Securing a manufactured home loan can feel as cozy and inviting as settling into your dream home, or as daunting as a wintery Charles Dickens scene if you’re not prepared. But don’t fret, we’re here to illuminate the path like the Ghost of Christmas Present in “A Christmas Carol 1984”. So, let’s dive deep into the world of manufactured home loans to ensure your journey is smooth sailing all the way through.

Securing a Manufactured Home Loan: Understanding the Basics

The Landscape of Manufactured Home Loans in 2024

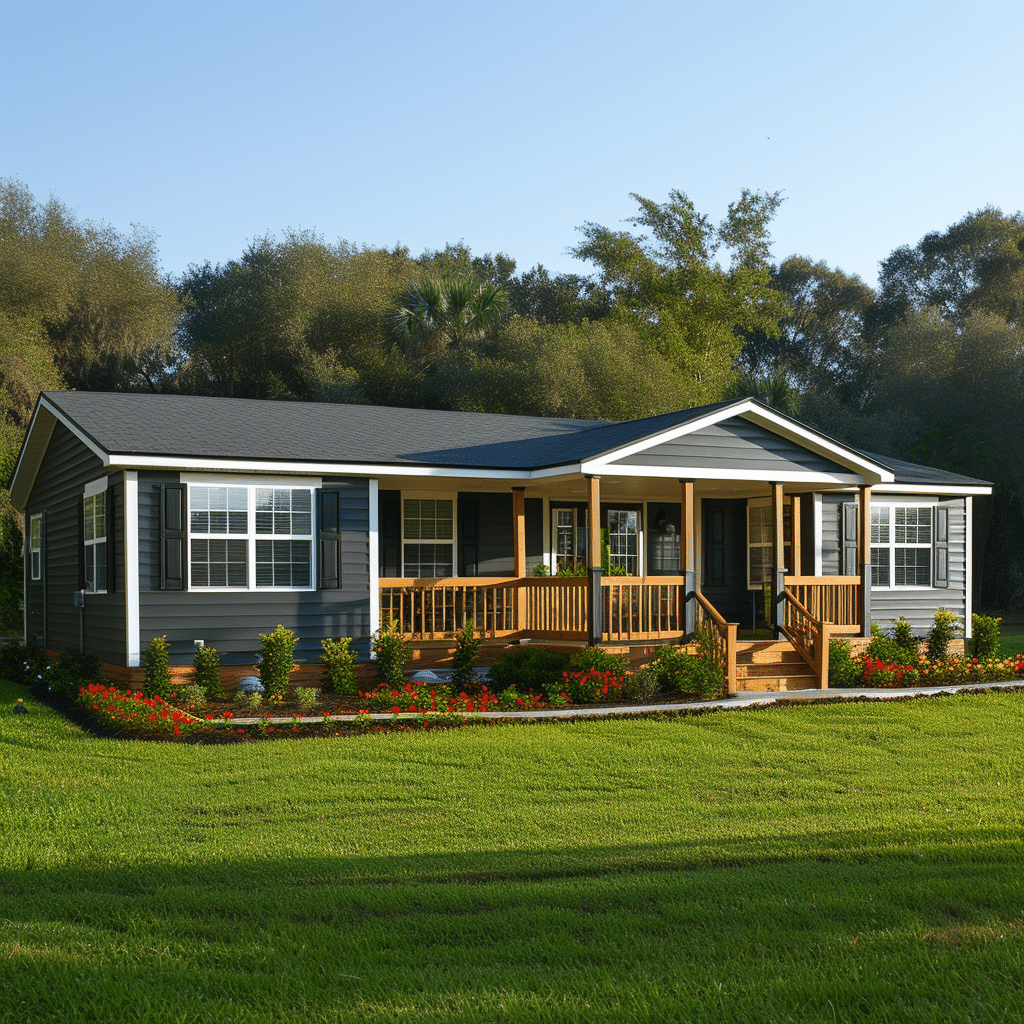

Remember the days when traditional brick-and-mortar houses were the only option for aspiring homeowners? Well, as Bob Dylan would sing it, “The times they are a-changin’.” Manufactured homes are now a practical solution for many, offering affordability and flexibility. But let’s be clear: these aren’t the Trailor homes” of yesteryear.

A manufactured home loan caters to properties that are built off-site and transported to their destination. These dwellings are often more affordable than traditional homes, which is a big thumbs-up for budget-conscious buyers. However, the key differences between manufactured and stick-built home loans could fill a book thicker than the “1984” novel, ranging from depreciation factors to loan terms.

