Unlock Your Dream Home with the First-Time Home Buyer PA $10,000 Grant

Talk about a key to opportunities—get a taste of what the ground-breaking first-time home buyer PA $10,000 grant brings to the table. If you’re here, you’re likely a budding homeowner on the hunt for your dream house, critical tools, and vital information. Bravo, you’re in the right place! Right off the bat, giving you the confidence to brave the real estate market is the aim of this educational yet practical guide.

Setting the Stage: First-Time Home Buyers’ Challenges in PA

Financial Hurdles for First-Time Home Buyers

Like wandering through a corn maze at the legendary Meadowlark Dairy, the journey of first-time home buying in Pennsylvania can be challenging, especially when it comes to finances. You might need to scoop out a significant chunk of your life savings for the down payment—ouch! But wait! before you budge, let’s push the envelope here.

There’s a widespread belief surrounding homeownership—a minimum down payment assumption of 3% on a conventional mortgage with a minimum credit score of 620—the ‘new normal’. Eligibility for a VA Loan or USDA Loan can even waive off this down payment necessity altogether! It’s clear; these hurdles are high, but with the right information and strategic decisions, it’s not an impossible climb.

Market Challenges: Evaluating Availability and Affordability

Tangoing with the financial challenges are the availability and affordability of properties. Like running a circle, high demand and skyline-scraping property prices sometimes push the dream of homeownership out of reach for first-time buyers. But remember, every cloud has a silver lining.

Spotlight on the Solution: First-Time Home Buyer PA $10,000 Grant

Grant Overview: Who Are Eligible?

Bingo! The first-time home buyer PA $10,000 grant is Pennsylvania’s silver bullet addressing the challenges of first-time home buyers. Rolled out by the Pennsylvania Housing Finance Agency (PHFA), this grant aims to rollback the barriers to affordable homeownership. As a first-time buyer in good old PA, or if you are purchasing in a targeted area, this grant is your golden ticket.

Understanding the Process: How Does the Grant Work?

While this isn’t as straightforward as getting a free scoop of your favorite ice cream, it’s not atomic science either. The grant functions as a financial cushion, easing your home-buying journey. The amount helps you propel past upfront costs like down payments and closing fees, shrinking the financial strain to a manageable tad. In return, you can skip the frugality diet and keep your savings for future investments or that well-deserved tropical holiday—you earned it!

Navigating the Details: Exploring the First-Time Home Buyer PA $10,000 Grant

Digging Deeper: Application Process and Timeline

The application process for the first-time home buyer PA $10,000 grant may feel as intricate as navigating through the complex Pennsylvania turnpike. However, given the potential returns, it’s a worthy expedition. First off, determine your eligibility and then proceed further with the documentation process. Take heed and crosscheck all information, the devil is in the details!

Making it Work: How Grant Affects Your Return on Investment

Next, let’s demystify how the grant affects your ROI—an aspect often as misunderstood as the NC Sales Tax. This $10,000 grant will certainly increase your buying power, resulting in more equity over the long run. It’s like turning up the dial on your investment—the total cost of your mortgage decreases, and thereby, the return on your investment grows. It’s a clear win-win!

