Buying a home in New York is much like navigating a labyrinth of high-rises, competitive bids, and swift market movements. It’s no walk in Central Park, but with the right blend of financial smarts and street savvy, the keys to your NY dream home can be handily yours. So let’s dive into the urban jungle, decode the maze, and snatch up some wisdom that could put you on the penthouse floor of the New York housing market.

Understanding the Unique Real Estate Landscape of New York

The New York real estate market is unique, to say the least. With median home prices that could make your eyes water faster than chopping an onion, it’s a hotbed of activity where only the most informed and prepared buyers thrive. Particularly as a first time home buyer NY, you need to know what’s up, or you’ll end up doggy-paddling in the East River.

In this concrete jungle, properties cascade from luxury high-rises in Manhattan to the charming brownstones of Brooklyn, and across the water to the more spacious retreats in Staten Island. Competition? You bet. It’s like “The Hunger Games” but with pre-approvals and closing costs. For example, a cozy nook in the West Village might attract a dozen buyers on day one. And let’s not even start on the frenzy of a well-priced Queens condo.

Different boroughs offer distinct vibes and markets. Manhattan is for those who thrive in the pulse of the city and have the bank balance to match. Brooklyn has become the land of the cool and the artistic, but with prices that can startle the underprepared. The Bronx, Queens, and Staten Island offer a more down-to-earth entry point for many, but each has its micro-markets that defy the borough-wide trends.

YouNique Designs First Time Homeowner Mug, Ounces, Housewarming Gifts for New (Black Handle)

$19.97

Celebrate the joy of homeownership with the YouNique Designs First Time Homeowner Mug, the perfect housewarming gift to commemorate this major milestone. This stylish mug features a sleek black handle that adds a touch of modern elegance to its classic ceramic silhouette. With its generous capacity, it’s ideal for savoring your favorite beverages, from morning coffee to evening tea, as you settle into your new space.

The YouNique Designs Mug is more than just a drinkware item; it’s a keepsake that holds cherished memories of a first home. The front of the mug is adorned with a heartwarming and witty message, tailored to resonate with new homeowners and celebrate their achievement. Durable and dishwasher safe, this mug is designed to be used and enjoyed daily, becoming a beloved part of the new homeowner’s kitchen collection.

Not only is this mug a thoughtful and practical gift, but it also adds a personal touch to the new homeowner’s day-to-day life. Whether it’s given as a surprise at a housewarming party or as a congratulatory gift from a realtor, the YouNique Designs First Time Homeowner Mug with Black Handle is sure to make the new residents feel right at home. It’s a warm reminder of the love and support from friends and family as they embark on this exciting new chapter.

Leveraging First Time Home Buyer Programs in NY for Financial Advantage

Now, brace yourselves for a game-changer: first time home buyer programs in NY. Knowing them is like having a superpower. The ‘SONYMA’ programs, for instance, are your great uncle with the deep pockets you never knew you had – offering low-interest mortgage loans and programs to help you with your down payment and borrowing costs.

The ‘HFA Preferred’ and ‘HFA Advantage’ programs are like the best navigators in this race, designed to help those with little cash for a down payment. And if those don’t float your boat, grants like ‘HomeFirst Down Payment Assistance’, which you can learn more about at Mortgage Rater ‘s comprehensive guide To Downpaymentassistance, might just give you the windfall you’ve been praying for.

