House appraisal is a vital aspect of the real estate journey that homeowners often disregard. Whether you’re buying, selling, or refinancing, understanding how the house appraisal process works can significantly affect your financial outcomes. After all, a solid grasp of what an appraisal entails helps you navigate the maze of homeownership with confidence.

Understanding House Appraisal: Why It Matters for Homeowners

When it comes to house appraisals, many people think it’s just a formality. But the truth is, it’s crucial for setting a property’s market value. An accurate house appraisal can influence how much you pay for a mortgage, determine selling prices, and ultimately impact how much equity you build over time. Knowing the ins and outs of this process can empower homeowners to make sound financial decisions that help grow their wealth.

Top 7 Secrets About House Appraisals Every Homeowner Should Know

Appraisers are licensed professionals responsible for delivering an unbiased opinion on a home’s worth. Companies like CoreLogic and HouseCanary combine data analytics with the expertise of experienced appraisers to provide accurate property assessments. Understanding that appraisers look at the property’s location, condition, and comparable recent sales, can help homeowners appreciate the process more.

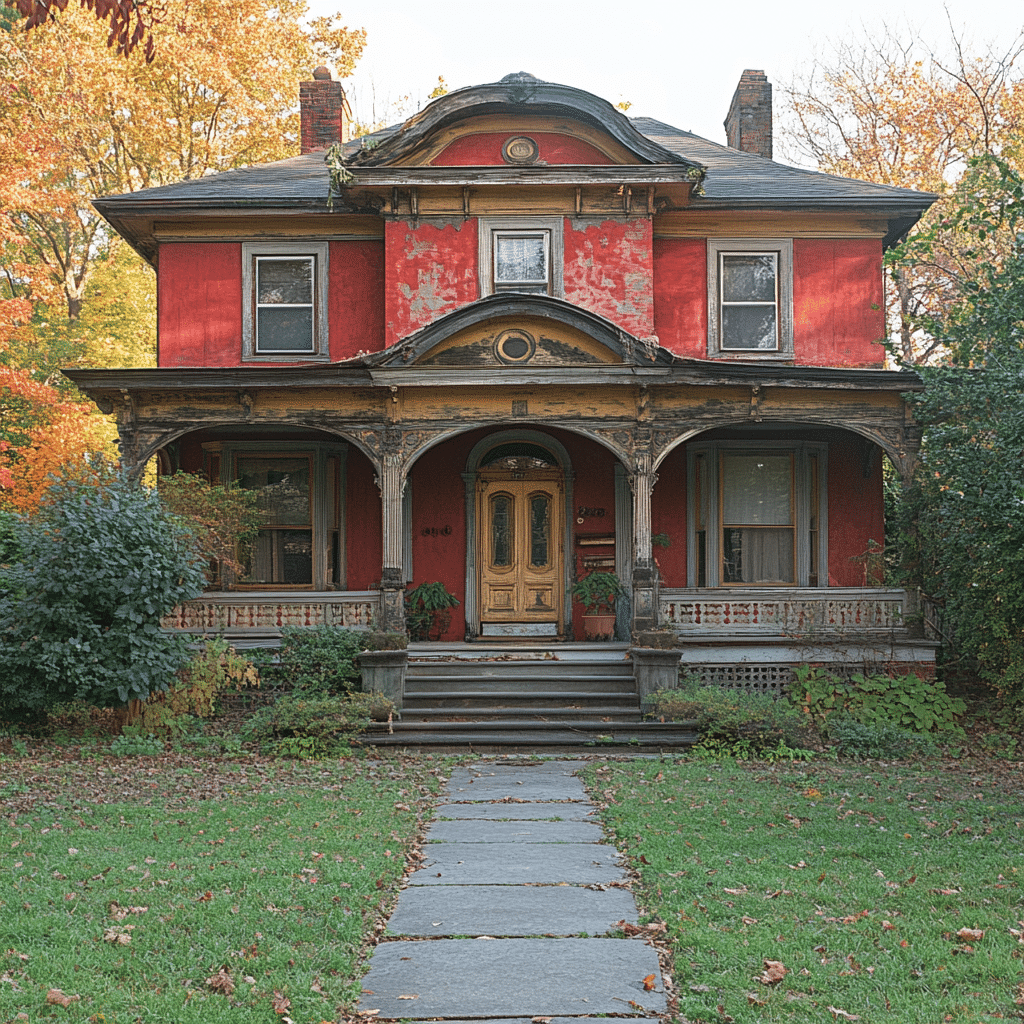

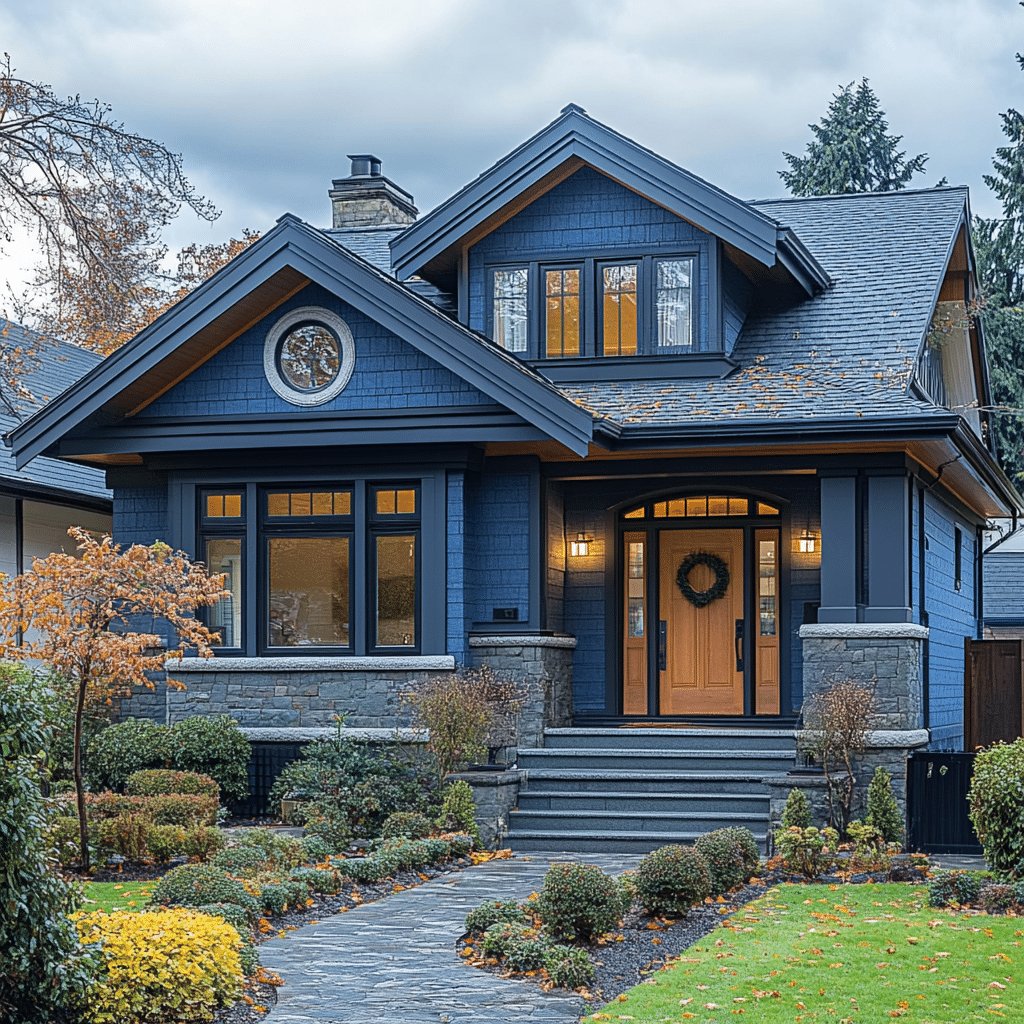

A variety of elements come into play when determining your home’s appraisal value, such as square footage, upgrades done, and local market conditions. To boost your home’s appraisal value, consider sprucing up your curb appeal and ensuring regular maintenance is performed. For instance, houses located in prime areas like Beverly Hills tend to appraise considerably higher than similar properties in less desirable neighborhoods due to demand.

Appraisers rely heavily on what’s known in the industry as “comps” to establish a fair market value. Competing sales in your neighborhood can serve as a benchmark for your home’s worth. Being savvy about pulling data from platforms like Zillow can help you advocate effectively for your property’s value. If similar homes feature renovations or distinctive attributes, make sure these enhancements are showcased during the appraisal process.

