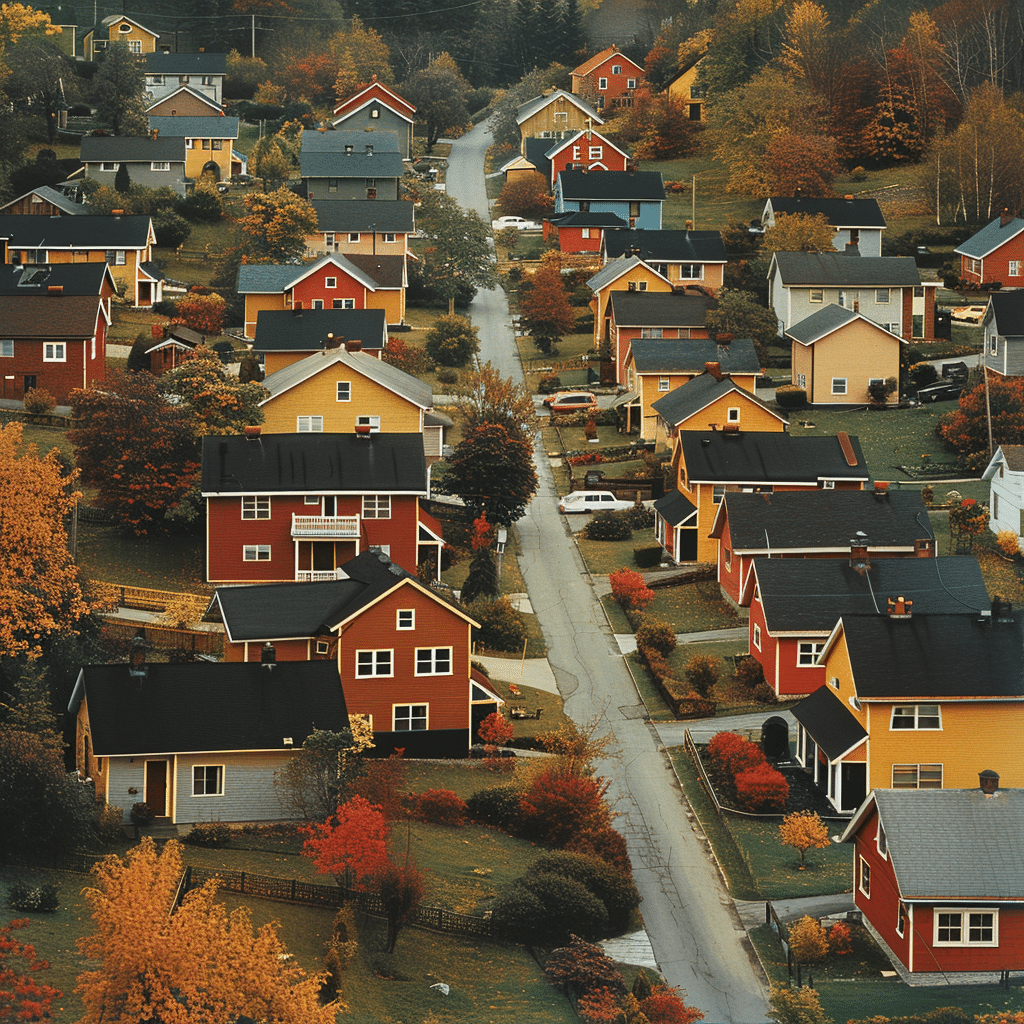

Comprehensive Forecast for Housing Market 2024

As we step into 2024, the housing market predictions are brimming with cautious optimism and diverse expert insights. The forecast for the housing market unfolds a complex tapestry of factors influencing the market trends, from economic conditions to migration patterns. Understanding these dynamics is crucial whether you’re eyeing the market as a homebuyer, seller, or investor.

Here, we delve into the multifaceted layers of the housing market forecast, laying out the analytical data and predictions from leading industry voices. We aim to arm you with information to make informed decisions in an ever-competitive market.

