In the ever-evolving economy, credit scores can be as enigmatic as they are crucial. They’re the bread and butter of your financial profile and the gatekeepers to your goals. Let’s unravel the mystery; is 670 a good credit score? And what can we do about it? As we dive into the details, remember: knowledge is power, and understanding your credit is the first step to financial empowerment!

The Real Impact of a 670 Credit Score in Today’s Financial Landscape

So, what’s the deal with a 670 credit score? How does it fit into the grand scheme of things? Here’s the scoop:

Good Credit Score Vintage Finance Gift T Shirt

$16.99

The Good Credit Score Vintage Finance Gift T-Shirt is the perfect way to show off your financial savviness and celebrate fiscal responsibility with a touch of retro flair. This unique piece of apparel features a bold, eye-catching design centered around the universal symbol of creditworthiness â the credit score. Set against a backdrop of vintage-inspired graphics and typography, the shirt proudly displays a range of high credit score numbers, making it an ideal choice for anyone who takes pride in their financial stability.

Crafted from a soft, comfortable cotton blend, this T-shirt is designed for both style and durability, ensuring it can be worn at casual outings, finance-related events, or even during those relaxed days at home. The fit is unisex and flattering for all body types, making it an inclusive option for anyone who values a good credit score. Additionally, the high-quality print is made to withstand wash after wash, keeping the colors vibrant and the message clear.

This T-Shirt isn’t just a fashion statement; it’s a conversation starter that allows like-minded individuals to connect over a shared appreciation for good credit practices. It makes for an excellent gift for finance professionals, recent graduates stepping into the world of personal finance, or anyone who has worked hard to achieve and maintain a stellar credit rating. Wearing this T-Shirt is an amusing yet proud acknowledgement of the importance of financial health and the success that comes with it.

Exploring the Spectrum: Is 670 a Good Credit Score?

Credit scores are like grades for your financial history, and they range from 300 to 850. A 670 credit score? It’s not a run-of-the-mill number—it represents your financial diligence to potential lenders.

Securing a loan with a 670 credit score might not land you the best interest rates, but hey, you won’t be turned away at the door.

It’s like being on the credit seesaw—balanced between good and just-okay. You’re reliable enough for lenders but could use a little boost.

Demystifying the 669 Credit Score Predicament

Oh, the difference a point can make! The gap between a 669 credit score and a 670 credit score might seem small, but it’s like the difference between two similar-looking cupcakes—one’s vanilla, the other’s lemon; each leaves a distinct taste in lenders’ mouths. These numbers tiptoe around the line of good credit, with one just managing to cross over.

A single point can sway a lender’s decision or change your interest rate, much like an extra point on a test might get you an A instead of a B.

Imagine it as a tightrope walk above the ‘fair’ credit safety net; one misstep and down you go.

Users’ experiences show this tiny leap can make all the difference, like a small adjustment to a recipe turning a good dish into a great one.

670 Credit Score: Navigating the Threshold Between Fair and Good

What makes a credit score fair, good, or even great? Here we dissect the invisible barriers separating each tier.

It could be as simple as a few timely payments or as tricky as reducing your credit utilization ratio.

Moving from fair to good is like shedding a weight—you can breathe a little easier, but there’s still a hill to climb.

Stories tell us that with a score of 670, loans and credit cards are attainable, but you’re not the VIP at the credit party yet.

The Potential of a 670 Credit Score: Opportunities and Limitations

Having a 670 credit score is like holding a mid-tier gym membership. You get access to most of the equipment, but the premium classes are out of reach.

Yes, the doors open, but they might creak a little. Home loans, auto loans, and credit cards welcome you, albeit with a higher APR.

Think of it as shopping with discount coupons; you save, but not as much as you could with VIP vouchers.

