Understanding Escrow: The Essential Homebuying Mechanism

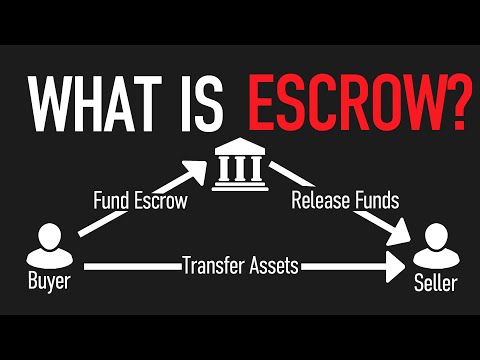

You’ve probably heard of escrow, but what’s the deal with it? Well, let’s cut through the financial jargon and keep it simple. In the world of home buying, escrow is like a trusted friend you give your money to hold onto while you and the seller work out the details of your property purchase. This impartial pal ensures that nobody gets shortchanged — you’re safe from losing your cash if things go sideways, and the seller knows they’ll get their money if everything checks out.

The escrow service? They’re the third wheel in this relationship — a neutral party who takes care of the nitty-gritty. Their job is to hold onto that dough of yours along with any necessary paperwork until each promise made in the house-selling dance is fulfilled. Their responsibilities span from guarding your earnest money to disbursing funds to the right pockets when it’s time to shake hands and pass over the keys.

But wait, there’s more! With a world that’s always online, escrow services have zipped into the future with digital savvy. Apps and platforms now make the whole process smoother than a don Julio cocktail. These days, a few taps on your screen can secure your spot in the housing market, thanks to the evolution of these trusty escrow guardians.

The Anatomy of an Escrow Account: What You Should Know

Alright, so what’s inside this escrow account? Imagine it’s a piggy bank, but instead of coins, it’s filled with the important stuff — we’re talking property taxes, homeowners’ insurance, and that all-important earnest money, the sign that you’re not just kicking tires but are genuinely ready to buy.

Here’s what goes into this financial safe house:

– Your earnest money, which is like a declaration of love to the house you’re buying, saying, “I’m serious about you.”

– Property taxes. Because Uncle Sam wants his piece of the pie, too.

– Insurance premiums, because you’ve got to protect your new digs from whatever life throws at it.

Escrow agents keep a watchful eye on these funds, following strict rules to make sure everything is on the up and up. They’re like the referees in a sports game — nobody messes with the rules on their watch. And let’s talk protecting your cash — security measures around these accounts are tighter than a stone wall, with layers of safeguards to keep your hard-earned money out of harm’s way.

Closing Escrow

$9.99

Closing Escrow is a cutting-edge software suite designed to streamline the final steps in property transactions, offering a seamless experience for real estate agents, buyers, and sellers. It is equipped with an intuitive interface that allows users to monitor the progress of their escrow process in real-time, ensuring transparency and efficiency. The platform integrates smoothly with banks, title companies, and legal frameworks, thereby reducing the paperwork and potential obstacles commonly associated with the closing phase of real estate deals.

One of the key features of Closing Escrow is its secure document management system, which enables the encryption and digital signing of vital paperwork, making it easier to finalize agreements promptly. Automated alerts and reminders keep all parties on schedule, reducing the likelihood of missed deadlines and costly delays. Furthermore, comprehensive audit trails and reporting tools assist in maintaining a meticulous record of the entire closing process, which is essential for compliance and future reference.

