Understanding FHA Loans for Mobile Homes in the Current Market

Navigating 21st Century Mortgage Options for Mobile Homes

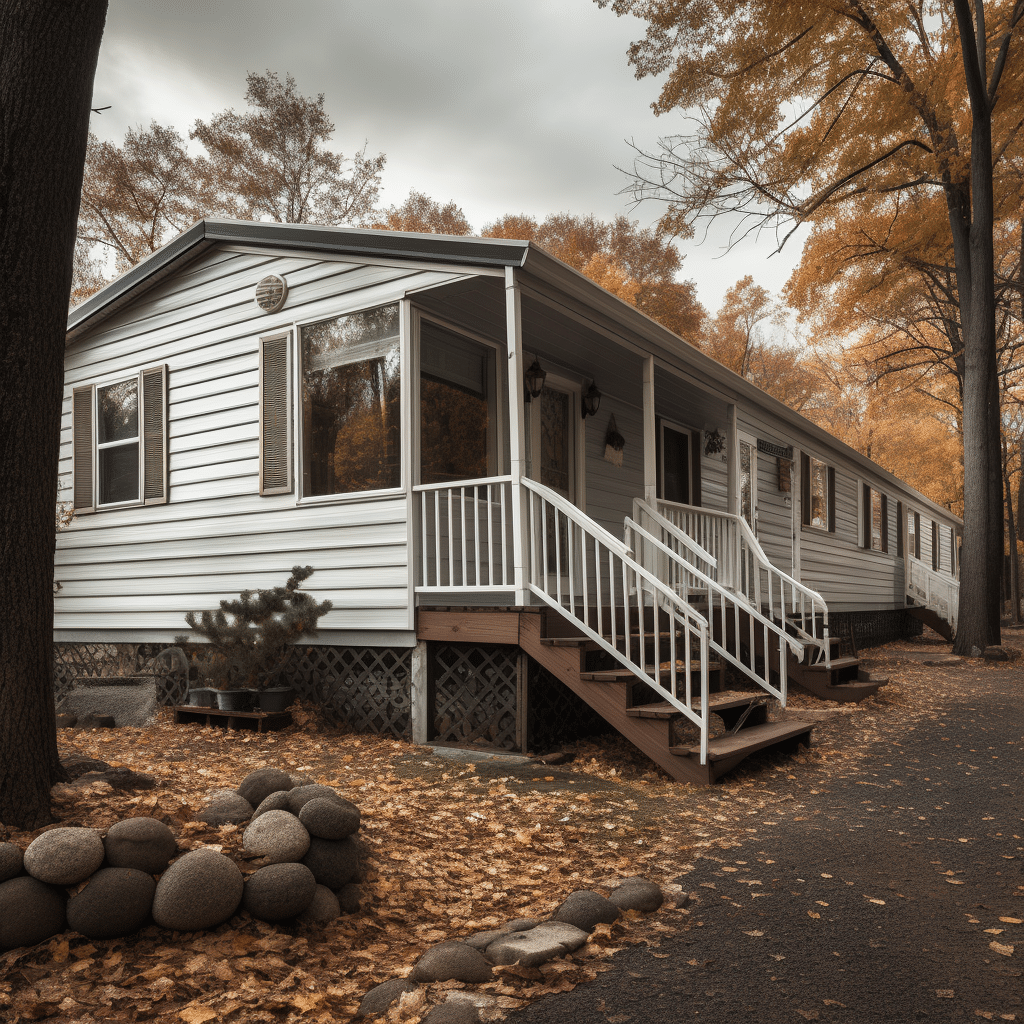

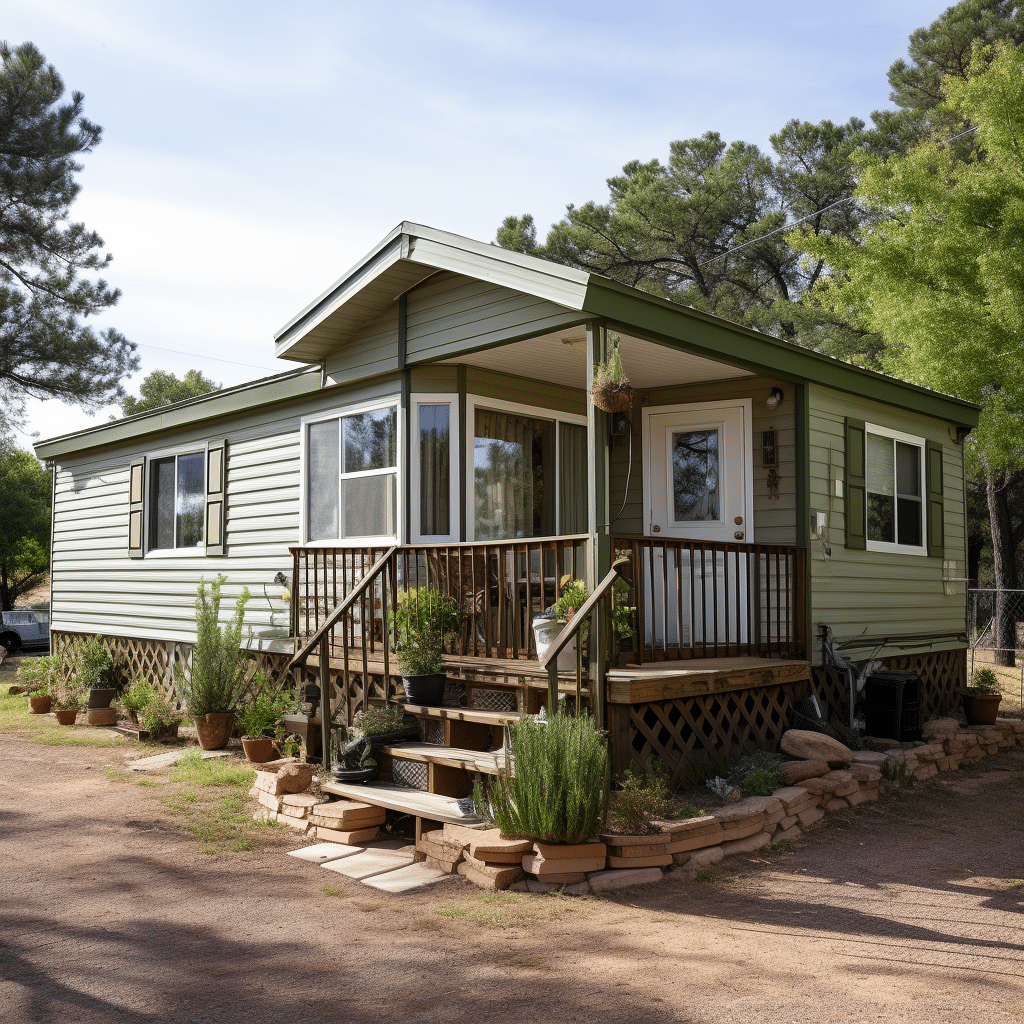

Gone are the days when a white picket fence and sprawling backyard defined the American Dream. In an about-face, more Americans are turning toward mobile homes as a viable, affordable housing solution. With wallets in mind, let’s talk turkey about the changing landscape of 21st-century mortgages for these modern abodes.

The Federal Housing Administration (FHA) isn’t stuck in the mud: they’ve adapted FHA loans for mobile homes, providing a foothold for would-be homeowners. As people catch wind of the financial savvy behind choosing mobile homes, FHA loans for these properties have become a hot topic.

The Basics of FHA Loans for Mobile Homes

Before we jump into the deep end, let’s paddle through the shallows. FHA loans are government-backed mortgages with typically easier credit requirements and lower down payments. For mobile homes, the devil’s in the details: these loans come with their own set of criteria and limitations that differ from traditional home loans.

