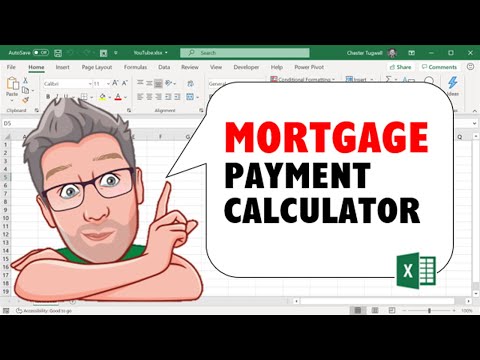

Understanding the complexities involved in a mortgage can be challenging. Fortunately, home loan calculators come to the rescue, simplifying the decision-making process by offering a detailed analysis of potential loan scenarios. These tools can decipher intricate terms and help you make informed decisions. This guide dives into the best home loan calculator mortgage calculators of 2024, showcasing their unique features and benefits.

1. Best Overall: Bankrate Mortgage Calculator

The Bankrate Mortgage Calculator consistently ranks as one of the most trusted home loan calculators in the market. Bankrate provides a robust platform with a wide variety of tools, making it a favorite among homeowners and industry experts.

Insight: Many users appreciate the clarity offered by Bankrate’s calculator, citing its detailed amortization tables as particularly helpful for long-term financial planning.

2. Best for First-Time Buyers: NerdWallet Mortgage Calculator

For first-time home buyers, NerdWallet’s home loan calculator mortgage calculator is an excellent starting point. Its intuitive design focuses on accessibility and understanding.

Analysis: With an emphasis on education, NerdWallet demystifies the mortgage process, offering tailored advice to guide new homeowners through all steps.

| Feature | Details |

| Estimated Monthly Payments on $500K Mortgage | $3,360.16 (30-year term, 7.1% interest rate) |

| Possible Range of Monthly Payments | $2,600 – $4,900 (depending on term and interest rate) |

| Annual Salary Needed for $300K House | $50,000 – $74,500 (varies by credit score, debt-to-income ratio, type of loan, term, and rate) |

| Interest Rate for $500K Mortgage (Example) | 7.1% |

| Common Loan Terms | 15 years, 30 years |

| Types of Home Loans | Fixed-rate mortgage, Adjustable-rate mortgage (ARM), FHA loan, VA loan, USDA loan |

| Key Variables Considered by Calculator | Loan amount, Interest rate, Loan term, Property taxes, Home insurance, Down payment, HOA fees (if applicable) |

| Benefits of Using Mortgage Calculator | Estimation of monthly payments, Understanding affordability, Financial planning, Comparing different loan scenarios |

| Price | Free (commonly available online) |

| User Input Requirements | Loan amount, Interest rate, Loan term, Down payment, Property tax rate, Home insurance cost, HOA fees |

3. Most Detailed: Zillow Mortgage Calculator

Zillow’s mortgage calculator is famous for its comprehensive analysis and detailed breakdown, making it an invaluable tool for any serious homebuyer.

Research: Zillow uses real-time data from its extensive real estate listings, ensuring that users get the most accurate and current information possible.

4. Best for Refinancing: LoanDepot Mortgage Calculator

When considering refinancing, LoanDepot’s home loan calculator mortgage calculator is one of the most comprehensive options available. It’s engineered to offer insights specifically tailored for refinancing.

Research Insight: LoanDepot’s calculator is designed to maximize user savings, offering a transparent view of refinancing benefits.

5. Best for Simplicity: Quicken Loans Mortgage Calculator

Quicken Loans offers a straightforward, no-nonsense mortgage calculator ideal for those who want quick and simple answers.

Commentary: Quicken Loans’ mortgage calculator is prized for its ease of use, making it a go-to for those needing immediate, uncomplicated financial insights.

6. Most Interactive: Redfin Mortgage Calculator

Redfin’s home loan calculator mortgage calculator is a dynamic, highly interactive tool designed to engage users through a visually compelling user interface.

Innovative Insight: Redfin’s calculator stands out for its ability to combine interactive graphics with real-time data, offering a unique, engaging user experience.

Decoding the Best Home Loan Calculator Mortgage Calculator for You

Choosing the right home loan calculator can feel overwhelming with so many excellent options available. It’s crucial to consider your needs and financial situation carefully. Whether you are a first-time home buyer, looking to refinance, or seeking a detailed financial breakdown, there’s a mortgage calculator specifically designed to help you reach your financial goals.

When selecting a home loan calculator mortgage calculator, it’s important to focus on the specific features that align with your individual requirements. Testing out a few different calculators might provide a broader understanding and comfort level with your financial projections. Ultimately, the right calculator can be a reliable ally in deciphering the complexities of home loans.

Using tools like Bankrate’s for an overall view or NerdWallet’s for educational insights can empower you to make the most informed decisions. As you explore these calculators, keep in mind that the information you get is only as useful as how you apply it to your own financial goals and circumstances.

