Are you on the hunt for the best home loan interest calculator to guide your financial decisions in 2024? Well, you’re in luck! Navigating the mortgage landscape can seem as baffling as a jigsaw puzzle, but a home loan interest calculator can be your trusty sidekick through the whole process. They help you estimate monthly payments, understand total interest payable, and chart the timeline of loan amortization based on several parameters, including interest rates, loan tenure, and principal amount. Let’s dive into the world of loan calculators and highlight the top choices for the coming year.

Understanding a Home Loan Interest Calculator

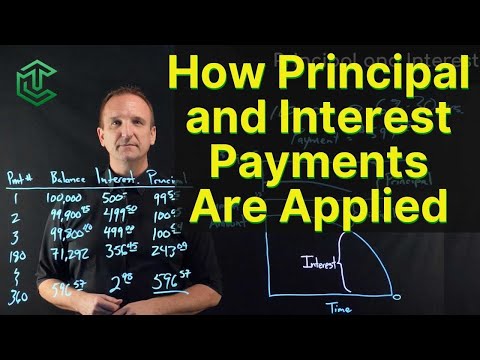

A home loan interest calculator is an essential tool for aspiring homeowners and current mortgage holders alike. These calculators crunch the numbers for you, helping estimate monthly payments, understand the total interest payable, and visualize the loan’s amortization over time. By inputting variables like the loan amount, interest rate, and loan term, you can get a clear picture of your financial obligations.

For instance, consider a $500,000 mortgage with a 7.1% interest rate over a 30-year term; the monthly payment would be $3,360.16, totaling $40,321.92 annually in principal and interest. By adjusting these parameters, you can see how changes impact your finances. So, understanding these calculators’ ins and outs can help you make sound financial choices.

Top 7 Home Loan Interest Calculators for 2024

1. Bankrate’s Home Loan Interest Calculator

Bankrate continues to be a trusted resource for financial advice, and its home loan interest calculator stands out for its user-friendly interface and detailed outputs. You can input various details, such as loan amount, interest rate, loan term, and start date, to get a comprehensive amortization schedule.

Unique Features:

– Side-by-Side Comparisons: Easily compare different loan scenarios.

– Prepayment Options: Customize to reflect any additional payments.

– Graphical Representations: Visualize principal and interest components monthly.

Find more about Bankrate’s Home Loan Interest Calculator.

2. NerdWallet Home Loan Interest Calculator

NerdWallet offers a rich platform for understanding home loans. Their home loan interest calculator not only helps figure out monthly payments but also offers insights with interactive sliders to adjust terms and rates conveniently.

Unique Features:

– Interactive Controls: Adjust loan terms and interest rates with ease.

– Breakdown of Expenses: Includes property taxes and homeowners insurance.

– User Forums: Community and expert support.

Find more about NerdWallet’s Home Loan Interest Calculator.

3. Zillow Mortgage Calculator

Zillow, widely known for real estate listings, also offers a highly regarded mortgage calculator. It allows you to incorporate taxes, insurance, and HOA fees to get a comprehensive estimate of your monthly obligations.

Unique Features:

– Customization Options: Adjust loan type and amortization period.

– Real-Time Market Updates: Syncs with property listings and market data.

– Budget Evaluation: Connects with Zillow listings for a dynamic view of what you can afford.

Find more about Zillow’s Mortgage Calculator.

4. Quicken Loans Mortgage Calculator

Quicken Loans, one of the largest mortgage lenders in the U.S., boasts a powerful yet simple home loan interest calculator. It’s designed to be straightforward, offering detailed insights, including closing costs.

Unique Features:

– Intuitive Interface: Easy-to-follow guidance.

– Expert Advice: Access to mortgage experts for personalized advice.

– Integration: Seamlessly connects to Quicken Loan’s application process.

Find more about Quicken Loans Mortgage Calculator.

5. Mortgage Calculator Plus

Mortgage Calculator Plus is a robust option, catering to both novice homeowners and experienced investors. It offers advanced features, including options for extra monthly payments to help strategize early loan pay-offs.

Unique Features:

– Multi-language Support: Interface available in ten languages.

– Detailed Explanations: Understand how various factors influence interest.

– Interactive Charts: Visualize your payment breakdown.

