Understanding FHA Student Loan Guidelines: The Gateway to Homeownership

What are FHA Student Loan Guidelines?

Imagine being a freshly minted graduate, saddled with student loans, and thinking, “Do these loans block my dream of owning a home?” It’s easier than you think, thanks to FHA student loan guidelines. Dating back to the Great Depression, FHA, or the Federal Housing Administration, aimed to stabilize the economy by making loans accessible and affordable – thereby igniting the flicker of homeownership in Americans across generations.

FHA introduced comprehensive terms and regulations, better known as FHA student loan guidelines. The beauty lies in their flexibility – they allow you to get a mortgage, even with hefty student loan debt. One might say these guidelines are your ‘golden ticket’ to homeownership!

FHA Student Loan Guidelines: Unveiling the Intricacies

Breaking down complex elements like FHA student loan guidelines can feel as baffling as untangling Christmas lights. But, fear not! Let’s pull back the curtain on these jargons.

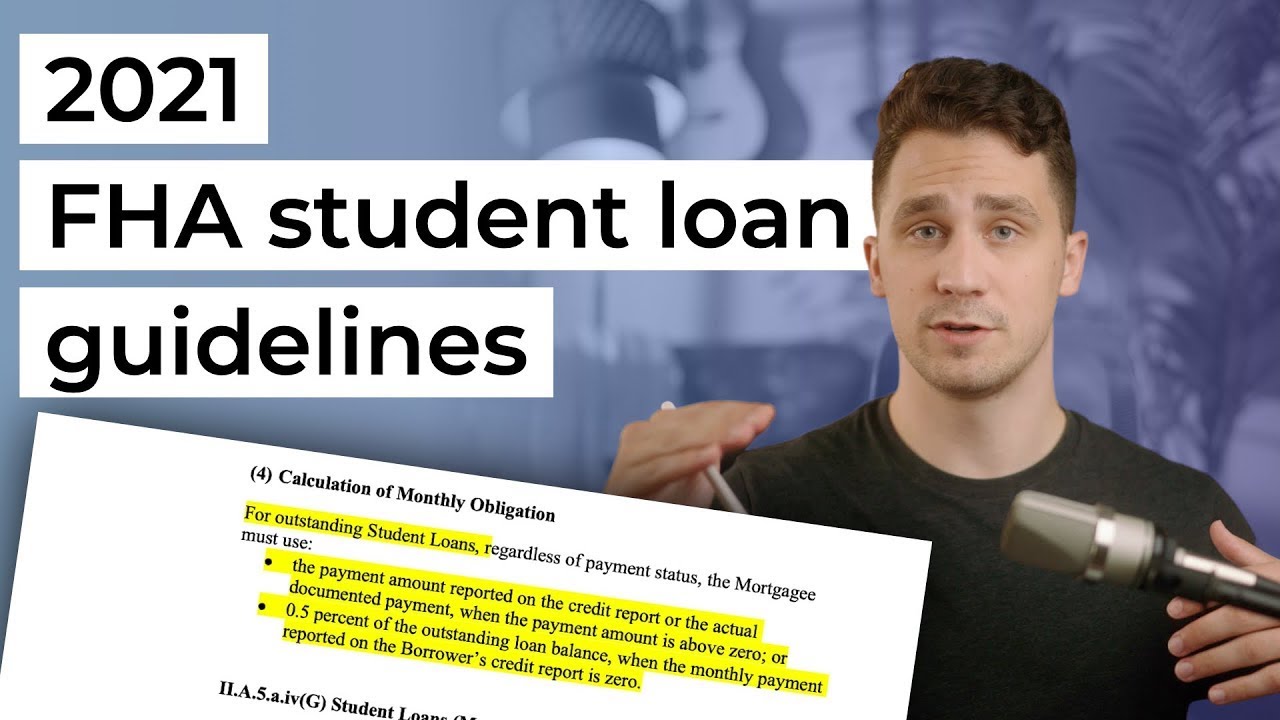

Firstly, the lender derives the monthly payment from your credit report or student loan statement. Of course, “there’s no such thing as a free lunch”, says Leslie Tayne Commenting These Guidelines. In other words, lenders prefer a debt-to-income (DTI) ratio of 43 percent or lower (as of October 13, 2024) but can bend a bit if you have extra cash reserves and higher credit scores.

