The financial world is a labyrinth, and when it comes to loans, even the savviest of spenders can get lost in the maze. But fret not! Let’s crack the code of the loan process and chart a path that winds from curiosity to that sweet sweet, approved loan status, making sure you’re as informed as possible about today’s loan market.

Deciphering the Loan Process: How Do I Get a Loan in Today’s Market?

Unpacking Your Eligibility: Can I Get a Loan Anymore?

First off, can you even get a loan anymore? You bet your bottom dollar, you can! However, the question is not just about availability—it’s about readiness. Let’s deep-dive into the current lending criteria.

Concretely speaking, knowing your financial footing is critical. A few years back, who knew that managing a luxurious escape to the cayman Islands all inclusive would be a testament to financial responsibility?

From Inquiry to Approval: How Can I Get a Loan Effectively?

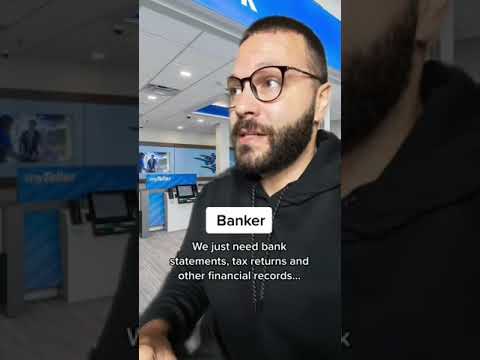

Look, getting from point A to point B requires a roadmap. Here are the steps for initiating that all-important loan application:

Moreover, accurate documentation is your friend in this. Let’s just say, having your papers in order is like having an Unblocked Games situation—nothing standing between you and success.

Preparing for the Commitment: Taking Out a Personal Loan Responsibly

Ah, the gravity of commitment—we’re talking about more than those French tip Nails. You have to prepare for the long haul with a personal loan:

Before you sign on the dotted line, bake this piece of advice into your brain: Budgeting is the yeast that helps your financial dough rise. And when it’s time for that new car or home renovation, a Pre approved Loans system could help you drive home with confidence or hammer down those improvements without a hiccup.

Innovative Loan Acquisition Strategies: How Do You Get a Loan with an Edge?

Today’s market has more gadgets and gizmos than ever. Here’s how you get a loan with an edge:

And it turns out, those posts of your homemade gourmet pet food might do more than rack up likes. Non-traditional data can now factor into how you snag that loan in the first place.

| Step | Description | Tips | Considerations |

|---|---|---|---|

| 1. Determine Loan Need | Assess why you need a loan: Consolidation, Home, Car, etc. | Be clear about the loan purpose to find the best type. | Avoid borrowing more than you need. |

| 2. Check Credit Score | Your credit score affects loan eligibility and rates. | Obtain a free credit report from major bureaus once a year. | Higher scores generally lead to better rates. |

| 3. Research Loan Options | Look into different types of loans, including personal, secured, and government loans. | Compare rates, terms, and fees from various lenders. | Be wary of loans that don’t require a credit check as they might have high costs. |

| 4. Prepare Documentation | Gather required documents like ID, proof of income, and financial statements. | Organize documents beforehand to expedite the application process. | Inaccurate or incomplete documentation can lead to rejection. |

| 5. Apply for Pre-Approval | Check if potential lenders offer a loan pre-approval to see potential rates. | Pre-approvals can help you shop around without impacting your credit score too much. | Pre-approval is not a guarantee of actual loan approval. |

| 6. Choose a Lender | Select a lender that offers the best terms for your needs and situation. | Consider local credit unions or community banks as they may offer competitive rates. | Ensure the lender is reputable and trustworthy. |

| 7. Complete Application | Fill out the loan application form with the chosen lender. | Double-check for accuracy and completeness. | Errors or omissions may result in processing delays. |

| 8. Review Loan Terms | Carefully review interest rates, fees, repayment schedule, and penalties. | Confirm the loan’s annual percentage rate (APR) which includes interest and fees. | Understand the long-term costs and your monthly payment obligation. |

| 9. Finalize the Loan | Accept the terms and finalize the loan agreement. | Keep a copy of the signed agreement for your records. | Late payments or defaults can negatively affect your credit score. |

| 10. Repay the Loan | Stick to the agreed repayment plan to avoid additional charges. | Setting up automatic payments can ensure you never miss a payment. | Early repayment may save on interest but check for prepayment penalties. |

Specialized Lending Knowledge: How to Get a Loan for a Student

You’re stepping into a world of academia and student loans. Here’s what you need to know:

Exploring the Unconventional: Places to Get a Loan Beyond Banks

When traditional banks give you the cold shoulder, look elsewhere for that warm financial embrace:

And let’s not forget the apps! Much like how arm rate or arm rates today are at your fingertips, so too are loan services that fit just right in the palm of your hand with a quick tap.