Closing Escrow not only helps with the technicalities but also enhances customer satisfaction by providing educational resources that demystify the escrow process for first-time buyers and sellers. The software’s customer support team is available for personalized assistance, ensuring any queries or concerns are addressed swiftly and with expert knowledge. Overall, Closing Escrow is the dynamic solution that modern real estate professionals need to facilitate a swift, secure, and successful property closing transaction.

| Aspect | Description |

|---|---|

| Definition | Escrow is a legal arrangement in which a neutral third party temporarily holds funds or assets during a transaction between two other parties. |

| Purpose in Real Estate | 1. To protect a buyer’s good faith deposit. 2. To hold funds for property taxes and insurance. |

| Escrow Account Management | Managed by an escrow agent or holder who oversees the transfer of ownership and funds upon fulfillment of the contract’s conditions. |

| Ownership of Funds | The buyer owns the money in the escrow account until transaction conditions are met, after which ownership transfers to the seller. |

| Monthly Payments | Part of the homeowner’s monthly mortgage payment goes into the escrow account to cover property taxes, homeowners insurance, mortgage insurance, and possibly flood insurance. |

| Benefits of Escrow | Reduces the risk of transaction failure by assuring the seller about the buyer’s intent; it also ensures that taxes and insurance are paid on time. |

| Avoiding Escrow | Can lead to consistent mortgage payments, but requires the homeowner to manage tax and insurance payments directly. |

| Escrow Refunds | Occur when actual bills, like taxes or insurance, are lower than estimated; the surplus is returned to the homeowner after an escrow analysis. |

| Escrow Fees | All parties may be required to pay a facilitation fee for the escrow service. |

| Escrow in Mortgages | A mortgage escrow account is set up by the lender to cover the homeowner’s future property tax and insurance obligations; lender adds escrow portion to the mortgage payment. |

| Real Estate Transactions | Sale may be held in escrow until the buyer secures financing, insurance, and meets other conditions necessary for the transaction. |

| Escrow Account Rules | A deposit must be made before starting the transaction, and the escrow funds are only released upon agreed delivery by the seller. |

The Escrow Process: A Step-by-Step Breakdown

The escrow process, while it can sound as complex as a tax code, is really just a fancy to-do list for buying a house. It goes something like this:

1. Open escrow — like starting a race, this is where you get set up with your escrow officer.

2. Drop in your earnest money — show everyone you mean business.

3. Let the inspections and negotiations begin — no one likes surprises after moving in!

4. Finalize your loan, because it’s all about the benjamins, baby.

5. Sign on the dotted line — get those pens ready for a workout.

6. Close escrow — like crossing the finish line, celebrate because you’ve just scored your new home!

But who’s involved? You’ve got buyers, sellers, real estate agents, lenders, and the escrow agent — a regular squad set to get you through to home plate.

Common issues? Sure, they happen. Maybe your credit score decides to be a pain, or there’s a hitch with the home inspection. The key is staying on top of it, ensuring clear lines of communication, and having a little patience.

Slim chances and tall tales aside, most escrow stories have happy endings. Just keep your eye on the prize and trust the process.

Escrow Fees and Costs: What to Expect and Why They Matter

Let’s talk turkey about escrow fees. These little numbers come with the territory and are how the escrow service keeps the lights on. They’re sort of the cover charge for entering Club Homeownership, covering the cost of paperwork, securing your funds, and so on.

But who picks up the tab? Buyers and sellers typically split the bill, keeping it fair and square. As for the cost, it varies — think location, transaction size, and a sprinkle of market rates to determine your bill. It could be a flat fee or a percentage of the home’s price.

Why does it matter? Because buying a house isn’t just about the sticker price — managing risk and ensuring everything is kosher legally is where escrow earns its keep. And if folks start rumbling about fees, it’s news. Recently, there’s been chatter about whether these costs are justified or need trimming — after all, everyone loves a good bargain.

Navigating Challenges With Escrow: Troubleshooting Tips

Now, what if you hit an escrow snag? Here’s the thing — knowledge is power. The more you know, the better you can dodge those hurdles. If your tax bill takes a nosedive, a little birdie called “escrow analysis” will not only let you know but might also get you a refund.

And if trouble brews? Say you find yourself in a pickle with the funds, or there’s a tug-of-war over conditions. This is when rolling up your sleeves and bringing in pros who know their way around the maze can untangle the knots. Real-life escrow tales teach us that it’s usually about getting everyone on the same wavelength to find that sweet spot solution.

