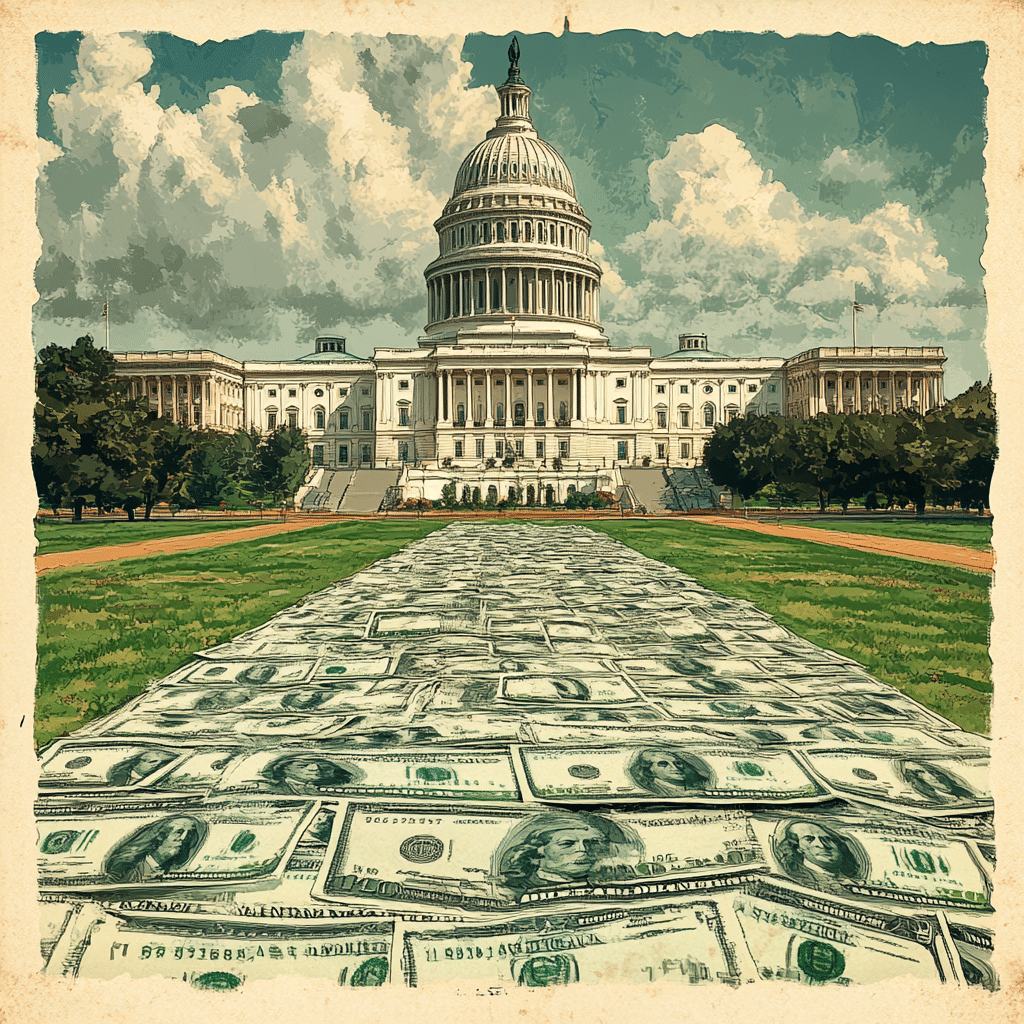

What is the Current Federal Interest Rate and How Did It Get Here?

As we scrutinize the federal interest rate today, we find ourselves in an extraordinary economic situation. The Federal Reserve interest rates today have skyrocketed to an imposing 7.5%, a noteworthy jump from the rates we’ve grown accustomed to in recent years. This sharp rise didn’t just emerge out of thin air. It’s the result of a slew of interconnected economic events.

Historically, current fed rates were tweaked with great care, responding to the ebbs and flows of inflation and employment trends. However, recent economic shocks and global political unrest have fast-tracked the Fed’s decision-making. Contemporary analysts pinpoint several culprits:

– Economic chaos induced by the pandemic.

– Persistent global supply chain hiccups.

– Inflation pressures hitting a four-decade peak.

– International tensions, particularly conflicts like the Russia-Ukraine war, unsettling global markets.

The Trend in Federal Interest Rates Today: Analyzing the Surge

When examining federal interest rates today, the dramatic climb from just 3% in early 2023 to the current 7.5% is jaw-dropping. Several key factors have driven this shift:

1. Inflation Rates Hitting Record Highs

The Consumer Price Index (CPI) has surged due to continued supply chain constraints and hefty pandemic stimulus packages, resulting in a staggering 12% inflation rate. This spike has forced the Fed to raise today’s federal interest rate in a bid to tame these inflationary fires.

2. Labor Market Tightening

The U.S. faces unprecedentedly low unemployment rates, dipping to 3.2% nationally. With wages climbing sharply, consumer and business spending has surged. This necessitated the rise in the current us interest rate to cool down the heated economic activity.

