Making a well-informed decision on your mortgage is crucial, and one of the key tools that can aid in this process is an interest rate calculator mortgage tool. This kind of calculator can help prospective homeowners understand how various interest rates will affect their monthly payments and total loan cost over time. This article provides an in-depth look at how to effectively use these tools, compares leading brands, and dives into some unique insights that can empower you in your mortgage journey.

How to Effectively Use an Interest Rate Calculator Mortgage Tool

Using an interest rate calculator mortgage tool can significantly simplify your mortgage planning. These calculators are designed to project the monthly payments you might incur based on various interest rates, loan terms, and other financial parameters. By inputting specific data like loan amount, interest rate, down payment, and loan term, you can get a clear understanding of your future financial commitments. This knowledge is essential for making informed decisions about your mortgage.

The primary benefit of these calculators is that they allow you to see how even minor changes in interest rates can affect your monthly payments and total loan cost. For example, adjusting the interest rate from 6% to 6.5% can show a noticeable increase in your monthly payments, emphasizing the importance of securing the best rate. These insights help you plan better by aligning your mortgage with your financial goals.

Moreover, many calculators nowadays incorporate additional elements such as property taxes, homeowners insurance, and even potential changes in interest rates over time. This complex input can give you a more holistic view of your financial obligations. Understanding these nuances can help you avoid surprises and ensure that your mortgage plan is sustainable over the long term.

Top 5 Interest Rate Calculator Mortgage Tools in 2024 and How They Compare

NerdWallet’s Mortgage Calculator

NerdWallet’s mortgage calculator stands out for its user-friendly interface and comprehensive data inputs. It allows users to enter detailed information about their loan, including home price, down payment, loan term, interest rate, and other significant costs like property taxes and homeowners insurance. By incorporating real-world data and offering customizable options, NerdWallet provides a robust tool that helps users get a clear picture of their financial commitments.

Bankrate Mortgage Calculator

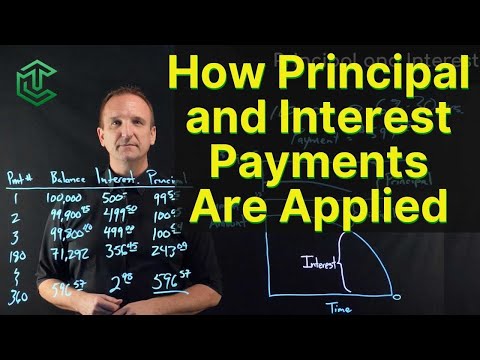

Bankrate’s tool is another leader in the market, known for its simplicity and reliability. Its focus is on providing clear estimates of monthly payments based on different interest rates, loan terms, and loan amounts. Additionally, it helps users understand the amortization schedule, which is crucial for long-term financial planning.

Quicken Loans Mortgage Calculator

Quicken Loans offers a calculator tool that ties directly into their mortgage application system. This seamless integration can expedite the process for those looking to proceed quickly from calculation to application.

Zillow Mortgage Calculator

Zillow’s calculator is particularly favored for its detailed graphics and intuitive layout. This tool not only helps users understand their potential payments but also visualizes how different scenarios alter their financial commitments over time.

Wells Fargo Mortgage Calculator

Wells Fargo offers a calculator that is deeply embedded within its wider suite of financial tools. This is particularly beneficial for existing Wells Fargo customers who can leverage this calculator to sync with their existing accounts.

| Category | Details |

| Interest Rate Range | In today’s market, a favorable mortgage interest rate can fall in the high-6% range as of May 9, 2024. |

| Factors Affecting Rates | Factors include: type of mortgage (fixed or variable), loan term (15 years, 30 years), individual financial circumstances, lender policies. |

| Comparison | Obtain quotes from multiple lenders to compare rates and find the most favorable option for you. |

| Loan Amount Example | For a $350,000 mortgage, a 20% down payment would be $87,500. (Down payments can be as low as 3%) |

| Down Payment Options | Standard: 20% ($87,500 on a $350,000 mortgage) \n Alternative: 3% down payment ($10,500 on a $350,000 mortgage) |

| Calculator Features | – Interest rate estimation based on input\n – Monthly payment projection\n – Total loan cost calculation\n – Comparisons for different down payments |

| Benefits | – Understand potential monthly payments\n – Plan for different down payment scenarios\n – Quickly compare lender offers |

| Price | Generally free online from mortgage lenders and financial websites. |

Unique Insights into Using an Interest Rate Calculator Mortgage Tool

Understanding the Time Value of Money

One often-overlooked aspect of mortgage calculations is the time value Of money. Using a calculator that allows for detailed input of future inflation rates and comparable investment returns can provide you with a more realistic view of your mortgage’s impact. For instance, adjusting for the expected inflation rate in 2024 (projected at 2.3% by the IMF), you can gauge how your mortgage payments might compare to your income growth over time.

The Role of Credit Scores

Interest rate calculators are often more accurate if they take into account the borrower’s credit score. For instance, a tool that integrates a credit-check feature can offer more personalized and precise interest rate estimates. Tools like the one provided by Quicken Loans often include this element, which can save you from possible surprises during the official loan estimate stage.

Other Cost Considerations

While using an interest rate calculator mortgage tool, it’s important to factor in other costs such as property taxes, homeowners insurance, and PMI (private mortgage insurance) if your down payment is less than 20%. These expenses can significantly alter your monthly payments and total loan cost, and ignoring them can lead to an inaccurate financial plan.