First and foremost, the mobile home must meet specific HUD standards, and the loan’s purpose can vary from purchasing the mobile home itself, the lot, or both. And remember, pals, these aren’t your regular stick-built homes, so expect a different application journey.

FHA Title 1 Loan: A Gateway to Mobile Home Ownership

For many, an FHA Title 1 loan is like finding a pearl in an oyster. It’s designed precisely for mobile homes and factory-built housing. Whether you own the land or have your home in a mobile home park, you can swim in these friendly waters.

Eligibility hinges on a couple of must-haves: the home has to be a primary residence and meet certain conditions. For the nitty-gritty details on loan terms, you’ll need your ducks in a row with the right documentation — we’re talking credit scores, income verification, you name it.

Exploring Bad Credit Mobile Home Loans Guaranteed Approval

Alright, here’s the real deal: bad credit mobile home loans guaranteed approval might sound like a dream, but the nod from lenders isn’t a slam dunk. However, don’t throw in the towel – FHA loans are the ace up your sleeve, designed to help folks with lower credit scores.

To stack the deck in your favor, prepare to demonstrate your financial stability and consider higher interest rates part of the bargain. Spruce up your credit score, save for a larger down payment, and voilà – you’re inching closer to approval.

Mobile Loans: Financing on the Move

Mobile loans are a different breed in the mortgage kennel. Legal classifications for your mobile home are the name of the game; it can be personal property or real property depending on its setup. Translation? It can impact your loan options and terms.

The financial implications for you, the consumer, are clear as day. Make sure you understand the fine print, from loan limits to insurance requirements, because nobody likes a surprise party when it comes to money.

Interest Rates and Repayment Terms for FHA Loans on Mobile Homes

Now, let’s dive into some numbers. Interest rates for FHA mobile home loans tend to be friendly, but they bob up and down with the current market tide. And repayment? You can stretch it out over a period of time that works for your budget, but long-term means more interest paid.

Here’s a kicker: refinancing is like a good stretch after sitting too long. It can shift your interest rate, shave off some monthly expenses, and even free up cash for other adventures in your life.

Case Studies: Success Stories of FHA Loans for Mobile Homes

Imagine the joy of sprawling in your own mobile home without a monstrous mortgage. It’s not a fairy tale; genuine folks have done it with FHA loans, turning their tin-can dreams into sturdy, affordable castles.

Success isn’t spun from cobwebs and fairy dust – it’s built on solid financial planning and understanding the ins and outs of these loans. So let’s pull back the curtain and learn from the triumphs of others.

FHA Loans vs. Other Financing Options for Mobile Homes

It’s a jungle out there with loan options crawling every which way. FHA loans might be your knight in shining armor, but it’s worth a peek at other contenders. From personal loans to manufacturer’s financing, every choice has its pros and cons.

Sniffing out the best loan for your situation is no picnic, but with a little elbow grease and due diligence, you can corner the one that fits like a glove.

Advanced Tips for Prospective Borrowers

Heads up, future borrowers! Navigating the FHA loan application requires some insider knowledge. Steer clear of common pitfalls, like biting off more loan than you can chew or overlooking important paperwork.

And hey, don’t just stare at the FHA loan in isolation – view it as a cog in your bigger financial strategy. Think about how this loan plays with other parts of your money machine.

Preparing for the Future: Long-Term Considerations

Let’s talk turkey about the future. With an FHA loan, your mobile home isn’t just a place to crash – it’s a slice of your financial pie. Maintenance and the threat of depreciation lurk around the corner, and when it’s time to sell, that FHA loan will be part of the chatter.

Staying on top of these developments can be like herding cats, but it’s part of the game if you want to thrive in the mobile home hustle.

