Understanding Loan Calculators Mortgage

Navigating mortgages can be as tricky as solving a Rubik’s Cube in the dark. But guess what? Loan calculators mortgage tools have come to light up the path for potential homeowners and financial experts. These nifty tools help you estimate monthly payments, evaluate loan options, and comprehend the long-term financial consequences of borrowing decisions. In 2024, loan calculators mortgage tools are better than ever — smarter, easier to use, and more insightful.

Top 7 Loan Calculators Mortgage Tools for Accurate Payment Estimations

1. Zillow Mortgage Calculator

Zillow’s mortgage calculator is a heavyweight in real estate tools. It allows users to input intricate details such as taxes, insurance, and HOA fees, providing a holistic view of monthly payment obligations.

Unique Feature: This tool integrates predictive analytics, giving users insights into how future financial changes might affect their mortgage payments. It’s like having a crystal ball for your mortgage.

2. Bankrate Mortgage Calculator

Bankrate’s mortgage calculator has long been a trusted ally for financial advice seekers. Offering a robust interface filled with customizable options for loan amounts, interest rates, and terms, it’s a solid aide for visualizing your mortgage journey from diverse angles.

Unique Feature: The inclusion of amortization schedules gives users a clear breakdown of their payments over time, perfect for the detail-oriented planner.

3. Quicken Loans Mortgage Calculator

Quicken Loans shines with their customer-centric mortgage calculator. This tool factors in property taxes, PMI, and homeowners insurance, ensuring you won’t be caught off guard by hidden costs.

Unique Feature: The seamless tie-in with Quicken Loans’ suite of loan tools makes the transition from estimation to pre-approval and application a walk in the park.

4. NerdWallet Mortgage Calculator

NerdWallet’s mortgage calculator is the teacher’s pet of the bunch, offering more than just numbers— it provides context, explanations, and advice based on your financial situation.

Unique Feature: Users can see how different mortgage types will impact their long-term finances, providing comprehensive guidance beyond just monthly payments.

5. Redfin Mortgage Calculator

The clarity and simplicity of Redfin’s mortgage calculator cater to both tech-savvy users and those who prefer simplicity. It offers detailed insights into how different loan types and repayment terms affect overall costs and affordability.

Unique Feature: Integrating real-time housing market data ensures accurate estimates based on current economic conditions.

6. MortgageLoan.com Mortgage Calculator

MortgageLoan.com features a suite of calculators, with the primary mortgage calculator being truly standout. It allows for nuanced inputs, such as various debt obligations, tailoring estimates closely to individual financial circumstances.

Unique Feature: The advanced graphing tool visualizes different facets of the loan repayment process, making it simpler to grasp the data and trends.

7. Forbes Advisor Mortgage Calculator

Forbes Advisor adds a fresh touch with their detailed mortgage calculator. This tool not only estimates monthly payments but also considers factors like inflation and potential interest rate fluctuations, giving long-term financial health insights.

Unique Feature: The “What If?” analysis tool helps users assess how changes in income or interest rates could affect their mortgage, providing a safety net for the future.

| Feature | Details |

|---|---|

| Purpose | Estimate monthly mortgage payments based on loan amount, interest rate, and loan term. |

| Common Loan Amounts | $150,000, $500,000 |

| Interest Rates (Example) | 7.0%, 7.1% |

| Loan Terms | 15 years, 30 years |

| Estimated Payment for $500K | $3,360.16/month at 7.1% interest for 30 years |

| Estimated Range for $500K | Between $2,600 and $4,900/month depending on interest rates and loan terms |

| Estimated Payment for $150K | $998/month at 7% interest for 30 years; $1,348/month at 7% interest for 15 years |

| Variables Considered | Loan amount, interest rate, loan term, property taxes, mortgage insurance |

| Tools Used | Online mortgage calculators, spreadsheet software |

| Benefits | – Quick estimation of monthly payments |

| – Helps in budgeting and financial planning | |

| – Comparison of different loan scenarios | |

| Limitations | – Does not account for all potential costs (e.g., taxes, insurance) |

| – Actual payments may vary based on additional factors such as credit score, escrow, and fees | |

| Usage | Input basic loan details to get an approximation of monthly mortgage payments |

| Additional Costs to Consider | Property taxes, mortgage insurance, homeowners insurance, HOA fees |

