In today’s real estate market, integrating a reliable home payment calculator into your mortgage strategy is non-negotiable. This indispensable tool offers potential homeowners comprehensive insight into their financial obligations beyond just the principal and interest. Accounting for taxes, insurance, and sometimes even Homeowners Association (HOA) fees, a top-notch home payment calculator helps illuminate hidden costs, ultimately enabling better-informed decisions. With nearly 51% of homebuyers now tackling monthly mortgage payments of $2,000 or more, and a significant jump to nearly a quarter facing payments above $3,000, understanding your financial landscape is crucial. Let’s dive into the best calculators out there, designed to support your journey to homeownership.

Why You Need a Home Payment Calculator

A home payment calculator doesn’t just help you calculate your mortgage payment; it offers a realistic picture of your financial future. More specifically, it:

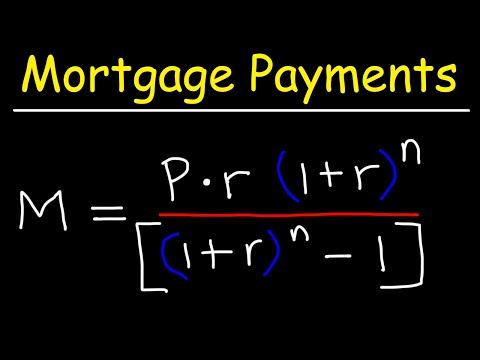

Bearing in mind that on a $300,000 mortgage at a 6% APR, your monthly payment can vary between $1,798.65 and $2,531.57 depending on the loan term, relying on accurate estimates is pivotal. The difference is even more apparent on a $200,000 mortgage with similar terms, affecting your financial planning considerably.

Top 7 Home Payment Calculators for Accurate Estimates

1. Zillow’s Mortgage Calculator

Zillow’s mortgage calculator is popular for its comprehensive yet user-friendly design. Suitable for both first-time homebuyers and seasoned investors, it includes:

Key Features:

– Real-time data from property listings

– Detailed breakdown of taxes and insurance

– Tools for refinancing estimates

Zillow’s integration with real-estate market trends allows you to predict home costs accurately, avoiding overcommitment.

2. Bankrate’s Mortgage Calculator

Bankrate offers a highly customizable calculator, perfect for experimenting with various down payment amounts and interest rates. This flexibility is ideal for those wanting tailored scenarios.

Key Features:

– Adjustable amortization schedule

– Interactive payoff calculator

– Graphical loan amortization representation

Bankrate’s tool transforms complex financial data into visual-friendly formats, making planning easier and more intuitive.

3. NerdWallet’s Home Payment Calculator

NerdWallet stands out for its straightforward design and precise monthly cost breakdown. It seamlessly combines principal, interest, property taxes, and insurance.

Key Features:

– Effortless user interface

– Accurate cost estimations

– Additional calculators for various loan types

NerdWallet simplifies the otherwise daunting task of understanding home-buying expenses.

4. Quicken Loans Mortgage Calculator

Quicken Loans, a top name in home financing, provides a mortgage calculator with advanced features. This tool is excellent for incorporating aspects like Private Mortgage Insurance (PMI) and varied interest rates.

Key Features:

– Automated PMI calculations

– Real-time loan eligibility checks

– Loan term comparisons

These advanced tools offer a broader financial perspective, assisting you in making well-rounded decisions.

5. Chase Bank’s Mortgage Calculator

Chase Bank provides a robust calculator that forecasts not only monthly payments but also long-term financial impacts, aiding better financial management.

Key Features:

– Advanced filtering for customized results

– Scenario comparisons for different terms and rates

– User-friendly interface

Utilize Chase’s calculator for nuanced financial scenarios and long-term planning benefits.

6. Redfin Payment Calculator

Redfin’s calculator is impeccable for a clear understanding of future monthly payments. Its real-time property listing integration offers a synchronized view of potential home costs.