In conclusion, the perfect home loan calculator mortgage calculator isn’t just a financial tool – it’s a key resource in your journey to homeownership, helping you navigate the terrain with confidence and clarity.

Finally, here’s a little secret: using Mortgage Rater’s home loan calculator will give you the edge you need to make the best decisions for your home-buying journey. So why wait? Dive in and see how these calculators can transform your financial outlook today!

Fun Trivia and Interesting Facts: Best Home Loan Calculator Mortgage Calculator

Historical Tidbits

Did you know that the concept of a home loan calculator traces its roots back to early computing? The first mortgage calculators were simple tools that evolved alongside advancements in technology. Today, they’re incredibly sophisticated, helping homeowners around the globe. In the past, folks had to crunch numbers manually, relying heavily on mathematical skills.

Practical Tools and Odd Facts

Interestingly, not everyone uses a home loan calculator solely for mortgages. Some homeowners use similar tools to plan for investments like a mantis tiller, calculating the return on investment before turning over a single spade of soil. These versatile calculators make it possible to forecast a wide variety of financial outcomes with precision.

Cultural Insights

In different cultures, the approach to home loans can vary drastically. For instance, in many Latin American countries, knowing the basics, such as being able to ask Puedo ir al Bano? (Can I go to the bathroom?), can break the ice in financial discussions, creating a basis for more in-depth conversations. It’s fascinating how simple phrases can facilitate more complex processes.

Modern Usage and Trends

Today’s home loan calculator mortgage calculator tools are vital in markets where mortgage rates 30 year can significantly fluctuate. They help potential homeowners understand the cost implications of long-term loans, enabling better financial planning.

Each bit of trivia reveals how integral these calculators have become, from everyday investments to navigating cultural nuances in the financial landscape. Whether you are in North America or planning to visit your local north port fl library, the modern, intuitive home loan calculator is your go-to tool for smart financial decisions, seamlessly linking historical evolution and contemporary needs.

How much is a mortgage on a $500,000 house?

Your estimated monthly payment on a $500K mortgage with a 30-year term at a 7.1% interest rate will be $3,360.16. Depending on your specific term and interest rate, this amount could range between $2,600 and $4,900.

How much would your mortgage be for a $400000 home?

For a $400,000 home, your monthly mortgage payment will vary based on the interest rate and loan term, but with a 30-year loan at a 7.1% rate, you’re looking at approximately $2,688 a month.

How much would a 30-year mortgage be on a $300000 house?

For a $300,000 house, a 30-year mortgage will usually have an estimated monthly payment, depending on the interest rate. Assuming a 7.1% rate, the payment will be around $2,016 a month.

How much money do I need to make to qualify for a 300 000 mortgage?

You would need to earn between $50,000 to $74,500 a year to qualify for a $300,000 mortgage. The exact income required can vary based on details like your credit score, debt-to-income ratio, loan type, term, and rate.

What credit score is needed to buy a $500,000 house?

To buy a $500,000 house, having a credit score of at least 620 is often necessary, but aiming for a score of 700 or higher can help you secure better loan terms and interest rates.

How much is a 20 down payment on a 500 000 house?

A 20% down payment on a $500,000 house is $100,000. This is usually recommended to avoid private mortgage insurance and to potentially get better loan terms.

What is the 20% down payment on a $400 000 house?

The 20% down payment on a $400,000 house amounts to $80,000. Paying this amount upfront can help reduce your monthly mortgage payments and avoid additional insurance.

Can I afford a 400k house on 100k salary?

With a $100K salary, you can generally afford a $400K house, but this will depend on your debt, credit score, and monthly expenses. A common guideline is to keep housing costs to about 28-30% of your income.

What should your income be for a $400000 house?

To afford a $400,000 house, your income should typically be in the range of $68,000 to $112,000 per year. Your exact required salary can change based on other financial factors like debts and credit score.

What credit score is needed to buy a $300K house?

For a $300K house, a credit score of at least 620 is usually needed. However, higher scores such as 700 or above can give you more favorable loan terms and interest rates.

Can I afford a 300K house on a 70K salary?

A $70K salary can usually support a $300K house purchase, given an ideal financial situation with low debts and a good credit score. Generally, it aligns well with housing costs being around 28-30% of your income.

What happens if I pay 3 extra mortgage payments a year?

Making 3 extra mortgage payments a year can significantly reduce your loan’s principal faster, thereby cutting down the total interest paid over the loan term and possibly shortening the term length.

How much house can I afford if I make $36,000 a year?

If you make $36,000 a year, you might afford a house priced around $120,000 to $150,000. Lenders typically prefer your housing costs to not exceed 28-30% of your monthly income, factoring in other debts.

Can I buy a house making 40k a year?

Buying a house with a $40K annual income is possible, generally for homes priced around $133,000 to $160,000, depending on your debt, down payment, and the mortgage rate you qualify for.

What credit score is needed to buy a $400k house?

To purchase a $400K house, a credit score of at least 620 is common, but having a score of 700 or higher will likely offer better mortgage rates and loan conditions.