Understanding the Best House Loan Calculator for Accurate Estimates

Purchasing a home is arguably the most significant financial commitment you’ll ever make. You don’t want to go in unprepared, right? That’s where a reliable house loan calculator steps in, offering you precise estimates and helping you make well-informed choices. In this article, we’ll dive deep into the best house loan calculators of 2024, shedding light on the tools that promise accuracy, ease-of-use, and meaningful insights into your dream home’s affordability.

Why a Reliable House Loan Calculator is Crucial

Buying a house isn’t just another purchase; it’s a long-term investment that directly impacts your financial stability. A solid house loan calculator serves more than one purpose:

Indeed, a house loan calculator is the backbone of a sound home-buying strategy, helping you prevent financial headaches down the road.

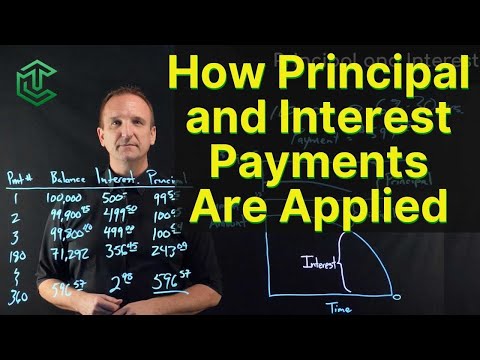

| Loan Amount | Interest Rate (APR) | Loan Term | Monthly Payment | Annual Income Required | Notes |

| $200,000 | 6% | 30 years | $1,199.10 | Not Specified | Monthly payment does not include escrow, insurance, or taxes. |

| $300,000 | 6% | 15 years | $2,531.57 | Not Specified | Monthly payment does not include escrow, insurance, or taxes. |

| $300,000 | 6% | 30 years | $1,798.65 | Not Specified | Monthly payment does not include escrow, insurance, or taxes. |

| $400,000 | 7% | 15 years | $3,595.00 | $130,068 | Monthly payment does not include insurance or property taxes. |

| $400,000 | 7% | 30 years | $2,661.00 | $130,068 | Monthly payment does not include insurance or property taxes. |

Top 7 House Loan Calculators of 2024

With numerous options available, we’ve handpicked seven house loan calculators known for their accuracy, user-friendly interfaces, and extra features that enhance the homebuying experience.

1. NerdWallet House Loan Calculator

Overview:

NerdWallet’s house loan calculator is highly comprehensive. It’s not just about calculating a monthly payment but delving into nuanced details crucial for informed financial decisions.

Unique Features:

– Customizable inputs for property tax and insurance.

– Breakdown of how different down payments impact the total loan amount.

– Real-time integration with local lender rates.

Analysis:

NerdWallet stands out by offering a categorical breakdown, showcasing more than just the surface numbers. This tool helps you get a crystal-clear view of your potential mortgage, making it easier to strategize your home-buying moves house loan calculator.

2. Bankrate Mortgage Calculator

Overview:

Bankrate’s mortgage calculator boasts a user-friendly interface and thorough results, making it a favorite among many homebuyers.

Unique Features:

– Live updates on current interest rates.

– Detailed loan amortization schedules.

– Customizable fields for property taxes, insurance, and HOA fees.

Analysis:

Its real-time rate updates and in-depth loan breakdowns make Bankrate an excellent choice for those who wish to stay current with market trends. The detailed amortization schedules provide a clear view of long-term commitments.

3. Zillow Mortgage Calculator

Overview:

Zillow integrates its mortgage calculator with its extensive property listings, offering a holistic house-hunting experience.

Unique Features:

– Direct application links with listed properties.

– Different loan type options (FHA, VA, conventional).

– User reviews and ratings for local lenders.

Analysis:

By syncing its calculator with property listings, Zillow allows buyers to simultaneously search homes and assess loan costs, saving valuable time and better aligning financial planning with property options.

4. Quicken Loans Mortgage Calculator

Overview:

Quicken Loans, now known as Rocket Mortgage, touts an easy-to-use mortgage calculator celebrated for its accuracy.

Unique Features:

– Instant pre-approval estimates.

– Real-time interest rate calculations.

– Mobile app integration for on-the-go access.

Analysis:

Its straightforward design and quick pre-approval feature are massive time-savers. Quicken Loans ensures you’re never in the dark about your loan eligibility, speeding up the home-buying process.

5. Chase Mortgage Calculator

Overview:

Chase provides a practical mortgage calculator that combines financial advice and accurate calculations.

Unique Features:

– Comprehensive homebuyer educational resources.

– Calculations include current Chase rates.

– Options for various mortgage types and terms.

Analysis:

Chase’s calculator is ideal for first-time buyers who might need a bit more guidance. It breaks down complex home-buying elements into digestible parts, making homeownership less intimidating.

6. MortgageCalculator.org

Overview:

This tool focuses exclusively on delivering top-notch mortgage calculations without unnecessary extras.

Unique Features:

– Wide range of customization options.

– Fields for including Private Mortgage Insurance (PMI).

– Detailed financial outputs like Principal, Interest, Taxes, and Insurance (PITI).

Analysis:

MortgageCalculator.org shines for those who require precise and flexible calculations. It strips away the distractions, offering an in-depth analysis purely centered on your potential mortgage.

7. Redfin Mortgage Calculator

Overview:

Redfin incorporates its real estate database into its mortgage calculator, providing extensive data to future homeowners.

Unique Features:

– Display of real-time interest rates.