Play your cards right, and a 670 score could be the stepping stone to a golden 720. It’s all about strategy, folks!

| Category | Details |

|---|---|

| :—————————– | :—————————————– |

| Credit Score Range | 670 falls within the range of 670 – 739, which is considered to be “Good” by most lenders. |

| Average American Score | The average FICO Score in the US was 714 in 2021, higher than 670. |

| Interest Rates for 670 | Typically higher than those with “Excellent” credit (740-850), but still offered relatively good rates. |

| Loan Approval Odds | High likelihood of approval for most types of credit products. |

| Credit Rating Definition | A score of 670 is generally labeled as “Fair” to “Good”. |

| Borrowing Options | Unsecured credit cards and personal loans are likely available, but with higher interest rates due to the perceived risk. |

| Auto Loan Specifics | A 670 credit score likely qualifies for auto loans below 10% APR but is above the threshold where rates tend to increase. |

| Mortgage Impact | It’s possible to qualify for a mortgage, but rates and terms might not be as favorable as those with scores in the “Excellent” range. |

| Improvement Potential | As 670 is on the lower end of “Good,” there is ample room for improvement to access better rates and terms. |

| Benefits of a 670 Score | While not the best score, a 670 credit score usually indicates a positive credit history, allowing for reasonable access to credit. |

Credit Building Strategies Specifically Tailored for a 670 Credit Score

A 670 credit score is like a canvas—good enough, but with room for a few strokes of genius to turn it into a masterpiece.

Punctuality is your best friend here; pay bills on time, and watch your credit grow. It’s not rocket science—it’s financial sense!

These gurus suggest a balanced diet of credit types and sage advice about low credit utilization—the secret sauce for credit score gains.

Some quick fixes could push you over the threshold, while strategic long-term goals lay the foundation for enduring success.

Credit Score Club High Credit Score Funny Financial Long Sleeve T Shirt

$24.99

The Credit Score Club High Credit Score Funny Financial Long Sleeve T Shirt is the latest must-have fashion item for anyone who loves finance with a touch of humor. Made from soft, breathable cotton, this long-sleeve tee ensures comfort all day long, whether you’re crunching numbers at work or out for a casual coffee run. Its eye-catching design features a vibrant graphic that playfully celebrates achieving that elusive high credit score, making it a conversation starter at any social gathering. The durable fabric holds up well to repeated washings, so your credit score won’t be the only thing staying high.

For finance professionals, those working to improve their credit, or just fans of quirky financial humor, this shirt is a whimsical way to show off your fiscal responsibility and sense of style. It comes in a range of sizes to ensure a perfect fit for all body types, ensuring you look your best while promoting the virtues of good credit management. The seamless rib at the neck and taped shoulder-to-shoulder construction provide added comfort and durability, underlining the shirtâs commitment to quality as firm as your commitment to financial stability.

Not only does the Credit Score Club T Shirt serve as a great personal wardrobe addition, but it also makes for a clever and appreciated gift for friends, family, or colleagues who appreciate the lighter side of finance. It’s the ideal attire for casual Fridays at the office, themed events, or just lounging at home while reviewing your latest credit report. With its unique blend of comfort and financial wit, this shirt is sure to be a hit, making it as reliable a choice in your wardrobe as a good credit score is in your financial life.

The Psychological Aspect: Perceptions of Having a 670 Credit Score

A 670 credit score isn’t just a number; it’s a reflection of your fiscal identity that affects how you see yourself—and how creditors see you.

For some, it’s a badge of honor; for others, a call to action. Lenders might see you as dependable, but suggest there’s room for growth.

When consumers reach this sunny financial plateau, it’s like a confidence injection that opens up a world of prime opportunities.

Much like deciding between a budget vs. luxury car, a 670 score might sway you toward safer bets than high-stakes gambles.

The Future of Credit: Is 670 a Good Credit Score Going Forward?

Credit scoring is as dynamic as the stock market; what’s ‘good’ today might be ‘just okay’ tomorrow.

As scoring evolves, even a good score like 670 must keep up—stagnation is not an option, forward is the only way.

Experts foresee score standards rising like skyscrapers—670 must grow or get left behind in the city of credit.

One legislative tweak and voilà, the credit landscape shifts! Keep your eyes peeled and adapt swiftly.

Staying Ahead: Tools and Resources for Maintaining and Improving Your Credit Score

Your 670 credit score can blossom with a little TLC, and there are tools galore for just that.

