Let’s break it down, folks! When you’re living or pulling in bread from the Land of 10,000 Lakes, understanding Minnesota income tax rates is crucial. Whether you’re sipping coffee by Lake Superior or hustling in downtown Minneapolis, your wallet needs to know what’s up with the tax man. So grab your calculators and let’s dive into the world of Minnesota income tax, shall we?

Determining Your Position in MN Tax Brackets 2024

Minnesota’s tax brackets are a bit like the seasons – they change every year and you’ve got to be ready for them! For 2024, you’ll find yourself wrapped up in one of four cozy brackets, with rates from a chilled 5.35% to a toasty 9.85%.

Navigating the Impact of Minnesota Income Tax Rates on Your Finances

Is the tax bite as bad as a Minnesota winter? Not entirely. But just like gearing up for the cold, you need to wrap your head around these rates for solid financial planning.

| Tax Rate | Single Filer | Married Joint Filer | Married Separate Filer | Head of Household |

| 5.35% | Up to $27,230 | Up to $39,410 | Up to $19,705 | Up to $32,600 |

| 7.05% | $27,231 to $87,110 | $39,411 to $156,570 | $19,706 to $78,285 | $32,601 to $131,190 |

| 7.85% | $87,111 to $164,400 | $156,571 to $273,470 | $78,286 to $136,735 | $131,191 to $214,980 |

| 9.85% | Over $164,400 | Over $273,470 | Over $136,735 | Over $214,980 |

Exploring Deductions and Credits Within Minnesota’s Tax Code

Want to save some green? Don’t overlook deductions and credits, folks. They’re like a secret fishing spot – a real treasure if you know where to look!

For example, knowing a thing or two about the Minnesota sales tax rate could be as useful as a good pair of winter boots. At 6.875%, it’s not just about what you earn but also about how you spend.

Four Seasons of Taxation: Understanding Minnesota’s Property and Seasonal Taxes

In Minnesota, we’ve got a different kind of season ticket – property and seasonal taxes. And trust me, they’re about as popular as a snowstorm in April.

The Nuances of Minnesota’s Tax System for Businesses

It’s not just personal taxes that can trip you up; businesses have their own tax tightrope to walk in Minnesota.

Preparing for Tax Season: Filing Tips and Deadlines

It’s like prepping for the first snowfall – you know it’s coming, so better to have your shovel at the ready. The deadline for filing is as firm as the ice on Lake Itasca come January.

Innovations in Minnesota’s Tax Policy: Looking Toward the Future

Ever watch “Succession Season 4“? Well, tax laws can have just as many twists and turns. Keeping up with recent changes is as crucial as keeping your ice scraper handy.

Minnesota Income Tax Calculator: Estimating Your Tax Liability

Math not your strong suit? Fear not! There are digital helpers out there. A Minnesota income tax calculator can estimate what you owe before you dive in.

MN Tax Brackets 2024: A Look at the Big Picture

Zoom out and what do you see? Tax brackets that ebb and flow like the Mississippi River. Keeping an eye on long-term trends gives you the lay of the taxation land.

Savvy Tax Planning: Proactive Strategies for Minnesotans

Feeling bold? Minnesota offers clever ways to manage taxes that are as slick as a freshly Zambonied ice rink.

Financial Forecast: Anticipating the Effects of Minnesota Income Tax Rates on Your Budget

Crafting a financial forecast without factoring in taxes? That’s like hitting the Boundary Waters with no paddle. Be smart – include Minnesota income tax rates in your budgeting blueprint.

A Fresh Perspective on Fiscal Responsibility Amidst Changing Tax Landscapes

Minnesota prides itself on not just cold winters but also a warm sense of community responsibility, especially when it comes to taxes.

Synthesizing Minnesota’s Tax Codes: A Holistic Understanding

Navigating Minnesota’s tax codes can sometimes feel like trudging through a blizzard. But with a bit of gumption and the right know-how, you’ll get to spring with your finances intact.

