Purchasing a home with loan in 2024 is more than a milestone; it’s a savvy financial move. This article explores why leveraging a mortgage to acquire a property is beneficial, especially in today’s economic landscape. From tax advantages to building equity, let’s dive deep into why a home with loan is a smart decision.

The Financial Advantages of a Home with Loan

Securing a loan to buy a home packs a punch of financial perks that many prospective homeowners often overlook.

Mortgage Interest Deduction

One major financial benefit is the mortgage interest deduction. This tax break lets homeowners deduct the interest paid on their home loans from their taxable income. For example, if your mortgage interest for the year totals $15,000, you can reduce your taxable income by this amount. This deduction can significantly lower your tax bill, making owning a home appealing for many.

Building Equity Over Time

Each mortgage payment reduces the principal loan amount, concurrently building your home equity. Unlike renting, where monthly payments essentially vanish without contributing to future assets, paying off a mortgage transforms your living space into a long-term investment. This gradual build-up of equity is a cornerstone of personal wealth.

Long-term Investment Potential with a Home with Loan

Appreciation in Real Estate Value

Historically, real estate values have appreciated over time. In cities like New York City and San Francisco, homeowners with mortgages have witnessed substantial increases in property value. Buying a home with a loan in 2024 can result in considerable returns, adding significant value to your financial portfolio.

Protection Against Inflation

Real estate often outpaces inflation, providing a stable investment that retains or increases in value even as the dollar’s purchasing power declines. By securing a mortgage, you’re essentially shielding yourself from inflation’s adverse effects, ensuring your investment grows sturdier over decades.

Renting vs. Owning a Home with Loan: A Comparative Analysis

Cost Efficiency

When comparing renting to buying through a home loan, the clear winner in terms of cost efficiency is typically homeownership. Over a 30-year period, while renters face increasing leases, homeowners with a fixed-rate mortgage enjoy predictable monthly payments, which are often lower in the long run.

