Navigating the world of mortgages in 2024 demands a good handle on financial tools like loan calculators. If you’re looking to buy a home priced between $250K-$300K, understanding how to use a loan calculator home can make all the difference. A top-notch loan calculator helps you make sense of monthly payments, unexpected costs, and complicated mortgage terms. In this article, we’ll explore the best mortgage calculators available, share crucial tips for 2024 homebuyers, and guide you through the essentials every homebuyer should know.

Top 5 Loan Calculator Home Choices for $250K-$300K Mortgages

1. Zillow Loan Calculator

Zillow is well-known in real estate circles. It offers a versatile and user-friendly loan calculator home tool that allows users to enter key details such as the loan amount, interest rate, term, and down payment.

Unique Insights:

– Market Trends Integration: Zillow integrates real-time market trends, giving you a more accurate estimate of future payment variations.

– User-Friendly Interface: Ideal for first-time homebuyers, the interface is simple and intuitive.

2. Bankrate Mortgage Calculator

Bankrate is a highly regarded name in personal finance. Their mortgage calculator provides a detailed amortization schedule, showing how each payment reduces the loan balance.

Unique Insights:

– Interest Rate Comparisons: This calculator allows you to compare different interest rates, making informed decisions easier.

– Detailed Cost Breakdown: It breaks down payments into principal, interest, taxes, and insurance, offering a clear picture of your payment structure.

3. NerdWallet Mortgage Calculator

NerdWallet’s calculator is especially helpful for those who may not be financially savvy. It provides detailed, easy-to-understand breakdowns.

Unique Insights:

– Customization Options: Users can tweak figures to see how changes in loan term or interest rates impact monthly payments.

– Educational Resources: Links to articles and guides explain various mortgage concepts in greater detail, such as the difference between Fico score And credit score, helping you become more informed.

4. Chase Mortgage Calculator

Chase Bank’s calculator combines user-friendliness with robust analytical capabilities.

Unique Insights:

– Historical Data Analysis: Check out historical interest rate trends and project future rate changes.

– Customer Support Integration: Access to mortgage advisors who can help interpret and act on the calculator’s results.

5. Redfin Mortgage Calculator

Redfin’s mortgage calculator stands out by considering both conventional and unconventional mortgage scenarios.

Unique Insights:

– Real-Time Mortgage Rate Updates: You get continuously updated mortgage rates to ensure accurate calculations.

– Integrated Home Listings: Directly link your calculations to Redfin’s extensive property listings for a seamless experience.

Mortgage Tips for Prospective Buyers in 2024

1. Understanding Interest Rates and APR

Interest rates are crucial to your mortgage. They fluctuate based on Federal Reserve policies and the economy. It’s vital to understand the difference between nominal interest rates and the Annual Percentage Rate (APR), which includes fees and additional loan costs. Utilizing a loan calculator home to compare APRs could lead to substantial savings.

Unique Perspective:

– Expert Analysis: Consult financial experts like Greg McBride of Bankrate to predict interest rate movements. Knowing whether to lock in a rate can save you money in the long run.

2. Factoring in Extra Costs

A $250K-$300K mortgage involves more than principal and interest. Expenses like property taxes, homeowners insurance, and possible mortgage insurance must be considered. Tools like the Zillow loan calculator can preempt any surprises by factoring these costs into your monthly payments.

3. Down Payment Strategies

Increasing your down payment can lower your monthly mortgage payments and might eliminate the need for private mortgage insurance (PMI). Generally, a 20% down payment is advised. Calculator tools can show you the impact of various down payment scenarios on overall loan costs.

4. Debt-to-Income Ratio (DTI) Considerations

Lenders closely scrutinize your debt-to-income (DTI) ratio, often preferring it to be below 36%. Calculators help you input existing debts and foresee how mortgage payments will affect your DTI, aiding in your loan approval process.

5. Pre-Approval vs. Pre-Qualification

Pre-approval is more rigorous than pre-qualification and carries more weight with sellers. A loan calculator can help determine the realistic loan amount you might be pre-approved for, easing your home buying journey.

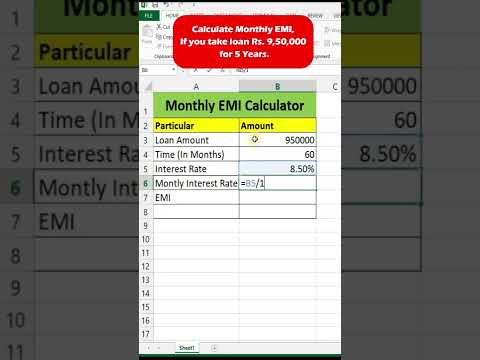

| Feature | Details |

| Monthly Budget for Mortgage | $2,000/month |

| Qualifying Home Purchase Price | $250,000 – $300,000 |

| Example Provided By | Matt Ward, Real Estate Agent, Nashville |

| Impacted By | Other financial factors such as credit score, down payment, debt-to-income ratio, and interest rates |

| Monthly Payments on $650,000 Loan | |

| – 30-Year Fixed Rate Loan | Interest Rate: 7.00% Monthly Payment: $4,324 |

| – 15-Year Fixed Rate Loan | Interest Rate: 7.00% Monthly Payment: $5,842 |

| Interest Rates | Influences monthly mortgage payments significantly |

| Key Features of a Loan Calculator | – Calculates monthly payments – Estimates loan payoff timeline – Compares different loan scenarios – Assists in budgeting for home purchase |

| Benefits | – Helps determine affordability – Offers financial planning insights – Assists in making informed decisions for home purchasing |

Conclusion: Empowering Your Mortgage Journey with Precision Tools

Understanding the intricacies of mortgages and skillfully using a loan calculator home can simplify the home buying process significantly. Leveraging tools from trusted brands like Zillow, Bankrate, NerdWallet, Chase, and Redfin helps prospective buyers in the $250K-$300K range navigate their journey with confidence and precision. Pairing the right calculator with informed strategies on interest rates, extra costs, and financial ratios equips you for success in the competitive housing market of 2024.

