value of your home minus any outstanding mortgage balances. For example, if your house is valued at $400,000 and you owe $150,000 on your mortgage, your equity is $250,000. This means you effectively “own” $250,000 worth of your home outright.

2. How Does Home Equity Work?

How does home equity work in practical terms? Home equity increases with two main factors: amortization and appreciation. As you steadily pay down your mortgage, the portion of the home that you own “free and clear” grows. Simultaneously, if property values in your area rise, so does your home’s equity. For instance, if your home’s value appreciates by 3% annually, a $400,000 property could increase in value by $12,000 per year.

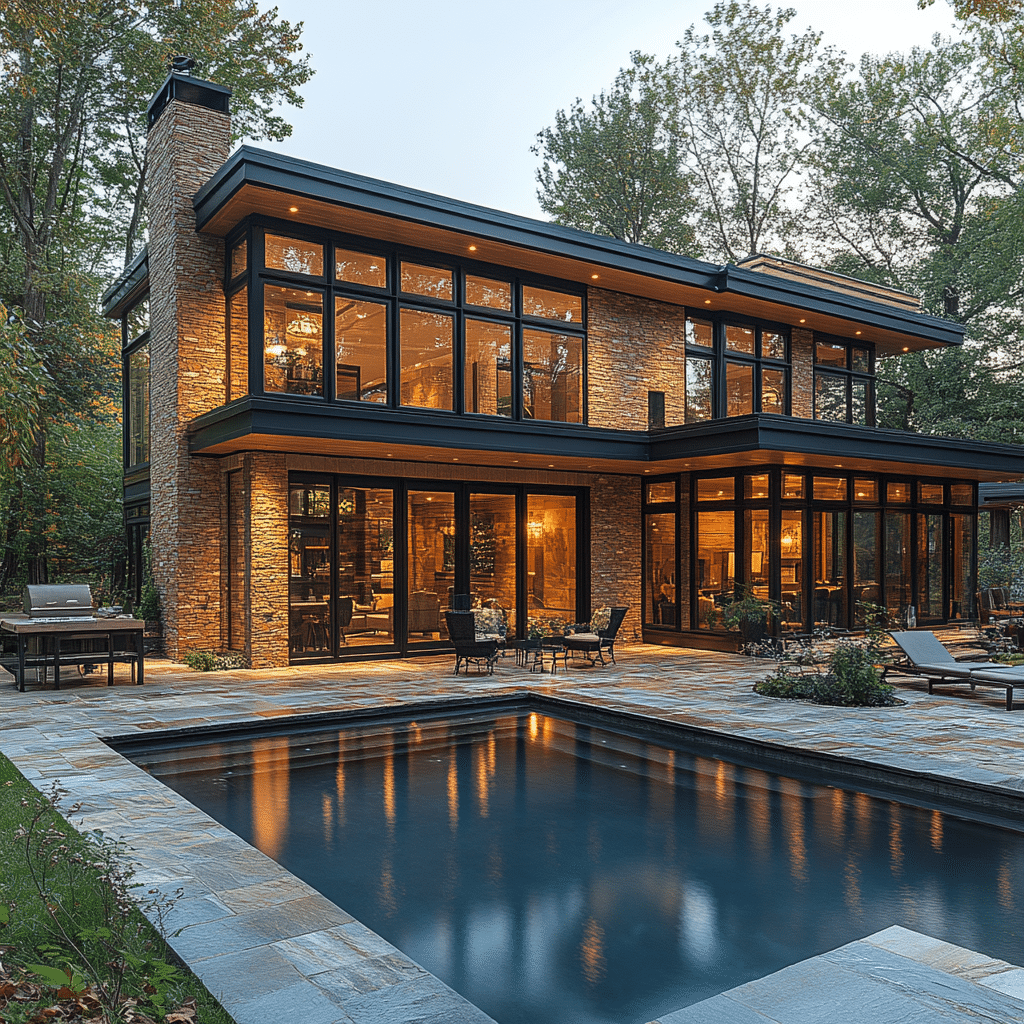

3. Home Improvements to Boost Equity Home Value

Investing in home improvements can significantly enhance your equity home value. Renovations like kitchen remodels, bathroom upgrades, or energy-efficient installations can yield a high return on investment. According to Remodeling Magazine’s 2023 Cost vs. Value Report, a minor kitchen remodel returns about 77.6% of its cost in increased home value. So, not only do you get to enjoy a nicer home, but your investment also boosts your equity.