Fact 1: Banks That Finance Mobile Homes with Land

Finding “banks that finance mobile homes with land” can occasionally feel like you’re trying to spot a leprechaun with a pot of gold. But certain financial institutions, like Wells Fargo and Quicken Loans, have recognized the changing tides and now cater to this niche market.

The search for banks that will support your manufactured home dream isn’t like trying to find “the A-Team” in their heyday – it’s much simpler. These banks look for creditworthiness, an acceptable debt-to-income ratio, and, crucially, the home needs to be classified as real property. You can expect interest rates to be slightly higher than traditional loans, with terms and conditions crafted to suit this unique form of homeownership.

Fact 2: How to Buy a Mobile Home with No Money Down

You might be thinking that purchasing with no money down is as likely as Tony Micelli scoring a perfect game in “Who’s the Boss” – but it’s not just a sitcom pipe dream! Innovative financing options are out there and accessible, even for mobile homes.

The USDA, for instance, offers loans for rural home buying that might just make your day. These government programs assist people who meet certain income and location criteria to leapfrog over the traditional down payment hurdle. Following a step-by-step guide to navigating these no-money-down options can put the keys to a new home in your pocket faster than you can book a professional sports speaker for your event.

Fact 3: Nuances of a Mobile Home Mortgage

Here’s where the rubber meets the road or, in this case, where the mobile home meets the mortgage. Unlike traditional housing, manufactured homes typically depreciate in value over time – though, some exceptions do exist.

Your usual “mobile home mortgage” comes with nuances that can make your head spin more than watching the entire A Christmas Carol 1984 cast rendition in double speed. For instance, Bank of America might offer mortgage packages that seem different from what you’ve seen in the traditional housing market. That’s because these packages need to account for the home’s potential depreciation. So, snatching the best mortgage terms will require some savvy – think scouting for Mobilehome insurance rather than settling for the first policy you stumble upon.

Fact 4: The Mobile Loan Approval Process

Consider the mobile loan approval process as an obstacle course that’s tailored just for you. It’s about proving your mastery and fit for the challenge. In this realm, lenders will pore over your documentation – from credit score to income verification – with as much attention as you’d give to “the best podcasts of 2024.

Before jumping into this process, tailor your borrower profile to look as fetching as a meticulously designed “mobile home near me” listing. Ideal candidates come prepared with their documents in a row, much like ducks, and possess an awareness of the underwriting quirks specific to mobile loans.

Fact 5: Long-term Considerations for Manufactured Home Loans

In a long-term relationship with your manufactured home loan, you’ll want to be as harmonious as the Whos The Boss cast. Depreciation is the ever-looming shadow in this narrative, but it doesn’t have to spell out an unhappy ending. Building equity can be an art form if you play your cards right, focusing on improvements and maintenance that add value.

Refinancing options are the cliffhanger in your home loan saga. Considering them at the right time can revive the storyline and set you back on a prosperous path, depending on interest rate trends and your financial situation. Weighing the pros and cons, much like assessing whether to invest in a mobile home trailer, will give you clear insight into your next act.

Conclusion: Navigating the Realm of Manufactured Home Financing

You’ve now traversed the mountains and valleys of manufactured home loans. They’ve evolved over time, much like a Dickensian character, from simple constructs to complex instruments adapted to 2024’s housing market.

Remember, dear reader, the strategies that can springboard you to the best loan for your needs are not buried deep within Marley’s crypt. They’re right here in the sensible, deliberate steps and savvy decisions of today’s manufactured home buyer.

As you ramble onwards, bear in mind that informed decision-making is your golden ticket in the realm of manufactured home investment. Consider the environmental and economic benefits of manufactured homes – they’re more than just a roof over your head; they’re a testament to the human spirit’s adaptability and ingenuity in an ever-evolving world. So go forth, prospective borrowers, and make your housing dreams a reality with the confidence of Ebenezer Scrooge on Christmas morning – transformed, informed, and ready to seize your day.