A Step-by-Step Guide: How to Take Out a Loan Without the Guesswork

Alright, you ready to dig into the nitty-gritty and get that loan? Let’s roll:

Interpreting the terms and conditions of a loan can be tougher than predicting the investment mortgage rates of the future. So, squint at that fine print as if it’s a secret map leading to treasure—because it kind of is.

Craft Your Path: How to Navigate Taking Out a Personal Loan in the Future

Look ahead and imagine the future of personal loans. Here’s how to stay on top:

And remember, a financial advisor can be like a trusty co-captain on your journey through the ever-windy seas of personal lending. They’re your go-to for when navigating gets tough.

Conclusion: Charting Your Unique Loan Journey

Phew! We’ve covered a lot. From technologically savvy acquisition strategies to the golden advice of tip-top preparation, it’s clear there’s more than one route to getting a loan. And hey, How To get The most back on Taxes is not the only smart financial move on the block.

Adopting personalized strategies, understanding future trends, and tackling the process with a responsible foot forward will not only help you stand out in the sea of applicants but also guide you towards a more secure financial horizon.

So there you have it, folks—your compass to a bountiful borrowing experience. Gauge your financial health like a hawk, and pretty soon, you’ll be in the driver’s seat, ready for that auto refinance or any other loan journey you’re about to embark on. Just remember: in the world of loans, it pays to be prepared, educated, and a little bit daring.

Trivia and Interesting Facts: How Do I Get a Loan?

A Historical Hurdle: When Loans Were Luxuries!

Believe it or not, there was a time when the question “how do I get a loan” would have baffled many. Loans weren’t always the streamlined process we see today. In ancient times, if you didn’t have a hoard of gold or a wealthy uncle, you could pretty much forget about borrowing money. Yep, getting a loan was as rare as a hen’s teeth! In fact, in some cultures, the idea of lending at interest was so frowned upon, it was downright taboo!

The First Credit Bureau: Guardians of the Galaxy of Lenders!

Ready for your mind to be blown? The first credit bureau surfaced in the 1800s, and it was as manual as churning butter. They kept ledgers! Hand-written records of who was naughty or nice with their finances. Fast forward to today, where your credit score is a passport to borrowing power,( serving as a quick snapshot for lenders about how trusty you are with the ol’ greenbacks.

Computers Say Yes: From Face to Face to Cyberspace!

Oh, the times they are a-changin’! Gone are the days when you’d sweat in your Sunday best, hat in hand, asking the bank manager for a loan. Now, you’re a few clicks away from a decision. Thanks to the wonder of the web, applying for a loan online( has become as easy as ordering a pizza. In fact, some say it’s even easier – at least you don’t have to tip!

The Size of the Prize: Big Numbers, Big Dreams!

Ever wonder what the world’s largest loan was? Brace yourself—the answer is more zeroes than you can shake a stick at. It was a whopping $21 billion, arranged for the mighty brewer Anheuser-Busch InBev. That’s a lot of beer money, right? But don’t worry, your quest on “how do I get a loan” probably won’t hit the billions (or, who knows, maybe you are on to something huge!).

Not Just for the Big Fish: Swimming in the Loan Pond!

Who said loans are only for big shots? Certainly not the world of microfinance! Started as a way to give a leg up to the little guy, microloans offer a sprinkle of cash( to let small business dreams flourish. And guess what? It’s been a game-changer for entrepreneurs globally. So, how do I get a loan? Well, maybe starting small is the way to go!

The Quintessential Quirky Q & A: How Do I Get a Loan, Really?

All right, enough with the history lesson, here’s the scoop! Really, when pondering, “how do I get a loan”, you’re tapping into an ancestral quest for resources. Modern-day loan hunting can seem like wandering in a financial jungle. However, with a little savvy, you can emerge as the king or queen of the loan-land.

