Mortgages can be a real bear, especially when tackling the intricate details by yourself. However, with the right tools, particularly a mortgage calculator by payment, the path becomes significantly smoother. By understanding and utilizing these calculators, first-time homebuyers, investors, and even those refinancing can make smart financial strides. Buckle up for an enlightening journey through the best mortgage calculators tailored for calculating payments in 2024.

Why a Specialized Mortgage Calculator by Payment Matters

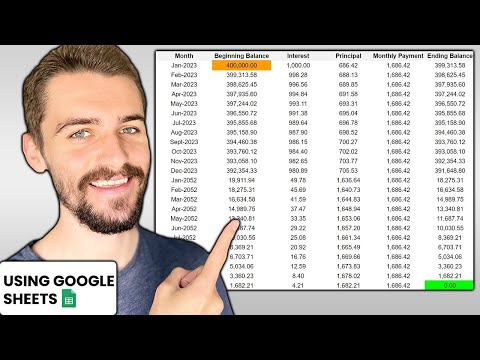

Understanding your mortgage payments isn’t just about knowing the principal and interest. A high-quality mortgage calculator by payment dives deeper, offering a comprehensive financial picture. Here’s what it takes into account:

Top 5 Mortgage Calculators by Payment for 2024

Sifting through the multitude of online tools can be tiresome. After rigorous research, we present five top-notch mortgage calculators by payment:

1. Bankrate Mortgage Calculator

If you’re looking for depth, the Bankrate mortgage calculator is a stellar choice. It computes everything from principal and interest to taxes and PMI.

2. Zillow Mortgage Calculator

Zillow, a household name, offers an intuitive and user-friendly calculator designed to cater to both new and seasoned borrowers.

3. NerdWallet Mortgage Calculator

NerdWallet’s calculator stands out for its extensive customization options and clear interface. It supports comparisons between various loan types and customizable inputs for taxes and insurance.

4. Quicken Loans (Rocket Mortgage) Calculator

Quicken Loans presents a precision calculator via Rocket Mortgage that offers a thorough payment breakdown. It’s great for quick and accurate assessments.

5. Chase Mortgage Payment Calculator

Chase’s calculator provides reliable calculations with a straightforward approach. It covers the basics like principal and interest comprehensively.

Making the Most of Mortgage Calculators: Expert Tips and Tricks

Choosing the right mortgage calculator is just the first step. Here’s how to maximize its potential:

| Monthly Mortgage Payment ($) | Home Purchase Price Range ($) | Loan Amount ($) | Interest Rate (%) | Loan Term (Years) | Monthly Payment (P&I) ($) | Annual Payment (P&I) ($) |

| 2,000 | 250,000 – 300,000 | 250,000 | 6 | 30 | 1,499.10 | 17,989.20 |

| 2,000 | 250,000 – 300,000 | 300,000 | 6 | 30 | 1,798.65 | 21,583.80 |

| 2,531.57 | 300,000 | 300,000 | 6 | 15 | 2,531.57 | 30,378.84 |

| 3,360.16 | 500,000 | 500,000 | 7.1 | 30 | 3,360.16 | 40,321.92 |

Future of Mortgage Calculators: What to Expect

As technology gallops ahead, expect mortgage calculators to evolve dramatically. The future holds the promise of AI-driven tools offering hyper-personalized advice based on real-time data and deep learning algorithms. Watch for calculators that integrate seamlessly with broader financial planning apps, offering insights beyond just mortgage payments.

In 2024 and beyond, using a mortgage calculator by payment is not just a matter of convenience; it’s about empowering yourself with the foresight to make sound financial decisions. Let these tools guide you towards mortgage mastery.

Navigating mortgages doesn’t have to be an uphill battle. With the right mortgage calculator by payment, you can unlock a clearer vision of your financial future. Whether you’re eyeing a property like the serene Merriweather Lakehouse or seeking to understand monthly payment mortgage calculator nuances, the journey becomes less stressful and more rewarding. Dive into these tools and step towards financial clarity with confidence.

Don’t miss out on our free government money For Seniors over 50 guide, especially if you’re planning for your golden years. Or if you’re aspiring to make your mark like Lsu Angel reese, getting your mortgage squared away is one giant step in achieving your goals.

Ready to calculate your future? Start exploring our monthly payment calculator mortgage today! Dive into financial clarity with Mortgage Rater and make those dreams a reality.

