When it comes to managing your mortgage, knowledge is not just power—it’s money in the bank. Understanding your mortgage amortization table is like holding the key to a treasure chest; it’s where all the secrets of your loan’s lifecycle are stored, ripe for the picking. With the right insight, you can save thousands and chart a faster course to financial freedom. But what makes an amortization table tick, and how can you turn this mundane-looking spreadsheet into a tool for financial success? Let’s embark on a journey to not just understand but to master the mortgage amortization table.

Demystifying the Mortgage Amortization Table

Imagine a roadmap that leads straight to the day you own your home outright—no strings attached. That, my friends, is your mortgage amortization table. It’s a detailed schedule that reveals the transformation of debt into equity, payment by payment.

At its core, an amortization table breaks down each mortgage payment into two critical pieces: the principal (the original loan amount) and the interest (the cost of borrowing). Add these together, and you’ve got your total monthly payment. After each payment, the balance remaining gives you a peek at your progress.

Now, let’s sprinkle some real-world savory seasoning into this. Say you’ve borrowed $300,000 at a 4% interest rate with a 30-year term. Early on, most of your monthly payment will be gobbled up by interest, but as time marches on, the principal gets a bigger slice of the pie. The amortization table shows you this shift with the precision of a Swiss watch.

The Nuts and Bolts of an Amortization Schedule

Peek behind the curtain of an amortization schedule, and you’ll find a recipe that’s part math wizardry, part financial foresight. The amortization calculation formula ensures that each payment chips away at the principal bit by bit while covering the interest cost. Honing in on the active voice here, you’re not just making payments; you’re strategically defeating your loan balance over time.

To grasp the mathematics, let’s dip our toes into a simple example. On that $300,000 loan at 4% interest, your initial payment might see a split where $1,000 tames the principal beast while $1,200 caters to the interest appetite. As months roll by, principal grows hefty, bodyslamming the interest amount. By the last payment, you’re practically kissing the principal, while interest sits in the corner, barely noticed.

The twist in this narrative is that while your payment amount remains consistent, the division between principal and interest changes—a dance choreographed by the amortization schedule for mortgage payments.

| Payment No. | Payment Date | Beginning Balance | Scheduled Payment | Principal | Interest | Ending Balance |

| 1 | Oct 1, 2023 | $200,000.00 | $954.83 | $288.16 | $666.67 | $199,711.84 |

| 2 | Nov 1, 2023 | $199,711.84 | $954.83 | $289.12 | $665.71 | $199,422.72 |

| 3 | Dec 1, 2023 | $199,422.72 | $954.83 | $290.08 | $664.75 | $199,132.64 |

| … | … | … | … | … | … | … |

| 358 | Aug 1, 2053 | $3,798.77 | $954.83 | $949.44 | $5.39 | $2,849.33 |

| 359 | Sep 1, 2053 | $2,849.33 | $954.83 | $952.52 | $2.31 | $1,896.81 |

| 360 | Oct 1, 2053 | $1,896.81 | $954.83 | $1,896.81 | $0 | $0.00 |

Mortgage Amortization Schedule: Visualizing Your Loan’s Future

A picture is worth a thousand words, and an amortization chart is like an epic novel for your mortgage. With one swift glance, it’s “whoa, I see the finish line!” This chart graphs the downward slope of your loan balance against time, highlighting how extra payments leave an indelible mark on your mortgage journey.

If you fancy making bold moves, such as adding a little extra to your monthly payments, the chart vividly showcases how this tweaks your timeline. Suddenly, it’s not a marathon—it’s a sprint!

How to Generate an Amortization Table Calculator

In an era where we can summon almost anything with a click, finding an amortization table calculator is a walk in the park. Tools from the likes of Bankrate or Zillow are like your personal mortgage gurus. Here’s the lowdown: punch in your loan amount, your interest rate, and your term, and boom—you’ve got your own custom mortgage amortization schedule calculator working its magic.

These online marvels don’t just give you numbers; they bare the soul of your mortgage, revealing the impact of varying interest rates and the power of extra payments.

Amortization Tables: Predicting Your Payoff Path

Slip into the shoes of a financial soothsayer. With your amortization table, you can gaze into the future and pinpoint the exact moment your home will truly be yours. Plotting an early escape? These tables are your compass.

Consider slathering your bread with extra principal payments now to reduce the loan’s lifespan. It’ll take a bit of belt-tightening, but the financial freedom payoff? Delectably rich.

