In today’s complex financial world, getting a grip on your mortgage estimate is essential for securing the best monthly payments possible. This guide takes a detailed dive into the various aspects that impact these payments, offering original insights and data analysis to help you on your journey.

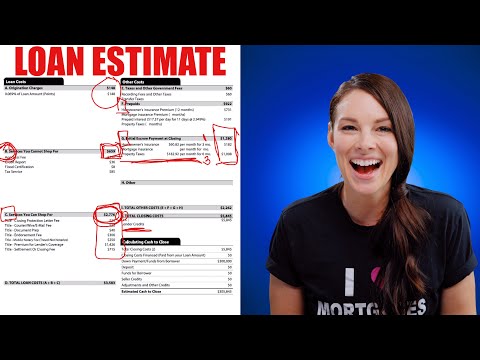

Breaking Down the Mortgage Estimate: Key Components

When you receive a mortgage estimate, it’s crucial to understand its key components. This section will help you decode the most important elements involved.

Loan Estimate Form Overview

The Loan Estimate form, regulated by the Consumer Financial Protection Bureau (CFPB), is designed to provide a transparent view of the costs associated with your mortgage. Key sections include:

Best Mortgage Companies for Accurate Estimates

Different companies offer varying levels of transparency and accuracy in their mortgage estimates. Below, we analyze some of the best in the business for 2024.

1. Quicken Loans

Quicken Loans consistently ranks high in customer satisfaction. Their comprehensive Loan Estimate form provides clear details, including information about adjustable rates and pre-payment penalties. Moreover, their high-tech interface allows customers to model different scenarios, providing a precise view of potential monthly payments.

2. Fairway Independent Mortgage Corporation

Fairway puts a strong emphasis on customer service and guidance. They offer an educational approach to their Loan Estimate, including webinars and easy-to-understand guides. This ensures that borrowers fully grasp how their monthly payments are calculated and what variables could affect them.

3. Wells Fargo Home Mortgage

Known for their nationwide presence, Wells Fargo offers detailed Loan Estimates that emphasize clarity in closing costs. They also provide handy calculators and tools on their website, helping prospective borrowers visualize different loan scenarios and their impacts on monthly payments.

| Criteria | 30-Year Fixed Rate | 15-Year Fixed Rate |

| Loan Amount | $600,000 | $600,000 |

| Interest Rate | 7.00% | 7.00% |

| Monthly Payment | $3,992 | $5,393 |

| Total Interest Paid | $836,975 | $371,207 |

| Total Amount Paid | $1,436,975 | $971,207 |

| Principal Paid | $600,000 | $600,000 |

| Loan Duration | 30 years | 15 years |

| Interest-to-Principle Ratio | 1.39:1 | 0.62:1 |

| Benefit | Lower monthly payments | Faster repayment, less interest paid overall |

Factors Influencing Your Mortgage Estimate: A Deep Dive

Several factors contribute to the complexity of determining monthly mortgage payments. Understanding these can give you the upper hand in financial planning.

Credit Score Impact

A high credit score typically results in a lower interest rate, directly reducing monthly payments. According to a 2024 study by Experian, borrowers with scores above 750 saw rates up to 0.5% lower compared to those with scores in the 650-700 range.

Down Payment Size

Larger down payments can significantly impact your Loan Estimate by reducing monthly insurance premiums and interest rates. For instance, a 20% down payment often eliminates the need for private mortgage insurance (PMI), substantially lowering monthly bills.

Loan Term Length

Choosing between a 15-year and a 30-year mortgage can drastically alter your monthly obligations. Shorter-term loans tend to have higher monthly payments but lower total interest over the loan’s life, as outlined by Freddie Mac’s Housing Market Outlook for 2024.

Enhancing Accuracy in Mortgage Estimates: Tips and Recommendations

To ensure you get the most accurate mortgage estimate possible, consider these strategies:

Regularly Update Financial Information

Consistently updating your financial situation, including income, debt, and assets, ensures that the Loan Estimate you receive reflects your current financial status.

Shop Around

Compare estimates from multiple lenders. Utilizing tools like the CFPB’s Loan Estimate Comparison tool can prevent surprises during the final approval process.

Seek Professional Advice

Consulting with a mortgage advisor or financial planner can provide personalized insights. An American Financial Association report highlights that borrowers who consult professionals often find savings opportunities missed by DIY approaches.

The Future of Mortgage Estimates

As technology evolves, mortgage estimates are becoming increasingly detailed and user-friendly. The integration of AI and advanced analytics is set to further enhance the precision and usability of these estimates.