And what would you say if I told you that you could potentially reduce your federal tax bill? Enter the Mortgage Credit Certificate (MCC) program, which did wonders for Sam and Liz from Staten Island, who shaved a sweet slice off their tax liability, more dough for decorating their new digs.

| Category | Description |

|---|---|

| Eligibility for First-time Homebuyer | Must not have owned a home in the past three years, meet income requirements, and complete a homebuyer education program. |

| Income Eligibility | Varies based on county and household size; must not exceed certain income limits. |

| Homebuyer Education Program | Required to complete an approved program to understand the home buying process and responsibilities of homeownership. |

| Down Payment Requirement | Minimum 3% of the purchase price, with at least 1% from personal funds. |

| The Downpayment Toward Equity Act | Proposed bill provides up to $25,000 for eligible first-generation first-time homebuyers. Status: Proposed as of Dec 5, 2023. |

| New York State Homeowner Assistance Fund (NYS HAF) | Federal program to help homeowners at risk of default or foreclosure due to COVID-19 related financial hardship. Eligibility based on financial impact due to the pandemic. |

| Counseling Agencies Contact | Recommended for more detailed information and assistance throughout the buying process. |

| Additional Requirements | Additional criteria may apply such as property location, price cap, and primary residence status. |

| Benefits | Assistance with down payment, education on home purchasing, potential grant money, and support for those affected by COVID-19. |

Mastering the Art of Timing in the NY Housing Market

When’s the best time to buy? Timing in the NY housing market can be as crucial as your morning espresso. Seize the market at the right moment and you could save more than a few bucks. Historically, late winter and spring bloom with listings, but prices might also be at an all-year high. Autumn can offer up some harvest as sellers look to close before the holidays.

Local real estate agents, seasoned in NY’s seasonal shifts, can offer invaluable advice. They’ve seen more seasons than Firefly Lane, and with their insights, you can hone in on the perfect time to make your move. Winter might seem dreary, but if you’re willing to brave the chill, you might just find your own slice of NY heaven sans the fierce bidding wars.

The Secret Tactics of Bidding in NY’s Intense Market

Let’s talk tactics. Bidding in NY isn’t for the faint of heart. Just ask anyone who’s been through it – like this couple who swooped in with an all-cash offer after their three previous bids were eaten for lunch. To win in New York, you must be willing to flex your creative muscles.

Use tech platforms like ‘Compass’ or ‘Zillow’ for real-time market analysis. Be proactive and consider unconventional terms that may sweeten the deal for life-hardened NY sellers, like shorter closing times or waiving certain contingencies. Just a little tip; don’t fly blind – knowing the Baltimore Orioles bird has more street smarts when it comes to real estate than entering a NY bidding war without a sharp agent and solid strategy.

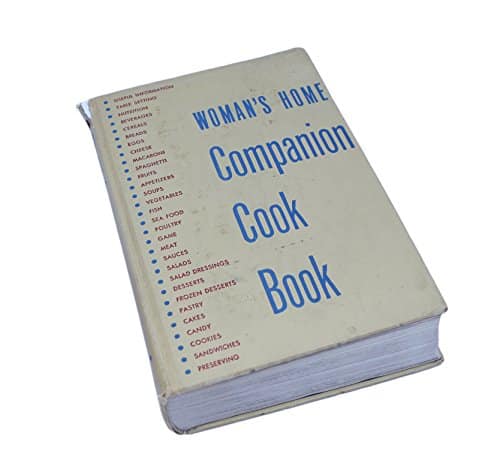

Woman’s Home Companion Cook Book

$35.00

The Woman’s Home Companion Cook Book stands as a cherished classic in culinary literature, revered for its comprehensive collection of timeless recipes and kitchen wisdom. This tome not only serves as a recipe book but also as a guide to the art of homemaking, reflecting the culinary traditions and practices of its time of publication. Spanning various cuisines and food categories, it covers everything from appetizers and main dishes to desserts and canning, providing homemakers with all the necessary tools to create delicious meals for their families. The attention to detail and clear instructions make it an invaluable resource for both novice cooks and experienced chefs alike, seeking to expand their repertoire or delve into the comfort of classic recipes.

Imbued with charming illustrations and presented in an easy-to-follow format, the Woman’s Home Companion Cook Book transcends mere utility to become a source of nostalgia and joy in the kitchen. Readers will find sections dedicated to meal planning, table setting, and nutrition, displaying the book’s holistic approach to cooking and dining as an integral part of family life. With its broad spectrum of dishes, from simple suppers to festive holiday feasts, this cook book ensures that every occasion can be met with the perfect menu. The pages are peppered with helpful tips and tricks that aid in demystifying even the most complex cooking techniques, making the journey from kitchen to table a delightful experience.

