Buying a home is exciting but can also feel like you’re navigating a maze of financial considerations. One of the most crucial steps in this journey is determining how much your monthly mortgage payments will be. That’s where home calculator payment tools can be a game-changer. These tools can provide accurate estimations, helping you make informed decisions without unnecessary stress. In this guide, we’ll delve into the best home calculator payment tools for accurate estimations in 2024, understand what influences their accuracy, and how you can get the most out of these powerful tools.

Understanding the Power of Home Calculator Payment Tools

Home calculator payment tools are essential for anyone looking to buy a home, refinance, or explore their mortgage options. They can provide realistic estimates based on real-time data, personal financial inputs, and various loan specifics. With the correct information, these calculators can give you a clear picture of what to expect financially.

Top 5 Home Calculator Payment Tools for Accurate Estimations in 2024

To get the most accurate insights, it’s important to use reliable tools. Here are the top five home calculator payment tools for 2024:

1. Zillow’s Mortgage Calculator

Zillow is a household name in real estate, and its mortgage calculator stands out. Known for its extensive integration with Zillow’s home listings, it offers real-time data on property taxes, insurance, and more.

Zillow’s vast and routinely updated database ensures you get the most accurate and comprehensive picture of your potential mortgage payments.

2. NerdWallet’s Home Affordability Calculator

NerdWallet’s calculator is designed to help you understand what you can genuinely afford by factoring in your detailed income and debt information.

NerdWallet’s calculator leverages in-depth financial analysis, ensuring financial stability while purchasing a home.

For a deeper understanding of mortgage affordability, check out My heart Goes out meaning.

3. Bankrate’s Mortgage Calculator

Bankrate offers a perfect balance between simplicity and detail. It’s approachable for first-time homebuyers yet provides in-depth insights for more seasoned buyers.

Its dual-function setup caters to users who need quick estimates and those who require detailed payment breakdowns over the loan term.

4. Realtor.com’s Mortgage Calculator

Realtor.com’s calculator integrates seamlessly with MLS listings, pulling relevant data directly from the current housing market.

Realtor.com’s close connection to MLS listings means users get up-to-date and precise data, crucial for accurate mortgage calculations.

5. Redfin’s Mortgage Payment Calculator

Redfin’s sleek design and powerful functionality make it a top choice. It allows users to tweak various loan aspects to derive highly tailored estimates.

The tool’s robust configuration options empower users to get highly tailored estimates, ensuring they align closely with their specific circumstances. To give it a try, visit home interest rate calculator.

| Mortgage Amount | Loan Term (Years) | Interest Rate (%) | Monthly Payment |

| $200,000 | 30 | 7.0 | $1,331 |

| $200,000 | 30 | 7.5 | $1,398 |

| $500,000 | 30 | 7.1 | $3,360.16 |

| $500,000 | 30 | Range 5.0 – 8.0 | $2,600 – $4,900 |

Factors Influencing Home Calculator Payment Accuracy

Understanding what affects the accuracy of home calculator payment tools is crucial. Several factors come into play, and recognizing these can help you get more precise estimations.

Data Integration from Real-Time Market Listings

Calculators like Zillow and Realtor.com use real-time data integration, ensuring the figures reflect current market conditions, including property value fluctuations and loan rate changes. Accurate data from the baltimore metro area, for example, can make a big difference in your calculations.

User-Specific Financial Details

Inputs such as income, debts, credit score, and lifestyle expenses significantly impact the estimator’s accuracy. Tools like NerdWallet excel because they delve deeper into these variables.

Loan Details and Customization Options

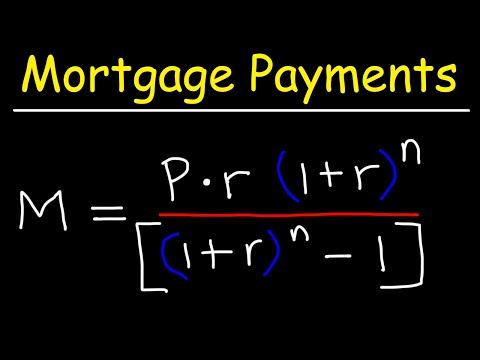

The ability to input and modify loan specifics (interest rates, loan term, etc.) affects the precision of the estimated payments. Tools with tailored loan configurations offer more reliable calculations. For example, as mentioned earlier, higher interest rates lead to higher monthly payments. A 30-year $200K mortgage with a 7% fixed rate would have a monthly payment of $1,331, while the same mortgage at a 7.5% fixed rate would be $1,398.

Enhancing Your Use of Home Calculator Payment Tools

Maximizing the benefits of these calculators involves a few strategic steps.

Regularly Update Personal and Market Data

Ensure your calculations include the latest data on personal finances and the real estate market. This practice is especially relevant in volatile market conditions, helping you avoid the pitfalls of outdated information.

Compare Estimates Across Multiple Platforms

Using several tools and comparing their outputs can provide a broader perspective and pinpoint potential discrepancies. For diverse perspectives, consider scenarios found here: estimate mortgage payment.

Consult Financial Advisors

While home calculator payment tools offer valuable insights, consulting a financial advisor provides personalized advice, corroborating the tools’ estimates.

The Future of Home Calculator Payments

As technology advances, the future of home calculator payment tools looks promising with AI and machine learning integrations. These enhancements could offer even more accurate predictions and comprehensive data analyses beyond current capacities. Exciting developments—the likes of Gannett Hires Taylor swift reporter covering significant strides in various fields—underscore the rapid evolution in financial tools and technology.

