Exploring the Importance of a Reliable Housing Calculator

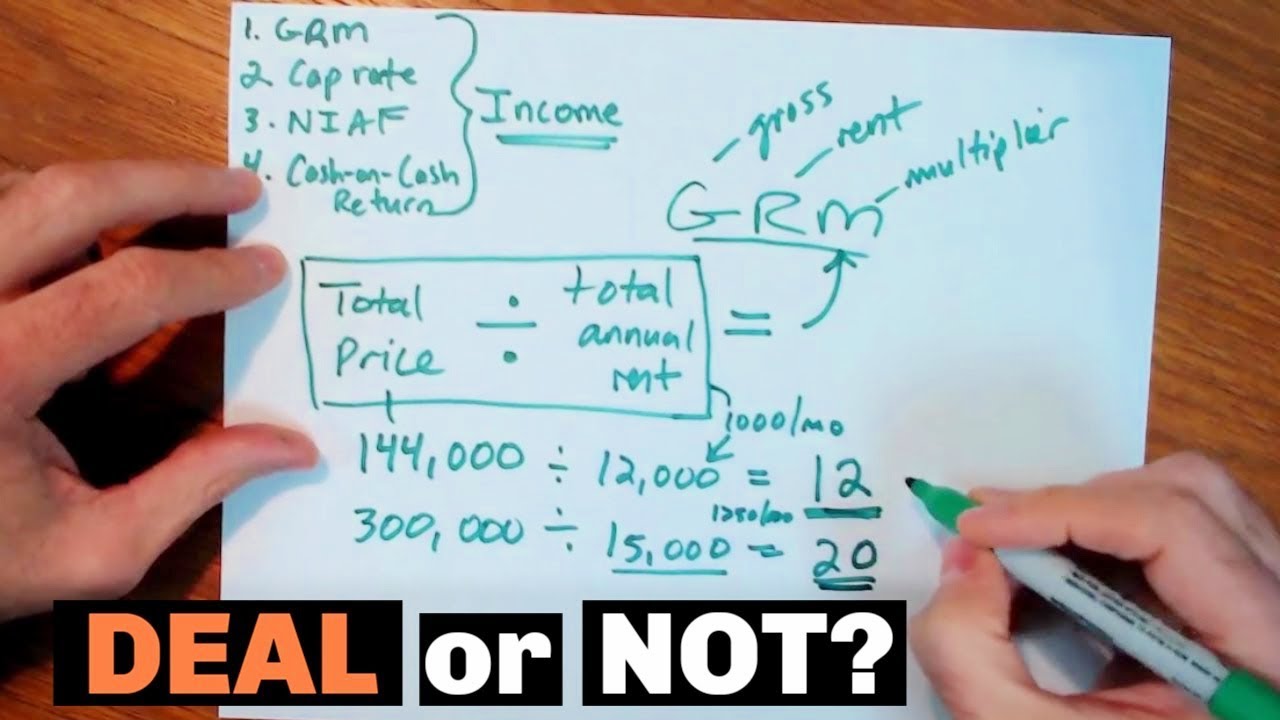

A housing calculator is a crucial tool for both prospective homebuyers and renters. These versatile applications extend way beyond simple mortgage calculations. They offer valuable insights into budgeting, affordability, and long-term financial planning. In today’s market, distinguishing between a basic mortgage calculator and a comprehensive housing calculator can significantly affect smart budgeting choices. Let’s dive into 2024’s best housing calculators, each crafted to meet various needs and preferences.

Top 5 Housing Calculators for Savvy Financial Planning

1. Zillow’s Affordability Calculator

Overview:

Unique Features:

In-depth Analysis:

Zillow’s tool excels at combining real-time data with user inputs, delivering accurate insights into what buyers can truly afford. This is crucial in a market where prices can fluctuate swiftly, affecting affordability. Zillow’s extensive data ensures that users stay ahead of market trends.

