Understanding How to Pay Off Credit Card Debt When You Have No Money

Friends, let’s face it. Sometimes life hands us lemons, and boy, do they seem sour. Recognizing the realities of your financial situation is the first step in this journey. Staring at a mountain of credit card debt when you feel like you’re down to your last penny can cause a tremendous amount of stress. But hey, cut yourself some slack! There’s a strategy called ‘how to pay off credit card debt when you have no money’, and this is what we’re gonna explore together.

Now, let’s consider the psychology behind debt accumulation. It’s like a rollercoaster ride without the safety bars, isn’t it? Overspending can often be emotional spending (think retail therapy). High credit limits, like the credit cards With $ 10000 limit Guaranteed approval, can create an illusion of affordability. However, the harsh truth is that these debts catch up with us, turning our financial situation upside down.

Determining How Much Credit Card Debt is Too Much

Asking “how much credit card debt is too much” is akin to asking “how much rain is too much?” In both cases, the answer is subjective and depends on various factors, notably your debt tolerance and your income.

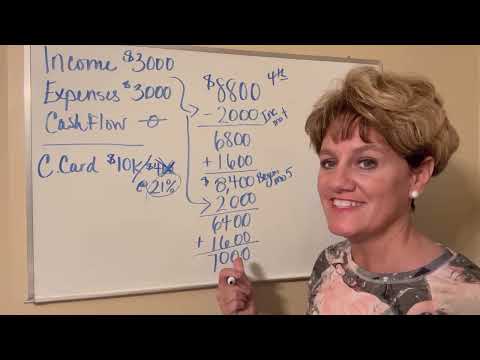

Financial gurus with the best jawlines around the world agree on one thing: The Debt-to-Income Ratio. This is your total monthly debt payments quashed with your gross monthly income. It’s like that classic pie slice, where smaller is usually better. Let’s consider an example: if your credit limit is $1000, you ideally should spend only 30% or less to maintain a healthy credit score.

| Strategies | Description | Benefits |

|---|---|---|

| Budgeting | Itemize your everyday expenses and cut back on unneeded purchases. Allocate more funds to repay debts | Can help free up money for paying debts, encourages mindful spending – you spend less and save more |

| Debt Consolidation | Consolidating all your debts into one single debt with a lower interest rate can substantially reduce your overall debt repayment | Simplifies debt management, can lower total interest payable, fewer monthly payments |

| Debt Snowball Method | Begin by paying off the smallest debts first. Once that’s paid, move on to the next smallest, and so on | Psychological wins from clearing smaller debts motivate you to continue, simplifies your debts over time |

| Debt Avalanche Method | Prioritizes paying off debt with the highest interest rate first | Saves more money over the long run as less interest accrues |

| Negotiate with Creditors | Speak directly to the credit card companies to negotiate a lower interest rate or a repayment plan | Lower rates mean less interest accrues, manageable repayment plans avoid straining your finances |

| Seek Professional Help | Consult a credit counselor or a debt management company. They can negotiate on your behalf and help you create a repayment plan | Expert advice takes the guesswork out of the process, can result in better negotiation outcomes |

| Increase Your Income | Consider asking for a raise, finding a job that pays more, or earning extra cash by selling unwanted items | More income means more funds to repay debts faster |

| Use Non-Profit Financial Services | Some non-profit organizations offer coaching, workshops, and counseling to help individuals handle their debts | Affordable (often free) resources, expert advice, community support |

Cracking the Conundrum: How to Pay Off $10 000 Credit Card Debt

Fretting about how to pay off a $10 000 credit card debt? Don’t worry; we’ve got solutions. Start by implementing a cash-only spending regime. This might seem old-school, as outdated as dial-up internet, but the truth is that cash-only spending helps limit overspending.

Next, let’s consider some strategies for debt reduction. Yes, folks, it’s time for the big guns! One approach is to tackle the highest interest cards first (the so-called avalanche method). Or, you could go for the snowball method, where you pay off the smallest debt first to gain momentum.

Steps to Start Paying Down Credit Card Debt Today

Dreaming about debt-free days while wondering how to pay off credit card debt when you have no money is as effective as wishing the weather away. It’s time to take practical steps. Firstly, creating a realistic budget is essential. This isn’t just another chore, like doing laundry or taking the trash out. It’s your ticket out of debtville.

Debt consolidation can also be a potent strategy. It’s like putting all your eggs in one basket – but in a good way. By relocating all your debts to one place, you’ll have a single payment to focus on, often with a lower interest rate.

