Welcome, savvy investors and curious minds, to an odyssey through the veins of finance, where we’ll unravel the enigma of the internal rate of return. Like a compass in the wilderness, understanding this concept can guide you through the financial jungles and help you emerge with treasure chests of informed decisions. It’s time to light the torches and delve deep into the caverns of the IRR.

Demystifying Internal Rate of Return for Savvy Investors

The internal rate of return – an investor’s north star, a beacon that financially savvy pirates are seeking on the high seas of capital ventures. But what exactly is this internal rate of return, and why does it cast such a spell on those who know its secrets?

Understanding the Basics: What Is Internal Rate of Return?

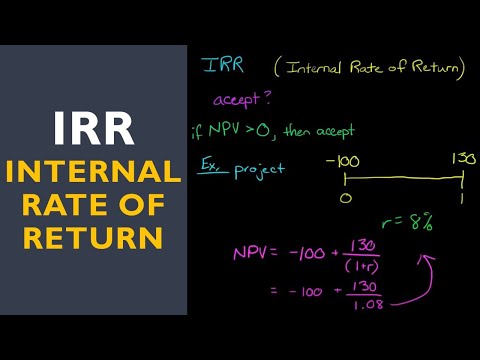

Imagine you’re a venture capitalist eyeing a potential goldmine in a startup like Mighty AI, or perhaps a renewable energy project by the giants at NextEra Energy. Before you go all-in, you’d need to calculate the internal rate of return. IRR plays the lead role in this financial saga; it’s that magical rate which brings the net present value (NPV) of all cash flows to a rocking zero in a discounted cash flow analysis. Simple, right? Think of it as the rate that says, “Hey, look here, at this exact percentage, you’ll break even over time.”

Now, let’s get practical. It’s June 2024, and Mighty AI has just closed another successful funding round. Venture capitalists were tripping over themselves to be part of it. Why? They’d crunched the numbers, and the internal rate of return spelled out a clear message: “This ship is sailing to Profit Town.”

| **Aspect** | **Details** |

|---|---|

| Definition | The Internal Rate of Return (IRR) is a financial metric used to estimate the profitability of potential investments by calculating the discount rate that makes the net present value (NPV) of all cash flows from a particular project equal to zero. |

| Formula | IRR is calculated using the NPV formula where NPV equals zero: |

| `0 = Σ[PV(Cash Flows)]` | |

| Calculation Steps | 1. Estimate expected cash flows, 2. Determine an initial IRR, 3. Calculate NPV at that rate, 4. Adjust the IRR until NPV = 0 through iterations or using financial software. |

| Importance | IRR is used for capital budgeting and to rank investments based on their potential to generate returns. |

| Comparison with ROI | ROI shows total growth since the start, while IRR annualizes the growth rate. Over one year, the values may be similar. |

| Use in Decision-Making | A project with a projected IRR that exceeds the cost of capital is usually considered profitable and worth pursuing. |

| Considerations | IRR does not take into account external factors such as inflation, risk factors, or alternative investment returns. It also assumes reinvestment at the project’s IRR rate, which may not be realistic. |

| Strategic Implication | A high IRR indicates good potential for profitability, but it must be weighed against market momentum, strategic positioning, business performance, and risk. |

| Types of Risks Associated | Types of IRR include repricing risk, basis risk, yield curve risk, option risk, and price risk. |

| Excel Function for IRR | The `IRR` function in Excel can help determine the project’s financial viability by calculating the rate at which NPV becomes zero. |

| Market Impact | IRR is influenced by changes in market rates, but it does not consider external market trends directly in its calculation. |

Comparing IRR, ROI, and NPV: What Sets Them Apart

Sometimes folks mix up their financial acronyms like socks in a washing machine. But they’re as different as night and day. ROI? That’s your Return on Investment; it shows the total groove since the start. NPV? Net Present Value, the difference between the investment cost and its present value. But IRR? That’s the cool cat of the bunch, showing you the annual growth rate that makes the NPV hit zero. Think of Warren Buffet and his Berkshire Hathaway empire; they don’t just throw darts on a board. They measure twice and cut once, knowing the differences between IRR, ROI, and NPV to safeguard their treasure chest.

Calculating IRR – The Ingredients You Need

Now, let’s roll up our sleeves and get down to business. Calculating IRR can seem more complicated than a grandma’s meatloaf recipe. But with the right tools and a sprinkle of patience, you’ll get there. Blackstone Group’s real estate investments? They didn’t just eyeball it. They used software tools – from the robust Invest for Excel to nifty online IRR calculators provided by the likes of Wells Fargo – to nail down those numbers.