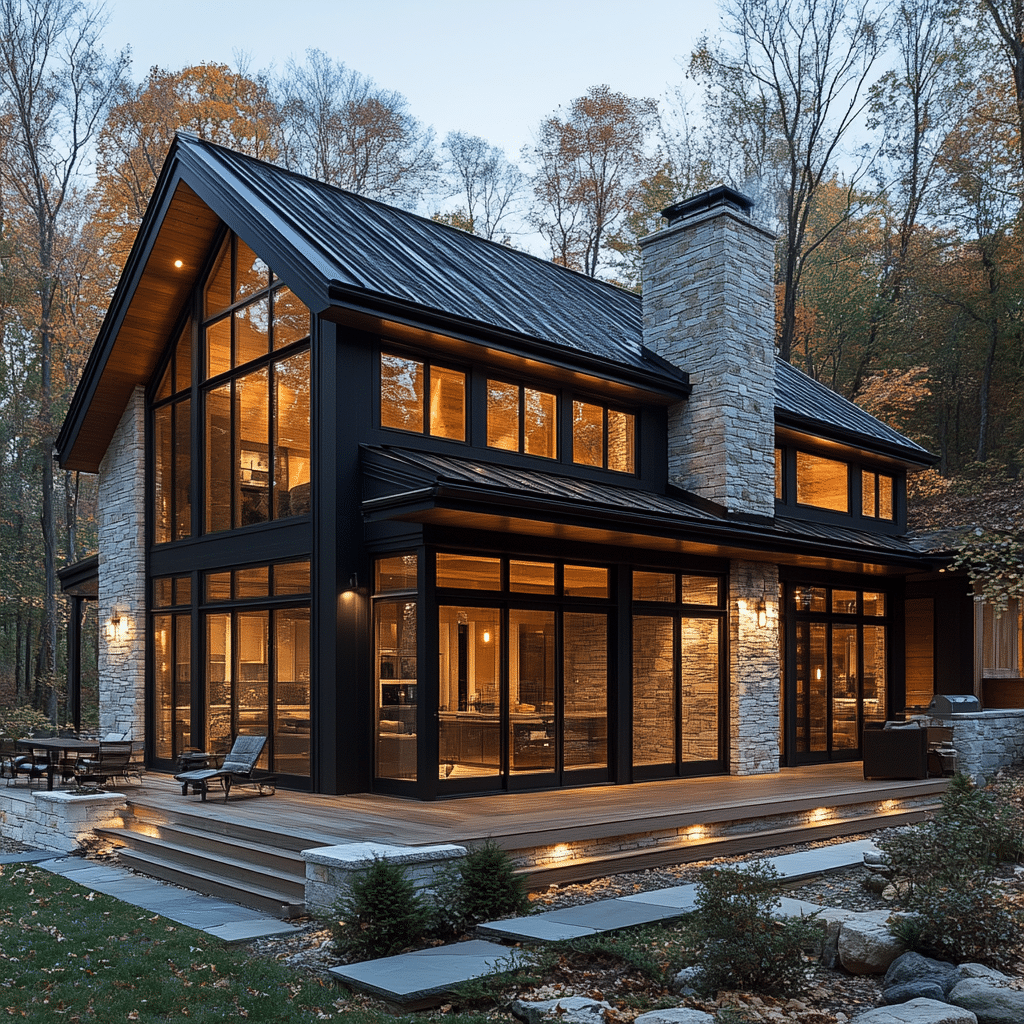

4. Utilizing Equity in House Loan for High-Return Ventures

An equity in house loan, such as a Home Equity Line of Credit (HELOC), allows you to borrow against your home’s equity. These loans typically come with lower interest rates compared to personal loans or credit cards. Savvy investors might use a HELOC to purchase rental properties, start a business, or invest in high-yield stocks—avenues that could potentially offer significant returns, outweighing the cost of borrowing. It’s like having your cake and eating it too.

