In a world where change is the only constant, the step towards homeownership is no less dynamic. As you’re tuning into the 2024 rhythm, understanding the market trends, assessing financial readiness, and getting the nitty-gritty of the process can seem daunting. But worry not! Let’s walk through this journey together with savvy advice and practical tips so that you can confidently proclaim, “Here’s how to buy a home!”

Understanding the Current Market: A Prerequisite to How to Buy a Home

The first step in mastering how to buy a home is to get a read on the pulse of the 2024 housing market:

For those wondering “can I buy a home in such a market?” Well, armed with the right info, yes you can!

How to Buy a House What Everyone Should Know Before They Buy or Sell a Home

$14.99

“How to Buy a House: What Everyone Should Know Before They Buy or Sell a Home” is the definitive guide for those entering the complex world of real estate transactions. Whether you’re a first-time buyer or a seasoned seller, this resource provides a comprehensive understanding of the entire process, from initial considerations to post-sale responsibilities. The book demystifies key concepts such as mortgage pre-approval, property valuation, and negotiation tactics, ensuring readers are fully equipped to make informed decisions. It also offers practical advice on choosing the right real estate agent, understanding housing market trends, and navigating legal requirements.

In this guide, readers will learn about the importance of financial preparation and discover how credit scores, debt-to-income ratios, and savings play crucial roles in securing favorable mortgage terms. The book highlights the various mortgage options available, explaining the differences between fixed-rate and adjustable-rate mortgages, as well as government-backed loans versus conventional loans. Expert tips on how to build a competitive offer and strategies for bidding in a seller’s market are invaluable for buyers looking to stand out among multiple offers. Additionally, the text explores the significance of home inspections and appraisals, emphasizing their impact on both the buying and selling process.

Selling a home is an art in itself, and “How to Buy a House” doesn’t shy away from this topic. It presents actionable advice on how to prepare a home for sale, price it effectively, and market it to attract potential buyers. Sellers will gain insight into negotiating offers, understanding contingencies, and managing the closing process. With real-life examples and checklists, the guide ensures that sellers have the knowledge to maximize their home’s value and complete the sale smoothly. For anyone caught in the web of buying or selling property, this book serves as an essential roadmap guiding them to a successful real estate journey.

Navigating Your Financial Landscape: Can I Buy?

Before you even start envisioning your dream home, let’s talk turkey:

With these insights, you’re already on a better footing, right? Let’s kick it up a notch.

| Step | Details | Tips & Considerations |

|---|---|---|

| Assess Your Finances | Credit score, income, savings, and debt-to-income ratio (DTI) | Aim for a credit score of 620+, and save at least 25% of the home sale price. Reduce DTI for better loan terms. |

| Determine Budget | Include cost of home, taxes, insurance, and maintenance expenses | Use online calculators to estimate mortgage payments. Keep in mind other homeownership costs. |

| Save for Down Payment | Aim to save 25% of the sale price (includes down payment, closing costs, moving expenses) | Save in high-yield savings or money market accounts for liquidity with some earnings. |

| Build an Emergency Fund | Save 3-6 months of living expenses before house savings | Provides a financial buffer for unforeseen events post-home purchase. |

| Get Pre-Approved for Mortgage | Based on credit score, DTI, income, and savings | Strengthen financial position before this step for better rates and negotiation power. |

| Explore Mortgage Options | Consider term lengths, interest rates (fixed vs. ARM), and if you qualify for special programs like FHA loans | FHA loans require lower credit scores, but come with additional costs like mortgage insurance. |

| Find a Real Estate Agent | Choose a licensed agent with good references and experience in your preferred area | An agent can provide valuable local market insights and negotiation help. |

| Search for Homes | Create a list of must-haves and nice-to-haves for your new home | Be flexible but know your deal breakers. Also, consider future resale value. |

| Make an Offer | Typically 1%-3% of the home’s price as an earnest money deposit, along with the offer and terms | Your agent can help structure a competitive offer based on comparative market analysis (CMA). |

| Home Inspection and Appraisal | Get a professional home inspection, and lender will order an appraisal | Necessary to discover any potential issues and to ensure the investment is sound. |

| Close on the Home | Finalize the mortgage, sign papers, pay closing costs (typically 2%-5% of home price) | Review all closing documents carefully. This is when the down payment and closing costs are paid. |

| Move In | Organize a moving company, if necessary, and transfer utilities to your name | Plan in advance to avoid any last-minute hassles and costs. |