Preparation can dramatically influence your appraisal outcome. Homeowners should gather relevant documents, tidy up, and take care of minor repair jobs. In fact, many real estate professionals advise homeowners to consider hiring an interior designer to stage their home effectively. A well-staged home can improve perception and potentially increase the appraised value.

Clearing up misconceptions can save you a lot of hassle. One rampant myth is that an appraisal is the same as a home inspection. While a home inspection focuses on a property’s condition, an appraisal is solely about determining market value. Moreover, many homeowners mistakenly think that renovations always lead to a value increase—this isn’t always the case, particularly if the improvements don’t align with neighborhood standards.

Economic conditions can significantly alter appraisal values. For instance, during the COVID-19 pandemic, many suburban homes saw their values soar due to heightened demand, whereas urban properties often experienced declines. Keeping an eye on local and national real estate market trends is vital for homeowners to understand how economic shifts can affect their home’s worth.

Receiving a low appraisal can have serious implications, such as financing issues, the need to renegotiate terms, or even losing a sale. It’s essential for homeowners to familiarize themselves with the appeals process available through many lenders. If you believe valuable characteristics of your home were overlooked, you can present supporting data or comps that bolster your case.

What to Do After You Receive Your House Appraisal Report

After receiving your house appraisal report, take time to review it thoroughly. Be proactive—if the appraised value falls short of your expectations, discuss your options with your lender or real estate agent. They can provide guidance on re-evaluations or strategies to contest the value. Mastering how to handle these discussions is important for protecting your investment.

Future Trends in House Appraisal

As we venture into 2024, technology is reshaping the appraisal landscape. Automated Valuation Models (AVMs) are increasingly common; they offer faster estimates based on data rather than traditional on-site evaluations. Nevertheless, homeowners should still lean on in-person appraisals, especially for unique or higher-value properties, to guarantee an accurate assessment.

Grasping these “house appraisal secrets” puts homeowners in a position of strength. With the right knowledge, you can approach the appraisal process with confidence and ultimately make more informed decisions about your property’s future. Each appraisal isn’t just a number but a crucial insight into the real estate market that can affect your investment deeply.

Remember, understanding house appraisals is all part of your journey as a homeowner. So, don’t just see them as hurdles—view them as opportunities that pave the way to smart, savvy financial choices!

House Appraisal Secrets Every Homeowner Should Know

The Basics of House Appraisal

You might think house appraisal is just some dry number-crunching, but it’s packed with interesting nuggets! For starters, did you know that a home’s condition can significantly affect its appraisal value? It’s often more than just square footage and location; well-maintained properties can fetch a higher price. Just as those shiny bose earbuds may catch your eye in a store, a fresh coat of paint or an updated kitchen can attract appraisers’ attention too!

Then there’s the significance of market trends. Appraisers often base their judgments on comparables—or “comps”—from similar homes that have sold nearby. No one would take a trip without knowing the route, right? Similarly, appraisers chart prices over time, which can be just as tricky as figuring out how much is home insurance or understanding what is a septic tank. Knowing the area’s sales trends can pave the way for a more favorable appraisal.

Fun Facts About House Appraisal

Now, here’s where it gets really fascinating! Did you know that the appraisal process can actually reveal the home’s hidden features? Surprises pop up often—things homeowners might overlook, like a robust HVAC system or a well-placed garden that adds charm! So, while you might be fuming over that Chipotle Guac recipe you can’t replicate, an appraiser might be championing your home’s unique character.

But wait, there’s more! Appraisers often consult sources like dynata for deeper insights into buyer demographics and trends that shape the market. This means your home’s value is influenced not only by bricks and mortar but also by the buying public’s preferences. Plus, awareness of cooperative living spaces, as described in the cooperative definition, can impact residential areas’ appraisals, demonstrating how community aspects play into house value evaluations.

So, as you gear up for an appraisal, remember: it’s not just numbers slapped on a sheet. It’s a culmination of various elements that contribute to your home’s worth. Keeping this in mind can make the whole process a bit less intimidating. Next time you’re contemplating home values, don’t forget to consider those pesky but essential factors!