Why You Need a Monthly House Payment Calculator

Navigating the mortgage landscape can feel like trying to find your way through a maze. A monthly house payment calculator is your guiding light, making it easier to predict and manage future expenses. Whether you’re an aspiring homeowner or a seasoned real estate investor, this tool is essential for understanding your financial commitment and planning accordingly.

Imagine being able to clearly see how much you’ll owe each month before signing on the dotted line. No surprises, just solid numbers. That’s the magic of using a monthly house payment calculator. It gives you the power to make informed decisions by providing an accurate insight into your potential monthly payments.

By understanding your monthly payments, you can better plan your budget, ensuring that homeownership remains a joy rather than a burden. This tool helps you break down your payments into manageable chunks, so you’re never caught off guard.

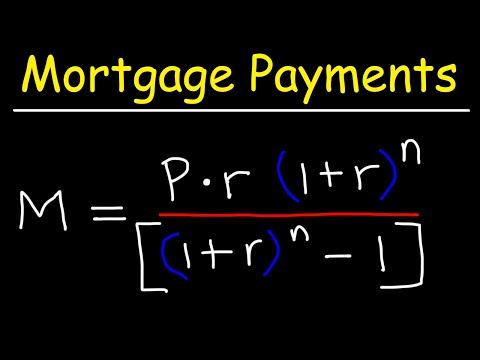

Understanding How a Monthly House Payment Calculator Works

To get the most out of a monthly house payment calculator, you need to grasp the key factors it considers. Let’s dive into the essential components:

Understanding these components simplifies the calculation process, ensuring you get an accurate picture of your monthly obligations.

Top 5 Monthly House Payment Calculators in 2024

Here are five standout mortgage calculators rated for their reliability, simplicity, and depth of features:

Key Benefits of Using a Monthly House Payment Calculator

Utilizing a monthly house payment calculator offers numerous benefits:

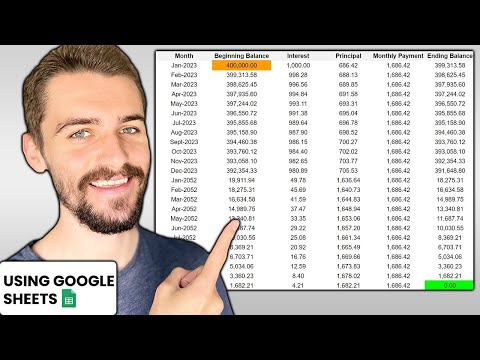

In-depth Analysis: Real Case Studies

Exploring real-life examples where individuals have used a monthly house payment calculator can offer valuable insights.

Jane was a first-time homebuyer who used the Zillow Mortgage Calculator. By inputting her details, she found that a 30-year fixed-rate mortgage was $200 less per month than a 15-year term. This allowed her to plan her budget better and purchase her dream home with confidence.

Tom, a seasoned investor, relied on the Bankrate Mortgage Calculator to analyze several investment properties. By comparing scenarios, he discovered that a property with lower taxes and insurance rates would significantly boost his cash flow. This analysis guided his decision-making, ensuring maximum profitability.

How to Maximize the Benefits of Your Monthly House Payment Calculator

To get the most out of a monthly house payment calculator, follow these tips:

By entering accurate data and exploring various scenarios, you can fully leverage the calculator’s potential.

Innovating Your Financial Decisions with Technology

Incorporating a monthly house payment calculator into your financial toolkit goes beyond convenience—it’s a strategic move. This calculator empowers you with data and insights necessary for making well-informed decisions about your mortgage.

These tools demystify home loans, breaking them down into digestible information. This clarity allows you to be proactive rather than reactive, making sound decisions for your financial future. Whether you’re exploring different loan terms, evaluating interest rates, or considering insurance cost variations, a monthly house payment calculator is your go-to companion.

By diving into different scenarios and understanding the full picture, you can confidently take control of your financial journey. Let technology guide your financial decisions, offering peace of mind and stability.

Remember, informed decisions lead to better financial health. Use a monthly house payment calculator to navigate the mortgage landscape with ease, ensuring every step you take is a step towards long-term financial success. Explore your options, adjust your plans, and take charge of your housing finances with confidence.

Take the first step now and try our monthly mortgage calculator to gain a clearer understanding of your financial future.

In summary, navigating through your financial options with tools like a monthly house payment calculator can ease a lot of stress, provide solid insights, and help you make sound, informed decisions. So, are you ready to explore the potential of your financial future? Dive in, and let’s make those numbers work in your favor!