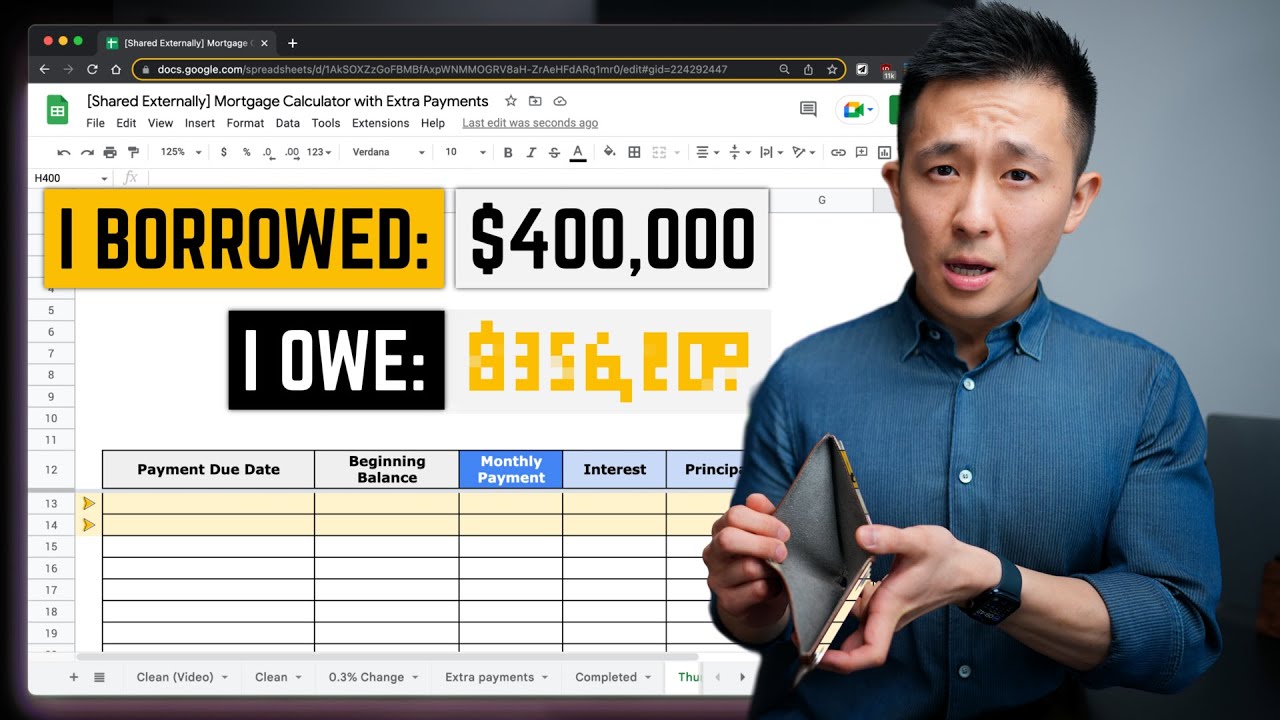

2. Bankrate Mortgage Calculator

Overview:

Unique Features:

In-depth Analysis:

The strength of Bankrate’s calculator lies in its ability to offer a comprehensive view of the mortgage payment structure. Understanding where each dollar goes enables users to manage their finances better and plan for future expenses efficiently.

3. NerdWallet Home Affordability Calculator

Overview:

Unique Features:

In-depth Analysis:

NerdWallet’s calculator is especially beneficial for first-time buyers who might need extra budgeting assistance. By linking mortgage affordability with overall budgeting, it ensures users maintain a balanced financial life post-purchase.

| Subject | Description | Details |

| Definition | A tool to estimate the amount of house you can afford based on various financial factors. | – Gross Income – Down Payment – Existing Debts – Mortgage Rate |

| Expense Guideline | Recommended housing expenses as a percentage of gross monthly income. | – Housing expenses: ≤ 28% of gross monthly income – Housing + other debts: ≤ 36% of gross monthly income |

| Example 1: $70,000 Salary | Affordability range for a $70,000 annual salary. | – Target monthly mortgage: $1,450 – $2,100 – Housing expenses: 25% – 36% of gross monthly income |

| Example 2: $36,000 Salary | Affordability range for a $36,000 annual salary, assuming no other debts. | – Estimated house price: $100,000 – $110,000 – Monthly mortgage: Just over $1,000 |

| Example 3: $138,000 Salary | Income needed to comfortably afford a $400,000 house. Assumes no other debts. | – Housing expenses: ≤ 28% of gross monthly income – Required monthly gross income: $11,500 |

| Factors Affecting Affordability | Key elements that influence how much house you can afford. | – Gross Income – Down Payment Savings – Existing Debts – Mortgage Rate |

| Benefit | Helps provide a realistic budget | – Ensures financial stability – Prevents overborrowing |

| Usage | How to use a housing calculator effectively. | – Input gross income, down payment, existing debts, and mortgage rate. – Adjust according to expense guidelines. |

Comparing the Best Housing Calculators: How to Choose

With several options on the table, picking the right housing calculator can feel overwhelming. Here’s a comparative breakdown based on key metrics:

Accuracy and Updates

User Experience

Comprehensive Insights

Final Thoughts on Utilizing Housing Calculators

In 2024, the housing market is dynamic, and informed decisions require accurate, up-to-date tools. Housing calculators from Zillow, Bankrate, and NerdWallet simplify the complex process of budgeting for a home while providing comprehensive insights crucial for strategic financial planning.

