Finding the right home loan monthly payment calculator can be challenging, especially with the plethora of options available in 2024. This guide dives deep into the best calculators out there, offering insights into how each tool can help you make sound financial decisions. Understanding which calculator to use will empower you to estimate your future monthly mortgage payments accurately and avoid unexpected financial surprises.

Why a Home Loan Monthly Payment Calculator is Essential for Every Homebuyer

A home loan monthly payment calculator is an indispensable tool for prospective homebuyers and current homeowners looking to refinance their mortgages. These calculators help you estimate your future monthly mortgage payments by accounting for factors such as interest rate, loan amount, loan term, and taxes. Accurate calculations can prevent you from encountering financial surprises that could disrupt your budgeting plans and lead to unnecessary stress.

Additionally, these calculators provide a transparent look into how various factors, like prepayments, taxes, insurance, and different loan types (e.g., FHA, VA), affect your overall payment structure. Whether you’re planning to buy your dream home or want to refinance at a better rate, a reliable payment calculator is your financial ally.

Top Home Loan Monthly Payment Calculators in 2024

In a crowded market, here are the top-rated home loan monthly payment calculators that stand out due to their accuracy, user-friendly interfaces, and additional features.

1. Zillow Home Loan Calculator

Overview: Zillow, a household name in real estate, offers a robust home loan monthly payment calculator. Not only does it provide estimated payments, but it also integrates Zillow’s real estate listings, giving you a realistic view of what you can afford.

Key Features:

– Real-time updates with current mortgage rates.

– Integration with Zillow’s extensive property database.

– Option to calculate different loan types (FHA, VA, etc.).

Pros: User-friendly interface, real-time rate tracking, extensive database.

Cons: Heavily tied to Zillow’s listings, which can be distracting.

2. Mortgage Calculator.org

Overview: Mortgage Calculator.org offers a comprehensive home loan monthly payment calculator with detailed options for additional costs like property taxes and insurance.

Key Features:

– Breakdown of monthly payments including taxes and insurance.

– Adjustable prepayment option to see how extra payments affect your loan.

– Free amortization tables and charts.

Pros: Detailed breakdown, visual aids like charts and tables, customization options.

Cons: Slightly outdated website design, which may affect user experience.

3. Bankrate Mortgage Calculator

Overview: Bankrate is known for its authoritative financial insights, and their home loan monthly payment calculator is no exception.

Key Features:

– Customizable fields for loan amount, interest rate, and term length.

– Detailed payment schedule and amortization chart.

– Comparison feature to evaluate different loan scenarios.

Pros: Credible source, detailed comparison options, includes extra calculators for affordability and refinancing.

Cons: Ads may clutter the interface for some users.

4. NerdWallet Mortgage Calculator

Overview: NerdWallet’s calculator is geared towards those looking for a straightforward and visually appealing tool to estimate their monthly mortgage payments.

Key Features:

– Modern and clean design for easy input and analysis.

– Interactive features that allow you to adjust variables and see instant results.

– Guides and articles for additional financial advice.

Pros: Modern design, educational resources, interactive features.

Cons: Requires creating an account for advanced features.

5. Quicken Loans Mortgage Calculator

Overview: Known for their Rocket Mortgage service, Quicken Loans provides a sleek and efficient home loan monthly payment calculator.

Key Features:

– Instant prequalification options tied in with the calculator.

– Detailed loan and payment breakdown.

– Immediate connection to a mortgage advisor for personalized assistance.

Pros: Prequalification feature, direct connection to lenders, detailed breakdown.

Cons: Geared towards funneling users into Quicken Loans’ services.

6. Amortization Schedule Calculator by MortgageHippo

Overview: MortgageHippo offers a comprehensive amortization schedule calculator that can also function as a home loan monthly payment calculator.

Key Features:

– Detailed amortization schedule with year-by-year payment plan.

– Option to include taxes, insurance, and PMI.

– Graphical representations of payment breakdown over time.

Pros: In-depth amortization details, inclusive of extra costs, visual aids.

Cons: More complex layout may be overwhelming for new users.