And hey, here’s where the good stuff kicks in — technology has made tracking escrow hiccups as easy as ordering those Womens fashion Sneakers you’ve been eyeing. Online platforms are smoothing out the bumps, keeping things running like a well-oiled machine.

Escrow

$62.90

Escrow is a secure financial arrangement that plays a pivotal role in a multitude of transactions, safeguarding all parties involved by holding funds or assets in trust until specific conditions are met. It offers a neutral third-party service that ensures that buyers and sellers, or other transactional parties, conduct their business with confidence that obligations will be fulfilled. The process begins when both parties agree on the terms and deposit the relevant assets or funds with the escrow provider. Once the provider confirms that all agreed-upon conditions have been satisfied, the assets or funds are released accordingly, ensuring a smooth, safe, and transparent transaction.

In the realm of real estate, escrow is an essential player, providing peace of mind for buyers and sellers throughout the property purchasing process. From earnest money holding to the final transfer of title, the escrow agent meticulously oversees each phase, ensuring that funds are disbursed only when all contractual terms are honored and all necessary paperwork is duly signed and verified. The escrow process helps prevent fraud by withholding payment to the seller until the buyer has received and approved the property free of encumbrances. This safety mechanism not only protects the buyer’s investment but also certifies that the seller receives payment promptly upon completion of the conditions.

Outside the traditional arena of real estate, escrow services are also utilized in online transactions, trade deals, mergers and acquisitions, and intellectual property agreements. Online marketplaces frequently use escrow to hold funds during the transfer of goods or services, reducing the risk of scams and non-payment. For larger trade agreements and business mergers, escrow agents are indispensable for handling large sums of money and complex regulatory compliance issues. The versatility of escrow services extends their reach, making them a foundational element for secure, trustworthy exchanges across a broad spectrum of industries worldwide.

Conclusion: Escrow Demystified and Your Path Forward

So, there you have it — escrow in a nutshell. It’s the trusty gatekeeper that sees your transaction through rain or shine. We’ve covered its anatomy, the fees, the process from start to finish, and even tossed in some troubleshooting tips for good measure.

Looking ahead, soaking in this escrow knowledge means you’re stepping into the ring with a solid footing. Armed with these insights, you’re ready to ride the property-buying waves like a seasoned sailor, and hey, maybe even help a friend or two avoid some heartache.

Embrace your future transactions with chutzpah. You’ve got the lowdown on escrow now, and that’s a big piece of the home-buying puzzle locked down. Go on, use this knowledge as your shield, and take on the housing market with gusto — after all, it’s your move.

Remember, at Mortgage Rater, we’re here to keep you informed and empowered every step of the way. Whether you’re eyeing that Fixed-rate Mortgage or pondering the virtues of an Fha loan, remember, it’s not just about landing the house — it’s about doing it smart. Welcome to the homeowner’s club!

Beyond the Basics: Escrow Unpacked!

Welcome, homeowners, homebuyers, and everyone in between! Hold onto your hats because we’re diving into the world of escrow. It’s not just a fancy word your realtor tosses around to sound smart—it’s a pivotal player in the property game!

What’s in a Name: “Escrow”? Sounds Fancy!

Funny thing, the word “escrow” might sound like it strutted straight out of a Shakespeare play, but here’s the kicker—it’s as modern as your morning latte. Think of it as a financial cushion, a neutral third party that holds onto something of value—usually dough—while two other parties sort out a deal.

Escrow and Arrows (A Holly Daye Mystery Book )

$3.99

“Escrow and Arrows” is the latest installment in the captivating Holly Daye Mystery series, perfect for fans of cozies with a twist of real estate intrigue. In this thrilling page-turner, our quick-witted heroine, Holly Daye, uses her expertise as both a savvy real estate agent and an amateur sleuth to untangle a web of mystery shrouding a high-stakes property transaction. As she navigates the treacherous waters of home sales, a puzzling murder implicates her client, and Holly must balance open houses with closed-case files. Rumors, suspects, and dead ends complicate the plot, as Holly races against the clock to clear her client’s name and close the deal before the killer strikes again.

