Understanding the intricate world of monthly payment calculator mortgage tools can feel overwhelming, but it’s essential for anyone serious about homeownership. These calculators are vital for homeowners and potential buyers to manage their finances effectively. By inputting loan details, they offer real-time insights into how much monthly payments will be, allowing for informed decision-making. We’ll explore the significant aspects, benefits, and top mortgage monthly payment calculators of 2024, providing thorough insights and analysis that will help you make the best choice.

Understanding Monthly Payment Calculators for Mortgages

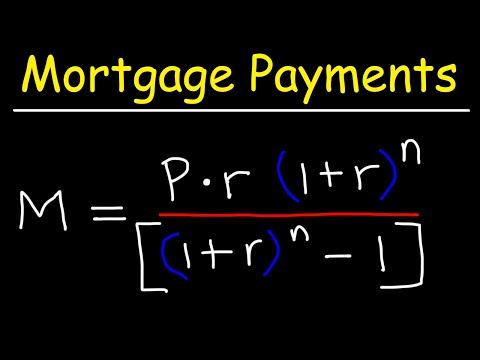

A monthly payment calculator mortgage tool is invaluable in today’s housing market. By entering details such as loan amount, interest rate, and loan term, you can instantly see your estimated monthly payments. This immediate feedback helps you budget effectively and make informed financial decisions. It’s not just about knowing the monthly cost but understanding the long-term financial commitment. The best mortgage calculators provide detailed breakdowns, including principal, interest, taxes, and insurance (PITI), helping you grasp the full scope of your mortgage.

Top 7 Monthly Payment Calculator Mortgage Tools of 2024

| Mortgage Principal | APR | Loan Term | Estimated Monthly Payment | Notes |

| $300,000 | 6% | 15 years | $2,531.57 | Excludes escrow costs. |

| $300,000 | 6% | 30 years | $1,798.65 | Excludes escrow costs. |

| $500,000 | 7.1% | 30 years | $3,360.16 | Payment range: $2,600 – $4,900. |

| $600,000 | 7% | 30 years | $3,992 | Excludes escrow costs. |

| $600,000 | 7% | 15 years | $5,393 | Excludes escrow costs. |

Enhancing Your Mortgage Planning with Monthly Payment Calculators

A monthly payment calculator mortgage tool is crucial for planning and managing mortgage payments. It offers real-time insights and personalized estimates, enabling informed decision-making. Whether you choose Quicken Loans, Bankrate, Zillow, NerdWallet, Redfin, Trulia, or Google, each tool offers unique advantages.

Beyond just using these calculators, pairing their insights with professional financial advice will help tailor your mortgage plan to your specific needs. By combining these tools with a thorough analysis of your financial situation, you can confidently navigate the significant investment of homeownership.

Discover how these tools can enhance your home-buying journey and strengthen your financial strategy, helping you achieve your homeownership dreams.

For more detailed projections based on your specific loan, try our monthly payment mortgage calculator and explore mortgage rate calculator. If you’re ready to take the plunge, apply For mortgage with us for a smooth experience.

Remember, understanding the specifics, like on a $300,000 mortgage with a 6% APR, you’d shell out $2,531.57 monthly on a 15-year loan, and $1,798.65 on a 30-year loan, not including escrow. For a $500K mortgage at a 7.1% interest rate, payments hover near $3,360.16 but could range from $2,600 to $4,900 depending on term and interest rate variations. Knowing these numbers underscores the need for a reliable mortgage calculator in your financial planning arsenal.

In the end, these tools not only break down complex mortgage data but also transform it into actionable insights. Embrace the power of these calculators and turn the daunting task of mortgage management into a straightforward, manageable process.

Monthly Payment Calculator Mortgage

Looking to navigate mortgage payments without breaking a sweat? The mortgage calculator by payment is your new best friend. This nifty tool helps you figure out your monthly dues, accounting for principal, interest, taxes, and insurance. But did you know there’s more than meets the eye?

Fun Facts About Mortgage Calculations

Let’s start with a curveball: the current interest rate can dramatically change your monthly mortgage payments. Wondering how? The current interest rate directly influences the cost of borrowing. A lower rate means cheaper loans, making a massive difference over a 30-year mortgage.