So there you have it, Minnesota’s tax terrain in a nutshell – twisty, turny, but totally navigable with the right compass. Keep this guide handy, and you’ll be talking tax like a pro at your next potluck. Stay savvy, stay smart, and here’s to keeping your earnings as warm and cozy as a Minnesota welcome!

Fun Trivia: Navigating the Land of 10,000 Tax Rates

Ah, Minnesota, known for its frigid winters, friendly folks, and—if you’ve ever taken a peek at their tax code—confusing income tax rates. It’s not quite as complicated as putting together furniture from that Swedish store, but close! Let’s dive into some trivia and cool facts that make understanding Minnesota’s income tax as engaging as watching your favorite hockey team score in overtime.

Did You Say “Land of 10,000 Lakes” or “Tax Brackets”?

Okay, we’re pulling your leg—Minnesota doesn’t really have 10,000 tax brackets. But, just like spotting the distinctive blue and white on the Cuba flag, identifying your correct tax bracket in Minnesota has a certain flair to it. The state boasts several tax rates that range from 5.35% all the way up to 9.85%. So, you might not need to sail to Havana to feel the waves; checking your tax rate bracket can send you on a roller coaster ride of its own!

Bet You Didn’t Know This About Minnesota Taxes

Hold onto your snow hats, because this one’s a doozy. Did you know that Minnesota was among the first states to implement an income tax back in 1933? That’s right, during the thick of the Great Depression, Minnesota decided it was time to start chipping in. Talk about timing, huh? Just goes to show that much like asking “How accurate Is Capital one auto Pre approval?” when it comes to getting a new car, when diving into taxes, it’s always best to find the most reliable source possible to steer you in the right direction.

The Curious Case of the “Marriage Penalty”

Ever heard of the term “marriage penalty”? In the world of taxes, it’s the odd phenomenon where some married couples end up paying more taxes filing jointly than they would individually. Well, Minnesota is one of the states where this can happen. It’s like deciding to share an ice fishing hut and finding out you’ve got less wiggle room than you thought. It’s not a deal-breaker, but definitely something to consider if you’re tying the knot in the North Star State.

In conclusion, figuring out your Minnesota income tax rate might not be a walk around Lake Minnetonka, but it’s certainly not as tough as numbing your toes off at a December Vikings game. With a dash of humor, a sprinkle of curiosity, and a reliable guide, you’ll navigate those rates like a pro. So buckle up, grab your tax compass, and let’s make understanding Minnesota’s income tax rates as enjoyable as a slice of homemade apple pie—à la mode, of course!

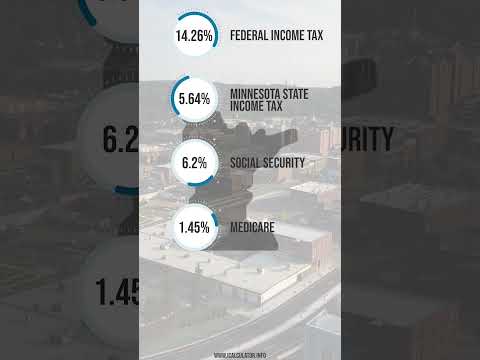

What is the MN state income tax rate?

– Oh, the Land of 10,000 Lakes and just as many tax questions, huh? Well, the MN state income tax rate is a bit of a sliding scale, buddy. It ranges from 5.35% to 9.85% depending on how much dough you’re bringing in.

What are the mn tax brackets for 2023?

– Brace yourself! The MN tax brackets for 2023 have a little something for everyone, whether you’re earning a little or a lot. They’re set up in four tasty tiers, starting at 5.35% for the low earners and ramping up to 9.85% if you’re really raking in the cash.

What are 2023 federal tax brackets?

