Mortgage lending has undeniably come a long way since 1934. The question of how many mortgages have been issued since then is intertwined with the economic barrage and policy shifts that have molded our reality. In the wake of the Great Depression, lending got a fresh face with the creation of the Federal Housing Administration (FHA). This marked a new dawn for modern home financing, opening doors for countless Americans to achieve homeownership dreams. By dissecting data from the Mortgage Bankers Association alongside historical chronicles, we can trace the fascinating patterns that have shaped the housing landscape for nearly a century.

The Evolution of Mortgage Numbers: How Many Mortgages Since 1934?

Understanding these numbers requires stepping back into the chapters of history. The Great Depression left a deep cut, urging the government to concoct policies that rebuilt public faith. That’s when the FHA came into the picture, striking a chord of affordability in mortgage lending. Fast-forward to today, and we see the prolific expansion of mortgages paving the way for economic growth and personal stability.

Key Milestones in Mortgage Issuance

The introduction of the FHA wasn’t just a policy tweak; it revolutionized accessibility to home loans. Before the FHA, the risk was all too high for lenders, making buyers wary. But the advent of FHA-backed loans turned the keys over to more Americans. Post-war prosperity further bolstered home buying, creating a surge in mortgage issuance like a well-oiled machine.

Ah, the GI Bill. This landmark legislation opened a floodgate for veterans to purchase homes, trickling down to an increase in national homeownership rates. The Baby Boom further ignited the demand for housing, and mortgages became a household concept. It’s akin to the Cursed Princess club getting a membership boom—unstoppable growth.

Enter the rollercoaster of high interest rates. Inflation crept in, causing mortgage rates to soar. Homeowners found themselves grappling with this shift, sparking a pivot to adjustable-rate mortgages (ARMs). Though risky, they found favor among many who sought a peek beyond the norm.

The landscape was again transformed with mortgage-backed securities surfacing. This not only swelled availability but brought a fresh breed of investors into the fold. Tech-driven solutions revolutionized the process, echoing the allure of modern spaces like Portside Pier, brimming with new possibilities.

The housing bubble and its eventual crash? A chapter of hard lessons. Yet, we rallied. COVID-19 too threw a curveball, but with record low rates and mortgage booms, it was a twist like a Willy Wonka meme, vibrant but cautionary.

Assessing Mortgage Affordability: How Much Can You Afford for a Mortgage?