Innovative Financial Planning with FHA Loans for Mobile Homes

Who says you can’t teach an old dog new tricks? FHA loans for mobile homes can be a shrewd move, whether you’re flipping homes or nesting for retirement. They aren’t just loans; they’re potential assets that can jiggle your financial jenga in all the right ways.

The smart cookie sees the bigger picture: juggling assets and debt with the finesse of a circus performer, with FHA loans as a potential safety net beneath the high wire.

Paving the Path to Your Mobile Home with FHA Loans

We’ve been around the block, folks, and now it’s time to bring it home. FHA loans for mobile homes offer a flexible, accessible route to homeownership for savvy consumers ready to tackle the application process, grapple with financial planning, and keep a keen eye on long-term goals.

With a spoonful of knowledge and a dash of determination, we’ve laid out the breadcrumbs to guide you to your mobile home dream. The FHA loan could be your golden ticket to planting roots in the mobile home market of tomorrow.

By adopting a sharp eye and an open mind, you’ll suss out the best FHA loan to bankroll your mobile home venture. So, roll up your sleeves, crunch those numbers, and let’s turn those mobile home dreams into realistic, rock-solid finance goals. Remember, the brightest financial futures are built on the foundations of informed decisions and proactive strategies. Welcome to the world of FHA loans for mobile homes, where the savvy borrower reigns supreme.

FHA Loans for Mobile Homes Trivia & Fascinating Facts

The “Packback” Story of Mobile Home Loans

So, you’re pondering over the idea of snagging an FHA loan for a mobile home? Well, before we dive into the nitty-gritty, did you know that mobile homes have a “packback” history of their own? Ever since the early days when they were called “house trailers,” these humble abodes have been packing up and rolling into the hearts and parks of America. Such a compelling history for the folks looking for flexibility and affordability! Packback homes, as I like to call them, can give bricks and mortar a run for their money when it comes to convenience.

Chilling at “The Little Nell” of Mobile Homes

Now, getting an FHA loan for your mobile home is kinda like snagging a room at “The Little Nell” in Aspen—but way more cost-effective. You might wonder, what’s the connection? Just like The Little Nell offers a cozy luxury vibe, an FHA loan makes owning a mobile home possible for those who may need a helping hand with their finances. It’s the comfy plush sofa of the mortgage world, giving you that snuggly feeling of warmth and security without the five-star price tag!

“Quality Mortgages” and You—A Match Made in Heaven

FHA loans aren’t your average bear; they’re kind of the bee’s knees when it comes to quality mortgages. First-time buyers, rejoice, because the FHA is like your fairy godparent. They sprinkle the magic dust of low down payments, make less-than-perfect credit scores work, and BOOM—you might just get the keys to your mobile castle!

Sunshine and Sunsets: California Dreamin’ on FHA Loans

Dreaming of hitching your mobile home to a star and setting course for the Golden State? Well, you best believe, California Mortgage Advisors Inc can help make those dreams as real as the sunshine in L.A. These guys offer the golden ticket to FHA loans in California, so you can watch the sunset from the deck of your mobile home instead of a pricey beachfront property.

Banc on It! Securing Your SoCal Sanctuary

Got your sights set on a mobile home in SoCal? No sweat—Banc of California Home Loans has been spotted leading the parade when it comes to financing these babies. If you’re ready to roll into the laid-back life, give them a jingle and they could be your ticket to endless summers and FHA loan bliss.

Is Cash King in the Mobile Home Realm?

Everybody and their uncle might think cash is king, but when it comes to mobile homes, FHA loans might just have the crown jewels. So, is cash an asset? Sure, but with an FHA loan, your cash can stay snuggly in your bank account while you still land the mobile home of your dreams. Plus, with less cash upfront, you could jazz up your new digs or have a financial cushion for a rainy day.

As you can see, FHA loans for mobile homes are packed with possibilities, just like a fun trivia game night. Now that you’re armed with some quirky facts and a better understanding, you’re ready to embark on the mobile home adventure with an FHA loan by your side!