7. Chase Mortgage Calculator

Overview: Chase, a major player in the banking industry, offers a highly reliable home loan monthly payment calculator integrated with their banking services.

Key Features:

– Real-time interest rates for accurate calculations.

– Personalized loan offers based on your input data.

– User-friendly interface with integrated financial advice.

Pros: Trusted financial institution, real-time rates, personalized offers.

Cons: Best suited for existing Chase customers.

| **Home Loan Monthly Payment Calculator** | ||||

|---|---|---|---|---|

| Mortgage Amount | Interest Rate | Loan Term | Monthly Payment | Escrow Note |

| $300,000 | 6% | 15 years | $2,531.57 | Escrow costs vary depending on your home’s location, insurer, and other details. |

| $300,000 | 6% | 30 years | $1,798.65 | Escrow costs vary depending on your home’s location, insurer, and other details. |

| $400,000 | 6% | 15 years | $3,375.00 | Escrow costs vary depending on your home’s location, insurer, and other details. |

| $400,000 | 6% | 30 years | $2,398.00 | Escrow costs vary depending on your home’s location, insurer, and other details. |

| $500,000 | 7.1% | 30 years | $3,360.16 | Payment could range between $2,600 and $4,900 depending on term and interest rate. |

| General Note | Approximately 51% of homebuyers face monthly mortgage payments of $2,000 or more, up from 18% two years ago. Nearly a quarter of homebuyers have payments above $3,000, up from 5% in 2021. | |||

| Feature | Description | |||

| Loan Term Options | Choose between 15-year or 30-year terms to suit your financial situation. | |||

| Fixed Interest Rates | Provides consistent monthly payments and helps with financial planning. | |||

| Escrow Account | Helps manage property taxes, homeowner’s insurance, and other costs more effectively. | |||

| Flexible Loan Amounts | Options available for various mortgage amounts, making it accessible for different homebuying budgets. |

Tips for Using a Home Loan Monthly Payment Calculator Effectively

Making the Most Out of Your Home Loan Monthly Payment Calculator

Choosing the best home loan monthly payment calculator involves understanding your specific needs and selecting a tool that offers the most comprehensive features to meet those needs. Whether you prioritize real-time data, user-friendly interfaces, or additional financial services, the tools listed above provide a range of options to help you navigate your home buying or refinancing journey with confidence.

By harnessing the power of these calculators, you can ensure that you are well-prepared to manage your mortgage payments, ultimately contributing to a stable and financially sound future. The key to making a well-informed decision begins with accurate calculations and realistic expectations, ensuring a smooth home buying or refinancing experience.

For more tools to help you on your mortgage journey, check out our home loan payment calculator, home loan interest calculator, and home loan rate calculator on Mortgage Rater.

Remember, with the right calculator, you can unlock the secrets to financial stability and homeownership success!

Home Loan Monthly Payment Calculator: Engaging Fun Trivia and Interesting Facts

The Magic Behind Home Loan Calculators

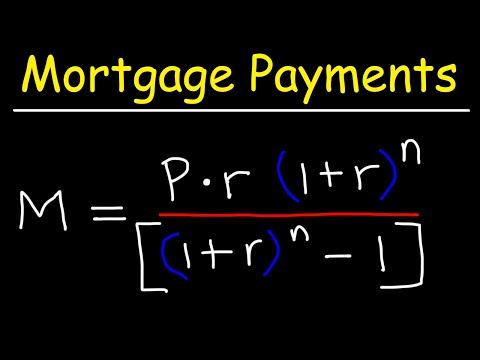

Ever wondered how a home loan monthly payment calculator works its magic? These tools are designed to take the guesswork out of mortgage planning by considering loan amounts, interest rates, and repayment terms. But there’s more to them than you might think! Did you know that their algorithms can be as intricate as the plot of a season of My Teen Romantic comedy SNAFU Season 1?( Just like the show’s unexpected turns, these calculators factor in multiple variables to give you an accurate monthly payment estimate.