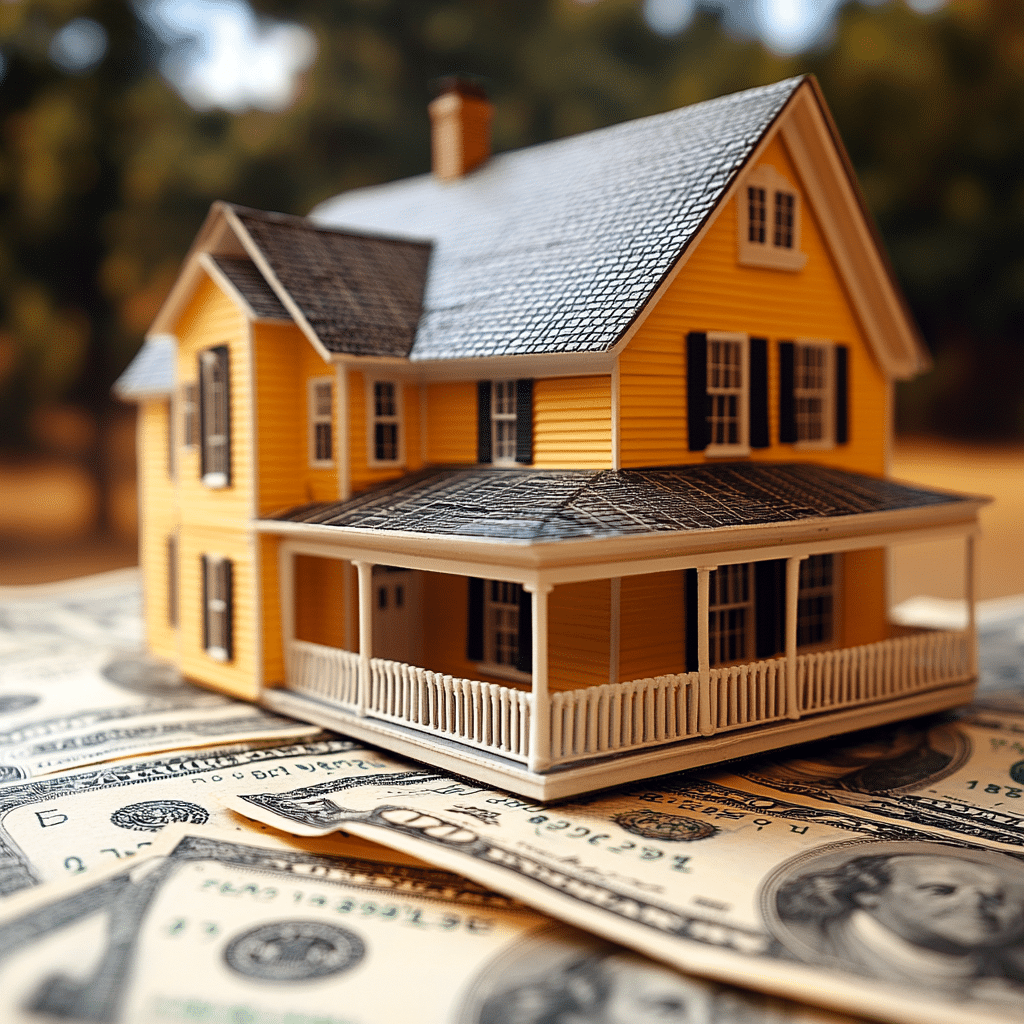

Determining how much you can afford for a mortgage is key when planning your homeownership journey. Over the decades, various factors have influenced this, from broad economic conditions to individual financial health. Present-day tools and analytics provide clearer visibility into how much afford mortgage, but it’s enriched by understanding the past.

Affordability Factors Over Time

Economic variabilities like inflation have always prodded buying power. Over time, wages have ebbed and flowed, affecting purchasing capabilities. Interest rates have been a game-changer too, swinging from double digits in the ’80s to record lows recently, as noted in changed in mortgage rates last month.

Government measures have tipped the scales both ways. The FHA was an affordability beacon, while new programs continue to aid first-time buyers. These policies ensure opportunities are available to more aspiring homeowners, a constant refrain throughout history.

Tools and Strategies for Evaluating Affordability

Knowing how much afford mortgage isn’t a mystery with modern calculators. Platforms such as NerdWallet have wiped away the fog, empowering individuals with useful insights. Calculating debt-to-income (DTI) ratios remains vital. This simple step is akin to having a reliable compass like the navigational certainty found in Dieppe France.

| Period/Year | Number of Mortgages Originated | Major Developments/Factors Influencing Mortgages |

| 1934 | Introduction | The National Housing Act establishes the Federal Housing Administration (FHA) to boost homeownership. |

| 1940s | 2 million+ * | G.I. Bill provides VA loans to World War II veterans, significantly increasing homeownership. |

| 1950s | 10 million+ * | Post-war economic expansion and suburbanization lead to a boom in mortgage originations. |

| 1960s | 15 million+ * | Rising homeownership and FHA/VA’s enhanced role in providing mortgage insurance. |

| 1970s | 19 million+ * | Introduction of adjustable-rate mortgages (ARMs) and the creation of Freddie Mac. |

| 1980s | 25 million+ * | Mortgage-backed securities and high inflation influence the mortgage market. |

| 1990s | 30 million+ * | Technology and financial innovation diversify mortgage products, leading to increased home purchases. |

| 2000s | 45 million+ * | Housing boom, subprime lending expansion, and the eventual financial crisis significantly impact totals. |

| 2010-2019 | 55 million+ * | Post-crisis recovery, stricter lending standards, and historically low interest rates drive mortgage activity. |

| 2020-present | 60 million+ * | Pandemic-induced demand for suburban homes and low interest rates fuel a robust mortgage market. |

Trends in Adjustable-Rate Mortgages: How Many 5yr ARM Mortgages Year Over Year?