In truth, getting a loan may not be as insane as wrestling an alligator, but it sure helps to know the ropes. Garner a strong credit score, shop around like you’re on a treasure hunt, and negotiate like a pirate, and you’ll land that cash booty. Remember, loans can be a friend or foe, so navigate with care, savvy borrower!

So, there you have it—a treasure trove of trivia and facts on “how do I get a loan”. May your loan-seeking journey be epic, and may the odds of approval be ever in your favor!

What’s the easiest way to get a loan?

Alright, here we go:

How can we get the loan?

What’s the easiest way to get a loan?

Well, the path of least resistance is often an online lender or peer-to-peer platform. Just hop online, fill out a quick application, and bingo! You can often get pre-approval quicker than saying “Show me the money!”

How can I borrow money and get it instantly?

How can we get the loan?

Getting a loan is like following a recipe – gather your financial docs, your credit score, and shop around. Compare different lenders like you’re picking out a ripe avocado, then apply for the one that feels like the best fit.

What type of loan is easiest to get?

How can I borrow money and get it instantly?

When you’re in a pinch, digital lenders are your new BFFs. They often have apps where you can apply faster than a greased pig and receive funds quicker than you can say “I need cash!”

How to borrow $500 quickly?

What type of loan is easiest to get?

Payday loans and personal installment loans might slide into your DMs like they’re the easiest, with less stringent credit checks, but watch out – they often come with a steep price tag.

How easy is it to get a $5,000 loan?

How to borrow $500 quickly?

Short on cash? Check out cash advance apps or payday lenders. Sure, they’ll charge you an arm and a leg in interest, but they’ll pass you the dough faster than a hot potato.

Which bank gives instant personal loan?

How easy is it to get a $5,000 loan?

Not too tough, really, if your credit’s not in the basement. Online lenders, credit unions, and some banks would give it a whirl, just make sure your ducks are in a row with a stable income and decent credit.

Which bank gives fastest personal loan?

Which bank gives instant personal loan?

Looking for fast cash? Some banks might drag their feet, but many online banks and lenders boast instant approvals – it’s like swiping right on your finances!

How to get instant loan in 5 minutes?

Which bank gives fastest personal loan?

I’d wager online lenders, with their high-tech doohickeys, take the trophy for speed. They’ve really got this down to a science!

What app lets you borrow money ASAP?

How to get instant loan in 5 minutes?

For a loan in a jiffy, try out a loan app or an online lender. They’re so fast; you’d think they were running from the cops!

Who is the best to borrow money from?

What app lets you borrow money ASAP?

In a cash crunch? Apps like Earnin or Dave will float you a few bucks – no muss, no fuss. Just download, apply, and violà – cash in your pocket!

How do I borrow $200 from cash App?

Who is the best to borrow money from?

Borrowing from family or close friends can save you the headache of interest rates. But remember, mixing money and relationships is like dancing with a cactus – proceed with caution!

How to get a loan when no one will approve you?

How do I borrow $200 from Cash App?

Easy as pie – if you’ve been using Cash App for a while, you might be eligible for their ‘Borrow’ feature. Just tap, follow the prompts, and keep your fingers crossed!

How hard is it to get a $30,000 personal loan?

How to get a loan when no one will approve you?

Feeling like a wallflower? Consider a cosigner, or look into secured loans where you put up some collateral. It’s not a piece of cake, but it could get you to the party.

What credit score is needed to get a loan?

How hard is it to get a $30,000 personal loan?

Getting your hands on $30k can be quite the hurdle unless your credit is spick-and-span and your income is as steady as a rock. Solid preparation is your best friend here.

How to get a loan when no one will approve you?

What credit score is needed to get a loan?

Lenders often tickle your fancy if your credit score’s around 600 or above, but the sweet spot? That’s usually upwards of 670, where rates get more tempting.

Who has the fastest loan approval?

How to get a loan when no one will approve you?

Square one again, huh? Look, secured loans or credit unions might be your ticket in. They’re known for giving folks a chance when they’ve been turned down elsewhere.

What is a hardship loan?

Who has the fastest loan approval?

Speed demons in the loan world are often fintech companies and online lenders. They’ve got loan approval down to a fine art – sometimes mere minutes!

How hard is it to get a $30,000 personal loan?

What is a hardship loan?

Caught between a rock and a hard place? A hardship loan is a lifeline – lower interest, smaller installments – offered by some lenders when you’re hit by life’s curveballs.