More than just a collection of recipes, the Woman’s Home Companion Cook Book encapsulates the essence of what it means to nurture and nourish. It connects generations of food lovers through a shared passion for home-cooked meals and the memories they create. The book’s enduring popularity serves as a testament to the importance of culinary heritage and the role that food plays in our lives, ceremonies, and traditions. For anyone looking to recreate the comforting tastes of home or to explore the rich tapestry of American home cooking, this cook book is an essential addition to any kitchen library.

Navigating the Closing Process Smoothly as a First Time Home Buyer in NY

Closing on a home in New York is an intricate dance that you don’t want to step wrong. Having a savvy real estate attorney is like having Dermot Mulroney guiding you through a tango – reassuring and necessary. They’ll help you understand your closing costs, which can be as variable as New York weather, and illuminate potential negotiation leeways.

Recent home buyers would tell you that the closing process held surprises they wish they had foreseen. One buyer, recounting his tale, learned only late in the game about the building’s pending litigation – info that can easily throw a wrench in your closing. Keep your eyes wide open and ask all the questions, even the ones that make you feel like a tourist on Fifth Avenue.

Financial Prep 101: Securing a Mortgage as a First Time Home Buyer in NY

Getting mortgage-ready isn’t a sprint; it’s more of a marathon. You’ll want to be in top financial shape, which means whipping that credit score into form and cutting down any debt-to-income flab. Think of it like prepping for “The Witcher” battle scene—planning, strength, and a little magic (aka savvy financial moves).

For a peek under the tent, fixed-rate mortgages offer stability in a city of unpredictability, while adjustable-rate and FHA loans can be paths less traveled that lead you home. And let’s not forget that improving your credit score can be as rewarding as hitting the high score on your favorite video game – it opens doors and keeps your costs down.

The Untapped Potential of Neighborhood Research for First Time Home Buyers in NY

Your neighborhood in NY is like the cast of a great series; it sets the stage for your life’s unfolding drama. Researching a neighborhood extends beyond asking if you can hail a cab at 2 am. Dive into tools like ‘GreatSchools’ for school ratings or crime statistics databases for the lowdown on safety.

Stories from the denizens of this city can be eye-opening. Like Jeff and Marla, who learned that their seemingly quiet block was the main thoroughfare for the annual parade – charming at first but less so at the crack of dawn every year. Remember, the neighborhood you choose is not just the backdrop for your daily life, it can play a starring role in your home’s appreciation over time.

The Fifth Avenue Apartment

$5.99

The Fifth Avenue Apartment is an epitome of luxury living in the heart of Manhattan, providing an unparalleled blend of elegance and modern convenience. Located on one of the most prestigious stretches of real estate in New York City, this exquisite residential destination features breathtaking views of Central Park and the iconic New York skyline. Each residence is meticulously crafted with high ceilings, expansive windows, and top-of-the-line finishes, ensuring that every detail caters to the most discerning tastes. The building’s striking architecture and timeless design make it an unforgettable presence on Fifth Avenue, standing as a testament to sophisticated urban living.

Residents of The Fifth Avenue Apartment enjoy an array of exclusive amenities that cater to every aspect of life and leisure. From a state-of-the-art fitness center and indoor swimming pool to a private lounge and a lush rooftop garden, convenience and comfort are just an elevator ride away. The 24-hour concierge and doorman service provide personalized attention, offering peace of mind with a focus on privacy and security. Additionally, on-site valet parking and a comprehensive building management system underscore the commitment to providing a seamless living experience.