Understanding Your Mortgage Calculator by Payment

When diving into the intricacies of using a mortgage calculator by payment, you might be surprised to learn that these tools offer far more than meets the eye. They not only help you figure out monthly payments but also provide insights into various loan options. For instance, programs like the Home Possible help first-time buyers with low-down-payment mortgage options. Pretty neat, right?

Fun Facts About Mortgage Calculators

Mortgage calculators aren’t just about numbers – they can uncover some rather fascinating tidbits too. For instance, a mortgage rate calculator can show how slight differences in interest rates can impact your overall payment. It’s kind of like how minor adjustments in a baseball player’s swing can affect whether they make the list of all time strikeout leaders. The small changes can make a big difference!

The More You Know

Here’s something to chew on: did you know that using a mortgage calculator can also aid in your long-term financial planning? By toying with different scenarios, you can see how adding extra payments or adjusting loan terms could save you thousands over the life of your mortgage. Just like understanding different mortgage products through a platform like Home Possible can tailor options to your financial situation, these tools empower you to make informed decisions and stay ahead of the game.

So, the next time you punch numbers into a mortgage calculator by payment, remember—you’re not just planning for a monthly bill. You’re setting up a future of financial wellness. And isn’t that a home run?

How big of a mortgage is $2,000 a month?

With $2,000 a month to spend on your mortgage, you could likely afford a home priced between $250,000 to $300,000. However, keep in mind that this is a rough estimate and other financial factors like your credit score, down payment, and existing debts will also play a role.

How much is a mortgage on a $500,000 house?

For a $500,000 mortgage at a 7.1% interest rate over a 30-year term, your monthly payment would be around $3,360.16. Over a year, you’d be paying about $40,321.92 in principal and interest.

How to calculate a monthly mortgage payment?

To calculate a monthly mortgage payment, first convert the annual interest rate to a monthly rate by dividing it by 12. For example, with a 6% interest rate, the monthly rate is 0.005. Then, multiply this rate by your loan amount. If your loan is $100,000, multiply $100,000 by 0.005, which equals $500.

What is my mortgage payment for a 300k house?

For a $300,000 mortgage at a 6% APR, your monthly payment would be $2,531.57 on a 15-year loan or $1,798.65 on a 30-year loan. These amounts exclude escrow costs, which can vary.

How much house can I afford if I make $36,000 a year?

If you make $36,000 a year, you might be able to afford a home priced between $100,000 and $150,000. This is just a ballpark figure and doesn’t account for other factors like down payments, debts, and interest rates.

How much house can I afford if I make $70,000 a year?

With a $70,000 yearly income, you could afford a home priced between $230,000 and $300,000. Remember, this is just an estimate and other financial factors like your credit score, debts, and down payment will influence your affordability.

What credit score do you need to buy a $500,000 house?

To buy a $500,000 house, most lenders generally prefer a credit score of at least 620. However, a higher score can get you better interest rates and terms.

What income do you need for a $500000 mortgage?

For a $500,000 mortgage, your annual income should typically be at least $125,000 to $150,000, depending on the loan terms, your other debts, and down payment.

How much money do you need to put down for a $500,000 house?

For a $500,000 home, a common minimum down payment is 20%, which would be $100,000. Some programs allow lower down payments, but these often come with higher interest rates or mortgage insurance requirements.

Will interest rates go down in 2024?

Predicting interest rates is tricky, and nobody can say for sure if they’ll go down in 2024. Rates depend on various economic factors like inflation and Federal Reserve policies.

What happens if I pay two extra mortgage payments a year?

Paying two extra mortgage payments a year can significantly reduce your loan term and the amount of interest you pay over time. This extra payment goes directly towards the principal, which helps you pay off your mortgage faster.

How much of your income should go to a mortgage?

It’s generally advised to spend no more than 28% of your gross monthly income on your mortgage. This includes principal, interest, taxes, and insurance (PITI).

Can I afford a 300K house on a 60k salary?

With a $60,000 salary, you might be able to afford a home priced around $200,000 to $250,000. A $300,000 home could be a stretch unless you have a significant down payment or little other debt.

Can I afford a 300K house on a 50k salary?

Making $50,000 a year could make it tough to afford a $300,000 house. You’d likely need a substantial down payment or other income sources to comfortably manage the mortgage payments.

What credit score is needed to buy a $300K house?

To buy a $300,000 house, lenders usually prefer a credit score of at least 620. A higher score will yield better interest rates and loan terms.