The Amortization Calc: Cracking the Code of Monthly Payments

There are as many flavors of amortzation calc as there are homes. Whether it’s a fixed-rate or adjustable-rate mortgage you’re after, these calculators take the guesswork out of your monthly payment recipe.

Maybe you’re eyeing an adjustable-rate mortgage like a hawk, wary of interest rate hikes. Enter the loan amortization calculator. It plays out potential scenarios, spelling out what each could mean for your wallet’s well-being.

Analyze and Calculate Amortization the Expert Way

Let’s don the expert hat and scrutinize the amortization schedule with a fine-tooth comb. It’s not enough to simply know your monthly payment; it’s about discovering the true cost of your loan over the long haul. If Elon Musk were to calculate amortization, he’d look beyond the immediate horizon to the stars—or in this case, potential savings from refinancing or extra payments.

Imagine slashing years off your mortgage and pocketing the savings. That’s some serious life-pro points right there! It’s about being proactive, not reactive.

Debt Amortization Table: Your Blueprint for Financial Freedom

Your debt amortization table isn’t just a mortgage tool; it’s a Swiss Army knife for all debts. It’s the skeleton key to unlocking quicker routes out of auto loans, student debt, and more.

Plot one for each debt you have, and watch as they dovetail into a master strategy. Suddenly, what seemed an Everest of obligations shrinks to a manageable hill.

The Loan Amortization Calculator – An Essential Tool for Borrowers

With calculators from names like Quicken Loans, you’re waltzing with the pros. These aren’t your grandpa’s abacuses; these are smart, savvy tools superbly equipped to slice and dice your amortization needs.

Whichever tool catches your fancy, the aim is the same: peeling back the layers of your loan to give you a transparent view of what’s ahead.

Mortgage Amortization Table in Action: Case Study Analyses

Let’s roll out some case studies, shall we? Like that one borrower who juggled her payments like a pro, charting a course for early retirement. Or the entrepreneur who, using an amortization table, diverted funds to invest in his business without destabilizing his home base. Their secret? A well-oiled amortization schedule that aligned with their life goals.

Navigating Prepayments with Your Mortgage Amortization Schedule

Venturing into the world of prepayments can be like finding a hidden passage in a maze. With your trusty amortization schedule, decipher the code that is ‘optimal prepayment timing.’

Remember, it’s not just about pouring any extra cash into the mortgage; it’s about knowing when and how much will make the most impactful thud against your loan balance.

Strategic Insights: Utilizing Your Amortization Table Calculator for Long-term Benefits

Sometimes, homeowners play checkers while their mortgage plays chess. Let’s level up, shall we? Targeting principal payments with the precision of an archer, navigating interest rate fluctuations—these are just a couple of advanced maneuvers that your amortization table calculator can assist you with.

Implement these strategic gambits and watch the game change. You’re no longer a pawn; you’re a queen moving across the board with purpose and power.

Conclusion: Mastering Your Mortgage with the Right Tools

Stepping back, what’s the takeaway from our deep dive into the mortgage amortization table? It’s this: your table is more than numbers; it’s a narrative, a story of your commitment, your hardship, and ultimately, your victory.

Master its nuances and let it guide you to informed decisions. Consult it, update it, and above all, understand it. It’s not just about paying off a loan; it’s about claiming your financial independence with the deft touch of a strategist and the smarts of an economist.

The mortgage amortization table is your ledger, your scroll of wisdom, and in the journey of homeownership, it’s one of the mightiest tools at your disposal. Use it well, and it will pay dividends in the currency of peace of mind and, yes, real, hard cash.

So there you have it, the bona fide secrets of mortgage mastery. Equip yourself with these insights and march forth with your mortgage amortization schedule as your flag. Let it be the beacon in your pursuit of a debt-free horizon. Your home is your castle—let no mortgage stand in your way.

Unlocking the Secrets of Mortgage Amortization Tables

Mortgage amortization tables may not be the most thrilling topic at first blush, but hang tight, because we’re about to inject some fun into finance! You thought understanding your mortgage was as dry as a chipotle pepper in the desert sun, but I’m here to spice things up—though I’m fresh out of Chipotle coupon Codes. Now, let’s dive headfirst into the captivating world of mortgage amortization.

