The impact of interest rate us policy changes has always been a hot topic. However, the effects seen in 2024 are turning heads more than ever. This article will break down the surprising and far-reaching consequences of these changes.

The Ripple Effect: Analyzing the Current ‘Interest Rate US’ Scenario

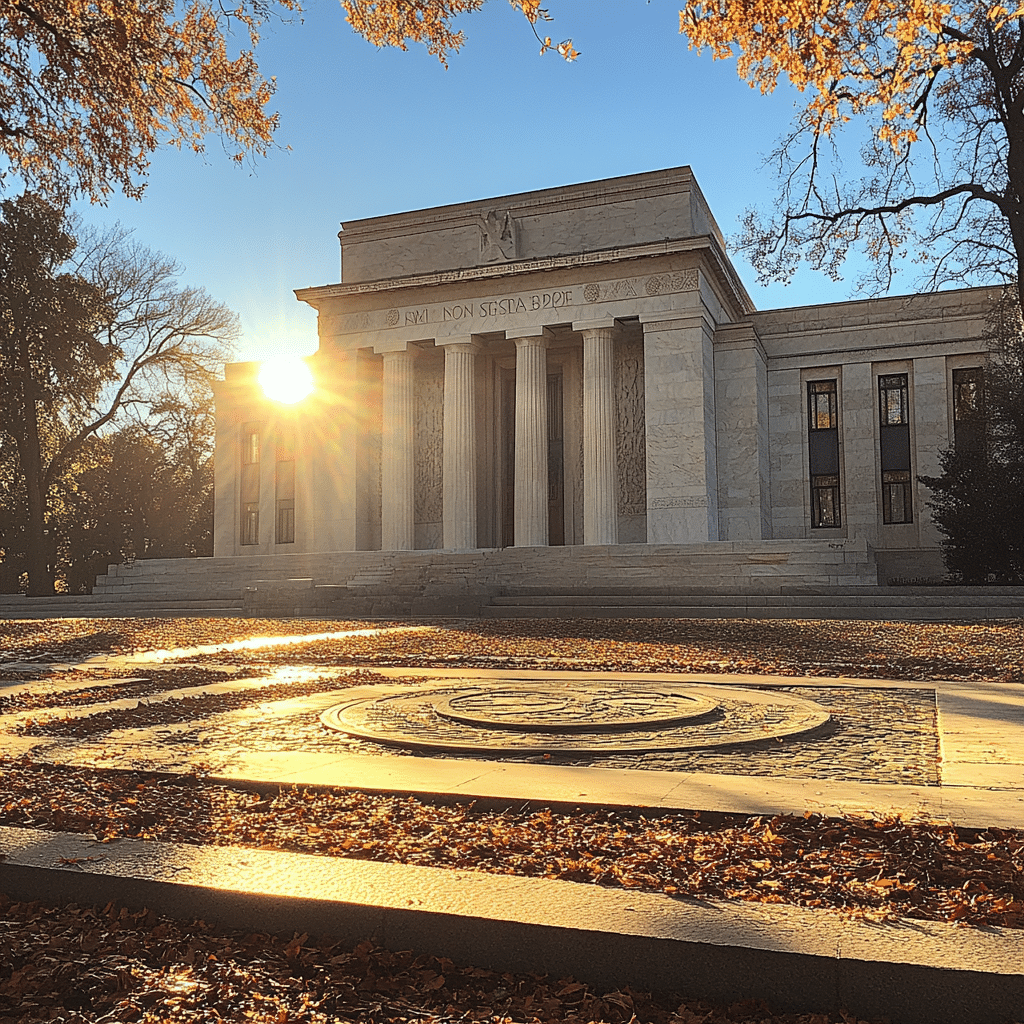

Understanding the present state of the interest rate us landscape requires an in-depth look at the Federal Reserve’s recent decisions and their cascading effects across various sectors.

Historical Context and Recent Changes

In 2024, interest rates US Fed have undergone multiple adjustments. Over the last year, the Federal Reserve increased the policy rate by a cumulative 200 basis points. This aggressive hike aims to tame rising inflation and stabilize the economy. However, these changes have permeated various facets of the economy, influencing everything from personal finance to corporate investments.

Sectors Most Affected

Housing Market

The US interest rate hikes have led to a significant spike in mortgage rates, pushing the average 30-year fixed mortgage rate to over 7%. This sharp increase has slowed home-buying activity. Real estate companies like Zillow and Redfin report decreased user engagement and a drop in listings.

Consumer Lending

Rising United States interest rates mean higher costs for consumers seeking loans. Credit card interest rates have surpassed 20%, a level not seen in decades. This scenario impacts spending: consumers are more cautious about taking on new debt.

Corporate Investments

For businesses, the higher us interest rate translates into more expensive capital. Companies, especially those in growth phases like Tesla and Amazon, face tighter budgets for expansion projects.

International Implications

The ripple effects of rising us interest rates aren’t confined to the domestic front. Global markets feel the pinch, particularly developing economies reliant on US investments. Countries like Mexico and Brazil have seen outflows of capital, leading to depreciated local currencies and increased import costs.

5 Unexpected Outcomes of ‘Interest Rates US’ Policy Modifications

The radical interest rate adjustments in the US have led to several unforeseen consequences. Here, we explore five surprising developments that are shaping the current economic landscape.

1. Surge in Alternative Investments

High interest rates US Fed have driven investors toward alternative options such as cryptocurrency and precious metals. With traditional investment vehicles offering lower returns due to higher borrowing costs, assets like Bitcoin and gold have seen a resurgence in popularity.