The location of The Fifth Avenue Apartment offers direct access to the cultural vibrancy and excitement of New York City, with world-class dining, shopping, and entertainment just steps away. Residents find themselves at the intersection of culture and commerce, surrounded by museums, theaters, and iconic landmarks such as The Plaza Hotel and The Empire State Building. The neighborhood’s historic charm blends seamlessly with modern-day luxury, making this address one of the most coveted in the city. Living at The Fifth Avenue Apartment is not just about enjoying a residenceit’s about embracing a lifestyle of unrivaled grace and prestige.

Conclusion: Building Your NY Dream Home from the Ground Up

Home buying in NY is no casual affair; it’s as serious as the final play in a fiercely contested game. As you embark on this high-stakes journey, remember to wield the insights and strategies we’ve mustered. Dive into the bureaucratic pool with your eyes wide open and emerge with keys in hand, ready to turn the lock on your NY dream home.

Lean on the financial muscle of programs like the recently proposed Downpayment Toward Equity Act of 2023, which has the potential to tremendously help first-generation buyers. And don’t forget, the bright horizon of homeownership in this vibrant city promises not only a roof over your head but a tangible triumph to celebrate as a first time home buyer NY.

So there you have it, the boiled-down essentials of what it takes to conquer the New York real estate scene as a first-timer. Now, take these tips, seize the helm, and set sail towards the skyline that’s waiting to welcome you home.

Essential Trivia for First Time Home Buyer NY

Hey there, future homeowners! Buckle up because we’re about to dive into some fun facts and nifty trivia that’ll have you grinning about the prospect of buying your first home in New York. You might just find the ride as thrilling as watching The Witcher season 3 cast shape their magical universe, except this adventure leads to your very own castle—or maybe a cozy apartment.

You Won’t Believe Your Eyes!

Imagine you’re trying to focus on spotting the perfect abode and bam! Your vision goes blurry. Well, don’t let that be a home-hunting horror story. Keep your peepers in tip-top shape by visiting My eye Dr. Once you’ve got the eagle vision, you’ll be able to inspect those properties like a pro!

Programs Galore!

I’ll bet you didn’t know there are as many first home buyer Programs as there are bagel shops in NYC. Alright, maybe not that many, but New York is brimming with programs designed to turn your home-owning dreams into solid brick and mortar reality. And if you thought bagels had variety, wait till you get a load of these programs.

Dig this: first time home Buyers Programs aren’t just a New York thing, it’s nationwide! That means your cousin in Texas actually used one of the texas first time home buyer programs for his ranch-style home. Yup, you two can have more in common now than just those family barbecues.

Loans That Feel Less Loan-y

Dreading the “L” word? Don’t sweat it! Loans For first time home Buyers are the fairy godmothers of the housing world. With more options than toppings at an ice cream stand, these loans are designed to make your first purchase smoother than a soft serve on a hot summer day.

A Helping Hand

Do you daydream of granite countertops or hardwood floors? Snap out of it because, with home improvement Grants, your dreams aren’t as far off as you think. They’re like the sidekick who helps you paint your walls without the Joker-level laughter at your dwindling wallet.

A Friendly Nudge Towards the Right Mortgage

Who knew that getting a mortgage could feel breezier than a stroll through Central Park? The Facop initiative is all about guiding you, hand-in-hand (but not in a creepy way), through the mortgage process. With some mortgage help, securing that loan is as satisfying as finding an empty cab in rush hour.

Alright, first-time home buyers in NY, that’s the rundown. You’re practically a trivia master now—so go out there and snatch up your slice of the Big Apple! Remember, owning your first home in New York is a big deal, and with these handy tips, you’re sure to take a bite out of the housing market like nobody’s business.

First Time’s the Charm

$N/A

“First Time’s the Charm” is an innovative toolkit designed to give beginners a seamless start in any new endeavor they choose to pursue, be it a hobby, skill, or professional venture. Crafted with the novice in mind, this comprehensive package includes easy-to-follow guides, step-by-step tutorials, and key equipment or access to resources tailored for first-time experiences. It demystifies the learning process, breaking down complex concepts into manageable, bite-sized lessons, ensuring that users understand the basics before advancing to more complex tasks. Whether you’re taking up knitting, learning a new language, or venturing into digital photography, “First Time’s the Charm” equips you with the confidence to learn efficiently and effectively.