Key Features:

– Seamless integration with real estate listings

– Comprehensive monthly cost breakdowns

– Tools for budgeting and saving

With Redfin, get clarity on your buying power and plan effectively for down payments.

7. Mortgage Calculator from U.S. News & World Report

This calculator entails robust financial analysis, making it a respected choice for those eager for precision.

Key Features:

– In-depth financial tools

– Detailed payment breakdown reports

– Comparative tools for various mortgage offers

U.S. News & World Report’s calculator dives deep, revealing insights often overlooked in simpler models.

| Criteria | Details |

| Current Mortgage Trends | – 51% of homebuyers face monthly mortgage payments of $2,000 or more, up from 18% two years ago. – Nearly 25% face payments above $3,000, up from 5% in 2021. |

| Example Payment Scenarios | $300,000 Mortgage at 6% APR – 15-Year Loan: $2,531.57/month – 30-Year Loan: $1,798.65/month $200,000 Mortgage at 6% APR – 30-Year Loan: $1,199/month |

| Loan Types | – Fixed-Rate: Consistent monthly payments, easier budgeting – Adjustable-Rate (ARM): Potentially lower initial rates that can change periodically |

| Key Factors Influencing Payments | – Interest Rate: Higher rates increase payments – Loan Term: Shorter terms mean higher monthly payments but lower total interest – Down Payment: Larger down payments reduce monthly payments |

| Escrow Costs | – Costs vary based on location, home value, insurance, and property taxes – Typically includes funds for property taxes and homeowners insurance |

| Tools and Features | – Principal and Interest Calculation: Standard part of calculators – Tax and Insurance Estimation: Some calculators include these for a more accurate monthly payment estimate – Amortization Schedule: Shows the breakdown of principal and interest over the loan term |

| Benefits | – Budgeting Aid: Helps potential homebuyers understand their future financial commitments – Comparison Tool: Allows for comparison of different loan terms and interest rates to find the most affordable option – Flexibility: Can adjust for various factors like down payment size, loan term, and interest rates to see different scenarios |

Deep Dive: How These Calculators Work

Successful home payment calculators offer accurate estimates by considering multiple elements:

Knowing how these factors interplay aids in selecting the most precise and useful calculator.

Unique Insights on Choosing the Right Calculator

Choose a home payment calculator based on:

Your choice should align with your specific needs, maximizing your financial planning and home-buying strategy.

Innovating Your Home-Buying Strategy

Using a home payment calculator can bolster your home-buying strategy. Tailoring different calculators to your unique requirements provides a clearer financial picture, helping you sidestep potential over-commitments. A detailed understanding of your financial commitments, facilitated by these calculators, forms the foundation of confident and wise home-buying decisions. Don’t just dream big; plan smart and secure your dream home with confidence.

For more tools to support your financial journey, check out Mortgage Rater’s home monthly payment calculator and home mortgage loan calculator. Dive into our extensive resources and insights today!

By keeping the article both educational, like Suze Orman, and practical, akin to Robert Kiyosaki, readers can navigate the mortgage landscape effortlessly. This blend ensures Mortgage Rater stands out as the go-to resource for mortgage advice and home-buying tools, driving users to our site and converting interest into applications.

Fun Trivia and Interesting Facts About Home Payment Calculators

The Unsung Heroes of Home Loans

Ever thought about how much a home payment calculator can save you? These nifty tools do more than just crunch numbers. Imagine Eboni Mills, a single mother juggling her job and kids, relying on these calculators to budget effectively and inch closer to her dream home. These calculators simplify complex variables, so it’s like having a financial advisor in your pocket.

Secondary Markets’ Surprising Role

What some might find fascinating is how calculations tie into the secondary market. Home payment calculators take into account secondary market conditions, indirectly affecting your mortgage rates. It’s a mind-boggling connection that brings Wall Street right into your living room. Complicated? Maybe. But darn effective. Using a house loan payment calculator can demystify these market influences, giving you a clearer picture of your real financial standing.