5 Shocking Tips to Master Homebuying in 2024

Tip 1: Utilize Emerging Tech Tools for Homebuying

The real estate game has gone digital, and boy, you’d better keep up:

These tools are not just cool; they are revolutionizing the very steps to buying a home.

Tip 2: Leverage Unconventional Property Markets

Ever heard of the “road less traveled”? It’s not just a poem; it’s a homebuying strategy:

Tip 3: Decode the Fine Print in Real Estate Regulations

Requirements to buy a house aren’t just about money; they’re about the law:

Ignorance isn’t bliss when you’re skimming the contract; it’s a potential pitfall.

Tip 4: Crafting a Winning Offer in a Competitive Market

You’ve found “The One,” but so have others. Here’s how you charm the seller:

It’s like The rookie Feds—you want to be strategic, determined, and able to negotiate like a pro.

Tip 5: Incorporate Sustainability and Energy Efficiency from the Start

Making your home a green haven isn’t just about feeling good; it’s smart economics:

It’s not just about saving the planet; it’s about saving greenbacks too.

How to Buy Your First Home or Investment Property with No Down Payment (DVD only)

$35.53

Unlock the secrets of real estate investment with the comprehensive guide “How to Buy Your First Home or Investment Property with No Down Payment”, now available on DVD. This invaluable resource is tailored specifically for aspiring homeowners and investors who are looking to enter the property market without the hefty initial financial burden. Narrated by industry experts, this program will guide you through a variety of innovative strategies that can enable you to secure a property investment with little to no upfront cost. Whether you’re looking to buy a home for your family or eyeing real estate as an avenue for wealth accumulation, this DVD is an essential tool for your financial library.

Delving into this extensive guide, you will be introduced to the fundamentals of property investment, credit management, and the home-buying process, all while learning how to navigate these systems without the traditional down payment. The DVD is structured to help you understand the intricacies of mortgage types, government programs, and private funding options that can work in your favor. You’ll gain insight into negotiating seller-financing deals, leveraging secondary financing, and utilizing grants and subsidies designed for first-time buyers and investors. Each topic is presented in clear, easy-to-follow sections, ensuring that viewers of all backgrounds can put these practices into action.

Beyond the practical advice, “How to Buy Your First Home or Investment Property with No Down Payment” will also inspire and empower you with success stories from individuals who have transformed their lives through no down payment purchases. These testimonials add a personal touch, demonstrating that the strategies taught are not just theories, but have been applied successfully in the real world. Understanding the potential risks and rewards is equally addressed to ensure you make informed, savvy decisions in your property investment journey. With this DVD, your dream of home ownership or starting an investment property portfolio is within reacheven if you’re starting from scratch with limited resources.

The Steps to Buying a Home: Aligning Your Strategy with 2024 Requirements

Homebuying isn’t a sprint; it’s a marathon that requires strategy and stamina:

Every step is crucial, and personalizing your plan to suit your unique situation is not just recommended; it’s essential.