Unraveling the World of Manufactured Home Loans

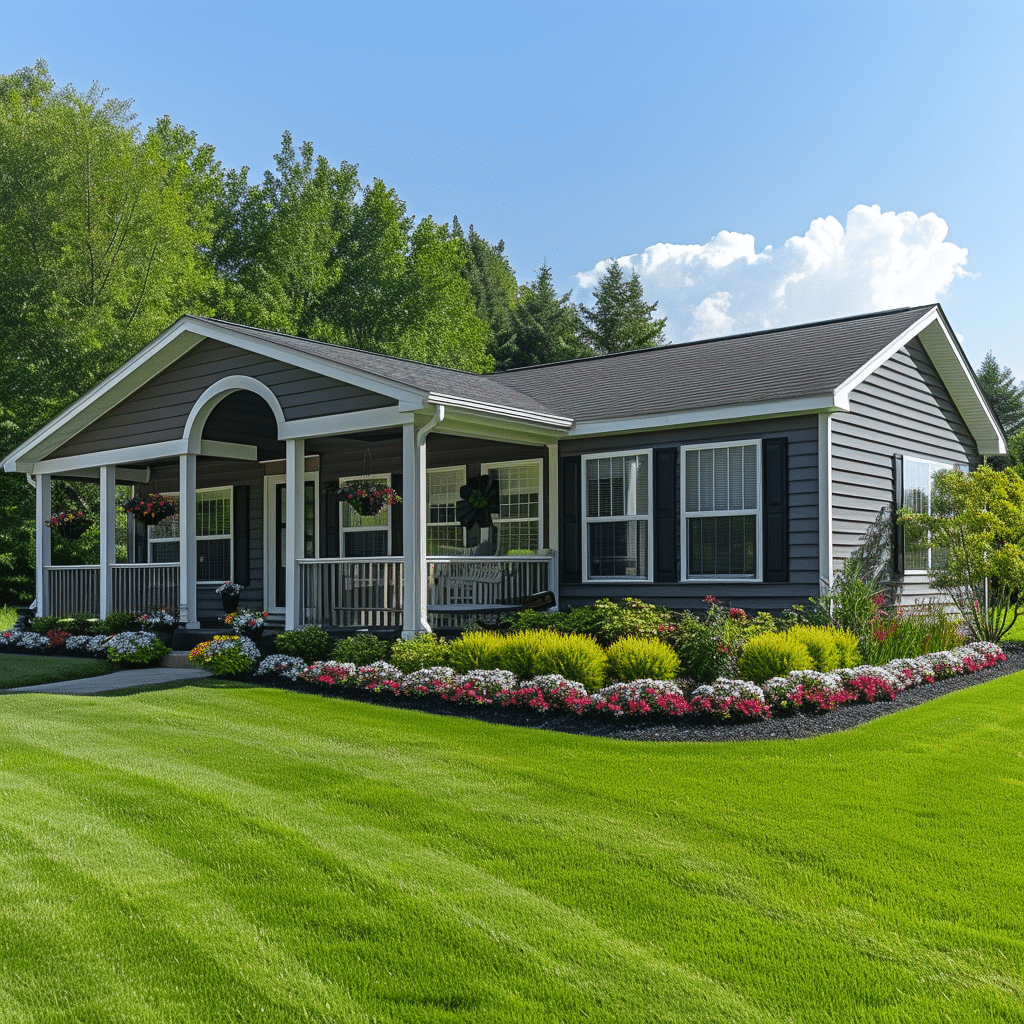

If you’re looking to snag a cozy corner of the world without breaking the bank, then listen up, because the path less traveled might just lead to a manufactured home loan. It’s true! These loans aren’t your garden-variety mortgages, and they’ve got a few tricks up their sleeve that can make becoming a homeowner as easy as pie.

A Moving Experience!

Ever dreamt of living in a home that could actually, well, move? With a manufactured home, that’s more than just a pipe dream. But get this – when it’s time to settle down, finding the perfect Mobil home near me is only a click away. No more endless scrolling or head-scratching; with the right click, you’re already halfway home!

The Finance Squad

Think “The A-Team,” but for mortgages. Securing a manufactured home loan takes a certain kind of finesse and a team that knows the ins and outs like the back of their hand. When exploring your options, remember it’s not just about finding a place to hang your hat, but also about assembling The A team cast of lenders who’ll help you navigate the nitty-gritty of loan terms and interest rates.

Learn On-the-Go

Who says learning about loans has to be dull? Add some pep to your step and some knowledge to your noggin with the best Podcasts 2024 on the go. While you’re jogging or commuting, tune in and turn up the wisdom as you learn the ins and outs of manufactured home loans. Before you know it, you’ll be dropping knowledge bombs like a pro!

