Understanding How to Calculate Internal Rate of Return: Grasping the Basics

When diving into the deep end of investment analysis, mastering the calculation of the internal rate of return, or IRR, is like learning to breathe under financial waters. The IRR is essentially the growth rate an investment is expected to generate annually. It’s akin to the heartbeat of an investment’s performance, giving you an insight into its potential profitability.

Knowing how to calculate IRR is crucial, not just for individual investors comparing stock options but for giant corporations like Tesla making capital budgeting decisions or a real estate mogul pondering over a new property acquisition. These real-world scenarios often rely on IRR calculations to forecast the profitability of myriad investment opportunities.

Tip 1: Familiarize Yourself with the IRR Formula

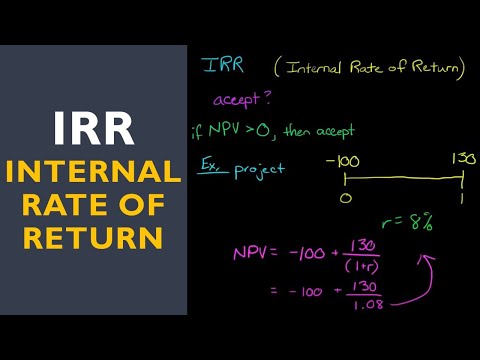

To get snug with the IRR definition, you’ve got to wrap your head around the IRR formula first. The IRR formula is NPV = net present value, which seems straightforward until you realize that it requires finding the rate that makes the net present value of all cash flows (both incoming and outgoing) equal to zero. It’s not as scary as it sounds, but it does take a bit of elbow grease.

Using the context of commercial real estate, let’s say you’re considering a $10,000 investment. An IRR of 20% would generate a tidy sum of $2,000 in profit, assuming this amount is reinvested each year. Let’s see how this formula plays out in real life by practicing with simplified investments.

| Subject Matter: How to Calculate Internal Rate of Return (IRR) | ||

|---|---|---|

| Step/Concept | Description | Example/Relevance |

| Understanding IRR | Indicates the annualized effective compounded return rate of an investment | An investment with a 20% IRR means that it yields a 20% return each year, compounded through the period. |

| Time Value of Money | Money available now is worth more than the same amount in the future | The IRR calculation accounts for the time value of money. |

| Net Present Value (NPV) | The difference between the present value of cash inflows and outflows | IRR is the rate at which NPV equals zero. |

| IRR Formula | NPV = 0 where NPV = ∑ (Cash inflows/outflows) / (1 + IRR)^t (t – time period) | For investment, IRR is the rate that makes the sum of discounted cash flows equal to the initial outlay. |

| Calculation Method | Trial and error or financial calculators/software | Typically performed using software like Microsoft Excel due to its complexity. |

| Cash Flow Projections | An estimate of the money expected to be generated and spent over a period | Essential to determine the future cash inflows that will be discounted when calculating IRR. |

| Initial Investment | The amount of capital put into the investment initially | If $10,000 is invested initially, it is the basis for the NPV calculation to find IRR. |

| Discounted Cash Flow (DCF) | A valuation method used to estimate the value of an investment | IRR is the discount rate that makes the DCF equal to the initial investment. |

| IRR Interpretation | The higher the IRR, the more desirable the investment | A 20% IRR is generally considered strong for an investment compared to lower rates. |

| Limitations of IRR | Does not account for scale, additional investments, or varying discount rates | IRR assumes reinvestment at the same rate as the IRR, which may not be realistic. |

| Modified IRR (MIRR) | Accounts for the cost of capital and reinvestment rates | MIRR = Positive cash flows x (1 + Cost of capital)^(n-t) / (Initial outlays x (1 + Financing cost)^t) |

Tip 2: Master the Process of Calculating IRR Manually

Calculating the IRR by hand is a bit like doing a high-wire act without a safety net. Here’s how you can do the step-by-step calculation: estimate a discount rate, calculate the NPV, adjust the rate, and repeat until the NPV is zero. It’s a trial-and-error process that may leave you yearning for a cup of coffee or ten. The complexity here stems from the fact that this rate is not explicitly solved for but implied through multiple attempts.

This old-school approach is powerful; however, it comes with limitations. Imagine handling a significant investment with numerous cash flows spread over decades. Yeah, pretty daunting, right?

Tip 3: Utilizing Financial Calculators to Calculate IRR Efficiently

Thankfully, we’re not stuck in the Stone Age. Financial calculators like the Texas Instruments BA II Plus or the HP 12C swoop in to save the day. These nifty gizmos can compute the IRR in a jiffy.

You simply punch in the cash flows at the appropriate intervals, hit the IRR button, and—voila!—the calculator spews out the rate, keeping manual error and mental breakdowns at bay. This can turn an arduous process into a relatively breezy affair.

Tip 4: Use Spreadsheet Programs for IRR Calculation

Crack open your Microsoft Excel or fire up Google Sheets because these spreadsheet programs are the trusty sidekicks of the modern investor. These applications have built-in functions, like IRR and XIRR, that make calculating the internal rate of return a breeze.