The Hidden Requirements to Buy a House

You’ve dotted the ‘I’s, crossed the ‘T’s, but wait, there’s more:

A Closer Look at the Actual Contract: Beyond the Steps to Buying a Home

Entering contract territory can feel like you’re navigating a maze blindfolded, but here’s the torch:

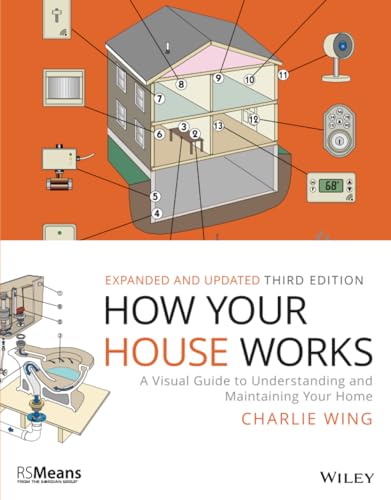

How Your House Works A Visual Guide to Understanding and Maintaining Your Home (RSMeans)

$15.39

“How Your House Works: A Visual Guide to Understanding and Maintaining Your Home,” published by RSMeans, is an essential resource for any homeowner seeking a deeper understanding of their home’s inner workings. Comprehensive and accessible, this guide demystifies complex home systems through easy-to-follow illustrations and clear explanations. From plumbing and electrical systems to heating and cooling, each major component of the house is covered, providing readers with the knowledge needed to troubleshoot common problems and perform basic maintenance.

The visual nature of this guide sets it apart, as it’s crafted to appeal to visual learners and do-it-yourself enthusiasts alike. Detailed diagrams and cutaways offer a behind-the-scenes look at the infrastructure of a typical home, illuminating the hidden processes that keep everything running smoothly. By breaking down information into digestible visuals, the guide ensures that users can quickly reference the exact information they need without being overwhelmed by technical jargon or complex schematics.

In addition to its instructional content, “How Your House Works” serves as a valuable preventive maintenance tool, alerting homeowners to potential issues before they become costly repairs. It empowers readers to confidently care for their homes, promoting a proactive approach to home maintenance that can save time, money, and stress. This guide is not just a one-time read but a go-to reference for the life of one’s home, evolving with the homeowner as they gain experience and tackle more advanced projects.

Conclusion: Homeownership Unlocked – Your Future Awaits

Grabbing the keys to your new home isn’t just about finding the right place; it’s about becoming a savvy shopper, a smart negotiator, and, yes, a bit of a legal eagle. As we’ve traveled through the home buying Tips and taken an insightful look into how to buy a home, one thing is clear: information is your greatest ally. The more plugged in you are, the higher your chances of snagging not just a house, but a home that’s also an investment and a slice of the future.

Remember, with a little bit of tech savvy, a dose of strategic thinking, a pinch of legal know-how, and a sprinkle of green living, you’ll be donning that homeowner’s cap in no time. Now, go forth and conquer the market; your future home awaits!

The Inside Scoop: How to Buy a Home with Fun and Surprising Tricks

Hitting the property market can sometimes feel like you’re stepping onto the set of a high-stakes drama series—not too different from the ones where the fabulous Hope Lange once starred. But worry not! We’re here to lighten the load with some refreshing trivia and out-of-the-box tips that will help you master how to buy a home.

Hold On, I’ve Seen This Scene Before!

It’s not every day that you come across tips that leave you gobsmacked, right? Well, brace yourself for a bit of drama—minus the script.

Did You Know? Way back when, during your parents’ or grandparents’ young adult years, buying a home was as straightforward as showing up at a bank with a pulse and a promise. Fast forward, and now there’s more paperwork than a season finale plot twist!

Spruce It Like a Movie Star’s Home

Ah, the allure of making a place your own. It’s like being the director of your life’s movie. Now, let’s say the credits have rolled on your home purchase, but the set needs a facelift. You might not have a blockbuster budget, but a loan For home improvement can be your financial stunt double. Look at that—you’re already turning your fixer-upper into a scene-stealer!

The Plot Thickens with a Twist of History

Get this—did you know that, once upon a time, mortgage paperwork used to be almost non-existent? And now, you’re more likely to find a needle in a haystack than to sign off on a home loan without signing your life away on documents. But hey, at least it’s not as complicated as the plot in a Naughty America drama—yep, there’s even a mortgage history lesson lurking in the naughty( details of film archives.