Here’s some trivia: the term “mortgage” actually comes from the Old French “mort gage,” meaning “dead pledge.” It’s called that because the pledge (the loan) dies when either the obligation is fulfilled, or the property is taken through foreclosure. Want to see how different property prices affect your payments? Give our home purchase calculator a whirl.

Intriguing Insights and Tools

Have you ever heard of Makoto Niijima? This character from the popular game Persona 5 uses strategic thinking to solve complex problems, much like tackling mortgage payments. Calculators simplify this elaborate process by breaking it into manageable chunks.

Another juicy tidbit involves “CO.” Ever pondered What Is The Co? The abbreviation stands for Certificate of Occupancy, and it’s essential when buying or refinancing a house. Knowing these little things can make your mortgage journey a lot smoother.

These fascinating nuggets not only enrich your understanding but also enhance how you strategize your mortgage plans. Keep playing around with the monthly payment calculator mortgage to stay ahead.

How much does a $300 000 mortgage cost per month?

For a $300,000 mortgage with a 6% APR, a 15-year loan will set you back about $2,531.57 per month, while a 30-year loan comes in at $1,798.65 per month. These amounts don’t include escrow costs, which vary.

How much would a $500000 mortgage cost per month?

If you’re looking at a $500,000 mortgage over 30 years with an interest rate of 7.1%, expect to pay around $3,360.16 monthly. Depending on your loan term and interest rate, your payment could range from $2,600 to $4,900 each month.

What is the monthly payment on a $400000 30 year mortgage?

For a $400,000 mortgage over 30 years, your monthly payment can differ widely based on your interest rate. Typically, it might be around $2,661 if we use similar rates for estimation, but it’s best to get a specific quote.

What is the monthly payment on a $600000 mortgage?

On a $600,000 mortgage at a 7% fixed interest rate, you’d be looking at monthly payments of about $3,992 for a 30-year term and $5,393 for a 15-year term. These figures don’t factor in possible escrow costs.

Can I afford a 300K house on a 60k salary?

With a $60,000 annual salary, a $300,000 house might be a stretch unless you have minimal debt and a solid down payment. Generally, lenders prefer your monthly housing costs to be around 28% of your gross income.

How much house can I afford if I make $70,000 a year?

Making $70,000 a year, you could likely afford a house in the $280,000 to $300,000 range, depending on your other debts and how much you can put down upfront. Keeping housing costs around 28-30% of your pre-tax income is a good rule of thumb.

How much is a 150K mortgage payment?

A $150,000 mortgage payment varies with interest rates and term, but on a 30-year loan at 6% APR, you’d pay roughly $899.33 monthly. Shopping around for the best rate can make a big difference.

How much is a $100000 mortgage per month?

For a $100,000 mortgage, a common estimate would be around $599.55 per month with a 6% APR on a 30-year term. Smaller loans tend to have higher interest rates, so shop around for the best deal.

What is the average monthly payment on a $250,000 house?

An average monthly payment on a $250,000 house typically falls around $1,498.88 assuming standard rates and a 30-year term. This doesn’t include insurance, taxes, or other escrow items which can add up.

What should your income be for a $400000 house?

To afford a $400,000 house, your income generally should be around $100,000 per year, assuming typical debt levels and a decent credit score. Lenders usually look for your housing payment to be no more than 28-30% of your gross monthly income.

What is the 20% down payment on a $400 000 house?

For a $400,000 house, a 20% down payment would be $80,000. Putting down a larger amount can lower your monthly payments and potentially eliminate the need for private mortgage insurance (PMI).

How much monthly is a 350k mortgage?

A monthly payment on a $350,000 mortgage would be approximately $2,099.52 on a 30-year term with a 6% APR. Variations in the rate and term will adjust this amount.

How much house can I afford if I make $36,000 a year?

With a $36,000 annual income, likely you’d afford a house in the $140,000 to $150,000 range. The key is keeping your monthly housing costs within 28-30% of your income.

How do people afford a $600000 house?

Affording a $600,000 house usually means having a substantial income, substantial savings for a down payment, and a good handle on other debts. For most, it includes a combination of dual incomes, savings, and good credit.

Is the 28/36 rule realistic?

The 28/36 rule is a decent starting point but may not account for everyone’s unique financial situation. It’s realistic for some, but not others, especially in high-cost living areas. Budgeting carefully is crucial.