To calculate IRR using Excel or Sheets, you need to set up your cash flows in a column, apply the IRR function, and point it to your range of values. Screenshots and examples provided in the software will guide you through each step seamlessly. If only everything in life were that easy.

Tip 5: Explore the Role of Software in Calculating IRR

We live in an age where software can do the heavy lifting. When it comes to IRR calculations, there are specialized tools within software such as QuickBooks or advanced functions in Excel like XIRR that handle more complex scenarios like irregular cash flows with grace.

Using these tools for complex investments saves time, and reduces errors, and, frankly, makes you look like a pro. They’re perfect for those who want to dive deeper without getting tangled in the intricacies of manual calculations.

Tip 6: Apply Real-world Examples to Understand IRR in Context

Picture this: a company like Berkshire Hathaway is evaluating potential investments. They don’t just flip a coin; they use IRR to assess the feasibility of projects.

Startup companies also use IRR findings to reassess and refine their growth strategies, ensuring that they are moving forward with financial efficiency. This case study analysis brings the abstract concept of IRR into concrete, applicable frames of reference.

Tip 7: Consider the Nuances and Pitfalls of IRR Calculation

Now, IRR isn’t perfect. It can be as slippery as an eel sometimes, especially regarding non-normal cash flows that can result in multiple IRRs. And let’s not forget the Modified Internal Rate of Return or MIRR, a slightly more complex sibling to the traditional IRR that accounts for different financing and reinvestment rates.

Understanding these nuances and potential pitfalls is crucial, and knowing when to apply advanced concepts like MIRR can spare you from a financial faux pas. So, when you’re knee-deep in IRR calculations, take these considerations seriously to avoid stumbling into common errors.

Conclusion: Solidifying Your Mastery on How to Calculate Internal Rate of Return

Let’s circle back to the heartbeat of investment performance: the IRR. From the basics to the more intricate nuances and pitfalls, we’ve swum through the waters of the IRR calculation. These 7 tips are your lifeboat in the vast ocean of financial analysis and investment decision-making.

Remember, knowing how to calculate the internal rate of return is not just about mathematical prowess. It’s about understanding the pulse of an investment, its vitality, and potential. So, dig in, practice with real data, and don’t shy away from complex scenarios. Your financial acumen will thank you for it.

Mastering the Mystery: How to Calculate Internal Rate of Return

Calculating the Internal Rate of Return (IRR) might seem as daunting as trying to understand the plot twists in “don’t worry darling,” but have no fear! We’re here to simplify the process with some trivia and fascinating facts that will make IRR as engaging as a blockbuster movie.

The IRR Equation: Not Just a Bunch of Numbers!

Once upon a time in the land of finance, the Internal Rate of Return was crowned the king of metrics. Why? Because it represents the true north of investment performance. Just like the character arcs in a skeet Ulrich thriller, the journey of IRR is full of intrigue and suspense. Did you know that the IRR equation itself is a polynomial equation that can’t be solved with simple algebra? It’s true! This equation requires iterative methods or financial calculators to crack the code.

The IRR Conundrum: More Twists Than a Drama

Diving into IRR, you’ll find it’s more unpredictable than the storyline of a drama movie. Why’s that, you ask? Well, buckle up, as the IRR can lead to multiple solutions. Just like trying to convert a Yt2mp3 file with unexpected outcomes, finding the true Internal Rate of Return might get you multiple results, and picking the right one is key to making your investment story a smashing success.

Pop Quiz Time!

Did you know that the IRR can sometimes pull a Houdini and disappear entirely? Yep, there are situations where, given certain cash flows, an IRR might not exist at all. Imagine that – like searching for a mysterious asian teen in a detective novel only to find they were a figment of the author’s imagination.

A Legal Twist: The Fine Print of IRR

You might think calculating IRR is as dry as legal paperwork, but it’s essential in understanding your financial health. Speaking of legal matters, always remember that a solid investment plan is as crucial as having a good lawyer, like those from five Lakes law group. They ensure everything is above board, much like double-checking your IRR calculations before making that big investment.

Calculating the Internal Rate of Return isn’t just about number crunching; it’s a journey through a maze of financial twists and turns. Each step of the way presents a new challenge, whether it’s the perplexing equation, the enigma of multiple solutions, or the vanishing IRR trick. But don’t fret; with these fun facts and an eye for detail, you’re now better equipped to tackle the adventure of how to calculate internal rate of return. Now grab your calculator – it’s showtime!

What is an example of IRR?

Whew, let’s dive into the world of IRR! It can be a rollercoaster, but buckle up; we can tame this financial beast together.

– Well, imagine you’ve got a project that needs $1,000 upfront, and bam!—it pays you $500 a year for the next three years. The IRR here is that sweet spot rate—the X factor—that makes your investment’s net present value hit zero. It’s like hitting the bullseye in darts, but with numbers.

What is the IRR method?