For potential homeowners or renters, leveraging these tools can mean the difference between financial strain and smart, sustainable budgeting. Remember, the best house mortgage calculator is the one that not only estimates what you can afford but also steers you toward a secure and savvy financial future.

If you’re curious about mortgage types, catch the latest Insights on various home Loans available today.

By aligning your choice with your financial situation and goals, you can confidently navigate the housing market. For more tailored advice or if you have specific questions, you can always rely on the housing loan calculator tools we offer at Mortgage Rater.

Discover the Fun: Housing Calculator Trivia

Did You Know?

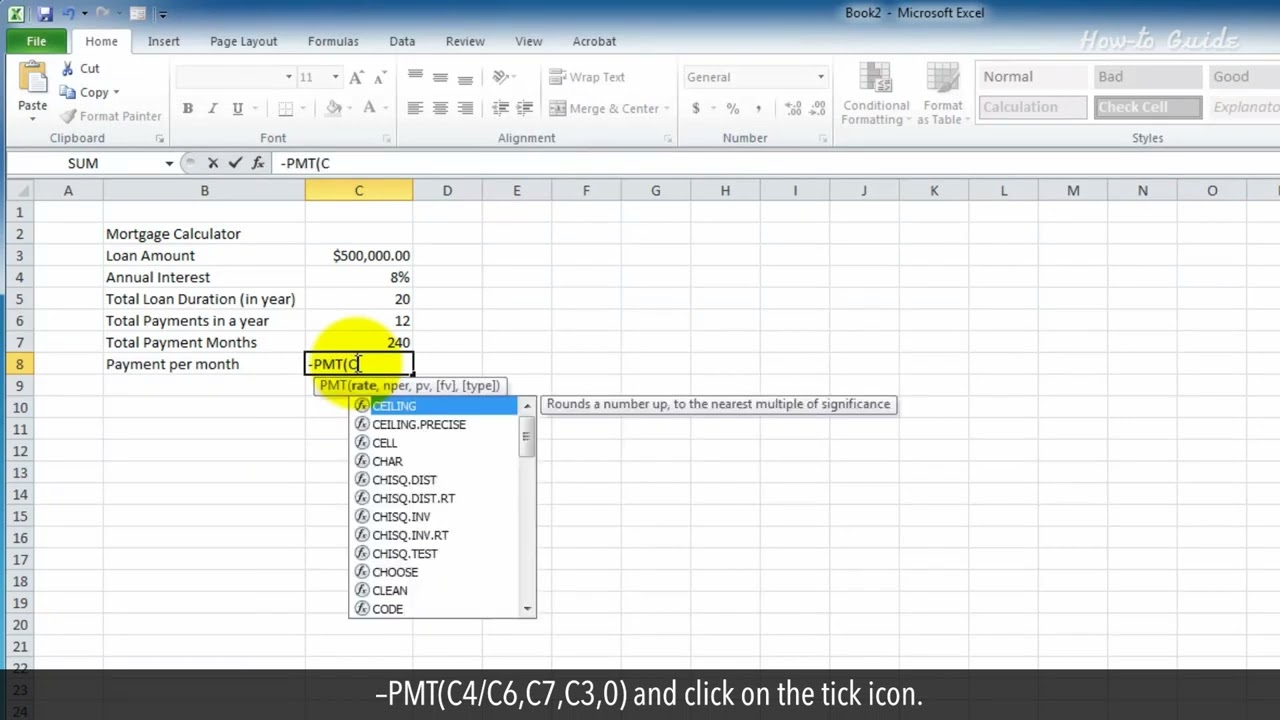

Let’s dive into some nifty trivia about housing calculators that might surprise you. Did you know that the first loan calculator home tools were rudimentary spreadsheets? They evolved from basic arithmetic entries into the sophisticated online tools we rely on today. These calculators can now analyze everything from your principal balance to the national mortgage interest rate, giving us unparalleled insights into our financial commitments.

A Marvel of Technology

One of the coolest aspects of modern housing calculators is their ability to integrate real-time data. This means as soon as there’s an update in mortgage rates, your calculator reflects the change, offering you the most current picture of your potential costs. It’s like having a financial advisor on call 24/7—but without the hefty fees!