Alright, now let’s say you’re trying to figure out the internal rate of return for your own investment. You’ll want to head over to Mortgage Rater’s guide on How To calculate internal rate Of return to get the scoop on the step-by-step process. It’s like having a financial Gordon Ramsay guiding your hand.

Applying the Internal Rate of Return in Real-world Scenarios

So you’ve got your head around what is internal rate of return, but what does it look like out in the wild? Here’s where IRR shines, from tech startups like Stripe, valuing their billions, to real estate moguls like CBRE Group shaping skylines. It informs investment firms like Vanguard on which mutual funds to give the green light. It’s not just about the money coming in; it’s about understanding the timing of each penny, and IRR is the maestro conducting the orchestra.

Advanced IRR Concepts: Modified IRR (MIRR) and Its Utility

But wait, there’s more. Enter MIRR – Modified Internal Rate of Return – the suave cousin of IRR, adjusting for the realities of different reinvestment rates. Bechtel Corporation didn’t build half the world’s infrastructure by resting on laurels. When they assess projects, they look at MIRR. It’s about adding a touch of sophistication to avoid those overinflated expectations.

Pitfalls and Limitations of Using Internal Rate of Return

Nothing in life is perfect, not even IRR. It waltzes on assumptions of constant reinvestment rates, as steady as a metronome, which isn’t always the case in the concert of life. Watch out for these blind spots. Look at Amazon; they didn’t reach the mountaintop of e-commerce by chance. They manage these pitfalls with maneuverability akin to a world-class gymnast, investing with agility and foresight.

Unveiling Secret Strategies for Maximizing IRR

To maximize your IRR, it’s like finding hidden tracks on a Taylor Swift album – you’ve got to dig a little deeper. If you’re curious about strategic maneuvers by private equity juggernauts like KKR & Co., look no further. It’s about forecasting cash flows sharp as a sniper – and for that, you’re gonna need some serious chops, the kind J.P. Morgan analysts wield with the precision of a Swiss watch.

The Future of Internal Rate of Return in Investment Analysis

We’re on the brink of a new era where AI wields its mighty algorithmic sword, reshaping the financial battlefield. Goldman Sachs isn’t just throwing darts at a board; they’re using AI insights to steer the investment ship home. What’s next? Could we see an AI-calculated IRR that outsmarts us all?

Conclusion: Mastering IRR for Investment Excellence

And there you have it, the circle is complete. We’ve journeyed through the realms of IRR, from the foothills of basics to the peaks of advanced strategies. Remember, wielding the internal rate of return is like holding a powerful amulet – use it wisely, with humility and precision, and the financial realms shall reward you generously. As for now, go forth and multiply your investments and may the spirit of Suze Orman’s wisdom and Robert Kiyosaki’s practicality infuse your every financial adventure!

Demystifying the Internal Rate of Return Enigma

When it comes to dissecting the complex world of finance, the concept of the internal rate of return (IRR) can seem as intricate as solving a Rubik’s Cube blindfolded. So, buckle up financial adventurers! Let’s dish out some mind-bending trivia and startling facts about the internal rate of return that’ll make you the coolest cat at your next investing meet-up.

Time Travel with IRR

Okay, IRR doesn’t actually involve hopping into a DeLorean, but it’s kinda like a financial time in Mexico city – a melting pot where every peso’s past, present, and future value parties together. Internal rate of return is the magician that turns cash flows from different times into one mesmerizing number. If you could warp time like you were chilling in the Zócalo, you’d understand why IRR is the go-to metric for investors who want to know if they’re hitting the jackpot or just pouring cash into a bottomless pit.

The High Heels of Finance

Ever seen those Schutz shoes that scream both style and substance? IRR is the stiletto of investment analyses – sharp, sleek, and without a doubt, a bit intimidating. It struts right into the financial runway and gives you the lowdown on your project’s true profitability. Wearing the IRR glasses, you’ll spot if an investment pumps up your portfolio or if it’s about to trip up your cash flow like a cobblestone alley in a pair of 6-inch heels.

That Aha! Moment

Picture this: You’re at a Taylor Swift atlanta concert, and right in the middle of ‘Shake It Off’, it hits you – the IRR of a project is the interest rate at which the net present value (NPV) equals zero. That’s the sweet spot where your expenses and earnings from a project have a stare-down, and neither blinks. It’s that aha! moment when everything harmoniously balances out, and you know you’re on the right track to profitability city.

Clucky Investment Choices

Choosing investments without pondering over internal rate of return is like ordering at chicken king without peeking the menu – you might get something delicious or end up with an unexpected spicy surprise that makes your wallet weep. By using IRR, you can ensure your cash isn’t just fluttering away into the wild blue yonder, but bringin’ in the golden eggs of returns. Don’t be a chicken – make savvier choices with IRR!