Scene Transition: From Viewer to Homeowner

Look, we all know that “location, location, location” isn’t just a catchy chime—it’s real estate’s holy grail. But remember, buying a home isn’t scripted. Trust your gut, keep your wits about you, and don’t be afraid to improvise. Shockingly, going off-script when house hunting can sometimes lead to finding the hidden gems.

Blooper Reel: The Lesser-Known Costs

Here’s an insider tip—watch out for those closing costs; they’re like uninvited extras who pop up and eat into your budget. Oh, and let’s not forget about those sneaky maintenance costs that seem to appear out of thin air, just like an unexpected plot twist.

So there you have it, folks! Buying a house might seem like navigating through a nail-biting suspense flick, but with these shockingly fresh tips and trivia, you’ll be on your way to your happily ever after in your new home. Just remember, every scene in this adventure counts, so make sure you’re the star who shines the brightest!

Nolo’s Essential Guide to Buying Your First Home

$25.99

Nolo’s Essential Guide to Buying Your First Home is the ultimate resource for anyone taking the plunge into the real estate market for the first time. Full of valuable insights and practical advice, this guide simplifies the complex process of home buying, covering everything from financial planning to closing the deal. It expertly deciphers the jargon and offers step-by-step guidance, helping you understand mortgage options, government programs, and tax advantages specifically tailored for first-time buyers.

Written by a team of experts in real estate, law, and finance, Nolo’s guide provides you with the confidence and know-how to navigate the realm of real estate agents, home inspections, and legal documents. It includes essential checklists for each stage of the home-buying process and shares tips on how to negotiate offer terms, contingencies, and concessions. Readers will also benefit from insights on the latest technology and online resources that can provide them with a competitive edge when searching and bidding for their ideal home.

Whether you’re considering a traditional single-family home, a townhouse, or a condo, Nolo’s Essential Guide to Buying Your First Home ensures you’re armed with the knowledge to make informed decisions. The book also addresses common concerns and mistakes first-time buyers make, providing real-life examples and solutions that can save you time, money, and stress. Trust Nolo to lead you to the doorstep of your first home with confidence and clarity, making the dream of homeownership a well-informed and rewarding reality.

How to buy a house for beginners?

Buying a house can be as mystifying as your grandmother’s secret gravy recipe for beginners, but fear not! Start with the basics: figure out how much you can afford, get pre-approved for a mortgage, and do your homework on locations and type of house you want. Once you’ve nailed that down, team up with a realtor who knows the ropes. Just like learning to ride a bike, it takes a bit of wobbling before you’re racing down the street!

How much money should you have before buying a house?

Ah, the age-old question: How much dough should you have before buying a house? Well, it’s not just the down payment you’ve gotta think about — there’s also closing costs, moving expenses, and a rainy-day fund for unexpected repairs. So, before you go house hunting, make sure you’ve got enough saved up to cover about 20% for a down payment, plus a little extra for those hidden costs. Trust me, having a cushion will help you sleep at night.

What does your credit score need to be to buy a house?

So, about that credit score when buying a house – think of it like a grade on your financial report card. Generally, lenders like to see a score of at least 620. But hey, the better the score, the more options you’ll have and the lower your interest rate could be. It’s like hitting the credit score jackpot!

How much is a downpayment on a house in Houston?

In Houston, a down payment on a house can feel like the wild west – it varies! On average, expect to dish out around 3-20% of the purchase price. For example, for a $300,000 house, that’s about $9,000 to $60,000. Not exactly chump change, but hey, everything’s bigger in Texas, right?

How much house can I afford based on my salary?

When it comes to figuring out how much house you can afford based on your salary, here’s the skinny: typically, you can afford a house that’s 2 to 2.5 times your annual income. So, you’re making $50,000 a year? Look for houses in the $100,000 to $125,000 range. Just remember, stick to what feels comfortable for your wallet, and don’t let anyone pressure you into more house than you can handle.

What are the 3 most important things when buying a house?