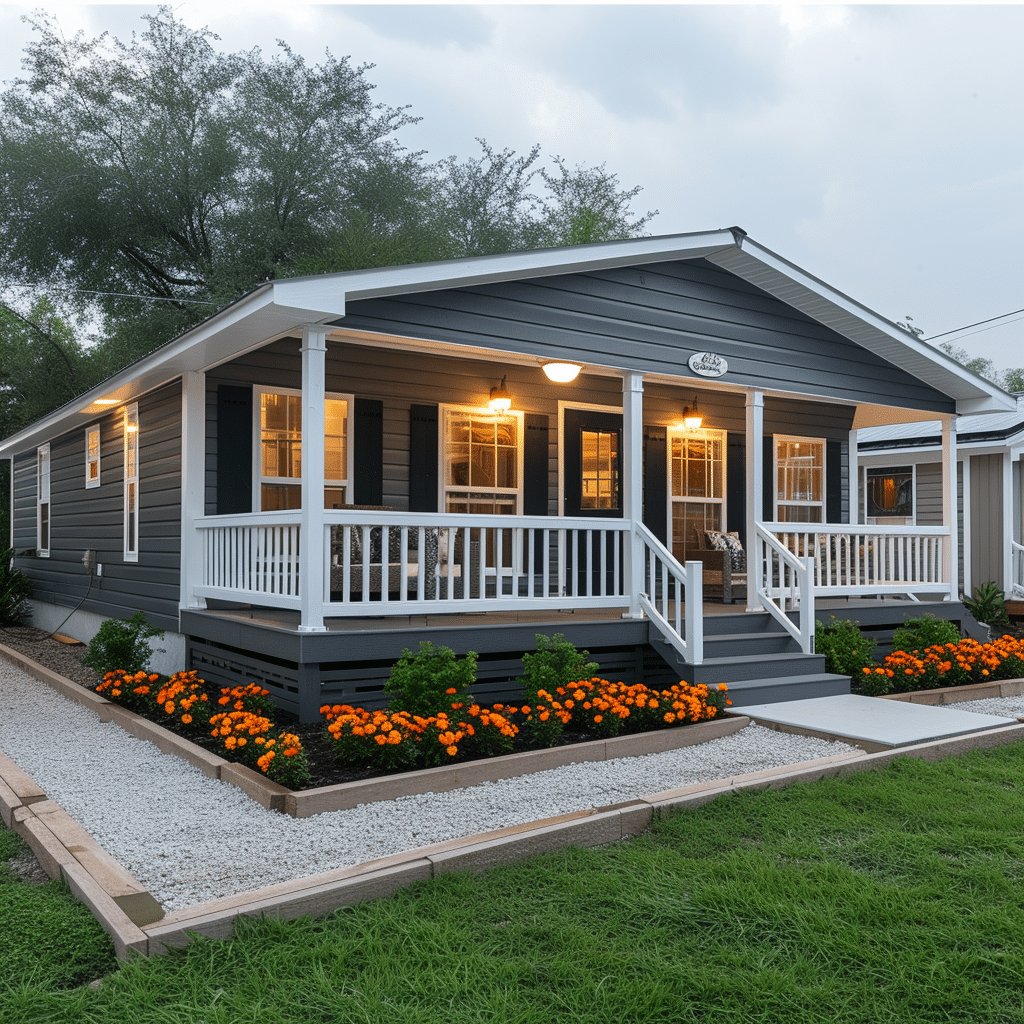

Touchdown for Your Budget

When you score a manufactured home loan, it’s like booking a top-tier ‘professional sports speaker’ for your high school pep rally – a total game-changer. These loans can be more budget-friendly than traditional mortgages, putting the goalposts of homeownership well within reach. Just think of all the touchdown dances you’ll be doing in your very own space!

So there you have it, some fun-size nuggets of info that might just tip the scales in favor of a manufactured home for your next pad. Remember, when it comes to home loans, it’s not one size fits all. A manufactured home loan could be the tailor-made suit you never knew you needed! Keep your ear to the ground, your eyes on the prize, and who knows? Your dream home might just come on wheels.

Who is the best lender for manufactured homes?

– Huntin’ down the best lender for manufactured homes is tricky, ’cause, let’s face it, they’re not everyone’s cup of tea. But hey, don’t sweat it! Fannie Mae’s steppin’ up to the plate, offering mortgages for these homes when they’re titled as real estate. So, find yourself an approved lender who plays ball with Fannie Mae, and you’re golden!

Is it harder to get a mortgage for a mobile home?

– Is it harder to get a mortgage for a mobile home? Well, in a nutshell, yes. Most mortgage lenders turn their noses up at financing mobile or manufactured homes, what with the lower cost and the worry about ’em losing value faster than a soufflé in a thunderstorm. But don’t throw in the towel; there are still a few options out there.