Financial Tactics when Money is Tight

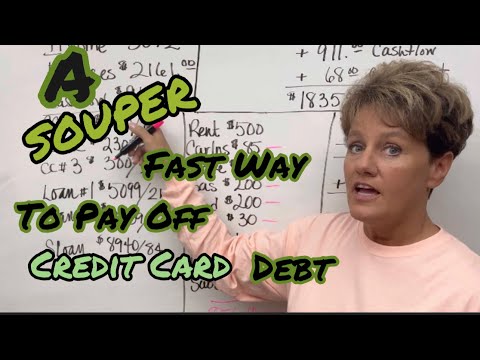

When times are tighter than a drum, try employing the Avalanche or Snowball Methods. Once upon a time, dear reader, people thought the earth was flat, but today we know better. Same goes for debt payment strategies. Opting for one of these strategies, you’re likely to pay off your debt much faster than making minimum payments.

Another intriguing option: Balance Transfers. This is a move where you transfer your balance (or balances) onto a different card, ideally with a lesser interest rate, much like moving houses to grab that lower rental deal.

Empowering Yourself: Learning How to Pay off Credit Card Debt When You Have No Money

Overcoming financial fears might seem as impossible as teaching an elephant to tap dance. But trust me, once you’ve rattled the cage of your financial fears, half the battle is won.

Prioritization is crucial here. It’s as essential as air to us humans. Start by tackling high-interest debts (like un) and gradually move towards lower interest debts.

Steady Progress: Balance Elimination for Long-Term Financial Health

Now, my friends, let’s talk about a secret weapon: negotiation. You might argue that only counter-terrorism agents negotiate. Though, in reality, we all can. In fact, you should negotiate interest rates with your creditors. All you need to do is pick up that phone, dial your creditor’s number (nervous? That’s okay!) and negotiate for a lower interest rate.

Speaking of negotiations, seeking professional assistance when necessary is absolutely okay. Sometimes, we all can use a little help, right?

Living Debt Free: Turning the Impossible into Possible

The journey toward learning how to pay off credit card debt when you have no money doesn’t end with paying off your last cent. Adapting financial habits for a debt-free living is equally important.

Living debt-free can drastically Improves your mental health, giving you one less thing to worry about. Remember how relaxed you felt the last time you settled a bill? Imagine that sensation lasting forever!

Reflective Finale: Toward a Brighter Financial Future

Finally, let’s take a step back and reflect. Yes, money matters. But we must learn to recognize and eliminate the undue negative stigma surrounding debt.

Celebrate small victories on the path to debts clearance. Each dollar paid off is a step towards financial freedom.

Set solid financial goals for sustainable prosperity. Visualize your future, a future unclouded by credit card debt.

Remember, dear reader, you’ve got the power to change your financial future. All it takes is that first step. Knowing how to pay off credit card debt when you have no money is not an art only a few can master. It’s a journey, a journey full of challenges, surprises, some hiccups and ultimately, sweet, sweet success.

How do I pay off debt if I live paycheck to paycheck?

Whoa, paying off debt when you’re living paycheck to paycheck seems like a Herculean task, doesn’t it? Let’s simplify it! Start by creating a budget, scour it for any penny-pinch areas, and redirect those savings to crushing debt. And, remember, always pay more than the minimum, every penny counts!

How do you pay off debt when you are poor?

Hey, being stuck in the financial mud isn’t forever! Paying off debt when you’re poor focuses heavily on budgeting and trimming the fat off your expenses. Tackle your high-interest debts first, work on boosting your income whenever you can, and be sure to breathe, it’s a marathon, not a sprint.

How do you pay off debt fast when you’re broke?

When you’re broke as a joke but still need to pay off debt, it’s about squeezing every last dollar. Consider applying the debt snowball method: repay the smallest debts first to gain momentum, then work your way up to bigger ones. It’s like climbing a ladder, one rung at a time and you’ll get to the top eventually.

How can I pay off debt and still live?

Living life while paying off debts is like chewing gum and walking at the same time, tricky but manageable. Make a budget that allows some wiggle room for fun so you’re not down in the dumps. Consistently monitor and adjust your budget, and remember, it’s okay to live a little, as long the debt is on a steady decline.

How many people who make over 100k live paycheck to paycheck?

You’d be shocked, but a surprising number of folks making over 100k are living paycheck to paycheck. It’s not precisely a sign of poverty, but rather a symptom of lifestyle inflation. They dine out too often, go on lavish vacations, and just keep upping the ante, ending up in the same boat as the rest of us, go figure!

Does living paycheck to paycheck mean you’re poor?

Living paycheck to paycheck? Does that tag you as poor? Not exactly. It just indicates that your income is highly intertwined with your expenses, so there’s not much left in the kitty at the end of the month. So, just because you’re walking a financial tightrope doesn’t necessarily mean you’re poor, just that it’s time to re-evaluate your spending habits.