Credit check total becomes your personal credit coach, guiding you to the land of excellent credit.

Brushing up on finance knowledge is never wasted; understanding what shapes your score can transform it.

It’s the digital age, folks! Use technology to budget, track, and build credit without breaking a sweat.

Body Trauma A WriterÂs Guide to Wounds and Injuries (Get It Write)

$17.95

“Body Trauma: A Writer’s Guide to Wounds and Injuries (Get It Write)” is an indispensable resource for authors looking to inject authenticity into the portrayal of physical injuries in their storytelling. This comprehensive guide delves into the intricate details of various types of wounds, from cuts and bruises to more severe afflictions such as gunshot wounds and burns. Written with precision and care, the book helps writers depict the realistic aftermath of bodily trauma on their characters, which is crucial for maintaining credibility and engaging readers who may be knowledgeable about medical details.

Authors will appreciate the clear explanations and practical advice on how to describe injuries and their immediate and long-term effects on a character’s physical and emotional state. “Body Trauma” provides a wealth of information on treatment options, healing processes, and the potential for complications, aiding writers in crafting compelling recovery arcs or dramatic turns in their narratives. The book not only explores the medical aspects of injuries but also considers the psychological impact on characters, adding depth to storytelling by focusing on the interplay between mind and body after a traumatic event.

Not just a manual for writers, “Body Trauma: A Writer’s Guide to Wounds and Injuries (Get It Write)” also serves as a useful reference for anyone interested in the accurate depiction of medical conditions in creative media. Featuring case studies, detailed diagrams, and a glossary of medical terms, the book ensures that readers can quickly grasp the complexities of medical situations. Whether for scripted television, novels, or video game development, this guide empowers creators to convey the reality of bodily harm with confidence and sensitivity, while keeping readers riveted to the fates of their beloved characters.

Case Studies: Personal Stories of Success with a 670 Credit Score

Real folks, real stories, real outcomes—let’s dive into the journeys of those who’ve made the most of their 670 credit score.

See how John from accounting or Susie from next door turned their credit from fine to fabulous.

Glean practical tips from the trials and victories of those who’ve walked a mile in your credit shoes.

The lessons? Priceless. Expert observations offer a treasure trove of insights to propel you forward.

Fostering Financial Empowerment with a 670 Score

Having a 670 credit score is like being at a crossroads—you can either settle or gear up for the journey towards credit excellence. It’s decent, but in the hustle and bustle of financial wellness, you could aim high and land among the credit elite. With customized strategies fueled by expert advice, there’s no reason your good credit can’t become great.

So, what’s the verdict? Is 670 a good credit score? It’s a solid foundation, but there’s more work to be done. Hold onto your hats—your credit score adventure has just begun!

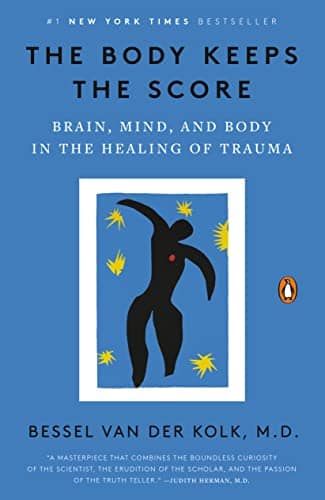

The Body Keeps the Score Brain, Mind, and Body in the Healing of Trauma

$13.99

“The Body Keeps the Score: Brain, Mind, and Body in the Healing of Trauma” is a profound exploration of how trauma impacts an individual’s physical, emotional, and mental well-being. Written by Bessel van der Kolk, a leading expert on post-traumatic stress disorder (PTSD), this book delves into the complex ways in which trauma reshapes the body and the brain, leading to challenges in one’s capacity to experience pleasure, engagement, control, and trust. Van der Kolk draws upon his own extensive experience and research to demonstrate how trauma results in alterations in the processing of emotions and memories, often leaving individuals feeling disconnected from their own bodies and realities.