5. Case Study: Jane Doe’s Success with Home Equity

Consider Jane Doe, who leveraged her home equity to scale her small business. With $200,000 in equity, she took out a $100,000 HELOC at a 4% interest rate. Jane invested this in expanding her business, which subsequently doubled her annual profits within three years. The appreciation of her property further increased her overall net worth. Jane’s smart use of equity turned her home into a financing powerhouse.

6. The Importance of Monitoring Market Trends

Understanding local market trends and property values can help you strategically tap into home equity. For instance, if you live in an area experiencing rapid growth, your property’s value—and thus your home equity—might increase faster than average. Websites and tools like Zillow, Redfin, and local real estate reports can provide valuable insights. Always keep an eye on the trends to make informed decisions.

7. What is Home Equity Release for Retirees?

For retirees, what is home equity if not a financial cushion? Home equity release options, such as reverse mortgages, allow homeowners aged 62 or older to convert part of their home equity into cash while still living in the home. This can be a viable strategy to supplement retirement income or cover healthcare costs. It’s like having a safety net that you can dip into when needed.

Innovative Ways to Maintain and Grow Your Equity Home

Maintaining and growing your equity home involves both strategic planning and proactive management. Keep an eye on interest rates and real estate market trends, budget for regular home maintenance and improvements, and explore various home equity loan products to find the best fit for your financial strategy.

Remember, leveraging home equity is not without risks. Ensure your investment ventures are well-researched and consult with financial advisors to craft a plan that aligns with your long-term financial goals. Building wealth through home equity is possible with careful planning, informed decisions, and an eye for opportunities that maximize returns while minimizing exposure.

Additional Resources

By understanding and utilizing home equity effectively, you open the door to new financial avenues that can significantly boost your wealth. Whether you’re making home improvements, diversifying your investments, or planning for retirement, your home is more than just a place to live—it’s a cornerstone of your financial future. So, take the leap and explore the boundless possibilities your equity home offers!

Equity Home Secrets to Building Wealth

Equity home is a hot topic for those looking to build wealth. Did you know? Building equity in your home is not just about paying off the mortgage. It involves smart strategies and knowing a thing or two about house equity loans. Let’s dive into some surprising trivia and facts that can make your equity home journey more exciting.

Equity Home Trivia You Didn’t Know

One fascinating way to consider building equity is parallel to the tales of hidden treasures. It’s like the infamous search on Nikumaroro Island, where the mystery of Amelia Earhart continues to intrigue treasure hunters. Just as diligent explorers decipher clues, savvy homeowners decode the secrets to leveraging their equity for financial gain. One such mystery unraveled is the house equity loan, a financial tool that lets you tap into your home’s value.

Ever wondered how to get ahead in equity home building without breaking a sweat? Knowing How To get a home equity loan could be a game-changer. Like picking the right slice at Pat’s Select, a local pizza favorite that knows its way around flavor, smart choices in home loans can significantly boost your wealth. Think about it – with the right steps, your equity home could become the cornerstone of your financial success.

Fun Facts and Surprising Tidbits

Speaking of smart choices, did you know that historical home values have, on average, doubled every 10-15 years? This tidbit shows the power of real estate investment and how equity home can become a reliable wealth-building tool over time. Keeping an eye on the market, akin to treasure hunting, can provide big payoffs. And just like a delicious meal at Pat ‘s Select can be a delightful experience, seeing your equity grow can be just as satisfying.

Equity home enthusiasts, remember, it’s not all about the numbers. It’s about making informed decisions and seeing the bigger picture. Like the curious case of Amelia Earhart’s legacy on Nikumaroro Island,( there’s a sense of adventure and discovery in building equity. Each informed decision brings you closer to your financial goals, proving that knowledge, strategy, and a touch of curiosity go a long way.

In sum, think of your equity home journey as a grand adventure packed with valuable insights, strategic choices, and maybe even a treasure hunt or two. Whether you’re diving into a house equity loan or savoring the small wins along the way, each step brings you closer to unlocking the full potential of your home’s equity. Happy hunting!