– So, what’s the deal with the IRR method? Think of it as the GPS for your investment journey. It navigates you through the financial fog to find that magical interest rate that sets your net present value to a big fat zero. It’s like your money’s version of breaking even!

How do you calculate internal rate of return on a property?

– To calculate the internal rate of return on a property, you gotta play with the numbers like a pro—balancing the cash you put in against the cash this property’s gonna make you over time. You need to figure out the rate that makes your investment zero-out financially, with all those cash flows turning into today’s dollars.

What is the modern internal rate of return formula?

– Alright, the modern internal rate of return formula isn’t your grandma’s recipe—it’s more like molecular gastronomy. It’s the rate where your net cash flows, discounted to today’s moolah, sum up to the initial investment. Easy? Not exactly, but it’s the key to knowing if you’re investing wisely or just throwing money down the drain.

How do you calculate IRR in Excel?

– Excel, ah, the trusty sidekick for number crunching! To calculate IRR in this nifty tool, it’s like setting up a friendly chat between your cells. Pop your cash flows into a column, call on the ‘=IRR()’ function, and let it do the heavy lifting. It’s like asking a math whiz to do your homework— slick and easy.

Is 6% IRR good?

– Is a 6% IRR good? Well, that’s like asking if pineapple on pizza is a culinary masterpiece—it’s all relative! Six percent could be solid gold if you’re comparing it to a snooze-fest savings account, but it might not have you dancing on the table if you’re aiming for the investment stratosphere.

Can you calculate IRR manually?

– Can you do IRR by hand? Sure, if you’re into mental gymnastics! It’s a trial-and-error marathon that’ll have you flexing your algebra muscles like you’re back in high school. Good times, right? But honestly, it’s a tough cookie—you’re better off letting a computer save the day.

Is the IRR difficult to calculate?

– Is the IRR tough to nail down? Heck yes, it’s like trying to catch a greased pig at a county fair. Without software, you’re in for a wild calculation rodeo, especially if your cash flows are more unpredictable than a soap opera plotline.

What is the difference between IRR and ROI?

– IRR vs. ROI—if they were boxers, they’d be in different weight classes. IRR throws punches in percentage form, showing you the efficiency of an investment over time. ROI, on the other hand, struts around showing off the total growth of your investment. Two fighters, one financial ring!

What are the disadvantages of the IRR?

– Now, the disadvantages of IRR—oof, where to start? First off, it assumes you can reinvest at the same rate… Yeah, because life’s always that predictable, right? Plus, it can give you multiple answers, like a cheeky magic 8-ball, and totally ignores the size of the project. Talk about being a little drama queen!

Can the IRR be negative?

– Can IRR be negative? Absolutely, it’s like getting a cold splash of water to the face telling you that your project’s expected losses are doing the tango with your initial investment. A negative IRR screams “Alert! Alert! You might be sinking more dough into this than you’re getting out!”

What causes IRR to decrease?

– What causes the IRR to take a nosedive? It’s like pouring water into your gas tank—expect a sputter-fest. Higher costs, slipping revenues, or delays can all gang up to give your IRR a serious case of the Mondays.

What is a good IRR for real estate development?

– So, you want a “good” IRR for real estate development? Okay, think of it as the grading curve in a super strict class. A solid IRR is one that beats the average Joe—around 15-20% is often hailed as pretty darn good. But don’t forget, context is king!

What are the two types of internal rate of return?

– There’s not just one, but two types of internal rate of return—regular IRR and MIRR, which is like IRR’s cooler cousin who went to an Ivy League. MIRR steps in to keep things real by considering the cost of borrowing and a more conservative reinvestment strategy.

Can you calculate IRR without initial investment?

– Calculating IRR without initial investment? It’s like trying to drive a car without wheels—where do you even begin? That initial investment is your anchor; without it, you’re adrift in a sea of guesswork.

What are the 4 types of IRR?

– Huddle up for the 4 types of IRR! We’ve got the classic IRR that we’ve been juggling, the Modified IRR (MIRR) that plays it safe, the Annualized IRR—sort of the “per year” average rate, and then there’s the XIRR, which tackles cash flows that aren’t regular as clockwork.

What are the three types of IRR?

– Three types of IRR coming right up! The traditional one’s the big cheese, then there’s MIRR, which gets brownie points for realism, and XIRR, for those wacky, uneven cash flows that don’t follow a schedule.

What is an example of a 10% IRR?

– Picture a 10% IRR in the wild: you drop $10,000 on a new hipster-approved, organic, gluten-free snack bar company, and in return, it pays you back with a groove that gets you to break-even land considering the time value of money, all set to a 10% annual growth beat.

What is an example of IRR in real estate?

– In real estate, IRR shines the spotlight on a property’s performance over time. Say you splurge on an apartment for $300,000 and after renting it to some trendy tenants and maybe fixing a leaky faucet or two, you sell it for a cool half a million five years later. That IRR is how you tell if you’re dancing in the winner’s circle or if you just had an expensive hobby.