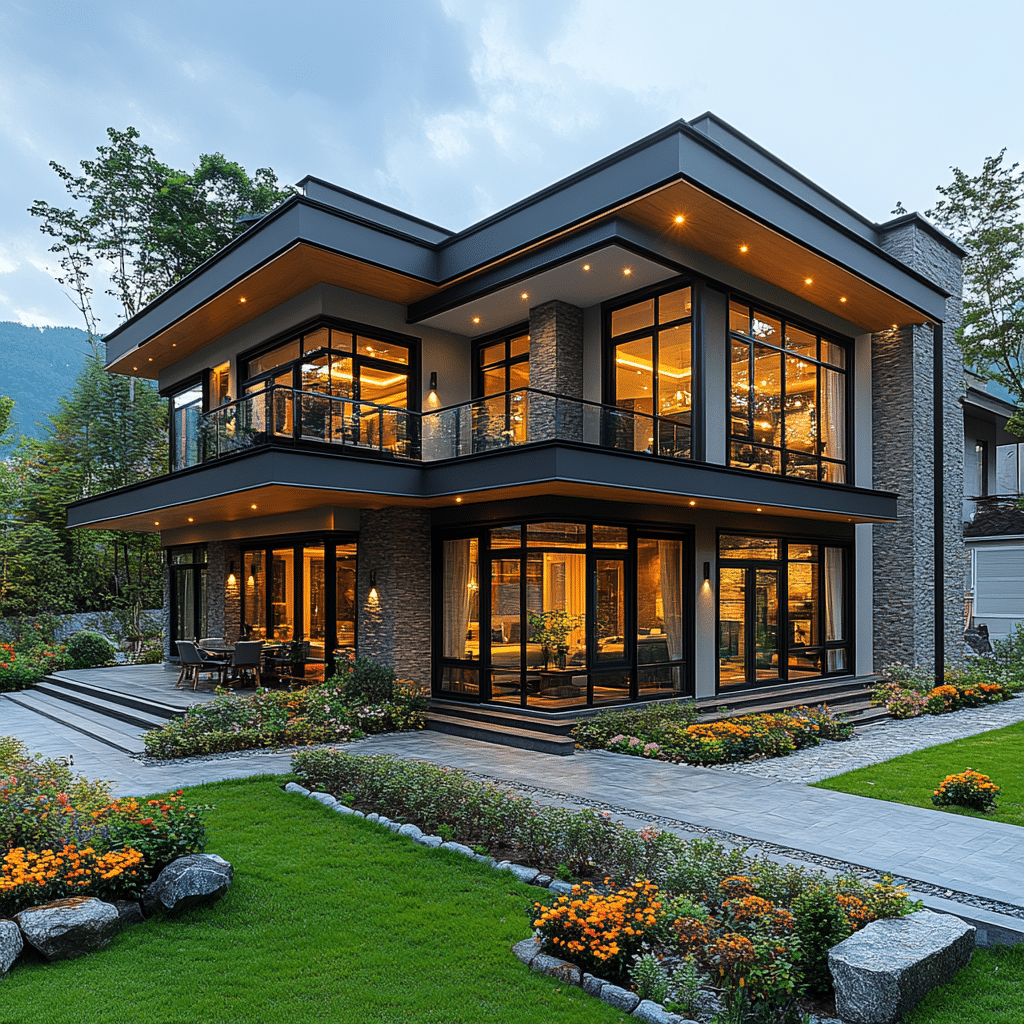

Freedom to Personalize

Renters are usually restricted by landlords in terms of modifications to their living spaces. Conversely, homeowners with loans have the liberty to tailor their homes to their tastes, whether through renovation, expansion, or redesign, enhancing both aesthetic and practical aspects.