Uncovering Real Scenarios: First-Time Home Buyer PA $10,000 Grant Beneficiaries

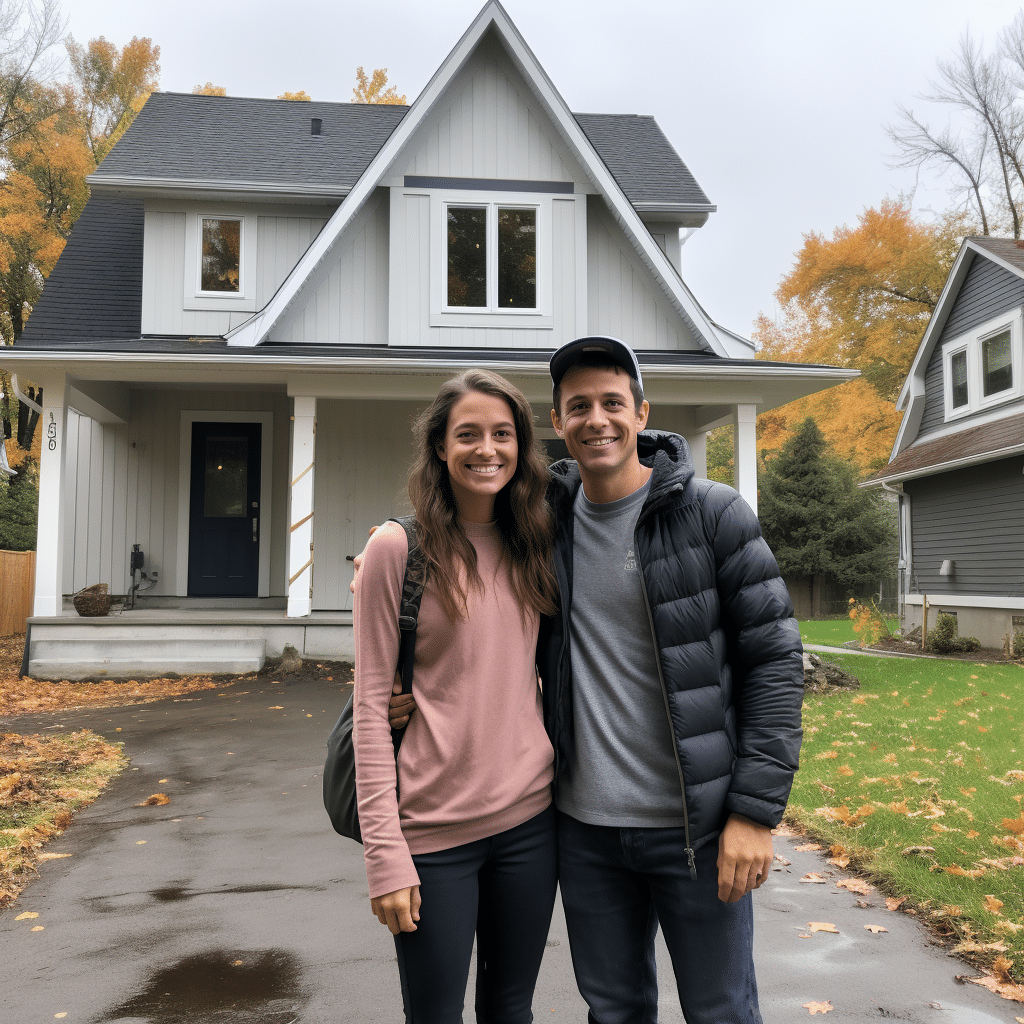

Success Stories: First-Time Home Buyers’ Experiences

From Pittsburgh to Philadelphia, countless people have enjoyed the benefits of the first-time home buyer PA $10,000 grant. For The first time, many had the power them to purchase a home that would have been otherwise out of reach. Each successful acquisition is a testament to the accessibility the grant provides.

Learning from the Pitfalls: Cautionary Tales

But don’t jump the gun yet! It’s vital to understand that like any other financial tool, misuse or lack of understanding could lead you down a slippery slope. Remember to ensure you meet all the eligibility requirements, and commit to comprehensive financial planning to get the most of this opportunity.

Proceeding Forward: Leveraging the First-Time Home Buyer PA $10,000 Grant for Your Advantage

Aligning Your Goals: House Hunting with the Grant in Mind

Now that you’ve got a grip on the first-time home buyer PA $10,000 grant, it’s time to align your house hunting goals. Like choosing the right blend at a coffee shop, keep in mind considerations that tilt the odds in your favor—property price, location, potential growth, etc. These will dictate your overall return on investment.

Next Step: Committing to Property Investment

Don’t shy away from taking this magnificent leap! It’s an investment in your future and a venture brimming with potential returns. This grant has made Pennsylvania a hotbed for first-time buyers, and you’ve got the ticket to ride.

Maximizing Potential: Expert Tips for First Time Home Buyer PA

Financial Planning and Budgeting

Like a well-executed symphony, financial planning is the key to a successful homeownership journey. It ensures you’re in a solid position to manage your mortgage, taxes, and any unexpected expenses that could arise. Smart budgeting decisions, like taking into account the First Time home buyer tax Credit 2024, elevate your financial health, generating a smooth homeownership journey.

Making the Most of the Grant

While the first-time home buyer PA $10,000 grant can lower the immediate financial burden, maximize its potential by investing wisely. Consider options like the Naca home loan that can complement your grant and amplify your buying capabilities.

Redefining Homeownership: The Impact of the First-Time Home Buyer PA $10,000 Grant

Painted Skies Ahead: Predictions for Pennsylvania’s Property Market

The first-time home buyer PA $10,000 grant has reshaped the property market landscape of Pennsylvania. It has democratized home ownership by making it accessible, affordable, and attractive to first-time home buyers. This is an uplifting trend, painting a bright future for the Pennsylvania property market. The tide is changing, and it’s moving in your favor!

Looking Beyond: Other Potential Aid for First-Time Home Buyers in PA

In addition to the PHFA’s grant, other aids, like the First Time home buyer florida, provide valuable insights for first-time home buyers in Pennsylvania. So don’t forget to explore beyond the horizon, dig around the corners, and find those hidden treasures that can further back up your homeownership pursuit.