The Value of Using Loan Calculators Mortgage Tools

Utilizing loan calculators mortgage tools offers benefits that go beyond simple estimations. Here’s why they’re indispensable:

Leveraging Technology for Mortgage Calculations in 2024

With the pace of technology, AI and machine learning are supercharging mortgage calculators, making them smarter and more accurate. These forward-thinking tools predict trends, evaluate risks, and offer personalized financial advice. They simplify mortgage planning and bring a level of personalization that’s been sorely needed.

Imagine knowing your estimated monthly payment on a $500K mortgage at a 7.1% interest rate— that’s about $3,360.16. But this could range between $2,600 and $4,900, depending on the term and interest rate. Likewise, a $150K mortgage at a 7% fixed rate might be about $998 per month over 30 years, or $1,348 monthly over 15 years.

Ultimately, the best loan calculators mortgage tools provide accuracy, ease of use, and comprehensive insights into your financial future. Whether you’re a first-time home buyer figuring out How To buy a home, or looking to refinance, let these tools be your guide. Dive into these calculators and let technology simplify one of life’s biggest financial decisions. For more on How To stop foreclosure, check out our other resources.

Find out more about the economics behind these tools and start planning your future with our detailed guides on loan calculator mortgage, loan mortgage calculator, and mortgage calculator loan links. You’ll end up feeling less like you’re drowning and more like you’re riding the waves to homeownership.

Fun Trivia and Interesting Facts About Loan Calculators Mortgage

Historical Tidbits and Modern Marvels

Curious about the magic behind loan calculators mortgage? These nifty tools have evolved quite a bit over the years, transforming from simple paper-and-pen equations to sophisticated online systems. The earliest forms were essentially manual abacuses used by lenders centuries ago. Today, these calculators do everything but brew your morning coffee! Mortgage professionals rely daily on these to provide accurate forecasts, making the home-buying process smoother. Plus, innovative tech keeps adding more bells and whistles, making them indispensable.

Surprising Connections

You might not expect it, but the principles behind loan calculators mortgage can be traced back to similar statistical models used in treatment protocols. For example, The Sinclair method utilizes calculated estimates like probability curves and risk assessments. Drawing from such fields emphasizes the versatility and reliability of these financial calculators. And, while their primary function appears singular, the methodologies underpinning their operations are pretty profound.

Fun Financial Facts

Speaking of versatility, did you know that if you pop define estate into a good online dictionary, it covers more than just property? It encapsulates everything from assets to legal rights, indirectly showing how a well-calibrated mortgage calculator can handle vast data landscapes. A reliable loan calculator harmonizes these various elements, giving you a clearer financial picture. It can turn the convoluted task of budgeting for an estate into a walk in the park, making your financial journey less bumpy.

In a nutshell, diving into the nitty-gritty of loan calculators mortgage reveals a rich tapestry of historical intricacies and cutting-edge applications. They simplify what could otherwise be a headache-inducing process, bridging the gap between complex calculations and user-friendly interfaces.

How much is a mortgage on a $500,000 house?

Your estimated monthly payment for a $500,000 mortgage is around $3,360.16 with a 30-year loan term and an interest rate of 7.1%. This can vary between $2,600 and $4,900 depending on different terms and rates.