– Alright, get ready to crunch some numbers! The 2023 federal tax brackets have been sliced and diced into seven juicy chunks, ranging from 10% to a top rate of 37%, depending on your income. Remember, Uncle Sam’s gotta get his cut!

Do you have to pay taxes on Social Security in Minnesota?

– Have to pay taxes on Social Security in Minnesota? Yep, you might! But hold your horses—it’s not as simple as a yes or no. Your Social Security may be taxed depending on your total income. So, you could be off the hook if you’re not above a certain limit.

Why is Minnesota income tax so high?

– Why is Minnesota income tax so high? Whoa, let’s not get all flustered! It’s because the state offers a boatload of services and wants to keep things nice and tidy, like those pristine lakes. High-quality services come with a price tag, after all.

Is Minnesota income tax high?

– Is Minnesota income tax high? You betcha! When you compare it to other states, Minnesota tends to be on the higher end. But remember, it’s a trade-off for all the top-notch public goodies they provide.

Does MN tax retirement income?

– Are your golden years in MN gonna be taxed? Yep, Minnesota does tax retirement income, including pensions and IRA withdrawals. But hey, there are some exemptions, so don’t panic just yet!

What is not taxed in Minnesota?

– What’s not taxed in Minnesota? Well, wouldn’t you know it—clothing, prescriptions, and most groceries get a free pass. So, you can at least save some bucks when you’re out shopping for the essentials!

Does Minnesota tax out of state income?

– Oh, the eternal question: Does Minnesota tax out of state income? In a nutshell, if you’re living in MN but earning money from out of state, you could still be on the hook for state taxes. But it’s a two-way street – credits for taxes paid to other states are part of the deal.

How much federal tax should I pay on $50000?

– How much federal tax on $50,000? Well, it’s not pocket change, but on 50 grand, you’d be in the 22% bracket for 2023. Don’t forget, though, it’s all about that taxable income after deductions and credits!

How do I know what tax bracket I am in?

– How to know your tax bracket? Easy peasy! Just take a gander at your taxable income after you’ve subtracted deductions. Then match it up with the IRS’s tax bracket table for the year. Voilà, you’ll find your spot!

At what age is Social Security no longer taxed?

– At what age is Social Security no longer taxed? It’s not about age, my friend, but rather how much other income you’re pocketing alongside your Social Security benefits. If that number’s low enough, Social Security can be tax-free regardless of your age.

How much money do I need to retire in Minnesota?

– How much to retire in Minnesota? Well, how long is a piece of string? It really boils down to your lifestyle. But ballpark? Financial advisors often suggest a nest egg upwards of a cool mil to live comfortably. Time to start saving!

Is Minnesota a good state to retire in?

– Is Minnesota a good state to retire in? Sure, if you’re into beautiful scenery and don’t mind the cold shoulder from Mother Nature now and then. The high taxes can be a bit of a snowdrift on your budget, though.

Does Minnesota have a property tax discount for seniors?

– Does Minnesota have a property tax discount for seniors? Yep, Minnesota doesn’t leave its older folks out in the cold – there’s a property tax deferral program for the senior citizens who qualify. A little financial warmth!

Is Minnesota tax friendly for retirees?

– Is Minnesota tax friendly for retirees? Well, it depends on who you ask! There are some perks, like the property tax deferral, but remember those retirement income taxes? They can be a bit nippy on your wallet.

What are the income tax rates for each state?

– Curious about income tax rates for each state? It’s a wild mix, with some states like Florida and Texas not taking a bite out of your income at all, while others, like California, might nibble a good chunk off.

How much is 150k after taxes in Minnesota?

– What’s 150k after taxes in Minnesota? That’s a decent chunk of change! You’re looking at around 30-33% going to taxes, including federal and state. So, you’d pocket around $100,000 to $105,000. Still not too shabby!

What state has the highest income tax?

– Which state has the highest income tax? California, come on down—your residents could be forking over up to a whopping 13.3%! That’s one title you might not want to win.