– Interactive charts visualizing loan payoff timelines.

– Estimate of closing costs and upfront cash needed.

Analysis:

Redfin’s integration of interactive tools and current rate data helps visualize your loan repayment journey. For a dynamic home-buying experience, this calculator is a stellar choice.

Choosing the Right House Loan Calculator for Your Needs

When selecting a house loan calculator, your individual needs take center stage. Consider the following:

Always align your priorities with the tool’s strengths to ensure it fits your specific requirements.

Final Thoughts: Empower Your Home Buying Decision

Embarking on the journey to homeownership can be complex and often emotionally taxing. Leveraging advanced house loan calculators not only offers precise financial insights but also aids in making informed decisions. These tools demystify monthly payments and present a holistic view of your long-term financial commitments, fostering stability and confidence in the real estate market.

With some of the best house loan calculators of 2024 at your fingertips, you’re well-equipped to make financially sound choices. Start by exploring the reliable house calculator mortgage options on Mortgage Rater. Here’s to making your dream home a reality!

Discovering the Best House Loan Calculator for Accurate Estimates

House Loan Calculator Fun Facts

Ever heard of a house loan calculator that’s fun and informative? You’re in for a treat! A house loan calculator does more than crunch numbers; it unveils hidden stories and quirky trivia that you might not expect. For instance, imagine comparing the precision of a house buying calculator with something as delicate as tracking the results of a hair-on-the-neck sporting event like the Man City vs BSC Young Boys standings. It’s all about accuracy and attention to detail.

The importance of a house loan calculator can best be understood by looking at today’s volatile market. Wondering how current rates affect your finances? You need to know todays home interest rates to get the most bang for your buck. With fluctuating markets, having a reliable calculator is like having a candle lit For The dead; it provides a bright, guiding light in the dark maze of mortgage options.

Ever thought a house loan calculator could be as intriguing as the world of plants? Meet the quirky hairy bittercress! This plant spreads its seeds with a bang, much like how an effective calculator can shoot your budget right where it needs to go. On the flip side, knowing about what are blues drugs can help you realize the seriousness of your financial commitments. While the house loan calculator won’t make your decisions for you, it provides you with the critical information required for confident choices.

A house calculator can feel like magic when estimating your budget. It’s akin to a sports fan analyzing Man City vs BSC Young Boys standings—every detail counts! Don’t let the process stress you out. Tools like the house buying calculator can make you feel like a financial wizard, primed to make the best choices.

That’s a wrap, folks! Next time you’re pondering mortgage rates or just want some fun facts, remember, the best house loan calculator brings more than numbers to the table—it brings life to your financial journey.

How much income do you need to qualify for a $400000 home loan?

You’d need to earn about $10,839 a month, or $130,068 per year, to afford a $400,000 home. Your actual income requirement will depend on various factors like your state, tax status, and other deductions.

What is the average mortgage payment for a $300 000 house?

For a $300,000 mortgage with a 6% APR, you’re looking at $2,531.57 per month on a 15-year loan or $1,798.65 on a 30-year loan, excluding escrow.

How much is a mortgage on a $400,000 house?

On a $400,000 mortgage with a 7% fixed rate, the monthly payment is $3,595 for a 15-year loan and $2,661 for a 30-year loan. Just remember that insurance and property taxes aren’t included in these figures.

How much is mortgage on a $200 K house?

For a $200,000, 30-year mortgage at a 6% interest rate, you’d pay about $1,199 per month. The exact payment will depend on the loan length and interest rate.

Can I afford a 400k house with 50k salary?

With a $50,000 salary, affording a $400,000 house might be tough. Generally, you need to make quite a bit more to comfortably manage the monthly payments and other related costs.

Can I afford a 400k house with an 80k salary?

You might be in a better position to afford a $400,000 house with an $80,000 salary, but it all depends on your debt situation and other financial commitments. Make sure to do the math and consult a financial advisor.

Can I afford a 300K house on a 70K salary?

With a $70,000 salary, you might be able to afford a $300,000 house, but it’s crucial to look at your total debt, monthly expenses, and any other financial obligations to confirm this.

Can I afford a 300K house on a 60k salary?

Affording a $300,000 house on a $60,000 salary could be tight. You’d need to have minimal debt and other financial obligations to make this work without overstretching your budget.

What credit score is needed to buy a $300K house?

To buy a $300K house, a credit score of at least 620 is often needed, but higher scores can get you better interest rates and loan terms.

What is the 20% down payment on a $400 000 house?

A 20% down payment on a $400,000 house would be $80,000. This helps you avoid paying private mortgage insurance and can get you better loan terms.

Is it hard to get a 400k mortgage?

Getting a $400,000 mortgage can be challenging if you don’t meet income, credit score, and down payment requirements. It’s always best to check with multiple lenders to see your options.

Can I afford a 400k house on 100k salary?

With a $100,000 salary, affording a $400,000 house is more feasible. You’ll need to consider other debts and expenses to ensure you’re not stretching your budget too thin.

What credit score is needed to buy a house?

A minimum credit score of 620 is generally required to buy a house, but a higher score will get you better loan terms and lower interest rates.

Can I afford a 200K house on 50K a year?

Affording a $200,000 house on a $50,000 salary is possible, but you’ll need to manage other debts and expenses carefully. Budgeting and financial planning are crucial here.

Will interest rates go down in 2024?

Predicting if interest rates will go down in 2024 is tricky as it depends on various economic factors. Keep an eye on market trends and consult financial experts for the latest updates.