What happens if you’re delinquent on your federal student loans? Sorry to rain on your parade, but you likely won’t qualify for an FHA loan. Also, there’s no sugar-coating this – the lender uses 1 percent of the loan’s outstanding balance, monthly payment on your credit report, or the actual documented payment to process the loan.

Now, if you’ve got cold feet thinking, “I have student loans; can I land a mortgage?”, cast your fears away. Having student loans is not your kryptonite while buying a house.

Does FHA Flip Rule Blend with Student Loan Guidelines?

‘Flipping’ in FHA lingo is where a recently purchased property gets resold with a significant price hike. But, what is the link between the mysterious FHA flip rule and student loan guidelines? Well, it’s an intricate dance designed to balance the interests of both students and lenders.

Navigating FHA Guidelines for Student Loans

Eligibility Criteria Under FHA Guidelines for Student Loans

Like a Rubik’s cube, figuring out the eligibility criteria can be challenging. Here are the main factors considered: your credit score, employment history, and most importantly, your student loan status. It’s as clear as day – delinquency on student loans is akin to walking on thin ice; it can jeopardize your eligibility.

Decoding the Documentation Process

Folk wisdom says that “the devil is in the details”, especially when it comes to documentation. From your credit report to employment verification, you’ll need a suite of documents for your application. Moreover, keep an eagle eye out for common mistakes such as missing or incomplete information which could hamper your application.

| FHA Student Loan Guideline | Description |

|---|---|

| Debt-to-Income Ratio (DTI) | FHA lenders prefer a DTI ratio of 43% or lower. However, they can be flexible if the borrower has extra cash reserves and higher credit scores. |

| Delinquency Status | Applicants with delinquent federal student loans will likely not qualify for an FHA loan. |

| Calculating Student Loan Payment | The mortgagee must use either: 1) The greater of 1% of the outstanding balance on the loan, or 2) The monthly payment reported on the borrower’s credit report, or 3) The actual documented payment, provided the payment will fully amortize the loan over its term. |

| Impact of Student Loans | Having student loans does not inherently disqualify an applicant from receiving an FHA mortgage. However, as a form of debt, student loans impact the overall financial picture, which factors into eligibility to buy a house. |

The Impact of FHA Student Loan Guidelines on Homeownership

FHA Student Loan Guidelines: Boon or Bane for Future Homeowners

Are these guidelines a silver lining or a storm cloud obscuring the homeownership horizon? The real estate scenario with respect to FHA student loan guidelines is like a double-edged sword for first-time homebuyers. While it makes loans accessible, it can be a speed bump for some due to its comprehensive process.

Case Studies and Real-life Applications of FHA Student Loan Guidelines

We have seen several successful homeownership journeys triggered by FHA student loan guidelines. It’s the very magic of these guidelines that has paved the way for potential homeowners to navigate the labyrinth of homeownership.

Preparing for Homeownership with FHA Student Loan Guidelines

Essential Steps to Leverage FHA Student Loan Guidelines for Homeownership

If your dream is homeownership, remember, “He who is well prepared has half-won the battle”. Strategic financial planning is crucial. Building a successful loan application is akin to baking – gather the right elements and follow the recipe to the letter to create a delicious outcome – in this case, a solid application!

Expert Tips and Tricks for Navigating FHA Student Loan Guidelines

Your journey through the FHA student loan guidelines doesn’t have to mirror a roller-coaster ride. Experts recommend innovative approaches like paying off your student loans quickly or increasing income to maximize approval chances.

Shaping the Future of Homeownership: A Close Look at FHA Student Loan Guidelines

Future Trends and Predictions on FHA Student Loan Guidelines

Let’s gaze into the crystal ball to discover the future implications for potential homeowners. While the intricacies may change, the core principles of the FHA guidelines for student loans will remain steadfast.