A Path to Financial Motivation

Picture this: Every time you glance at your mortgage amortization table, it’s like listening to a motivational speaker cheering you on as your balance diminishes—boo-yah! With each payment, you’re one step closer to owning your home outright. Think of your table as the roadmap of your mortgage journey, steering you clear of interest-heavy payments and toward the land of equity. So, before you start, inspire yourself to conquer that mortgage!

A Tale of Two Interests

Riddle me this: Did you know that in the early stages of your loan, you’re basically just giving your lender a fancy interest dinner, and the principal is just an after-dinner mint? But fear not, as the tables turn—literally. As you progress, like a narrative twist straight out of a Kirsten Storms plotline, more of your payment goes toward the principal, not the lender’s pocket.

The Hidden Cast Members: Principal and Interest

Just like a gripping Ratched cast ensemble where each character plays a vital role, your mortgage payment has some key players too. Initially, interest hogs the spotlight, but don’t underestimate the silent power of the principal lurking in the background. Over time, this unsung hero takes center stage, and before you know it, you’ve got more equity than a Broadway producer on opening night.

When “Amortize” Becomes Your Favorite Verb

Let’s not mince words: to “amortize” is probably one of the most satisfying financial actions you can take. Who wouldn’t feel triumphant watching their loan’s principal get pulverized with the force of an Alycia Baumgardner knockout punch? Every payment is a jab at that mortgage balance, showing it who’s boss.

The Art of Forecasting

Forecasting your budget with a mortgage amortization table can be as precise as predicting tomorrow’s weather—sometimes it’s spot-on, and other times, well, you get the idea. It’s crucial to remember that although this table can be a nifty crystal ball for your finances, life might pitch you a curveball. So, stay on your toes, and be ready to adapt like a financial ninja.

Bottom line: Your mortgage amortization table is more than a snooze-worthy spreadsheet—it’s a roadmap, a cast of characters, a motivational speech, a weather forecast, and a financial punch all rolled into one. Approach it with a bit of humor and a dash of creativity, and you’ll be the master of your mortgage universe before you know it. Now, go out there and amortize like a champ!

How do you calculate mortgage amortization schedule?

Calculating a mortgage amortization schedule can seem daunting, but it’s a piece of cake with the right tools. You’ll just need the loan amount, interest rate, and term length. Crunch the numbers using an online calculator or excel formulae – they’ll do the heavy lifting, churning out how much of your payment goes towards the principal vs. interest over the life of the loan.

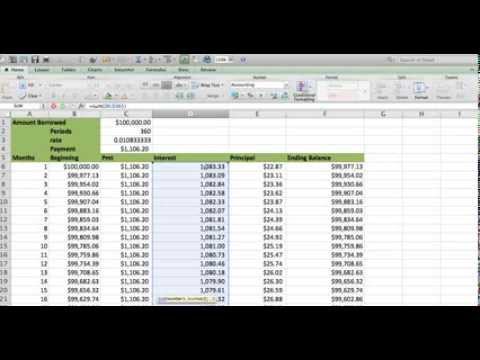

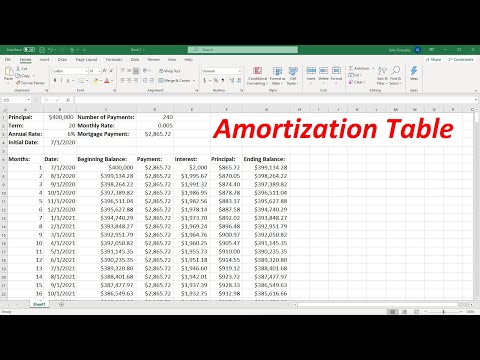

How do you create an amortization table?

Want to craft your own amortization table? Grab a spreadsheet and let’s get rolling! Start by jotting down your loan balance, interest rate, and the total number of payments. For each period (usually monthly), calculate the interest, subtract it from your fixed payment to find the principal paid, and voilà – the remaining balance is your next month’s starting point. Rinse and repeat until the loan bites the dust.

What is a 30-year amortization schedule?

A 30-year amortization schedule is like the marathon of home loans – it’s a lengthy run! This is where you stretch your loan payments over 30 years, which can make your monthly bills more manageable, but hey, it’s a trade-off with more interest paid over the lifetime of the loan.

What is a 5 year loan with 25-year amortization?

A 5-year loan with 25-year amortization is pretty unique. You’re signing up for loan payments as if you had a 25-year term, but hold your horses, because the balance will need refinancing or paying off in full after just 5 years. It’s like a teaser of low payments before the real show hits the road.