Wrapping Up: Making Smart Financial Decisions

Leveraging the best home calculator payment tools can make a significant difference in your home buying experience. Accurate and reliable data at your fingertips empowers you to make well-informed financial decisions. The future holds exciting enhancements in these tools, promising even more precise and user-friendly experiences for prospective homebuyers. Stay informed, compare estimates wisely, and consider professional advice to get the most out of every tool available to you.

Remember, accurate home calculator payment tools are invaluable assets in your home-buying journey. Steer your financial ship with confidence, and you’ll be well on your way to making savvy, well-informed decisions.

Home Calculator Payment: Fun Trivia and Interesting Facts

Curious about the magic behind a home calculator payment? Let’s dive into some captivating tidbits that might surprise you!

Home Interest Surprises

Did you know the home interest calculator has roots tracing back centuries? Long before online tools, people relied on abacuses and manual calculations to figure out interest rates. Today, nifty calculators empower us to quickly determine monthly payments, saving both time and effort. Imagine plugging in your numbers while juggling daily activities without breaking a sweat!

Quirky Algorithms and Unexpected Inspiration

Here’s a fun twist! Some of the algorithms behind these calculators were inspired by unconventional sources. Believe it or not, engineers have drawn parallels between mathematical models for predictive analytics and amusing cultural phenomena. Need a laugh? Check out this quirky snake meme, where a snake loop is humorously likened to complex interest calculations.

Data Matters

Another fascinating nugget is how these calculators crunch enormous datasets to offer precise estimations. If you’re into programming, you’d appreciate how data manipulation works. For instance, the r read csv function in R programming plays a pivotal role in managing and analyzing data, ensuring your home calculator payment is as spot-on as possible.

Enjoy these intriguing insights as you navigate the landscape of home financing. Who knew home calculator payments could be so fun and fascinating?

What is the average mortgage payment for a $300 000 house?

A typical monthly payment for a $300,000 mortgage can vary based on interest rates and loan terms. Assuming a 30-year term and around a 7% interest rate, you’d be looking at roughly $2,000 to $2,200 per month. Those numbers can change depending on your exact rate and any additional costs, like insurance and taxes.

How much is a house payment on a $200 000 house?

For a $200,000 mortgage with a fixed interest rate of around 7%, you’re looking at a monthly payment of about $1,331. If the interest rate is 7.5%, the payment goes up to roughly $1,398 per month.

How much is a house payment on a $400 000 home?

A $400,000 mortgage payment will depend on your interest rate and loan term. With an interest rate of around 7%, you might expect monthly payments in the ballpark of $2,665. But remember, it can vary if your rate or loan terms change.

How much is a mortgage on a $500,000 house?

The estimated monthly payment on a $500,000 mortgage, assuming a 30-year loan with a 7.1% interest rate, is about $3,360.16. That can range anywhere between $2,600 and $4,900, depending on your specific interest rate and loan term.

Can I afford a 300K house on a 60k salary?

Affording a $300,000 house on a $60,000 salary might be tight. Financial experts usually suggest that your monthly mortgage payment shouldn’t exceed 30% of your monthly gross income. This comes out to about $1,500 per month, and a $300K mortgage could be a bit more than that when you factor in taxes and insurance.

How much house can I afford if I make $70,000 a year?

On a $70,000 annual salary, you could typically afford a house priced around $275,000 to $300,000, following the rule that suggests your mortgage payment should be about 30% of your gross income. Keep in mind other debts and expenses when making this calculation.

Can I afford a 200K house on 50K a year?

With a $50,000 salary, a $200,000 house might be manageable if you have a solid down payment and low existing debt. Ideally, your monthly mortgage payment should be no more than $1,250, which is roughly what you’d pay for a $200K mortgage at around 7% interest over 30 years.

What credit score do I need to buy a 200000 house?

Generally, lenders will look for a credit score of at least 620 to approve a mortgage for a $200,000 house. A higher score could get you better interest rates, though.

How much is a 150K mortgage payment?

For a $150,000 mortgage at around a 7% interest rate over 30 years, your monthly payment would be about $999. That can vary a bit with changes in the interest rate.

What should my income be for a 400k house?

To comfortably afford a $400,000 house, you might need an annual income of around $100,000. This assumes a good credit score and low existing debts, following the guideline that housing costs should be around 30% of your gross income.

How much income do I need for a 300K mortgage?

For a $300,000 mortgage, your yearly income should be in the ballpark of $75,000, assuming a typical interest rate and loan term. This keeps your monthly payment within a manageable range, about 30% of your gross income.

What is the 20% down payment on a $400 000 house?

A 20% down payment on a $400,000 house would be $80,000. Putting down this amount can help you avoid private mortgage insurance and potentially get a better interest rate.

What credit score is needed to buy a $500,000 house?

To buy a $500,000 house, you’ll generally need a credit score of at least 620, though a higher score is always more favorable for securing a lower interest rate and better loan terms.

How much income do you need for a 350K house?

For a $350,000 house, an annual income around $87,500 could be necessary, sticking to that rule of keeping your monthly mortgage payment within about 30% of your gross income.

How much income do I need for a $500,000 house?

To afford a $500,000 house, you should aim for an annual income of around $125,000, assuming typical interest rates and loan terms. This keeps your monthly payments at a reasonable level compared to your gross income.