From Real Estate to Pop Culture

Did you know that even a fan of Attack on Titan might find home payment calculators exciting? When you’re figuring out if you can afford a home while anticipating the dub release date, it’s all about multi-tasking, right? Calculators can make that juggling act a tad easier, letting you focus more on your binge-watching and less on number crunching.

The Odd Connection

Here’s some quirky trivia for you: terms like “bird dogging” aren’t just slang in real estate. They play a part in discussing home payment calculators too! Bird dogging involves scouting potential leads, and those deals often start their life in a calculator. Knowing the meaning can put you a step ahead, making you a smarter, sharper buyer.

Unexpected Inspirations

Lastly, ever heard of gay hypnosis? Surprisingly, it has an unexpected connection with home payment calculators. Both involve understanding subconscious desires and realigning your actions. Just like hypnosis helps in understanding deep-seated patterns, a home payment calculator can reveal hidden financial insights, guiding you toward better decisions.

These bite-sized nuggets of information make the home payment calculator not just a tool but an engaging companion on your home-buying journey.

How much would a payment be on a $400 000 home?

For a $400,000 home with a 6% APR on a 30-year mortgage, your monthly payment would be around $2,398, not including taxes and insurance. If you choose a 15-year loan, the payment would be about $3,374.

Is $2,000 a month mortgage high?

A $2,000 a month mortgage is pretty common these days. Over half of buyers are paying this much or more. So, it’s becoming the norm, even though it was less common a couple of years ago.

How much is a monthly payment on a $300 K house?

For a $300,000 house at a 6% APR, the monthly payment is about $1,799 for a 30-year loan. If you go for a 15-year loan, it’s much higher at around $2,532, not counting escrow, taxes, or insurance.

How much would a house payment be on a $200 000 house?

On a $200,000 house with a 30-year mortgage at a 6% fixed interest rate, the monthly payment is about $1,199. This doesn’t include taxes or insurance, which can vary.

How much income do you need to qualify for a $400,000 mortgage?

To qualify for a $400,000 mortgage, you usually need an income of around $100,000 a year, depending on your debts and other financial commitments.

Can I afford a 400K house on 100k salary?

With a $100,000 salary, you can likely afford a $400,000 house, but it depends on your debt, credit score, and expenses. It’s always good to talk to a lender to know for sure.

How much house can I afford if I make $70,000 a year?

If you make $70,000 a year, you can typically afford a house priced between $210,000 and $245,000. This varies with how much debt you have and your mortgage terms.

What is the 28 36 rule?

The 28/36 rule means you shouldn’t spend more than 28% of your gross monthly income on housing costs and no more than 36% on total debt, including your mortgage.

Is 50% of take home pay too much for a mortgage?

Spending 50% of take-home pay on a mortgage is high and can be risky. Financial experts recommend you aim for the 28/36 rule to avoid stretching yourself too thin.

What credit score is needed for a 300K house?

To get a mortgage for a $300,000 house, you’d generally need a credit score of at least 620. Higher scores can get you better rates.

Can I afford a 300K house on a 60k salary?

With a $60,000 salary, you might struggle to afford a $300,000 house unless you have a low debt-to-income ratio. It’s smart to talk to a mortgage advisor.

What income is needed for a 250K mortgage?

For a $250,000 mortgage, you’d typically need an income of around $62,000 to $75,000 annually. Your specific situation might differ based on your debt and other factors.

Can I afford a 200K house on 50K a year?

Earning $50,000 a year could qualify you for a $200,000 house, particularly if you have minimal debt and good credit. It’s good to get pre-approval to see where you stand.

What credit score is needed to buy a house?

To buy a house, you’ll generally need a credit score of at least 620. However, better scores can help you score lower interest rates and better loan terms.

Will interest rates go down in 2024?

Predicting interest rates is tricky, but many experts are hopeful that rates might go down in 2024. Keeping an eye on the market and talking to lenders can help you stay informed.