Find more about Mortgage Calculator Plus.

6. Dave Ramsey Mortgage Calculator

Dave Ramsey’s expertise shines through his home loan interest calculator, known for focusing on debt repayment and financial planning. It’s particularly useful for those following his financial peace methodology.

Unique Features:

– Debt Repayment Focus: Tailored for aggressive debt reduction.

– Integration: Links with Ramsey’s broader financial tools.

– Guides and Tutorials: User-friendly resources to help navigate the calculator.

Find more about Dave Ramsey’s Mortgage Calculator.

7. Redfin Mortgage Calculator

Redfin offers a calculator celebrated for its seamless integration with property searches. This calculator includes a wide range of criteria to provide reliable estimates in sync with current market conditions.

Unique Features:

– Property Listings: Integrated with Redfin property searches.

– Scenario Tracking: Save and compare different mortgage scenarios.

– Graphical Breakdown: Detailed insight into taxes and insurance costs.

Find more about Redfin Mortgage Calculator.

| Category | Details |

| Loan Amount | $500,000 |

| Interest Rate | 7.1% (example), 6% (example), 7% (example) |

| Loan Terms | 30-Year, 15-Year |

| Monthly Payment (30-Year, 7.1%) | $3,360.16 |

| Annual Payment (30-Year, 7.1%) | $40,321.92 |

| Monthly Payment (30-Year, 6.0%) | Lower than $3,360.16 |

| Monthly Payment (30-Year, 7.0%) | $4,990 (for $750,000 loan) |

| Monthly Payment (15-Year, 7.0%) | $6,741 (for $750,000 loan) |

| Simple Interest Calculation | Principal * Interest Rate * Loan Term |

| Monthly Principal Payment | Principal / Loan Term (in months) |

| Benefit of Lower Interest Rate | Significant savings over loan term |

| Calculator Features | – Input fields for Principal, Interest Rate, Loan Term |

| – Calculates Monthly and Annual Payments | |

| – Option to compare different interest rates and loan terms | |

| Benefits | – Quick estimation of loan costs |

| – Helps in comparing loan options | |

| – Assists in financial planning and budgeting | |

| Price of Calculator (if product) | Generally Free (varies by provider) |

Key Factors When Choosing a Home Loan Interest Calculator

Accuracy and Customization

The ideal home loan interest calculator must offer high accuracy and a multitude of customization options. Whether it’s adding taxes, insurance, or PMI, having these variables enhances the reliability of the estimates. For instance, the home loan rate calculator can help you factor in these elements.

User Interface and Experience

An intuitive interface is crucial for user engagement. Calculators like those from Zillow and Bankrate excel here, providing user-friendly designs that cater to both beginners and experts.

Real-Time Updates

In a constantly shifting market, a calculator that updates in real-time offers a competitive edge. Zillow’s and Redfin’s calculators shine with their real-time adaptability, syncing with current market trends to provide precise estimates.

Additional Resources

Renowned calculators, like those from NerdWallet and Dave Ramsey, provide in-depth financial insights, educational guides, and community support, ensuring a holistic approach to mortgage planning. Be sure to check daily Reflections For today for daily motivations to stay financially disciplined.

Final Insights on Maximizing Your Mortgage Planning

Choosing the right home loan interest calculator can significantly impact your financial roadmap. By leveraging advanced features from calculators by Bankrate, NerdWallet, Zillow, Quicken Loans, Mortgage Calculator Plus, Dave Ramsey, and Redfin, you can make informed decisions for your home buying journey in 2024. Crucially, adjust parameters carefully, factor in taxes and insurance, and trust these powerful tools to guide you to sound economic choices. For more detailed information about mortgage calculations, you can always explore home loan monthly payment calculator or home loan payment calculator.

Go ahead, crunch those numbers and embark on your homeownership journey with confidence!

Remember, smart planning today will pave the way for financial security tomorrow. Happy calculating!

Home Loan Interest Calculator Benefits and Fun Facts

If you’re diving into a home loan, a home loan interest calculator is a fantastic tool to simplify your journey. It’s more than just numbers—let’s sprinkle some fun and intriguing tidbits while we’re at it.