Looking Ahead: The Future of Interest Rate Calculator Mortgage Tools

With advancements in AI and machine learning, the next generation of mortgage calculators is expected to become even more personalized and predictive. Imagine a tool that not only evaluates your current financial health but also provides recommendations based on anticipated economic trends and personal life events. Some fintech companies, like Better Mortgage, are already exploring these avenues, aiming to revolutionize how we interact with mortgage planning.

In the foreseeable future, these tools might incorporate real-time data from various financial institutions, predictive analytics about future interest rate trends, and even customized advice based on individual user profiles. This will immensely improve the accuracy and relevance of mortgage calculations, making the home buying process smoother and more transparent.

Final Thoughts

Choosing the best interest rate calculator mortgage tool involves considering your unique needs and the specific features each tool offers. From seamless integrations with real-time lender rates to detailed visual aids and personalized loan options, each tool provides distinct advantages. Leveraging the right calculator can make a significant difference in understanding your mortgage obligations and ensuring you’re getting the best possible deal in 2024’s dynamic mortgage market. Stay informed and choose wisely to navigate your financial journey successfully.

For more insights on interest Definitions finance, or to calculate your potential mortgage using our loan mortgage payment calculator, visit Mortgage Rater and take control of your financial future today!

Fun Trivia and Interesting Facts About Interest Rate Calculator Mortgage

Sip and Calculate

Did you know you can use an interest rate calculator mortgage while enjoying bubble tea And pondering your future home’s finances? It’s a unique way to blend pleasure with practicality. Interestingly, just like the myriad flavors of bubble tea, there are diverse factors that mortgage interest rate calculators consider. From loan terms to credit scores, each ingredient adds to the overall “flavor” of your mortgage.

Beyond the Basics

Ever wondered what mortgage interest rates are all about? Diving into the specifics can be as intriguing as exploring the universe of space Godzilla. Mortgage interest rates, just like interstellar phenomena, come with their own set of complexities and variables. These rates dictate your monthly payments and ultimately, the total amount you’ll pay over the life of your loan.

Calculator Wonders

Want to know how much house you can afford? A house payment calculator might come in handy. These calculators not only show monthly payments but also help in strategizing the best loan terms. Incorporating this tool can seamlessly transition the guessing game of financing into a more precise and manageable process.

Exploring these fascinating tidbits makes using an interest rate calculator mortgage both fun and informative. Whether you’re sipping on your favorite drink or marveling at cosmic creatures, these tools help demystify the intricacies of your mortgage journey.

Is 6% interest high for a mortgage?

A 6% interest rate for a mortgage isn’t unusually high in today’s market. It falls within the high-6% range, which is considered good depending on various factors. Always check with multiple lenders to find the best rate for your situation.

How do you calculate mortgage interest rate?

To understand a mortgage interest rate, lenders look at factors like your credit score, loan term, and current market conditions. They use these to determine the rate they offer you, so it can vary from person to person.

How do I calculate the interest on my mortgage?

For calculating the interest on your mortgage, you’ll need your principal loan amount, the interest rate, and the loan term. The interest you pay each year is calculated by multiplying the loan balance by the interest rate.

How much is a 20% down payment on a $350 000 house?

A 20% down payment on a property worth $350,000 is $87,500. Not everyone pays 20%, though; many buyers opt for lower down payments, sometimes as low as 3%.

Will rates go down in 2024?

Predicting mortgage rate trends is tricky, and while some experts think they might stabilize or go down in 2024, there are no guarantees. Keeping an eye on economic indicators and Federal Reserve announcements can provide hints.

Will mortgage rates ever be 3 again?

Seeing mortgage rates at 3% again seems pretty unlikely in the current economic climate. Rates have risen and are influenced by various factors like inflation and monetary policy, which makes a drop back to 3% improbable for now.

How to get a lower mortgage rate?

To get a lower mortgage rate, improve your credit score, make a larger down payment, or consider a shorter loan term. Shopping around and comparing rates from different lenders is also a good strategy.

What makes mortgage rates go down?

Mortgage rates typically decrease when the economy slows down, inflation cools, or when the Federal Reserve lowers interest rates. Keeping an eye on these economic conditions can give you an idea of potential rate drops.

What is the lowest ever mortgage rate?

The lowest ever mortgage rates were seen during the pandemic in 2020, reaching around 2.65% for a 30-year fixed-rate loan. These historic lows were driven by emergency actions from the Federal Reserve to support the economy.

How do I calculate the total interest on my mortgage?

To calculate the total interest on your mortgage, use an amortization formula that takes into account the principal, interest rate, and loan term. Online mortgage calculators can also help you get a quick estimate.

What is the interest rate today?

Today’s interest rate can vary based on the lender, loan type, and your personal financial situation. Checking a few different sources like lender websites or financial news can give you the most up-to-date rate.

How do I calculate my interest rate?

To figure out your exact interest rate, you’ll need your loan’s annual interest rate and loan balance. Loan agreements and lender statements typically outline these details clearly.

How much house can I afford if I make $70,000 a year?

If you make $70,000 a year, a good rule of thumb is to afford a house about three to four times your annual income, so you might afford a home in the $210,000 to $280,000 range. Lender guidelines and your own financial commitments will fine-tune this amount.

What income do you need for an $800000 mortgage?

For an $800,000 mortgage, lenders generally look for annual incomes that are about 3-4 times the property value, so you might need around $200,000 to $266,000 per year. Exact requirements depend on the loan terms and your other financial factors.

How much income do you need for a 350K house?

For a $350,000 house, lenders often use a 3-4 times income rule, meaning you’d likely need an annual income of around $87,500 to $116,600. Factors like down payment size and existing debts can also influence this figure.