Empower your home buying journey with accurate tools and sound advice. Visit Mortgage Rater for more information on navigating today’s mortgage landscape.

Loan Calculator Home Fun Trivia and Interesting Facts

Unpacking the Value of Loan Calculators

Ever wondered what does the value mean when you input numbers into a loan calculator home? These tools aren’t just number crunchers; they offer insights into potential monthly payments, interest rates, and more. It’s like peering into a financial crystal ball, providing a clearer picture of your future mortgage commitments.

Sports Injuries and Housing Markets

Curious tidbit: major sports events, believe it or not, can impact real estate trends! Take the recent Mark Andrews injury; such events can shift local economies and tangentially influence housing prices. When using your loan calculator home, remember that broader cultural events can ripple through the market in unexpected ways.

The Power of Precision: Different Calculators

Let’s dive into specifics. A housing loan calculator helps you tweak various parameters to see how extra payments could potentially shorten your loan term or reduce interest over time. Each slight adjustment might seem small, but the cumulative effect can be significant. Comparably, a housing calculator takes a different approach, focusing on overall affordability. It’s all about finding the right tool to match your specific needs.

Triple Cs Impact

Ever heard about the triple Cs—capacity, credit, and collateral? These core components are crucial in determining your loan eligibility. Whether you’re using a loan calculator home to figure out potential monthly payments or gauging how much home you can afford, understanding these elements can make the process smoother. Fun fact: even local publications like the Times Herald Record often offer tips and insights into managing these crucial factors more effectively.

By keeping these trivia points and interesting facts in mind while using your loan calculator home, you’ll gain a richer, more holistic understanding of your financial journey towards homeownership. It’s not just about numbers—it’s about making informed decisions with all the cards on the table.

How much is a 300k mortgage per month?

For a $300,000 mortgage, your monthly payment would depend on the interest rate and loan term. As a rough estimate, with a 7% interest rate on a 30-year fixed mortgage, you could expect to pay around $1,996 a month.

How much is a mortgage on a $500,000 house?

For a $500,000 house, the mortgage payment varies based on the interest rate and term. Using a 7% interest rate on a 30-year fixed mortgage, your monthly payment might be about $3,328.

How much is a mortgage on a $400,000 house?

With a $400,000 house and a 7% interest rate on a 30-year mortgage, your monthly mortgage payment would be roughly $2,662.

How much house can I afford for $5000 a month?

With $5,000 a month for a mortgage, you could potentially afford a home priced between $600,000 to $700,000, depending on factors like your interest rate, loan term, and other financial obligations.

Can I afford a 300K house on a 70K salary?

On a $70,000 salary, you might be able to afford a $300,000 house, but it’s tight. It depends on your other debts, down payment amount, and interest rates. The 30% rule suggests keeping housing costs within 30% of your monthly income.

Can I afford a 300K house on a 50k salary?

On a $50,000 salary, affording a $300,000 house is quite challenging. You’d likely need a larger down payment and minimal debts to make it work, and you’d still be pushing financial limits.

What credit score is needed to buy a $500,000 house?

To buy a $500,000 house, a good credit score would generally be 620 or higher. Higher scores can help you get better interest rates and loan terms.

How much income do you need for a 350K house?

For a $350,000 house, you’d likely need an annual income of around $65,000 to $75,000. This hinges on other debts, down payment, and interest rates, aligning with keeping mortgage payments within 30% of your income.

How much should I make to afford a $500,000 house?

To afford a $500,000 house, your income should be around $100,000 to $120,000 per year. This range helps ensure that your housing costs remain manageable in relation to your earnings.

What should my income be for a 400k house?

For a $400,000 house, your income should ideally be between $80,000 and $100,000. This estimate helps keep mortgage costs within a safe proportion of your overall budget.

What is the 20% down payment on a $400 000 house?

A 20% down payment on a $400,000 house is $80,000.

Can I afford a 400k house on 100k salary?

With a $100,000 salary, affording a $400,000 house is quite feasible. Assuming you have moderate debts and a good credit score, your financial situation should align well with mortgage affordability guidelines.

How much house can I afford if I make $36,000 a year?

If you make $36,000 a year, buying a house will be tough. You’d likely qualify for a home priced around $100,000 to $140,000, factoring in expenses, debts, and keeping monthly payments within a comfortable range.

Can I afford a house making $2000 a month?

Making $2,000 a month makes it quite challenging to afford a house. Based on typical affordability guidelines, you’d be looking at homes in the range of $80,000 to $100,000 max.

Can I afford a 300k house on a 60k salary?

On a $60,000 salary, you might be able to afford a $300,000 house, but it’s stretching it. You’ll need a decent down payment and minimal debts to manage the monthly payments comfortably.