Adjustable-rate mortgages have oscillated in popularity with the economy’s pulse. The five-year ARM, particularly, has been a go-to for many navigating home financing. Reviewing data on these trends provides clarity on what the future might look like.

The Lifecycle of the 5yr ARM

The inception of ARMs in the 1980s marked a pivot toward flexibility beyond conventional fixed-rate mortgages. The 5yr ARM seemed like a golden ticket for many, with its initial irresistible lower rates. Enthusiasts compared it to a safe space much like why This Florida city Is a safe haven From Hurricanes—offering refuge albeit temporarily.

Comparative Analysis

Comparing 5yr ARMs with fixed rates delivers a tale of attraction and risk. Data shared by Freddie Mac introduces a dynamic analysis. Borrowers are drawn to ARMs, seeking the prospect of lower initial payments. Yet, the potential financial implications require a cautious approach. Real-world insights, such as those from Bank of America, spotlight the nuances and consumer behaviors, painting a wider story.

Wrapping Up: The Changing Face of Mortgages

From 1934 to 2024, the journey of mortgages tells of resilience, adaptation, and forward-thinking. Entering a mortgage is more than just a loan; it’s a partnership in economic growth and personal achievement. Understanding historical contexts, assessing affordability judiciously, and evaluating mortgage types enriches one’s mortgage expedition. The road ahead is built on such informed decisions. Let’s unlock the potential that lies in mortgages and make wise choices today, as seen in findings like who Has The best mortgage loan and possibilities surrounding When are mortgage rates going down.

The ever-adapting mortgage market stands testament to change and opportunity. Empowerment comes through knowledge—equipping you to shape your homeownership future with confidence. Mortgage Rater is here to guide that journey, helping write your success story in the pages of mortgage history itself.

How Many Mortgages Since 1934: Surprising Facts

A New Era in Home Financing

Jump back to 1934, when the Federal Housing Administration (FHA) first started granting mortgages. Who would’ve thought this would kick-start a housing revolution? Fast forward to today, and it’s estimated that over 100 million mortgages have been approved since then. That’s a staggering number considering the advancements in home financing over the years. Speaking of advances, did you know the first amortized mortgage( allowed buyers to pay off their homes in installments? This concept made home buying more accessible than ever before, paving the way for the thriving property market we see now.

Quirks and Fun Facts about Mortgages

Believe it or not, the ’30s was a time when owning a home equally meant having to fork out nearly half of it in the first downpayment! Imagine having to cough up 50% of your home’s value upfront. Luckily for us, modern mortgages don’t operate like that. With lower down payments( becoming mainstream, homeownership became achievable for the average Joe. Moreover, the introduction of credit scoring in the ’80s revolutionized the loan approval process, giving rise to the phrase, “you are your credit score.”

Timelines and Key Milestones

Heading into the late ’90s and early 2000s, the mortgage landscape got a serious makeover. Subprime mortgages( were all the rave, offering loans to those with less-than-perfect credit. While the 2008 crisis highlighted their pitfalls, these products initially opened doors for potential homeowners who might have otherwise been excluded. Notably, post-recession reforms did spruce up regulatory frameworks, ensuring properties didn’t turn into financial sinkholes. These regulations helped stabilize the mortgage system, even though it wasn’t all smooth sailing!

Over the decades, we’ve seen an ever-expanding mortgage portfolio catering to diverse financial needs. From terms extending over 30 years to interest-only solutions, the choices seem limitless today. The journey since 1934 has been a whirlwind of changes that shaped the housing market we navigate now. It’s safe to say as long as people dream of owning homes, mortgages will keep evolving, bringing along with them a cache of surprises, history, and opportunity.