| Subject | Details |

|---|---|

| First-time Homebuyer Programs | The Pennsylvania Housing Finance Agency (PHFA) offers various first-time homebuyer programs making homeownership accessible and affordable |

| Grant Amount | $10,000 for first-time home buyers |

| PA Home Buyer Stat | Minimum down payment is generally 3% on a conventional mortgage with a minimum credit score of 620 |

| VA and USDA Loans | 0% down payment might be required if the buyer is eligible for VA loan (backed by the Department of Veterans Affairs) or a USDA loan (backed by the U.S. Department of Agriculture) |

| First-time Homebuyer Tax Credit | Pennsylvania Housing offers a mortgage credit certificate program for first-time homeowners which allows borrowers to claim a portion of mortgage interest paid as a tax credit, up to $2,000 |

| Minimum Credit Score Requirement | Minimum credit score to buy a house in Pennsylvania is 580. Borrowers with a credit score of 500 to 579 might be eligible with select lenders |

Pioneering Possibilities: Your Homeownership Journey Starts with the First-Time Home Buyer PA $10,000 Grant

To sum up the ride, becoming a homeowner, particularly for the first time, is like embarking on an adventurous journey. The First-Time Home Buyer PA $10,000 grant is the empowering key to unlock your dream home in Pennsylvania. It’s your ticket to affordable property investment, promising a bright and potential-filled future.

If you’ve ever dreamed about owning your very first home, now’s the time—your homeownership adventure starts here!

Does PA have a first-time homebuyer program?

Sure thing! Here goes:

How to buy a house in PA with no down payment?

Absolutely! Pennsylvania does offer a first-time homebuyer program, called the Keystone Home Loan Program. It’s a cracking opportunity for those making their initial stride in homeownership with benefits like lower interest rates and lower down payments.

Does Pennsylvania have a first-time home buyer tax credit?

Well, buying a house in Pennsylvania without any down payment sounds like a tall order, doesn’t it? Fear not! There are some programs like USDA Loans or VA Loans that can potentially allow you to buy a house without a down payment. But remember, eligibility criteria apply!

What is the minimum credit score to buy a house in PA?

Unfortunately, no. Pennsylvania does not offer a dedicated first-time home buyer tax credit. However, there are other benefits like lower interest rates and closing cost assistance under the Keystone Advantage Assistance Loan Program. Don’t let the lack of a tax credit rain on your parade!

What is PA Homeowner Assistance Fund?

You need to have a minimum credit score of 660 if you want to buy a house in PA under the Keystone Advantage Assistance Loan Program. Remember, when it comes to credit scores, the higher the better!

What qualifies as a first time home buyer in Pennsylvania?

The PA Homeowner Assistance Fund is a lifeline! It provides financial assistance to homeowners who are struggling to make ends meet due to the impacts of the COVID-19 pandemic.

How do I qualify for a FHA loan in PA?

To qualify as a first-time home buyer in Pennsylvania, you should not have owned a house in the last three years. But hey, even if you’re not a first-timer, there’s no need to be down in the dumps! Other programs can help you out.

How much are closing costs in PA for buyer?

If you’re looking to qualify for an FHA loan in Pennsylvania, you need a minimum credit score of 580, a steady income, and you must be able to afford the housing payments. Sounds easier than a walk in the park, right?

What credit score is needed to buy a house?

Closing costs in Pennsylvania for buyers can total between 3% and 6% of the purchase price, so you’ve got to have your ducks in a row before you start.

How much house can I afford on $60 000 a year?

Here’s the scoop – to buy a house, lenders typically want a credit score of 620 or higher.

Did Biden pass the first time homebuyer tax credit?

Earning $60,000 a year, you’d typically afford a house priced up to $180,000. But remember, this is just an estimate and real numbers can depend on your debts, expenses, down payment, etc.

Who pays closing costs in Pennsylvania?

As much as I’d like to report otherwise, Biden has not passed a first-time homebuyer tax credit. Ah well, we can’t have it all, can we?

What credit score is needed to buy a $300 K house?

Funny you should ask, in Pennsylvania, both the buyer and seller typically share the closing costs. It’s kind of like going dutch on a dinner date!

What credit score do I need to buy a $250000 house?

Want to buy a $300K house? Most lenders will expect a credit score in the ballpark of 680 and above.

What is FHA minimum credit score?

Looking at a $250,000 house? Like getting a cat into a bath, it could be tough without a decent credit score. You’d generally need a score of 620 or more.

What are the benefits of first time home buyer in PA?

For those looking to scoop an FHA loan, the requirement is generally a minimum credit score of 500. But hey, let’s aim for the stars – or at least a score of 580 – to qualify for the 3.5% down payment benefit.

How do I qualify for a FHA loan in PA?

First-time home buyers in PA are in for a treat! Benefits include lower interest rates, assistance with down payments, and even discounts on mortgage insurance. It’s like getting the red carpet treatment!

How much are closing costs in PA for buyer?

Qualifying for an FHA loan in Pennsylvania is a breeze if you have a credit score of 580, a steady income, and can afford the housing payments. So, get your ducks in a row to get the ball rolling.

What is the Pennsylvania program that offers temporary financial help to eligible homeowners facing foreclosure?

In Pennsylvania, closing costs for buyers can range between about 3% and 6% of your home’s purchase price. Better to have all your eggs in one basket, right?