Monthly House Payment Calculator: Fun Trivia and Interesting Facts

Unlocking Interesting Insights

When it comes to calculating your monthly house payment, who would’ve thought there’s fascinating trivia hidden behind those numbers? Let’s dive into some titbits. For example, using a reliable monthly house payment calculator can save you a lot of hassle in the future. It’s surprising, but being precise about your calculations might just keep the negative amortization monster at bay. Ever heard of it? It’s a sneaky scenario where your loan balance increases despite making payments! Not fun, right?

Historical Oddities

Now, let’s get into some quirky history. Believe it or not, in ancient times, people used apotropaic symbols to ward off evil spirits from their homes. While these symbols were quite effective back then, I guess today’s homeowners would prefer knowing their exact monthly mortgage payment instead of relying on mystical symbols!

Pop Culture and Beyond

Speaking of curious facts, did you know that in the popular Girls Last Tour Manga, the dystopian adventure of the two characters could make one deeply appreciate the comfort of having a home, let alone knowing the precise monthly payment? Sometimes, entertainment and reality intersect in the strangest of ways.

And, if you’re into language trivia, here’s a fun one: there are more words with “sari” in them than you might think. Curious? Look it up here. Wrapping your head around this could be as surprising as realizing how a monthly mortgage payment calculator( can simplify your life.

In short, whether you’re an ancient history buff, a manga enthusiast, or a language lover, there’s always something intriguing about breaking down your monthly house expenses. Plus, knowing these bits of trivia might make the process a tad more enjoyable!

How much is a monthly payment on a $400 000 house?

On a $400,000 mortgage with an interest rate of 6%, your monthly payment would be $2,398 for a 30-year loan and $3,375 for a 15-year one.

How much house can I afford if I make $7,500 a month?

If you make $7,500 a month, you might be able to afford a house priced between $225,000 to $262,500, depending on your debt, down payment, and other monthly expenses.

How much house can I afford at $1400 a month?

If you can afford $1,400 a month for your mortgage, you might qualify to borrow around $204,913. Add a $20,000 down payment, and you could purchase a home worth $224,913. Don’t forget you’ll need extra cash for reserves and closing costs.

What is the monthly payment on a $600000 mortgage?

With a $600,000 mortgage at a 7.00% fixed interest rate, your monthly payments would be roughly $3,992 for a 30-year loan and $5,393 for a 15-year loan.

How much house can I afford if I make $70,000 a year?

Making $70,000 a year, you could afford a house priced around $200,000 to $250,000, considering you have a good credit score, a decent down payment, and minimal debt.

How much is a monthly payment on a $350 000 house?

For a $350,000 mortgage at a 6% interest rate, your monthly payment on a 30-year loan would be approximately $2,098, while on a 15-year loan it would be about $2,953.

How much house can I afford if I make $36,000 a year?

With an annual income of $36,000, you could likely afford a home priced around $100,000 to $120,000, depending on your down payment and other financial factors.

Can I afford a 300k house on a 50k salary?

On a $50,000 salary, affording a $300k house is challenging. Typically, you could realistically afford a home in the $150,000 to $175,000 range, depending on your other expenses and debt.

Can I afford a house making $2000 a month?

Making $2,000 a month, affording a house would be tough as your budget might only allow for a home priced under $100,000, depending on your down payment and debt situation.

Can I buy a house if I make 3k a month?

With an income of $3,000 a month, you might qualify for a mortgage for a house priced between $100,000 to $125,000, considering your financial situation and debt.

Can I buy a house if I make 25K a year?

Earning $25K a year makes buying a house pretty challenging, but you might afford homes priced in the $50,000 to $75,000 range if you have savings for a down payment and minimal other debt.

What credit score is needed to buy a house?

To buy a house, a credit score of around 620 is generally the minimum for a conventional loan, though higher scores will get you better terms and interest rates.

How do people afford a $600000 house?

Affording a $600,000 house typically requires a high income, solid credit, a significant down payment, and minimal other debt. It’s usually feasible for those making over $150,000 a year.

Do I have to put 20 down on a house?

You don’t have to put 20% down on a house, but doing so helps you avoid private mortgage insurance (PMI) and lowers your monthly payment. Many lenders accept lower down payments with different conditions.

Is the 28/36 rule realistic?

The 28/36 rule is realistic for many people, as it suggests spending up to 28% of your gross monthly income on housing and 36% on total debts, helping maintain a balanced budget.