Beyond mere instructions, “First Time’s the Charm” incorporates access to a supportive community and mentorship programs where novices can seek advice and receive constructive feedback from a network of friendly, experienced individuals. Every aspect of the product is designed for encouragement and accessibility, fostering an environment where questions are welcomed and triumphs are celebrated, no matter how small. This community focus helps to alleviate common fears and frustrations associated with learning something new, thereby transforming the daunting task into an enjoyable journey. The toolkit’s unique community-centric approach provides a sense of belonging and shared excitement, as users from around the globe connect over their learning milestones.

Understanding that motivation is key to a successful first-time learning experience, “First Time’s the Charm” includes a personalized progress tracking system and virtual rewards that celebrate every step forward. The customizable nature of the product ensures that it caters to individual learning styles and paces, recognizing that every beginner has a unique path to mastering a new skill. Additionally, the toolkit offers flexibility and is constantly updated with the latest trends and educational methods to keep the users engaged and informed. Whether you crave the ease of learning from the comfort of your home or need the flexibility to fit new learning adventures into a busy schedule, “First Time’s the Charm” is your trusty companion, making the first step as rewarding as the mastery that follows.

How do I qualify for first time home buyer grants in NY?

Wanna snag a first-time home buyer grant in NY? Well, strap in and get ready for a ride through paperwork city! You’ve gotta show you’re a financial newbie when it comes to buying a home and meet certain income limits. Depending on the program, they might want evidence that you’re cozying up with a mortgage counselor or taking a homebuyer education course. Oh, and sometimes they wanna be sure the crib you’re eyeing is your only one.

How much do first time home buyers have to put down in New York?

Oh, the dreaded down payment in New York! First-time home buyers usually get this notion they gotta sell an arm and a leg to scrounge up the cash. But hey, relax! While 20% down is the gold standard, programs like the State of New York Mortgage Agency (SONYMA) can get you in with as little as 3% down. And if you’re tight with Uncle Sam, FHA loans might dip to 3.5%. So, not too shabby, huh?

What is Biden’s $25,000 downpayment toward Equity Act?

Have you heard of Biden’s generous helping hand, a.k.a. the $25,000 downpayment towards Equity Act? It’s like the fairy godmother of home-buying bills for first-timers and the economically disadvantaged. If it gets the seal of approval from the powers that be, it could hand over a hefty stack of cash to help with down payments. However, don’t count your chickens before they hatch—it’s still waiting to make friends with Congress.

What is the NYS Homeowners Program?

The NYS Homeowners Program is pretty much a lifeline for folks riding the New York housing rollercoaster. Aimed at helping low to moderate-income earners get a slice of the apple pie, it extends grants to repair and rehab a home you already own or to grin and bear the costs of making a new place your castle.

How much house can I afford with $10,000 down?

Dreaming of house shopping with $10,000 in your pocket? Let’s talk turkey. Your down payment is just part of the tale, and it dictates how much house you can wrangle. Toss that $10,000 down, and you might eyeball homes between—let’s ballpark here—$100,000 and $500,000, depending on the loan type, interest rate, and lender terms. But remember, don’t bite off more than you can chew!

What benefits do first time home buyers get in New York?

If you’re a first-time home buyer in New York, you’re in for some sweet deals and perks. Tax credits, Star Exemption, and possibly more breathing room when it comes to down payments. Not to mention, there’s a smorgasbord of tailored programs just waiting to roll out the red carpet—or in this case, the welcome mat!

How to buy a house without putting down 20%?

Scared stiff about not having 20% for a down payment? Take a breath! There’s a bunch of backdoors into the housing market without that big wad of cash upfront. Peek at FHA loans or a lil’ something called private mortgage insurance (PMI). Plus, programs like those pesky acronyms—VA and USDA loans—might get you in with a big fat zero down if you’re eligible.