When buying a house, the 3 most important things are: location, location, location! Nah, I’m kidding – there’s more to it. Think location for sure, but also consider the condition of the home (no money pits, please), and don’t forget about the potential for future resale value. After all, you don’t want to be stuck with the one home on the block that just won’t sell.

What house can I afford on 70K a year?

Earning 70k a year is like having a golden ticket to a decent market for housing. You can afford a house that’s about $210,000 to $270,000 without stretching your wallet too thin. But remember, that’s before taxes, insurance, and avocado toast add up. So crunch those numbers carefully!

How much house can I afford with $10,000 down?

With $10,000 down, roll up those sleeves and get ready to do some number-crunching! The house you can afford depends on various factors like interest rates and your other debts. Generally, a $10,000 down payment might mean a $200,000 house with a conventional loan, but hey, who says you can’t shop around for a better deal?

Can you buy a house if you make 25k a year?

Can you buy a house making 25k a year? Sure, you can! But it’s kinda like trying to squeeze into your high school jeans — doable, but tight. You’ll be looking at more modest digs, probably under the $75,000 range. But hey, small houses can pack a punch — lower costs, less cleaning. Win-win!

How much can you borrow with a 720 credit score?

With a 720 credit score, you’re strutting into the lender’s office like you own the place. You can typically borrow a hefty sum, but it depends on your debt-to-income ratio. High score plus low debt means you could borrow enough for a castle, but let’s be real – you’ll probably get a loan for a house that’s around 3 to 4 times your annual income.

What credit score is needed for a 300K house?

For a cool 300k house, lenders are eyeing you like you’re a hotshot—expect to have a credit score of at least 620-640. But to hit the best interest rates zone, aim for 740 or higher. That’s when lenders start throwing confetti and offering the VIP rates.

What credit score do you need to buy a $250000 house?

Chasing after a $250,000 house? You’ll need a credit score that’s around 620 as a starting point. But if you want to snatch that low-interest brass ring, try to get that score up to 740 or so. The higher the number, the better your borrowing terms — and that’s no small potatoes!

What is the income limit for first time home buyers in Texas?

For first-time homebuyers in Texas, there ain’t a set income limit, but there are programs to help make the dream a reality. Take, for example, The Texas State Affordable Housing Corporation — they’ve got some nifty first-timer perks. Just remember to check if your pockets are deep enough for their qualifications.

What is a good down payment for a $200 K house?

For a $200K house, a good down payment is about 20%, which is a cool $40,000. It’s a chunk of change for sure, but it sets you up to save on interest and avoid mortgage insurance, which is like trying to dodge raindrops — better to stay dry if you can!

What is a good salary in Houston?

In Houston, a good salary is enough to enjoy a BBQ in your backyard without fretting over the next bill that’s due. Think around the $50K-$70K range, which should keep you living comfortably as long as you’re not trying to keep up with the Bezos’.

How do I educate myself to buy a house?

Educating yourself to buy a house is like prepping for the final exams — hit the books and soak up all that knowledge. Scour the internet, join home-buying seminars, and crack open those real estate guides. Forewarned is forearmed, and you want to be locked and loaded when stepping into the housing market.

What are the first 5 steps to buying a house?

Ready, set, buy! The first 5 steps to buying a house are super important. Begin by assessing your budget, then get pre-approved for a mortgage, not just pre-qualified. Next, find an expert realtor who knows their stuff. Now, search for that dream home and finally, make a competitive offer. It’s like a treasure hunt, with the prize being your very own home!

Can you take money out of your 401k to buy a house?

Thinking about taking money out of your 401k to buy a house? Woah, cowboy — slow down and consider the consequences. Yes, you can often borrow from it for a home purchase, but there could be penalties or tax implications. Weigh the pros and cons, and chat with a financial advisor before cracking that nest egg.

How much of a down payment do I need to buy a house in Los Angeles?

In Los Angeles, a down payment feels like you’re saving for an Oscar campaign. You’ll typically need at least 10-20% in such a competitive market. For a million-dollar pad, that’s a staggering $100,000 to $200,000. But hey, that’s the price of living among the stars!