In the ever-evolving landscape of home financing, navigating the influx of information can be as tedious as nailing jelly to the wall. But fear not, prospective homeowners and refinancing maestros, because today’s golden ticket lies within the candid world of mortgage broker reviews. Like finding that perfect slice of protein cookie dough, a top-notch mortgage broker can sweeten the deal on your journey to property nirvana.

Insights on Mortgage Broker Reviews: Navigating the Best in Business

Mortgage Broker Review: The Role and Value in Today’s Market

Let’s chop it down to basics: mortgage brokers are your personal financial matchmakers, finding that dream connection between you and a suitable lender even if you want to buy a tiny home depot home.

Pros of a Mortgage Broker:

– Shopping made easy. Picture a one-stop shop for loans—brokers offer you a slew of options tailored to your needs.

– They’ve got the golden key. More access to lenders means a buffet of mortgage plans at your fingertips.

Cons of a Mortgage Broker:

– Lack of familiarity. It might feel a bit like a blind date when you first deal with your broker.

– A few missing pieces. Not all lenders are keen to dance with brokers, so you might miss out on some exclusive deals.

In today’s market, trends quo suggest that while a whole lot of brokers offer a ‘whole of market’ service, getting cozy directly with a lender might still play a fancy chord or two. With affordability checks tighter than a drum and lending criteria more scrutinized, brokers adapt by getting even savvier in 2024.

| Aspect | Details |

|---|---|

| Service Type | Whole of Market Mortgage Broker Reviews |

| Primary Advantages | – Access to a wide range of lenders and mortgage products. |

| – Can save time, effort, and potentially money in the mortgage process. | |

| – One-stop shop for mortgage advice and application assistance. | |

| – Usually free for the borrower as brokers are typically paid by lenders. | |

| Primary Disadvantages | – May not have familiarity with the broker; need to establish trust. |