2. Rising Rental Prices

While owning a home has become more expensive, renting hasn’t become a walk in the park either. The demand for rental properties has spiked, causing rental prices to increase by an average of 15% nationwide. Companies like Airbnb have experienced a surge in bookings as more people look for temporary housing solutions.

3. Strained Small Businesses

Small businesses, particularly in retail and gastronomy, rely heavily on credit to manage their cash flows. Elevated United States interest rates make loans costlier, putting additional financial strain on these enterprises. Surveys indicate that 38% of small businesses are struggling more with debt repayments compared to 2023.

4. Tech Sector Adjustments

Tech giants such as Google and Meta have responded to rising rates by cutting back on long-term projects and shifting focus to short-term profitability. This strategic pivot aims to protect their stock prices, which are vulnerable to financial market volatility.

5. Enhanced Savings Yields

On the flip side, consumers benefit from higher yields on savings and fixed deposits. Banks like Wells Fargo and JPMorgan Chase report a significant uptick in savings account deposits as customers take advantage of better returns.

| **Category** | **Description** |

|---|---|

| Current Interest Rate | 7.42% (as of October 2023) |

| Historical Trends | – 1990s: Average ~8% – 2000s: Average ~6% – 2010s: Average ~4% – 2020s: Fluctuates between 2.68% and 7.42% |

| Types of Interest Rates | – Fixed Rate: Interest remains constant over the loan term – Adjustable Rate (ARM): Interest varies based on an index rate |

| Factors Influencing Rates | – Federal Reserve Policy – Inflation – Economic Growth – Housing Market Conditions – Global Events |

| Impact on Monthly Payment | Higher rates lead to higher monthly payments; a 1% increase in interest rate can significantly increase the monthly mortgage payment on a 30-year fixed-rate loan. |

| Benefits of Low Rates | – Lower monthly mortgage payments – Increased home affordability – Potential for higher property values |

| Risks of Rising Rates | – Higher borrowing costs – Reduced housing affordability – Potential decrease in homebuyer demand |

| Current Federal Funds Rate | 5.25%-5.50% (as of October 2023), which influences broader interest rate trends including mortgage rates |

| Average Mortgage Rate by Loan Type | – 30-Year Fixed: ~7.42% – 15-Year Fixed: ~6.50% – 5/1 ARM: ~6.00% |

| Sources for Data | – Federal Reserve – Freddie Mac – Mortgage Bankers Association (MBA) – U.S. Department of Housing and Urban Development (HUD) |

Navigating the Future of US Interest Rates

As we move further into 2024, the landscape shaped by US interest rates will remain intricate and dynamic. Stakeholders – from individual consumers to large enterprises – must adapt to the evolving environment.

Strategic Adaptations

For consumers, this translates to rethinking loan and investment strategies. Financial advisors recommend focusing on paying down high-interest debt and exploring more secure, high-yield savings opportunities.

Businesses might innovate through cost-effective technology implementations or new revenue streams less sensitive to interest rate fluctuations. The hospitality sector, for instance, is leveraging AI to optimize operations and reduce dependency on credit.

Future Projections

Economists predict that the policy rate US might stabilize by mid-2025, offering some relief. Yet, the lessons from this period highlight the importance of agility and strategic foresight in financial planning.

Our understanding of United States interest rates and their diverse impacts continues to evolve. While challenging, these fluctuations also present opportunities for growth and innovation in unprecedented ways.

Through strategic planning and innovative solutions, individuals and businesses can navigate these choppy economic waters. While the road ahead may seem uncertain, it’s far from insurmountable.

For those interested in staying updated on the latest developments, tools like My Ql .com and insights on what the Fed did today can be invaluable. Stay informed, stay prepared, and remember, at Mortgage Rater, we’re here to help you understand and adapt to these economic tides.

Shocking Impact of Interest Rate US: Fascinating Trivia and Intriguing Facts

Hidden Stories of Interest Rates

Interest rates in the US impact more than just loans and mortgages. For one, did you know that the US prime rates, often set by the Federal Reserve, directly influence the rates lenders offer their most creditworthy customers? This connection underscores how shifts in federal rates can affect everything from your mortgage to your savings account. As a fun side note, while the Federal Reserve’s decisions may seem mysterious, you can catch up on what actions they’ve taken with just a quick look here What Did The fed do today.

Impact Beyond Finance

Interest rates can even ripple through unexpected places. For instance, when highly leveraged economies suddenly face high rates, it can lead to severe financial strain, causing panic—imagine a pro athlete collapsing under unexpected pressure! This might sound like the recent player Collapses. Furthermore, the everyday federal interest rate today could be having unseen consequences on your favorite hobbies. For example, if you’re into niche markets like manga, economic shifts can affect publishing costs, impacting series such as My Dress-up Darling Manga.

The Social Fabric

Interest rates also weave into the social fabric, affecting pivotal life events. For instance, a sudden spike in interest rates might challenge your financial planning goals, prompting you to do it For state and reconsider your investment strategies, just like people often rethink their priorities when engaging with motivating pursuits. Speaking of impact, there’s something profoundly moving about how personal losses, such as when a dream friend Died, can reshape our lives in unforeseen ways—much like how fluctuating interest rates reshape economic landscapes.

By embedding these trivia points into our understanding of interest rates, we realize just how interconnected and significant these financial metrics are. Whether it’s prime rates, federal changes, or cultural impacts, everything’s tied together in surprising ways. So next time, as you’re pondering the impact of interest rate US, remember these fascinating angles on one of the most influential economic levers out there.