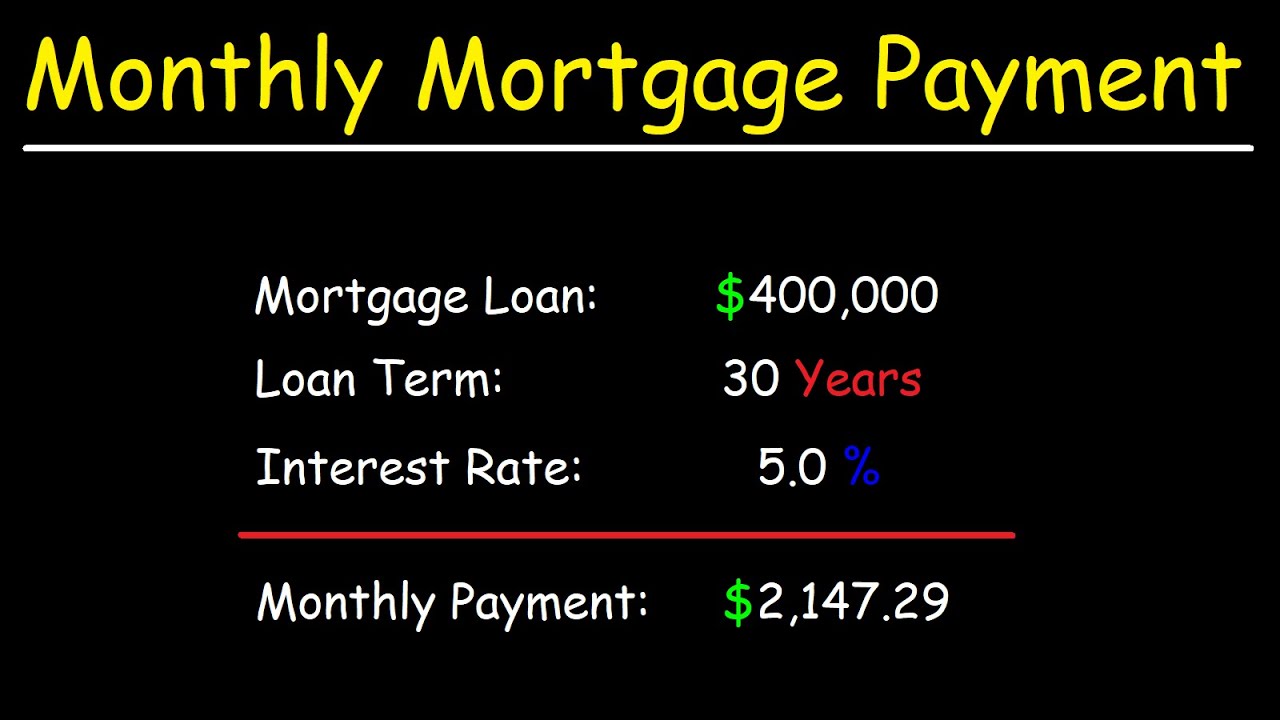

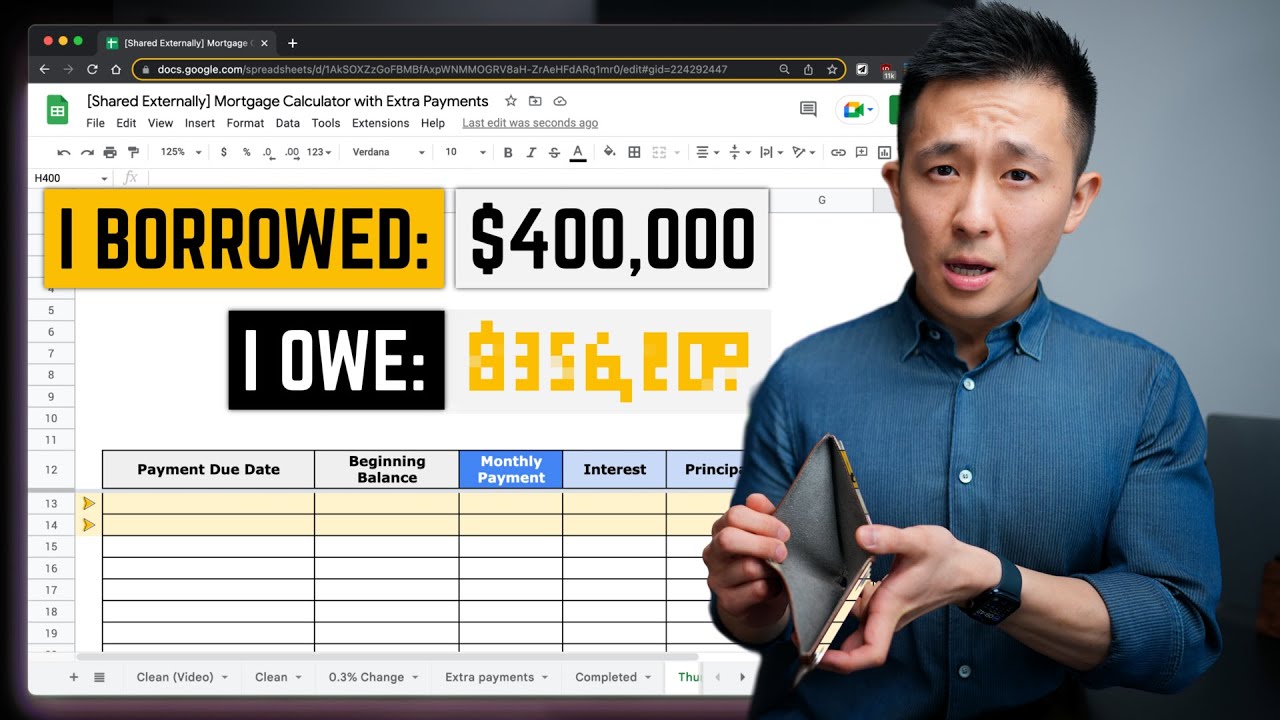

How much would your mortgage be for a $400000 home?

For a $400,000 home, monthly mortgage payments can vary widely based on interest rates and loan terms. On average, at a 7.1% rate for 30 years, you’d be looking at around $2,688.13 per month, but this isn’t set in stone and can differ based on various factors.

How accurate are mortgage payment calculators?

Mortgage calculators provide close approximations based on the information you input, like loan amount, interest rate, and term. They help you get a ballpark number, but actual payments might differ due to factors like taxes and insurance.

How much is a 150K mortgage payment?

For a $150,000 mortgage at a 7% fixed interest rate over 30 years, the monthly payment would be roughly $998. If you opt for 15 years, it jumps to about $1,348 per month, excluding taxes and insurance.

What credit score do you need to buy a $500,000 house?

To buy a $500,000 house, a good credit score to aim for is at least 620, though higher scores will get you better interest rates and loan terms.

How much income do you need for a 350K house?

To afford a $350,000 house, your yearly income should ideally be around $87,500, assuming a standard mortgage amount and typical interest rates.

Can I afford a 400k house on 100k salary?

On a $100,000 salary, you can generally afford a $400,000 house, but this depends on other debts and financial obligations you might have.

What is the 20% down payment on a $400 000 house?

A 20% down payment on a $400,000 house comes out to $80,000. It’s a chunk of change, but it saves you from needing private mortgage insurance (PMI) and can also reduce your monthly payments.