How do you calculate monthly amortization on a home loan?

To calculate monthly amortization on a home loan, you’ll need to dance with some numbers. You’ll have to get the principal, interest rate, and loan term all in a row, then use an amortization formula or an online calculator to get your monthly payment. It’s like baking – measure correctly for the best results!

How do you calculate monthly amortization?

For monthly amortization, just follow the bread crumbs: take your loan details and plug them into an amortization calculator or spreadsheet. It’ll break down the soirée into monthly payments showing both principal and interest, revealing the gradual decrease of your loan balance – easy as pie!

What is the easiest way to calculate amortization?

The easiest way to calculate amortization? It’s a no-brainer – online amortization calculators are your best pals! Just type in the loan amount, interest rate, and term, and let the internet work its magic. You’ll have a full amortization schedule faster than you can say “Show me the money!”

How do you make an amortization table by hand?

Making an amortization table by hand is old school, but it’s doable! You’ll need patience as you lay out payments across the term. Calculate interest for each period, determine the principal paid, and chip away at the loan balance. It’s a tad tedious, sure, but there’s a certain charm in crunching numbers the traditional way.

What does 5% amortization mean?

When someone says “5% amortization,” grab your magnifying glass because it’s time to investigate! It usually means your loan has a 5% interest rate, and the payments are spread out, or “amortized,” over a certain period. Essentially, it’s a snapshot of how the interest plays out in your payment plan.

Can I ask the bank for a amortization schedule?

Can you ask the bank for an amortization schedule? Absolutely! Banks and lenders are usually more than happy to provide you with a schedule showing your payment timeline. It’s like asking for directions – they’re there to help guide you through your loan journey.

Should I do 25 or 30-year amortization?

Choosing between a 25 or 30-year amortization can feel like standing at a crossroads. Go with 25 years for higher payments but less interest long-term, or pick 30 years for lower monthly dues at the cost of more interest paid over time. It’s a classic tortoise-and-hare scenario – faster payoff versus lower payments.

When should you amortize your mortgage?

Deciding when to amortize your mortgage is like finding the sweet spot for your doughnut glaze – it’s got to be just right. Consider your financial goals and stability. If you’ve got extra cash and crave less debt, early amortization might be your jam, but if you’re riding the waves smoothly, sticking to schedule works too.

How to pay off $150,000 mortgage in 10 years?

To pay off a $150,000 mortgage in 10 years, you’ll need to put your game face on and boost those payments. Use an online calculator to find the heightened monthly amount. Pump extra cash into your principal when you can, and dive into budgeting to free up funds. Every penny counts on this financial fitness quest!

How can I payoff my mortgage faster?

Paying off your mortgage faster is like turning up the heat on a slow cooker – things progress quicker! Make extra payments, biweekly instead of monthly, or refinance for a shorter term. Put any windfalls, like tax refunds or bonuses, toward the mortgage. Before you know it, you’ll be mortgage-free.

What is cheaper in the long run a 15-year loan or a 30-year loan why?

In the long run, a 15-year loan usually ends up cheaper than a 30-year loan – here’s the scoop. Although the monthly payments are higher, the shorter term means you’ll pay a lot less in interest over the life of the loan. It’s a bit like choosing between a sprint or a marathon – both get you to the finish line, but one might save you some sweat!

What is amortization and mortgage and its formula?

Amortization is the game plan for paying down your mortgage, spread over set payments for the loan term. The formula? Break out the spreadsheets to calculate payments that cover both interest and principal, with interest decreasing over time. It’s the roadmap of your journey from borrower to outright homeowner.

What does 5 year term 20 year amortization mean?

Hearing “5-year term, 20-year amortization” is a bit like a meal with two courses. You’ll fork out payments based on a 20-year schedule, but don’t get too cozy – after 5 years, you’ll need to renew or refinance. Think of it as a short-term commitment with a long-term flavor.

What is the formula for the monthly payment?

Looking for the formula for the monthly payment? Pull out your detective kit! It involves the loan amount, interest rate, and number of monthly payments. The calculation can seem as tricky as a Rubik’s Cube but fear not – an online loan calculator can solve this puzzle in a click.

What is the formula for the monthly payment of a loan?

The formula for a loan’s monthly payment needs three pieces of the puzzle: the loan amount, the interest rate per period, and the total number of periods. Input these into the formula or let a calculator be your guide. It’s like finding the secret sauce for a perfect payment sandwich!