Top 7 House Market Predictions from Industry Leaders

1. Steady Growth Predicted by National Association of Realtors (NAR)

The National Association of Realtors (NAR) predicts a steady growth in the housing market throughout 2024, estimating a 3% increase in home prices. Tight inventory and sustained demand, especially in suburban areas, are crucial factors underlying this growth. For those pondering whether will home prices drop in 2024, NAR’s outlook suggests otherwise, pointing to a robust year ahead.

2. Zillow’s Optimistic Outlook

Zillow’s analysts expect a moderate price increase of around 2.5% in major metro areas. The rise in remote work trends has nudged housing preferences, boosting demand for homes with office spaces. Therefore, the housing market predictions 2024 envisage sustained interest in homes providing functional work-from-home environments.

3. Redfin’s Cautious Prognosis

Adopting a more cautious stance, Redfin forecasts a marginal uptick in housing prices by about 1.8%. They cite potential economic headwinds and a prudent lending atmosphere as key factors. This caution translates into a tempered but steady market environment, offering a balanced perspective on whether will house prices go down in 2024.

4. CoreLogic’s Statistical Approach

CoreLogic projects a 2.2% rise in housing prices, leveraging extensive data analytics. Growth hotspots include regions such as Austin, TX, and Orlando, FL, driven by tech sector expansion and favorable climate. This prediction indicates selective regional growth within a generally stable forecast for the housing market.

5. Freddie Mac’s Mortgage Market Analysis

Freddie Mac forecasts steady mortgage rates, predicting averages around 5%. This stability in rates supports home affordability, indirectly aiding gradual price increases. Stability in mortgage rates is a key piece of the housing market predictions, ensuring that affordability remains within reach for many buyers.

6. Realtor.com’s Regional Insights

Realtor.com highlights regional variations with the Southeast and Southwest regions poised for higher-than-average price appreciation. Factors such as robust job markets and migration trends drive this localized growth, adding depth to the house market predictions for 2024.

7. Goldman Sachs Economic Research

Goldman Sachs offers a more tempered forecast, predicting a price increase of no more than 1.5%. They attribute this to global economic uncertainties and potential interest rate fluctuations. This conservative view balances the spectrum of predictions, highlighting cautious optimism.

| Aspect | Prediction for 2023-2024 | Factors to Consider | Impact on Buyers | Impact on Sellers |

| Home Prices | Stabilization or slight decline | Economic conditions, interest rates, inflation | Better affordability, but cautious about overall economic stability | May need to adjust price expectations, longer selling times expected |

| Interest Rates | Potentially high but volatile | Federal Reserve policies, inflation numbers, global economic trends | Higher cost of borrowing, might deter first-time buyers | Could lead to reduced buyer demand |

| Housing Supply | Gradual increase | New constructions, easing supply chain issues, government policies | More options to choose from, potentially less competition | Increased competition among sellers, need for more competitive pricing |

| Rental Market | Continued strength | High demand, affordability issues in home buying, supply constraints | Consider renting as an alternative, stable rental rates expected | Opportunity for landlords, high occupancy rates, potential for rent increases |

| Technology Influence | Enhanced digital platforms | Growth in real estate tech, virtual tours, AI in property management | Easier property search and viewing, more informed decisions | Improved marketing tools, ability to reach a wider audience |

| Suburban vs Urban | Preference for suburban areas | Pandemic aftermath, remote working trends, lifestyle changes | Greater availability in suburbs, possible price drops in urban areas | Increased demand in suburbs, urban properties may take longer to sell |

| Government Policies | Supportive measures | Incentives for first-time buyers, affordable housing initiatives, tax benefits | Financial support, grants, tax relief | Could stimulate housing demand, especially in affordable sectors |

| Employment Trends | Job market recovery | Economic recovery, sector-specific growth, remote working environments | Increased confidence in job security, willingness to invest in housing | Greater pool of potential buyers, housing market growth linked to job recovery |

Housing Market Predictions 2024: Will Home Prices Drop?

Evaluating the Possibility: Will House Prices Go Down in 2024?

The question on many minds is: “will home prices drop in 2024?” Although opinions vary, most experts expect stability or modest growth rather than significant declines. Several factors play into this scenario:

Economic Conditions

While the U.S. economy has shown resilience, a potential downturn could temper housing prices. Global economic disruptions or shifts in national policy could impact housing demand and, consequently, prices. According to some analysts, external factors might keep the market in a holding pattern rather than a decline.