The Human Element

Now, here’s something really interesting. Ever wondered about the human touch in these calculators? It’s the people behind the scenes—the developers and financial experts—who ensure these tools are user-friendly and accurate. Interestingly, some initiatives around housing affordability have been driven by unexpected advocates. Groups like Mothers Against drug deaths have extended their mission to promote stable housing as a means to combat community issues, bringing diverse voices to the table.

Local Insights

Lastly, let’s not overlook the localized advice these calculators can offer. For instance, if you’re in Los Angeles, you might find that calculators designed with insights from Los angeles mortgage Brokers provide more tailored advice that aligns with the local market. Now, isn’t that a fun fact to keep in your back pocket?

In the ever-dynamic sphere of housing finance, a good calculator is more than just a gadget—it’s your roadmap to smarter budgeting!

How much income do I need for a $300 K house?

To comfortably afford a $300,000 house, your annual income should be around $103,000. This aligns with keeping your monthly housing expenses around 28% of your gross income.

How much house can I afford based on my salary?

The house you can afford based on your salary depends on your gross monthly income, existing debts, and the interest rate on your mortgage. It’s best to aim for housing costs between 25% and 36% of your gross monthly income.

How much house can I afford if I make $70,000 a year?

With a $70,000 salary, you could afford a house with a mortgage payment ranging from roughly $1,450 to $2,100 per month, putting the home price between $250,000 and $300,000 depending on your other debts and down payment.

How much house can I afford if I make $36,000 a year?

If you’re making $36,000 a year, you can afford to buy a house priced around $100,000 to $110,000, assuming you have no other debts and can manage a monthly payment of just over $1,000.

Can I afford a house on 40K a year?

On a $40,000 annual income, you could likely afford a house in the range of $120,000 to $130,000, provided your debts are minimal and you have a modest down payment.

Can I afford a house on 50k a year?

With a yearly income of $50,000, you could afford a home priced between $150,000 and $170,000, depending on your debt load and down payment.

Can I afford a house making 80000 a year?

Earning $80,000 a year, you could comfortably purchase a home in the range of $250,000 to $300,000 while keeping your mortgage payments within the recommended portion of your income.

Can I buy a house if I make 45000 a year?

On a $45,000 salary, you can afford to buy a house priced between $140,000 and $160,000, given that you maintain low debt levels and save for a modest down payment.

How much house for $3,500 a month?

For a $3,500 monthly budget, you could aim for a house priced between $350,000 and $400,000, assuming your total housing expenses include taxes, insurance, and maybe some HOA fees, and you keep other debts in check.

Can you live off of 80k a year?

Earning $80,000 a year, you can live comfortably. You’ll have enough to cover housing, utilities, groceries, and even some extras like dining out and vacations, while also being able to save for the future.

What credit score is needed to buy a $300K house?

To buy a $300,000 house, your credit score should ideally be at least 620, though higher scores will get you better interest rates and loan terms.

Is 70k a year good for a single person?

Making $70,000 a year is pretty solid for a single person. It allows for a decent lifestyle that includes comfortable housing, regular savings, and some discretionary spending.

Can a single person live on $36,000 a year?

Living on $36,000 a year is doable for a single person, but it will require careful budgeting. You’ll need to prioritize essential expenses and possibly cut back on extras.

Can I buy a house making $35,000 a year?

With a $35,000 annual income, buying a house is challenging but possible. You might be able to afford a home priced around $100,000 if you have very low debt and significant savings for a down payment.

Can I buy a house with 36k income?

On a $36,000 income, you can look at homes priced around $100,000 to $110,000. Keeping your debt low and saving for a down payment is crucial.

Can I afford a 300K house on a 60k salary?

With a $60,000 salary, affording a $300,000 house might stretch your budget too thin, as it would push the limits of recommended housing expense ratios even if you have minimal other debts.

Can I afford a $300 K house on a $70 K salary?

Making $70,000 a year, you could afford a $300,000 house comfortably. Your mortgage payment would fit within the 25% to 36% range of your gross monthly income.

How much do you have to make a year to afford a $350 K house?

To afford a $350,000 house, your annual income should be in the ballpark of $115,000, keeping your monthly housing expenses at or below the recommended 28% of your gross income.

What is the 20 down payment on a $300 000 house?

A 20% down payment on a $300,000 house would be $60,000. Having a substantial down payment helps you get better loan terms and lowers your monthly mortgage payments.