3. Real Estate Market Heat

Housing markets remain red-hot, driven by intense demand. Adjustments in the current fed rate are imperative to prevent a housing bubble. Higher rates act as a coolant to the overheated real estate sector.

| Category | Details |

| Federal Interest Rate | 5.5% |

| Type of Rate | Federal Funds Rate |

| Effective Date | October 2023 |

| Set By | Federal Reserve (The Fed) |

| Impacts | – Consumer loans and mortgage rates |

| – Business loans | |

| – Credit card rates | |

| – Savings accounts | |

| Economic Context | – Inflation control |

| – Economic growth moderation | |

| – Employment rates | |

| Loans Affected | – Fixed-Rate Mortgages |

| – Adjustable-Rate Mortgages (ARM) | |

| – Personal Loans | |

| – Auto Loans | |

| Investment Influence | – Bond Yields |

| – Stock Market | |

| Benefits of Lower Rates | – Lower borrowing costs |

| – Increased consumer spending | |

| Risks of Higher Rates | – Higher borrowing costs |

| – Reduced consumer spending | |

| – Potential economic slowdown | |

| Recent Rate Changes | – Last rate hike: September 2023 (+0.25%) |

| – Previous rate: 5.25% |

Impact of Current Fed Interest Rates on Different Sectors

Real Estate

Soaring mortgage rates, hinging on the fed interest rate today of 7.5%, present substantial challenges for future homeowners. The average 30-year mortgage rate now hovers around 10%, creating a cooling effect on the once-flaming housing market. Potential buyers are taking a step back, leading to a more balanced market.

Stock Market

Investors are navigating choppy waters as current fed interest rates shake the foundations of stock valuations. Indices like NASDAQ and S&P 500 have experienced corrections, mirroring the more expensive capital investment landscape. Traditionally high-growth sectors are particularly sensitive to these shifts.

Small Businesses

Small and medium enterprises (SMEs) feel the pinch of today’s federal interest rate acutely. Increased borrowing costs can hamper expansion and operational liquidity, posing significant hurdles to growth and innovation.

The Role of Geopolitical Influences and Economic Policies

The current fed interest rate is influenced by more than just U.S. domestic policy; international economic variables play a crucial role. Consider these factors:

1. Energy Prices

Global energy prices have spiked, driven by geopolitical strife and conflicts like the ongoing Russia-Ukraine war. These price hikes trickle into operational costs across industries, pressuring the Fed to raise rates.

2. Trade Policies and Tariffs

Trade tensions, especially between the U.S. and China, complicate the Fed’s decisions. Increased tariffs and trade barriers inflate costs for consumers and businesses, pushing the federal reserve interest rates today higher to manage inflation.

Comparing Current Interest Rates: Fed vs. International Central Banks

Current interest rates fed standards compared with other major central banks provide a fascinating comparison. For instance:

– The European Central Bank (ECB) is holding its rate at 5%, taking a more conservative stance.

– The Bank of England (BoE) has set its prime rate at 4.5%, managing their regional inflation with a moderate approach.

– The Bank of Canada (BoC) maintains a 6% rate, balancing growth stimulation with inflation control.

This comparison underscores the Federal Reserve’s aggressive approach in addressing unique U.S. economic challenges.

Forecast: What Lies Ahead for the Fed Interest Rate?

Looking ahead, economists like Paul Krugman suggest that fed rates today might stabilize but will likely stay elevated for some time. Future projections depend on several factors:

– Ongoing inflationary pressures.

– Persistent international uncertainties.

– Long-term shifts in global economic landscapes.

Fed Chair Jerome Powell has emphasized a data-driven approach for future us interest rates today adjustments, aiming to balance economic growth with inflation control.

Final Thoughts: Mastering the New Economic Landscape

The rollercoaster of the federal interest rate today provides a wealth of insights and cautionary tales. As potential homeowners, investors, and business owners, understanding this dynamic is critical. We must devise strategies to flourish despite rising rates. Careful observation and forward-thinking policies will be key in making the most of this challenging economic climate.

By keeping an eye on the current us interest rate, we can better plan and adapt to these financial shifts. Whether you’re seeking the best mortgage interest rate or just trying to understand What Did The fed do today, knowing the intricacies of the finance world has never been more important. Be prepared, stay informed, and use our tools at Mortgage Rater to navigate this landscape confidently. For a detailed look at today ‘s interest rates, visit our site now.

Through proactive planning and staying abreast of economic trends, we can turn these challenges into opportunities, ensuring a financially sound future, despite the high-interest rate environment.

Federal Interest Rate Today: Shocking Surge Insights

Historical Rollercoaster

The federal interest rate today can often feel like a wild ride. Did you know that it once hit an all-time high of 20% back in 1980? Imagine trying to buy a home or take out a loan with those rates! This astronomical spike was due to rampant inflation at the time. Fast forward to today, and although we’ve seen some alarming increases, it’s still nowhere near what it was during the late ’70s and early ’80s. Speaking of large numbers, it’s interesting to note that states with the lowest property tax rates often have higher interest rates to balance their budgets. So, while you might save on taxes, the interest might just take a bigger bite out of your wallet.

Seasonal Connections

Ever wonder if there are seasonal trends in federal interest rates? It might sound a bit spooky, but some believe that rates tend to fluctuate around major holidays. This Halloween, instead of just shopping for Halloween Trees, keep an eye on those rates! Historically, rates have seen shifts during the end-of-year holiday season due to consumer spending patterns and economic forecasts for the upcoming year.

Prime Insights

Another interesting tidbit is the relationship between federal interest rates and Us Prime Rates. The prime rate is the interest rate commercial banks charge their most creditworthy customers and is influenced heavily by the federal funds rate. So, when the federal interest rate today takes a hike, you can bet your bottom dollar that the prime rate will follow suit. This interconnectedness underscores the importance of keeping abreast of both rates, especially if you’re planning a significant financial decision.

Pop Culture Intrigue

Did you know that the famed cartoon character, Kikuri Hiroi, once drew parallels between economic terms and their influence on daily life in an episode? It’s fascinating how pop culture sometimes dips its toes into the seemingly mundane world of finance, shedding light on how these rates impact our everyday purchases and savings. So, the next time you catch your favorite show, pay attention – you might just learn something useful about the federal interest rate today!