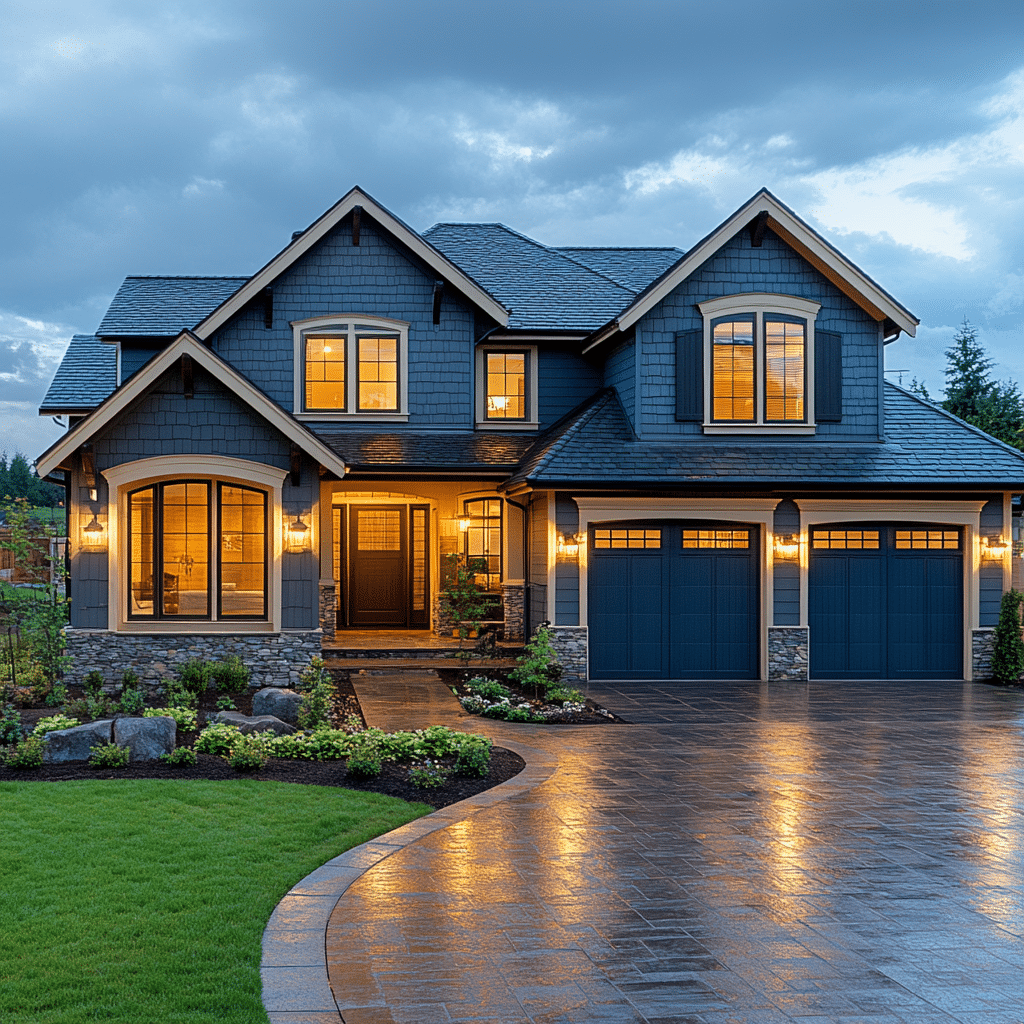

Enhanced Stability and Security with a Home with Loan

Predictability in Monthly Payments

Fixed-rate loans ensure that your monthly mortgage payments remain stable over time, unlike fluctuating rental prices. This predictability fosters a more secure financial environment, aiding in long-term planning and stability.

Sense of Community and Belonging

Homeownership fosters a stronger bond with the local community. Homeowners typically engage more in neighborhood activities, local governance, and community-building efforts, creating a deeper sense of belonging.

Leveraging a Home with Loan for Potential Wealth Accumulation

Home Equity Line of Credit (HELOC)

As your equity builds, you can borrow against it with a Home Equity Line of Credit (HELOC). This can provide funds for significant expenses like home improvements, education, or debt consolidation, using your home’s equity as collateral.

Rental Income Opportunities

In urban areas, converting part of your home into a rental unit can generate extra income. This additional revenue stream can accelerate mortgage repayment or bolster your financial portfolio, making your property work harder for you.

Future-proofing with a Home Loan

Beyond merely acquiring a property, a home loan can be a tool for ensuring a sustainable future. In 2024, green financing options are available, making energy-efficient upgrades reachable. These improvements can slash utility costs and reduce your carbon footprint, aligning with environmental goals.

Final Thoughts on the Benefits of a Home with Loan

A home with loan unfolds a wealth of financial, personal, and future-oriented advantages. From enjoying significant tax deductions and building equity, to ensuring long-term stability and potential wealth accumulation, the benefits are immense. This strategic homeownership approach not only improves financial health but also enhances overall life quality, making securing a home loan a smart investment in your future.

For more information about securing a mortgage, consider exploring www.MortgageRater.com. Your journey to a smarter homeownership begins now.

Home with Loan: Discover Key Benefits

Fun Trivia About Home Loans

Owning a home with a loan has some fascinating bits of trivia! Did you know that taking out a home loan is one of the most common ways people acquire homes? In fact, it’s not just a financial step but also a significant life milestone. Interestingly, in Rockville, New York, home loans have supported countless families in securing their dream homes. This city has seen a notable percentage of its residents becoming homeowners through housing loans.

Lesser-Known Facts About Home Loans

Here’s another tidbit for you: the modern concept of home loans began to gain traction in the early 20th century, transforming home ownership from a distant dream into a tangible reality for many. Today, even police officers in La Vergne often rely on home loans to afford their residences. It’s a testament to how integral these loans are to various community members, including those who protect and serve.

The Impact of Home Loans on Communities

You might find it surprising, but home loans also play a crucial role in community development. Through programs that offer free guest Speakers on financial literacy, communities can learn more about managing their mortgages and building a solid financial foundation. These educational efforts help demystify the processes surrounding home loans and empower residents to make informed decisions about their financial futures.

The Cultural Influence of Home Loans

Lastly, here’s a fun cultural twist: home loans are often highlighted in popular media and sports arenas! Just like the ubiquitous Wheel Of Nfl teams for sports enthusiasts, home loans are an omnipresent theme in movies and TV shows, highlighting their deep-rooted presence in our daily lives. These loans aren’t just about numbers; they blend into the fabric of our society, shaping our living experiences and community structures.

With these fun facts at your disposal, it’s clear that a home with a loan isn’t merely a financial transaction—it’s a gateway to many intriguing aspects of modern living.