The Building Blocks of Portfolios

Think of IRR like Bearbrick collectibles – some might look just pretty on a shelf while others are rare, sought-after gems. Each investment in your portfolio has its own IRR, making it unique. The trick, much like with Bearbricks, is to know which pieces add value to your collection and which are just hogging space. Don’t just collect – curate your investments based on their IRR to build a portfolio that’s as enviable as a full set of Series 37.

Well, there you have it, folks, a whirlwind tour of the internal rate of return. Who knew this financial metric could be as thrilling as a math-themed amusement park ride? Just remember, while IRR is one smooth operator in the numbers game, it’s not the be-all and end-all. Pair it with other financial metrics, and you’ve got yourself a diversified toolkit that would make even the most seasoned of investors tip their hats!

What is the IRR in simple terms?

Alright, let’s break it down! IRR, or Internal Rate of Return in plain English, is like your financial compass—it tells you the percentage you’re winning (or losing) on your investment over time when you even out all the cash flows. Think of it as the interest rate that makes the money you put in equal the money you get out.

What does 30% IRR mean?

Hold your horses! If someone’s talking about a 30% IRR, they’re basically saying that the investment’s expected to grow at a pace where you get a 30% return annually. That’s nothing to sneeze at—it’s like your money’s on a supercharged treadmill!

What is the difference between IRR and ROI?

Now, if we’re chatting about the nitty-gritty, IRR and ROI are like cousins with different vibes. ROI is the total gain you get, whereas IRR is the yearly growth rate that gets you there. Imagine ROI is your total road trip mileage, and IRR is your regular speed.

How is the internal rate of return calculated?

Calculating the IRR basically feels like a treasure hunt—except you’re hunting for the rate that sets your investment’s net present value to zero. And guess what? You’ll usually need a financial calculator or spreadsheet ’cause this isn’t your average back-of-the-envelope math!

What is a good IRR ratio?

Talking about good IRR ratios is like asking if the weather’s good for surfing—it really depends on the waves you’re looking for! Generally, you want an IRR that’s higher than alternative investments or borrowing costs; otherwise, why dive in?

Is 6% IRR good?

Ah, the eternal question: Is 6% IRR good? Well, if it’s beating the pants off what you’d get in a safer investment like a savings account, then yeah, it’s not too shabby. But it’s no big winner if other opportunities are doing backflips with higher returns.

Is 100% IRR possible?

% IRR? Whoa, Nelly! It sounds like a unicorn—a rare and mythical beast indeed. While it’s possible, especially in high-risk ventures with massive payoffs, don’t bet the farm on seeing that number often.

Is an IRR of 12 good?

An IRR of 12%, now we’re talking! It’s like a solid B+ in grade school—the kind that has your parents nodding with approval. It’s generally seen as a strong return, particularly if it’s stomping all over the average market rates.

Why a higher IRR is better?

We all love a good “more is better” scenario, and with IRR, a higher number usually means your investment’s bringing home the bacon in better shape than a lower one. Just like you’d rather have a bigger slice of pie, right?

What is the downside of IRR?

But here’s the catch with IRR—it’s no crystal ball. It assumes you can reinvest your cash flows at the same rate, and life’s rarely that predictable. Also, it could lead you astray if it’s tied up in a long-term project that seems shiny up front but doesn’t reflect the actual risk or timing of cash inflows.

What is a good return on investment over 5 years?

Now, when you’ve been in the investment game for 5 years, a good return can mean doubling your dough or hitting somewhere between 7-10% annually. It’s like saying, “not too shabby” to your investment smarts if you’re in that ballpark.

Should I use ROI or IRR?

Choosing between ROI and IRR is like picking your dance moves—depends on the tune! ROI’s great for simple, straightforward charm. But IRR? It’s your go-to for the rhythm of cash flows over time. It’s all about context, folks!

What is a good NPV?

For a good NPV, think positive—the bigger, the better! A positive NPV tells you your investment’s worth more than its costs, kinda like finding money in your old coat pocket and then some!

What is a good IRR for real estate development?

In the world of real estate development, a good IRR often sits around 15-20%. It’s like hitting a solid home run—not quite out of the park, but enough to get the crowd going!

What is an example of an internal rate of return?

An example of IRR? Imagine investing in a hip coffee shop. You shell out some initial cash, then get a stream of profits every year. The IRR is the annual rate that makes your spend and earnings break even over time. So if your IRR’s a cool 10%, it’s like saying your cash grows at a steady 10% per year in the café biz.