Surprising Origins and Inspirations

While it might seem like these calculators have always been around, they actually owe their origins to financial tools developed back in the 1970s! Think of it like the classic anime From The 80s,( which laid the foundation for modern favorites. Similarly, early financial calculators paved the way for today’s sophisticated home loan tools, making it easier for everyone to understand their mortgage options.

Fascinating Tidbits

What’s more, home loan calculators aren’t just about crunching numbers. They can offer insights into different loan scenarios, helping you avoid pitfalls and make better decisions, a bit like shopping smart at Graul ‘s Market.( This family-owned market has been a community staple, offering the finest goods much like how calculators provide the best loan insights.

More Than Just Numbers

Think dealing with finances is all about boring numbers? Think again! The design of these calculators is often user-friendly and aesthetic, sometimes even incorporating stylish elements like paisley Designs( to make your mortgage planning experience as pleasant as possible. Who knew mortgage planning could also appeal to your sense of style?

So, next time you use a home loan monthly payment calculator, remember it’s doing much more than simple arithmetic. It’s a blend of history, design, and innovation, almost making it as interesting as the latest Harry And Meghan news!(

How much does a $300 000 mortgage cost per month?

With a $300,000 mortgage at a 6% APR, the monthly payment is $2,531.57 for a 15-year loan and $1,798.65 for a 30-year loan, not including escrow costs.

What is the monthly payment for a $400000 house?

For a $400,000 mortgage at a 6% interest rate, you’re looking at a monthly payment of $2,398 on a 30-year loan and $3,375 on a 15-year loan.

Is $2,000 a month mortgage high?

A $2,000 monthly mortgage payment is quite common these days. About 51% of homebuyers are now paying $2,000 or more per month, which is a big jump from 18% just a couple of years ago.

How much would a $500000 mortgage cost per month?

On a $500,000 mortgage with a 30-year term and an interest rate of 7.1%, you’d be paying around $3,360.16 each month. This could vary between $2,600 and $4,900, depending on your specific loan term and interest rate.

Can I afford a 300K house on a 60k salary?

Affording a $300K house on a $60K salary can be tight. Lenders usually want your mortgage payment to be no more than 28-31% of your monthly gross income; on K annually, that means your max monthly payment should ideally be around ,400 to ,550.

What credit score is needed to buy a $300K house?

To buy a $300K house, you typically need a credit score of at least 620. Higher scores can get you better interest rates and terms.

How much house can I afford if I make $70,000 a year?

If you make $70,000 a year, you can generally afford a home priced between $280,000 and $350,000, depending on interest rates and other debt payments.

How much income do I need for a 300K mortgage?

For a $300K mortgage, you’d likely need an annual income of at least $75,000 to comfortably make the payments, considering the debt-to-income ratio used by most lenders.

How much income do you need to qualify for a $400000 home loan?

To qualify for a $400K home loan, you’d typically need an annual income of at least $100,000, factoring in your debt-to-income ratio and other financial commitments.

Is 50% of take home pay too much for a mortgage?

Spending 50% of your take-home pay on a mortgage is generally considered too high. It’s usually recommended to keep housing costs below 30-35% of your income to leave room for other expenses and savings.

Is 40% of income on a mortgage too much?

Using 40% of your income on a mortgage is still pretty high. Most financial advisors suggest keeping it to 30-35% for better financial flexibility and resilience.

What is a good monthly house payment?

A good monthly house payment varies by income, but staying below 30% of your monthly income is a good rule of thumb. This helps ensure you have enough for other expenses and savings.

How much income do you need for a 350K house?

For a $350,000 house, you’d typically need an annual income of around $88,000 to $100,000, depending on interest rates and other credit qualifications.

How much income do you need for a $500000 mortgage?

To manage a $500,000 mortgage, you’d typically need an annual income of around $125,000 to $150,000, considering the debt-to-income ratio and other expenses.

How to pay off a $500,000 mortgage in 5 years?

Paying off a $500,000 mortgage in 5 years is a tall order. You’d need to make large monthly payments—around $8,333, not including interest. It would require significant financial discipline and possibly extra income sources to meet this goal.