The Path Ahead: Homeownership with FHA Student Loan Guidelines

Are we there yet? As you prepare for tomorrow’s homeownership dream, remain vigilant and focused. Use The Benefits Of an Fha loan and leverage the Differences between conventional And Fha Loans to your advantage.

Let this journey bring out the best in you, as Dwayne Johnson, ‘The Rock’, suggests with his famous eyebrow raise! It’s a road with bumps and turns, but armed with the knowledge of FHA student loan guidelines, your dream of homeownership is just around the corner!

What are the FHA guidelines for student loans?

Well, here’s the skinny on FHA guidelines for student loans: Essentially, if you have deferred loans, under the FHA guidelines, lenders must use 1% of the total loan amount or the actual documented payment as your monthly student loan payment. It’s as simple as that!

Are student loans considered for FHA loan?

Like it or lump it, yes — student loans are considered for FHA loans. More specifically, they are included in your Debt-to-Income ratio calculations. It’s a stickler but important in assessing your ability to repay the mortgage.

How to calculate student loan payment for FHA loan?

If you’re left scratching your head over how to calculate student loan payments for an FHA loan, don’t sweat it! Lenders use 1% of your total student loan balance or the fully amortized payment, whichever is higher.

Can student loans stop you from buying a house?

Gosh, can student loans stop you from buying a house? You may find this hard to swallow, but yes – substantial student loan debt could damper your dreams of home ownership. It increases your DTI ratio, which could make mortgage lenders nervous.

How do student loans affect FHA?

Student loans pop up like a bad penny when talking about FHA loans, don’t they? If you have one, it can affect the loan’s approval and your interest rate. Too high of a loan, and it’s game over for your FHA loan.

What will disqualify you from an FHA loan?

Banking on an FHA loan? Hold onto your hat! Bad credit, insufficient credit history, a high debt-to-income ratio, especially from out-of-control student loans, etc., can disqualify you faster than a cat on a hot tin roof.

Can you be denied a mortgage because of student loans?

Ay caramba! Yes, you can be denied a mortgage because of student loans. If your debt-to-income ratio is too high, many lenders will think twice before giving you a mortgage.

How much is the average student loan payment on $60000?

Stuck with a $60000 student loan and wondering what your payment might be? On average, for a standard 10-year plan, you’ll likely shell out around $690 per month. Yikes!

How much are student loan payments based on income?

Concerned about student loan payments based on income? Here’s the lowdown: They can vary greatly but are generally 10% – 20% of your discretionary income.

What determines student loan amount?

Student loan amounts are determined largely by your educational costs, like tuition, fees, room and board, books and related expenses. No two ways about it!

Do student loans count in debt to income ratio?

Yes, Virginia, student loans do count in the Debt-to-Income ratio. Lenders like to see this number as low as possible.

Is it bad to use student loans for housing?

Is it a bad thing to use student loans for housing? Yes, it’s generally frowned upon. I mean, it’s not exactly playing with fire, but it will increase your debt and potentially strain your budget down the line.

What is the 28 36 rule?

The 28/36 rule? Simple as pie. It suggests that a household should spend a maximum of 28% of its gross monthly income on total housing expenses and no more than 36% on total debt service, including housing and other debt such as student loans.

What are the FHA guidelines for deferred student loans 2023?

The FHA guidelines for deferred student loans in 2023 state that if a student loan is in deferment or forbearance, the lender may use 1% of the outstanding balance as the monthly payment for the DTI calculation.

What are the new student loan guidelines?

The new student loan guidelines require lenders to include student loans in borrowers’ debt-to-income ratio calculations, even if they’re in deferment or forbearance. So, you’ll need to factor those into your financial plan.

What are the 7 requirements to qualify for a federal student loan?

To qualify for a federal student loan, you’ve got to jump through seven key hoops: demonstrate financial need, be a U.S. citizen or eligible non-citizen, possess a valid Social Security number, and so on. Not exactly a walk in the park, but worth it!

What are the new FHA changes for 2023?

The new FHA changes for 2023 include a slight increase in mortgage insurance premiums and a lowering of loan limits in high-cost areas. Keep a bead on these changes to make sure you fit the bill.