Set against the backdrop of the scenic town of Thornberry, Holly finds herself dealing with an exclusive property that should have been an easy escrow, but things go south when the seller is found dead with an arrow in his back. The festivities of the annual Thornberry Archery Tournament provide cover for a much darker gamea game that Holly must decipher before another shot is fired. Each new showing reveals another hidden motive, and with the accuracy of a master archer, Holly must aim her investigative skills at a target obscured by secrets and lies. Balancing humor with suspense, this murder mystery will keep readers on the edge of their seats, guessing until the very end.

As Holly draws closer to the truth, familiar characters from the series return to lend a hand, while new faces bring fresh challenges and wit to the storyline. Interwoven with the drama is an amusing dose of romance and small-town gossip, providing light relief amidst a tale packed with danger and deception. With a blend of charismatic charm and shrewd deduction, “Escrow and Arrows” will delight regular readers of the series and newcomers alike. The combination of Hollys tenacity and the riveting plot make this book an unputdownable read that will leave fans eager for the next chapter in her adventures.

Did You Say “Neutral Party”?

Yes, indeedy! Like Switzerland during, well, every conflict ever, escrow is that neutral territory where your greenbacks chill until the deal is done and dusted. Everyone has peace of mind knowing the money’s in a safe spot, and nobody’s getting hoodwinked.

But Wait, There’s More! “Equity” Enters the Chat

Hang tight; we’re linking up concepts here. Escrow relates to your home equity too—yep, that’s your home’s value minus what you owe. It’s kinda like the powerhouse of your financial standing when it comes to property. The more Equity you have, the stronger your position. It’s a financial flex that even buck mason would tip his hat to.

So, Can I Bundle That?

You betcha! Think of escrow like a Swiss Army knife—it’s got all these different functions. Sometimes, it’s not just about the sale; it’s also about holding your property taxes and insurance payments. Kinda like bundling your internet and cable, but for your house stuff.

The “Sexs Pakistan” of Financial Transactions?

Okay, let’s clear this up—when you hear Sexs pakistan, what springs to mind? Maybe something spicy, exotic, or mysterious? That’s escrow for you. It’s got that allure, especially when you realize how it protects your transaction from going sideways. It’s the spice that keeps the financial dealings savory and safe.

Now, For a Quick Game of “Did You Know?”

So there you have it, folks. Escrow ain’t just another five-letter word; it’s a five-star player in your property purchase saga. Keep it in mind, and you’ll be playing the real estate game like a pro. Now, give yourself a pat on the back; you’re practically an escrow whiz!

Escrow Officer Gifts Funny Sassy Thank You Appreciation for Women Co Workers, Friends or Family

$6.99

Title: “Escrow Officer Gifts Funny Sassy Thank You Appreciation for Women Co-Workers, Friends, or Family”

Are you looking for the perfect way to express your gratitude and put a smile on your favorite escrow officer’s face? Look no further than our unique collection of funny and sassy appreciation gifts, crafted specifically for the amazing women in the real estate industry. Each item in this curated line-up combines humor with a touch of class, conveying your thanks with a giggle-worthy twist. From mugs with witty one-liners about the joys of closing deals to chic desk accessories that shout out their escrow prowess, our gifts are a surefire way to brighten her day and workspace.

Crafted for durability and daily use, every product is not just a token of appreciation but also a practical tool for the professional woman. Imagine the laughter and the stories that will be shared when she sips her morning coffee from a mug that reads “Keep Calm and Let the Escrow Officer Handle It” or organizes her desk with a sassy nameplate stating “Queen of Closings.” Our gifts are made to withstand the hustle of the hectic escrow world, ensuring that your gesture of appreciation lasts as long as the memories it creates.