What should your income be for a $400000 house?

For a $400,000 house, your income should ideally be around $100,000 per year. This can vary based on other financial factors like debts and existing savings.

What is a good rule of thumb for mortgage?

A good rule of thumb for mortgages is the 28/36 rule: no more than 28% of your gross monthly income should go to housing costs, and no more than 36% should go to total debt.

How to easily calculate mortgage payment?

To easily calculate a mortgage payment, you can use the formula: M = P[r(1+r)^n]/[(1+r)^n-1]. Or, better yet, just use an online mortgage calculator to save the headache!

How much house can I afford if I make $70,000 a year?

If you make $70,000 a year, you can afford a house priced around $280,000 to $300,000, depending on your other debts and expenses.

How to pay off 150k mortgage in 5 years?

To pay off a $150,000 mortgage in 5 years, you’d need to make substantial monthly payments of around $2,950, depending on the interest rate. Cutting down on expenses and making extra payments can help.

How much income do you need to qualify for a $150,000 mortgage?

For a $150,000 mortgage, you’d generally need an annual income of about $37,500. This can differ based on the interest rate and loan terms.

Why does it take 30 years to pay off $150,000 loan even though you pay $1000 a month?

Even though you pay around $1,000 a month on a $150,000 loan, it takes 30 years to pay off due to interest. Payments early in the loan term primarily cover interest, with more going toward the principal later on.