Historical Tidbits

Did you know that the concept of interest dates back thousands of years? In ancient Mesopotamia, around 3000 BC, loans were recorded on clay tablets. Today, we have precise online tools to help track interest, such as What Is a good APR, which can dramatically impact your monthly payments. A home loan interest calculator can save you countless hours and provide clarity on what to expect in the long run.

Intriguing Comparisons

Picture this: just like the detailed Paintings Of Sunflowers, your financial future flourishes with attention to detail. Much like analyzing the subtle differences in sunflower hues, a home loan interest calculator helps you discern the best rates and save money in the grand scheme of things. With a few inputs, you get a comprehensive view of your potential loan outcomes.

Surprising Connections

Unexpectedly, tools like a home loan interest calculator can be as crucial as your morning ritual at your favorite spot, say, enjoying breakfast at Miss Shirley’s Cafe Annapolis. Just as breakfast sets the tone for your day, this calculator kickstarts your financial planning, ensuring you’re ready for the big leap into homeownership.

With these intriguing nuggets and a user-friendly home loan interest calculator, you’re well on your way to making informed and wise decisions on your mortgage journey. Remember, every step you take with the right tools brings you closer to your dream home.

How much interest do you pay on a 500k house over 30 years?

On a $500,000 house loan over 30 years at a 7.1% interest rate, you’d pay around $705,658.56 in interest. That’s a lot more than the original loan amount, but it’s spread out over 30 years.

How do you calculate interest rate on a home loan?

To figure out the simple interest on a home loan, multiply the loan amount (principal) by the interest rate, and then multiply that by the loan term. For regular monthly payments, the principal is divided by the number of months in the loan term.

Is 6% good for a home loan?

A 6% interest rate on a home loan is pretty decent. It might not seem like a big deal, but shaving off even 1% can save you a ton of money over the life of the loan.

What will be the monthly payment on a home mortgage of $750000 at 7% APR interest to be paid over 30 years?

For a $750,000 mortgage at a 7% interest rate over 30 years, you’re looking at a monthly payment of about $4,990. It’s a hefty sum, so plan your budget accordingly.

How much is a $300 000 mortgage payment for 30 years?

With a $300,000 mortgage over 30 years at a 7% interest rate, your monthly payment would be roughly $1,996. It’s spread out over a long period, but it’s still a significant commitment.

What happens if I pay 3 extra mortgage payments a year?

Paying 3 extra mortgage payments a year can make a big difference. You can shorten your loan term significantly and save lots of money on interest. It’s like putting your mortgage on the fast track.

Will interest rates go down in 2024?

Predicting interest rates is like predicting the weather – it’s tricky. While some experts think rates might go down in 2024, it’s really anyone’s guess. Keep an eye on economic trends for clues.

What is a good interest rate on a house?

A good interest rate on a house right now is anything around 6% or lower. Rates can vary based on market conditions and your personal financial health, so shop around.

How to make your interest rate go down?

To make your interest rate go down, you can improve your credit score, pay down existing debts, and save up for a larger down payment. You can also shop around and compare different lenders.

What credit score is needed to buy a $300K house?

A credit score of at least 620 is usually needed to buy a $300K house, but higher scores can get you better rates and terms. Aim higher if you want the best deals.

What is a good FICO score for a mortgage?

A good FICO score for a mortgage is generally 740 or higher. This score can help you get the best rates and save a lot of money over the life of the loan.

How to get the lowest mortgage rate?

To snag the lowest mortgage rate, start with a solid credit score, shop around for different lenders, consider paying for points to lower your rate, and keep your debt-to-income ratio low.

How to pay $100,000 mortgage in 5 years?

Paying off a $100,000 mortgage in 5 years means making higher monthly payments. For example, you’d need to pay roughly $1,887 per month at a 6% interest rate. That’s a big commitment, so make sure it fits your budget.

When was the last time 7% mortgage rates?

The last time mortgage rates were around 7% was in the early 2000s. Rates have fluctuated quite a bit since then, but they’ve been relatively low for years before recently rising again.

How much would a $500000 mortgage cost per month?

For a $500,000 mortgage at 7.1% over 30 years, your monthly cost would be around $3,360.16. It’s a chunk of change, so be sure to factor that into your financial planning.