| – Brokers may not have access to deals from all lenders, some only offer | |

| mortgages directly to consumers. | |

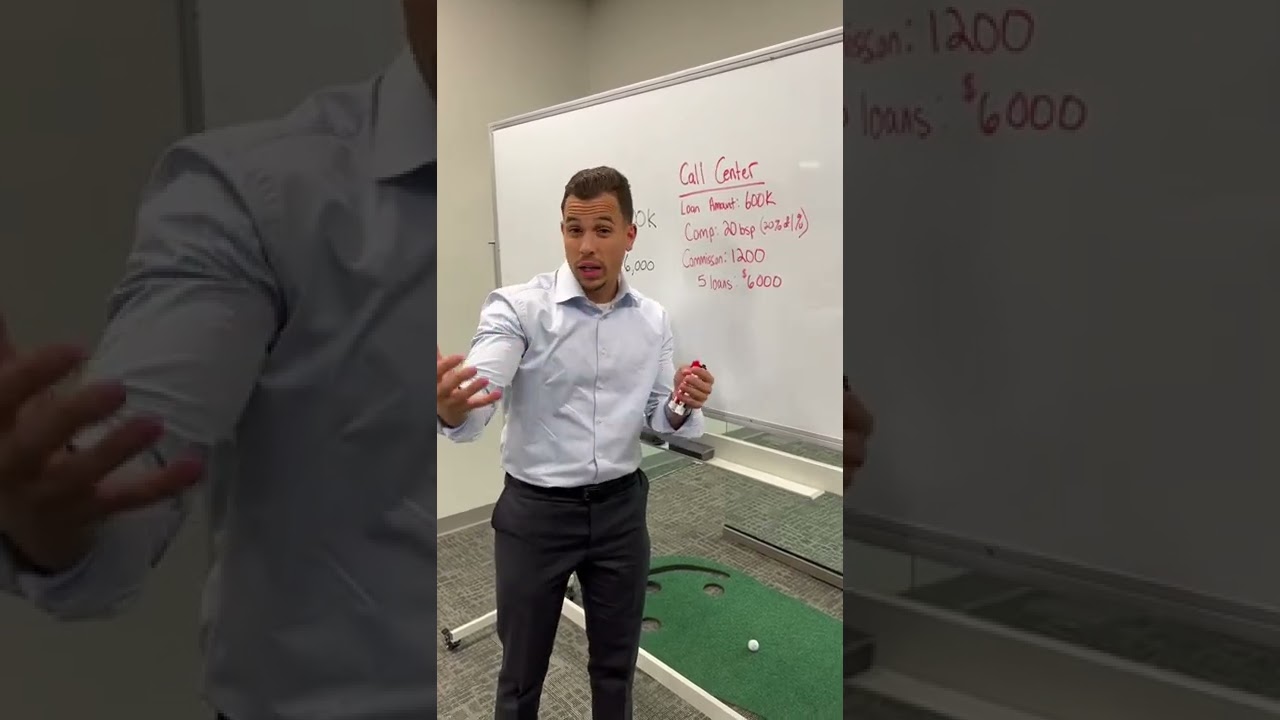

| Payment to Brokers | – Generally 1% to 2% of the loan amount, paid by the lender after closing. |

| – In some cases, the borrower pays the broker at closing. | |

| Potential Misalignment of Interests | – A broker’s recommended products may be influenced by commission |

| structures rather than the borrower’s best interest. | |

| Access to Lenders | – Brokers can have better and more access to lenders than consumers. |

| – ‘Whole of market’ brokers have the broadest access, but still not | |

| universal coverage. | |

| Direct Lender Benefits | – Going directly to a lender can sometimes yield a better deal. |

| – Some prefer the familiarity and direct communication with their bank. | |

| Broker Market Coverage | – A ‘whole of market’ broker reviews a wide range but not all available |

| mortgage products on the market. | |

| Review Considerations | – Look for unbiased and comprehensive broker reviews. |

| – Check if the broker has a track record of offering competitive rates and | |

| transparent advice. | |

| – Consider the broker’s experience and industry credentials. |

Mortgage Broker Ratings: Understanding the Criteria

When it comes to mortgage broker ratings, think of it as scoping out the best airbnb in San Diego: You’re looking for comfort, quality, and bang for your buck.

Ratings are gauged on:

– Customer Service: Is talking to this broker like catching up with an old pal or pulling teeth?

– Loan Options: Do they have more flavors than Baskin-Robbins, or is it one size fits all?

– Success Rates: Do they close deals faster than an auctioneer on a sugar rush?

Brokers who take the championship belt are those who excel across the board and treat you like the champ you are.

Navigating Mortgage Broker Reviews: Analyzing Feedback and Data

Think of reviews for mortgage brokers as breadcrumbs leading you to the cottage made of candy—only the cottage is a trusted broker, and the candy is the sweet, sweet deal you’re looking for.

So how do you separate the wheat from the chaff?

1. Spot the genuine from the generic – look for personalized tales over cookie-cutter praise.

2. Timestamp it – check out the latest reviews since the dinosaur age isn’t helping anyone.

3. Relevance is key – ensure reviewers’ situations echo your own, so their experience is applicable.

Making Informed Choices: Mortgage Brokers Reviews from Real Clients

Here’s where the rubber meets the road, with real stories painting the picture.

– Young professionals may opt for a broker who’s a wiz with tech and jargon-free talk.

– The seasoned investor might buddy up with a niche expert broker with insights as deep as their portfolio.

Expert Analysis: How to Make a Recommendation to Tom. Which Loan Should He Use?

Let’s say Tom’s the everyman in search of a mortgage that fits like Cinderella’s slipper. An expert might suggest a broker with:

– A track record of honesty and transparency.

– A smorgasbord of loan options to cater to his unique financial palate.

Mortgage Brokers Reviews: The Trendsetters and Innovators

Shout out to brokers redefining the game with shiny tech and fresh strategies. They’re reimagining customer service with every swipe and click, making the old school pen-and-paper crew sit up and take notice.

The Trusted Names: Longstanding Excellence in Mortgage Broker Reviews

These are the legends, the brokers whose names are uttered in reverent tones for their consistent mixing of traditional touchstones with 2024 flair.

What’s Next? A Glimpse Into the Future of Mortgage Brokering

AI and big data are the new crystal balls, foreshadowing a future where brokers and artificial intelligence tag team to deliver the mortgage dream.

Beyond the Numbers: The Human Element in Mortgage Broker Reviews

It’s the personal cheers and compassionate ears that truly set apart a broker, creating enduring echoes through client lives and making more than just financial dreams come true.

Final Reflections: The Real-World Impact of Choosing Wisely

As we wrap up this home tour of broker knowledge, it’s clear expertise counts for a lot, but choosing with a full deck of cards is how you win this game. Make sure to scour those mortgage broker reviews as meticulously as you’d survey a new home, because, in the grand scheme of things, a mindful selection today could mean a joyful homestead tomorrow.