Surprise your colleague, friend, or family member with a present that celebrates her role as an escrow officer and acknowledges the hard work and dedication she brings to the industry. Whether it’s for a holiday, work anniversary, or just because, our collection of humorous gifts for escrow officers is the perfect way to say “thank you” in a fun and memorable manner. Let her know that her expertise doesn’t go unnoticed and that her ability to navigate the complexities of real estate transactions is both admirable and deserving of a little comedic relief.

What does escrow mean on a house?

Oh, the mystery of escrow! In the world of homebuying, “escrow” is like a trusty sidekick holding onto funds or assets (think property taxes and insurance premiums) until the home buying process crosses the finish line.

Who owns the money in an escrow account?

When it comes to the cash stashed in an escrow account, technically, you own it. But, before you start daydreaming about how to spend it, remember, it’s earmarked for specific bills related to your house.

Should I remove escrow from my mortgage?

Thinking about ditching escrow from your mortgage? Hold your horses! It can simplify your life by managing property-related bills, but if you’re confident you can handle them on your own and your lender allows it, yeah, you could give it the boot.

Is escrow paid back?

“Is escrow paid back?” you ask. Well, it’s not a boomerang, but if you’ve overpaid, the extra dough should come back your way in the form of an escrow refund.

Can I lower my escrow payment?

Wishing you could lower your escrow payment? Well, you might be able to trim it down by challenging property tax assessments or sniffing out cheaper home insurance. Just don’t skimp on coverage, alright?

Why do I pay escrow on my mortgage?

So, why do you pay escrow on your mortgage? Simple – it’s like a piggy bank for your taxes and insurance, ensuring you never accidentally skip a payment and end up in hot water.

What are the disadvantages of escrow?

What’s the catch with escrow? For starters, it can make your monthly mortgage payment bigger and it’s hands-off, meaning you don’t control when payments are made.

Why is my escrow so high?

If your escrow is sky-high, chances are your property taxes or insurance premiums have ballooned – ouch! Best to check those statements or it might just keep going up.

What happens if I pay off my escrow balance?

Knocking out your escrow balance is like dropping the mic on your property expenses. Once paid, you might get a refund for the surplus or a reduction in future payments.

Is escrow good or bad?

Escrow: friend or foe? It can be a helpful buddy, making sure your bills are paid without you worrying. But for some, it’s got a bit of a control issue since you can’t directly manage your own funds.

Can your mortgage go up because of escrow?

Yes, your mortgage can hike up if escrow costs swell – that’s the part no one’s thrilled about.

Is it better to have escrow or not?

Which is better, escrow or no escrow? That’s like asking if coffee is better black or with cream. If you crave financial stability and ease, escrow is your cream. But if you prefer to call the shots, black’s your bet.

What happens if I overpay escrow?

Oops, overpaid your escrow? No sweat, your lender should send a refund your way or lower your upcoming payments.

How do I check my escrow balance?

Curious about your escrow account balance? Just log into your lender’s website or give them a ring, and they’ll spill the beans.

Who is responsible for an escrow mistake?

If an escrow mistake pops up, it’s usually on the lender or escrow manager to fix it. Cross your fingers they’re quick about it!

How does escrow work on a mortgage?

Escrow and mortgages go together like peanut butter and jelly. You pay into it monthly, and it covers your tax and insurance bills when they’re due – smooth, right?

Does escrow mean closing?

Does escrow mean you’re closing on a house? Not quite. It’s more like you’re in the final lap, with money held safely until the deal is sealed.

Why does my escrow keep going up?

When your escrow starts packing on the pounds, it’s often because your taxes or insurance rates have hiked up. Time for a review!

What happens if I pay extra on my escrow?

And what if you splurge extra on your escrow? Well, it’s good news! You’ll either get a refund for the overpayment or enjoy smaller payments in the future. Either way, you’re kind of ahead!