Interest Rates and Affordability

The Federal Reserve’s decisions on interest rates will be pivotal. Should rates rise sharply, buying power may decline, cooling price growth. Conversely, if rates stay as stable as Freddie Mac predicts, it implies a modest price increase aligned with broader housing market predictions 2024.

Inventory Levels

Persistently low inventory levels will likely support price stability. Without a substantial increase in housing supply, significant price drops seem improbable. Therefore, for those asking, “, the constrained inventory remains a key determinant.

Migration Trends

Migration trends, particularly the movement from expensive urban areas to affordable suburban and rural locales, will bolster price growth in these regions. This dispersal of demand mitigates the risk of a broad decline in home prices, aligning with regional predictions from Realtor.com.

Housing Market Forecast Summary: Key Takeaways

Navigating through 2024, it’s apparent that a delicate balance of economic drivers, interest rates, and migration trends will sculpt the housing market. Though a decline in housing prices can’t be entirely ruled out, the consensus leans toward stability or modest growth. Staying well-informed and adaptable will be critical for stakeholders.

Navigating the Future: Strategic Considerations for Buyers and Sellers

For Homebuyers

Homebuyers should brace for competition in desirable markets. Opportunities may arise in regions experiencing less aggressive price hikes. Flexibility and local market research can unveil promising prospects.

For Sellers

Sellers can leverage the projected price stability. Listing homes to capitalize on seasonal demand spikes can maximize returns. Understanding local buyer behavior will be critical.

For Investors

Investors should consider diversifying portfolios, focusing on high-growth potential areas highlighted by CoreLogic and Zillow. Identifying markets with tech industry expansions or favorable living conditions can enhance returns in a generally temperate market.

Crafting a Calculated Approach in 2024’s Housing Market

In summary, the 2024 housing market, with insights from leading experts, presents a dynamic yet navigable landscape. The balance of data-driven forecasts and strategic flexibility will be vital for capitalizing on market opportunities.

For comprehensive guidance on your housing journey, explore all resources and analysis provided by Mortgage Rater. Whether you need mortgage rates, brokerage services, or housing market updates, our platform is here to support your informed decision-making throughout 2024.

To learn more about housing trends and mortgage advice, visit our detailed section Real Estate brokerage near me. Remember, being prepared and adaptable will be your greatest assets in the housing market of 2024.

Housing Market Predictions 2024: What Experts Say

The Future Looks Bright (or Does It?)

Ever wondered if you should hold your breath waiting for house prices to drop? Well, you’re not alone. Many homeowners and potential buyers frequently ask, When will house Prices drop? The truth is, forecasting the housing market is a bit like predicting the weather: sometimes you get it right, and sometimes, not so much. But experts are here to give us some clues for 2024.

A Glimpse into the Crystal Ball

Let’s not beat around the bush—people are buzzing about whether there’s a looming crash on the horizon. It’s a hot topic, and analysts have been debating will The housing market crash? Most experts agree that while the market may cool down in certain areas, a total crash seems unlikely. Whew, that’s a relief! In essence, it’s like admiring Paintings Of Sunflowers—you( see the vibrancy and life, but there’s always that small underlying uncertainty about the future.

Local Market Curiosities

Did you know that small towns like Bidford on Avon can offer unique insights into broader market trends? Often overlooked, these local markets can sometimes act as bellwethers for what’s to come. Fascinating, right? Speaking of local flavors, think about how distinctive places like Baltimore city Public Schools can affect housing desirability trends. Surprisingly, school districts play a more significant role than many realize, influencing where families choose to settle down.

Sports and Stock Phrases

Switching gears, let’s talk sports! Ever heard the saying, “Real estate is a bit like baseball?” It’s all about the timing and strategy. Just like Baltimore Orioles broadcaster Kevin brown calls a game, experts in housing keep a keen eye on market movements and strategies. Sometimes they’re spot-on, and other times, not so much, but they certainly keep things interesting.

In sum, housing market predictions for 2024 mix certainties with surprises. Whether you’re eyeing a family-friendly neighborhood or a quaint village, staying informed is essential. And maybe—just maybe—you’ll find your perfect place amid all the twists and turns.