Is it worth paying a mortgage broker?

Is it worth paying a mortgage broker?

Well, let’s break it down! Shelling out cash for a mortgage broker can be totally worth it if you’re itching to snag the best deal on your home loan. These pros can tap into a wide lender network, do the legwork, and sometimes haggle better rates than you’d get flying solo. Just like hunting for hidden treasure, a solid broker might help dig up a gem of a mortgage.

Is it best to use mortgage broker?

Is it best to use a mortgage broker?

Heck yes, for many folks, using a mortgage broker is the way to go! Especially if the thought of comparing zillions of lenders has you breaking out in a cold sweat. A broker does the heavy lifting, hunting down competitive rates and suitable loan terms, making your journey to homeownership a tad less bumpy.

What is a disadvantage of a mortgage broker?

What is a disadvantage of a mortgage broker?

Hang on, though, it’s not all roses! A downside to using a mortgage broker is they may not have access to the whole market, meaning you could miss out on a lender with the perfect loan for you. Plus, some charge fees that’ll have you reaching deeper into your pockets, so it’s key to weigh the pros and cons.

Who typically pays a mortgage broker?

Who typically pays a mortgage broker?

Alright, so who’s forking over the dough to the mortgage broker? Generally, it’s the lender who pays commission once your loan closes. But don’t forget—nothing’s free! Sometimes, these costs might boomerang back to you through higher interest rates or fees, wrapped up in the loan like a sneaky surprise.

At what point should I see a mortgage broker?

At what point should I see a mortgage broker?

Timing’s everything, right? You’ll want to chat with a mortgage broker before you start daydreaming about paint swatches. Typically, that’s after you’ve squirreled away a down payment but before you start touring homes. Getting pre-approved through a broker can give your house-hunt the green light!

Is it best to talk to mortgage broker or bank?

Is it best to talk to mortgage broker or bank?

Tough call! Speaking with both could be your best bet. See, a mortgage broker offers a buffet of loan options, while your bank serves up their house special. Compare what’s on offer—your bank might slice you a deal for loyalty, but a broker could serve up a smorgasbord of alternatives if your bank’s menu isn’t tempting.

How long does a mortgage application take through a broker?

How long does a mortgage application take through a broker?

Patience is a virtue! A mortgage application through a broker can take anywhere from a few days to a couple of weeks to get the initial okie-dokie. Then buckle up for the full process, which could be a month-long rollercoaster ride or more, including all the checks, paperwork, and underwriting.

Can a mortgage broker get you a bigger mortgage?

Can a mortgage broker get you a bigger mortgage?

Maybe, maybe not—it’s not a surefire thing. A mortgage broker has the chops to shop around and potentially lock down a more generous mortgage by finding a lender with laxer rules or better risk appetites. But remember, it always boils down to what you can responsibly afford—don’t bite off more than you can chew!

Why not to use a broker?

Why not to use a broker?

Playing devil’s advocate, aren’t we? Skip the broker if you fancy yourself a mortgage maestro and enjoy getting down to the nitty-gritty with banks. Also, if your heart’s set on a specific lender or you’re a golden child with your bank, you might nab better terms directly. Plus, it sidesteps broker fees, which can be a win for your wallet!

Do banks pay mortgage brokers?

Do banks pay mortgage brokers?

Yep, banks often foot the bill for mortgage brokers as a finders-fee for funneling borrowers their way. This commission gets the broker hyped up to pair you with a bank’s loan products. Just keep your eyes peeled for biases—it’s always great to know if your broker’s playing favorites with lenders paying fatter commissions.

How much do mortgage brokers get from lender?

How much do mortgage brokers get from lender?

It varies, but generally, mortgage brokers get a slice of the pie, ranging from 0.50% to 2.75% of the loan amount. This commission can be a one-time payout at closing or ongoing kickbacks over the loan’s life. Kinda like getting a tip for hooking someone up with a great date, but in the finance world!

Why do banks pay mortgage brokers?

Why do banks pay mortgage brokers?

Well, banks shell out to brokers because they’re matchmakers, linking banks with borrowers who might not walk through their doors otherwise. Paying brokers is a smart play for banks to widen their net without shelling out heaps on advertising or branch expansion. Call it outsourcing the legwork to reel in more customers!