How much are closing costs in NY?

Brace yourself: closing costs in NY don’t come cheap—they’re like that sneaky last item at checkout that makes you gulp. You’re looking at anywhere from 2% to 5% of the home’s purchase price. Translation? For a house running at $300,000, that’s a cool $6,000 to $15,000. Ouch!

What are FHA loan requirements?

So, you’re eyeing up an FHA loan, huh? Gotta keep your ducks in a row to meet their criteria: credit scores that aren’t downright sad, a down payment as low as 3.5% if you’ve got at least a 580 score, and steady income and employment. They’ll also peek at your debt-to-income ratio to make sure you’re not juggling more than you can handle. Plus, the house must be your main squeeze—no side home shenanigans!

Can you buy a house if you make 25k a year?

Making $25k a year and wondering if a house is in the cards? It might feel like a tight squeeze, but it’s doable with a pinch of hope and a dollop of determination. Peek at low-income housing programs, score a low-interest mortgage, and embrace a teeny tiny house payment that won’t leave you eating ramen for life.

What is the golden down payment?

The “golden down payment” isn’t as mystic as it sounds—it’s that sweet 20% of the home price that buyers aim for to dodge PMI and snag better mortgage terms. Hit that 20% mark and lenders will be doing cartwheels because it means you’re less of a gamble.

When you don’t have 20% down payment?

Got less than 20% to plunk down? No sweat! You’re joining a big club! Dive into options like PMI, or lean on government programs that are more forgiving on the down payment front. And hey, don’t forget heartfelt gifts from family or grants that don’t expect a dime back.

What is the NY tiny home grant for 2023?

The NY tiny home grant for 2023? Oh, it’s a neat little leg-up for those looking to hop onto the tiny home bandwagon. It helps cover some of the tab for purchasing one of those adorable, pocket-sized places that are all the rage. Keep your ear to the ground, though, for details and eligibility—it’s as fresh as new kicks!

Who is eligible for NY Homeowner Assistance Fund?

The NY Homeowner Assistance Fund is like the cool aunt who swoops in to save the day. Basically, if you’re a homeowner who’s hit a rough patch paying your mortgage because of the pandemic, this fund could throw you a lifeline. It’s got some hoops to jump through like income requirements and proving pandemic hardship, but hey, it’s worth a shot.

What is NYS Affordable Housing Program?

The NYS Affordable Housing Program is a beacon of hope for those trying to navigate the rough waters of high housing costs. It’s about building, buying, renovating, or just getting a leg up to afford a safe and decent place to hang your hat, targeting those who don’t have cash spilling out of their pockets.

Who is eligible for NY Homeowners Assistance Fund?

Who’s eligible for the NY Homeowners Assistance Fund? If you’re getting the blues and struggling to keep up with mortgage payments, this might be your golden ticket. Eligibility’s all about facing hardship after January 2020, earning a moderate income, and proving you really, really need the help to stay afloat.

Are $30000 grants offered to first time homebuyers in Suffolk County?

$30,000 grants for first-time homebuyers in Suffolk County? Yep, that’s the real deal—if you’re lucky enough to meet the checklist. You’ve gotta nail those income qualifications and be ready to live in your new digs for a bit. It’s not a handout for flipping houses, but a step up to plant roots in the community.

How much are closing costs in NY?

Closing costs in NY, let’s break it down again—expect to fork over 2% to 5% of the purchase price on these sneaky extras. For a $300,000 home deal, you’re handing out somewhere between $6,000 and $15,000. So better start saving those pennies!

How to buy a house in NYC with no money down?

Dreaming of a house in NYC with zero down? It might sound like pie in the sky, but it’s not totally off the table. Look out for VA or USDA loans (if you’re chummy with the right qualifications), or go hunting for down payment assistance programs. They’re like the secret sauce to getting the keys without emptying your pockets.