Through a mix of case studies, scientific studies, and accessible explanations, the author illustrates the inefficacy of traditional talking therapies for certain types of trauma-related issues. He provides insight into innovative therapies that can activate the brain’s natural neuroplasticity and allow individuals to reclaim their lives. These include eye movement desensitization and reprocessing (EMDR), yoga, mindfulness techniques, and other body-based interventions that help to address the root causes of trauma-related difficulties.

Van der Kolk’s seminal work has reshaped our understanding of trauma and its treatment, moving beyond the traditional focus on mind and narrative to incorporate the pivotal role of bodily experiences. “The Body Keeps the Score” serves as a vital resource for therapists, individuals dealing with the aftermath of trauma, and anyone interested in the intricate connection between the mind and body. This book’s holistic approach underlines the need for treatments that move towards the integration of traumatic memories, allowing for healing on a deeper and more enduring level.

Is a 670 credit score good to buy a house?

Sure, here we go!

What can a 670 credit score get you?

Well, a 670 credit score is kinda like your B- student in school—pretty good, but not top of the class. You can usually get your foot in the door to buy a house, but don’t expect the red carpet treatment with the best interest rates.

Is a 670 credit score good enough to buy a car?

With a 670 credit score, you’re sitting in a decent spot – you can snag a variety of loans and credit cards, but you’ll probably be checking the mailbox for better offers.

What interest rate will I get with a 670 credit score?

Is a 670 credit score good enough to buy a car? You bet! It’s like bringing a solid glove to the baseball game – you might not catch the fastest pitches, but you’ll still get a good deal on the lot.

Is 660 a good credit score to buy a house?

Interest rates with a 670 score? Let’s just say you won’t be dancing in the streets. You’re looking at average rates – not the worst, but hey, it could definitely be better.

What credit score is needed for a 300k house?

Now, a 660 credit score to buy a house? That’s like bringing an umbrella for a chance of rain. It’s good enough, but you might get a few drops on you in the form of higher interest rates.

How to increase credit score from 670 to 750?

For a $300k house, you’re gonna need a credit score that’s playing with the big boys – think 740 or higher to reel in those sweet, sweet low-interest rates.

What’s a perfect credit score?

Wanna bump that 670 to a 750? Roll up those sleeves! Start by paying bills on time, every time, and chip away at any debt. Like grandma’s secret recipe – it takes time and consistency.

What is an average credit score?

The Holy Grail, a perfect credit score, is a shiny 850. It’s like a unicorn, rare and somewhat mystical, but oh so majestic if you can achieve it.

Is 670 a good credit score for a 22 year old?

Average Joe’s credit score? That’s usually hovering around the 710 mark. It’s enough to get you through the door for some decent loan terms.

Is a 670 credit score good for a 21 year old?

For a 22-year-old, a 670 score is like getting the hang of adulting – you’re on the right track but still have some room to grow and impress.

What credit score do you need to buy a $25000 car?

At 21, sporting a 670 credit score? You’re ahead of the game, kid! Keep it up, and you’ll be financial hot stuff before you can rent a car without crazy fees.

What is a good credit score for my age?

Need wheels worth $25,000? Aim for a credit score of 660 or better – it’s like having a golden ticket to get those keys without a hair-raising interest rate.

Can I get a personal loan with a 670 score?

What’s a good credit score for your age? It’s like keeping up with fashion trends – always aim for the best, but trends change, so focus more on good financial habits.

What is a decent credit score to buy a car?

With a 670, can you grab a personal loan? Sure thing! It’s not a slam dunk, but lenders aren’t likely to give you the cold shoulder either.

What is the perfect credit score to buy a house?

Decent credit score to buy a car? Anything above 660 will have dealers shaking your hand, but the sweet spot for the best rates starts at 720.

What credit score do I need to buy a 400k house?

Perfect credit score to buy a house? Anything north of 760 and you’ll be the belle of the mortgage ball, scoring the best terms and rates.

What credit score do you need for a 350 000 home loan?

Dreaming of a $400k house? You’ll need a score that’s looking its Sunday best – think 720 and up to charm those lenders.

What is the basic credit score to buy a house?

For a $350,000 home loan, roll in with a 740 or higher credit score, and you’re golden – lenders will be lining up with open arms.