What is the loan term for a mobile home?

– When it comes to mobile home loan terms, they’re not marathon-long, but you’ve got a decent stretch ahead. Title I manufactured home loans generally have a term of up to 20 years—just enough time to plant your roots and watch ’em grow!

What credit score do you need for a Fannie Mae manufactured home?

– Dreamin’ of a Fannie Mae manufactured home? You’ll need at least a credit score of 620 to meet their standard credit requirements. So, if your credit score’s sittin’ pretty in that ballpark, you’re in the game!

Why is it harder to get a loan for a manufactured home?

– Why the tough road for manufactured home loans? Well, these abodes tend to drop in value like a hot potato, and lenders are about as keen on that as cats are to swim. They often cost less, too, which means lenders make less dough, and let’s be honest—no one’s excited about smaller slices of pie.

What is a method for financing manufactured homes?

– Financing your mobile house dreams? Title I manufactured home loans have got your back. They’re not free money from Uncle Sam, but you can hash out a fixed interest rate with the lender and have a solid 20 years to pay it back.

Why don’t lenders like manufactured homes?

– Lenders give manufactured homes the cold shoulder mainly ’cause they’re like cars—drive ’em off the lot, and their value starts droppin’ like flies. Banks aren’t too thrilled to gamble on something that might not be worth its salt down the road.

Why do banks not finance manufactured homes?

– Banks are all about playing it safe, and when it comes to financing manufactured homes, they’re more skittish than a long-tailed cat in a room full of rocking chairs. It’s ’cause these homes often cost less and shed value faster than a snake sheds skin.

Why do banks not finance mobile homes?

– Why do banks have the jitters about financing mobile homes? Simple—they’re scared stiff about the resale value plummeting faster than stock in a bubble-gum blowing contest. Plus, the dough they rake in on these loans often isn’t worth the hassle.

How long are most mobile home loans for?

– Most mobile home loans aren’t a sprint; they’re more like a nice, leisurely stroll. With a typical loan term of up to 20 years, you’ve got some serious time to kick back and make yourself at home.

What is the oldest manufactured home that can be financed?

– Got your eye on a vintage manufactured home? Well, hold your horses. The actual age limit for financing can be as flexible as a yoga instructor or as strict as a drill sergeant, depending on the lender. But keep in mind, the younger, the better for snagging that loan.

Why are mortgage rates higher for mobile homes?

– Mortgage rates for mobile homes? Higher, my friend—like a giraffe’s neck. It’s ’cause these homes go down in value faster than a lead balloon, and lenders gotta cover their backs with a few extra bucks.

What FICO score do you need to buy a mobile home?

– If you’re lookin’ to hitch your wagon to a mobile home, you’ll need a FICO score that’ll make lenders sit up and notice. Something around 620 should just about do the trick, depending on the specifics of the loan.

Which type of loan on a manufactured home would not be eligible for purchase by Fannie Mae?

– Wanna a loan for a manufactured home but not in Fannie Mae’s ballpark? Well, homes not titled as real estate are sitting on the bench, I’m afraid. That’s the kind of ball game Fannie Mae just won’t play.

What credit score do I need for an FHA loan?

– Lookin’ to get your mitts on an FHA loan for that shiny new residence? Roll up with a credit score of at least 580 to put down just 3.5%, or strut in with a 10% down payment if your score’s sittin’ between 500 and 579.

What company makes the best quality manufactured homes?

– Talkin’ about who’s the cream of the crop for manufactured homes? Everyone’s got a different top dog, but do a little digging, read some reviews, and you’ll find a manufacturer that’s the bee’s knees—solid, reliable, and the talk of the town.

Why do lenders not like manufactured homes?

– Lenders give manufactured homes the side-eye ’cause they dive in value faster than you can say “belly flop,” and they don’t rake in much cash for the banks. It’s a tough crowd, and lenders are choosy about who they invite to the party.

What is the average credit score needed to buy a mobile home?

– Average credit score to buy a mobile home? Well, it isn’t set in stone, but you wanna aim for the stars—or at least a 620 or thereabouts—to keep lenders from showin’ you the door.

How much do you have to put down on a manufactured home in California?

– Droppin’ a down payment on a manufactured home in California? Brace yourself—it could be around 5-10% of the home’s price. But hey, it’s California, land of palm trees and big dreams, where prices often soar higher than a Hollywood blockbuster.