For instance, fintech companies like Better Mortgage are leveraging machine learning to provide more nuanced estimates, taking into account a broader spectrum of variables that influence payment structures. This trend towards hyper-personalization implies that future borrowers will have even greater clarity and control over their mortgage decisions.

By focusing on understanding the intricacies of mortgage estimates, you can make informed decisions leading to optimal monthly payments. Whether you’re a first-time buyer or refinancing, this knowledge equips you to navigate the mortgage landscape with confidence and foresight.

To calculate your potential mortgage payments, you can use our Mortgage Payment calculator or Mortgage Estimate calculator. With Mortgage Rater, you’ll have the tools and insights needed to make your best financial decisions.

Fun Trivia and Interesting Facts About Mortgage Estimates

When you’re trying to crack the code of a mortgage estimate, there are lots of intriguing tidbits that can make the process more engaging. And let’s face it, we all love a good trivia session every now and then!

Mortgage Calculators: Your Financial GPS

Did you know that using a mortgage home calculator can feel like having a financial GPS? It helps you figure out your monthly payments with ease, almost like magic. Speaking of magical moments, remember those fun facts like when you wondered how tall is Shakira while daydreaming about your future living room dance parties? It’s these quirky details that make the journey to homeownership less droll and more delightful.

Famous Figures and Their Financial Feats

Flashback to the `90s with a bit of laughter and nostalgia—Chris Farley, the comedic genius, entertained millions but also had his struggles. Although his death picture might be a somber reminder of his battles, it’s also a poignant reflection on the importance of a solid financial foundation. Whether planning for the future or just managing the present, these lessons resonate deeply. And hey, speaking of stars, let’s not forget Katy Perry on Idol! Just like crunching those mortgage numbers, judging on American Idol requires a sharp eye for detail.

Credit Unions and Calculator Capers

To get the best mortgage estimate, you need reliable institutions like Sun Federal Credit Union. They offer the tools and support to help you map out your financial path. And if you think building the perfect mortgage plan can feel like one of the stupidest tasks, think again. With the right resources, what seemed arduous can become straightforward.

In the end, unlocking a stellar mortgage estimate isn’t just about numbers—it’s also about the stories and context that come with them. From calculators to credit unions, and from pop culture to financial literacy, there’s always something new to learn and enjoy.

How much would your mortgage be for a $400000 home?

For a $400,000 home, your mortgage will depend on the down payment, interest rate, and loan term. Assuming a 20% down payment and a 30-year fixed-rate mortgage at around 7%, you’d be looking at a ballpark monthly payment of roughly $2,130, not including taxes and insurance.

How much is a 300k mortgage per month?

For a $300,000 mortgage over 30 years at a 7% interest rate, your monthly payment would be around $1,996, before adding in taxes or insurance.

How much house can I afford for $5000 a month?

With a $5,000-a-month budget for housing, you could afford a home in the ballpark of $750,000, given you stick to the general guideline of keeping your mortgage payment at or below 30% of your monthly income.

What is the monthly payment on a $600000 mortgage?

At a 7% fixed interest rate, your monthly mortgage payment on a 30-year $600,000 mortgage would be approximately $3,992, while a 15-year term would bring it up to about $5,393 a month.

Can I afford a 400k house on 100k salary?

Earning $100,000 a year, you can probably afford a $400,000 house, depending on your overall debt and monthly expenses. Lenders typically look for your mortgage payments to be about 28% of your monthly income.

How much house can I afford if I make $70,000 a year?

With a yearly income of $70,000, you might afford a home priced around $280,000 to $320,000, following the basic rule of thumb that suggests a mortgage that’s roughly 3 to 4 times your income.

Can I afford a 300K house on a 60k salary?

On a $60,000 salary, you can afford a house priced around $240,000 to $280,000, assuming you have minimal other debts and can make a decent down payment.

Can I afford a 300K house on a 50k salary?

With a $50,000 salary, you’d be looking at homes in the $200,000 to $240,000 range. This is a rough estimate, as actual affordability will also factor in your debt, down payment, and local real estate market.

What credit score is needed to buy a $300K house?

For a $300,000 house, a credit score of around 620 or higher is generally needed for a conventional loan, though a higher score can help you secure better interest rates and terms.

How much house can I afford if I make $36,000 a year?

If you’re making $36,000 a year, a good rule of thumb is you might afford a house priced between $144,000 and $160,000, provided you have little other debt and a decent down payment.

What is the 28/36 rule?

The 28/36 rule suggests you spend no more than 28% of your gross monthly income on housing costs and no more than 36% on total debt, including your mortgage, credit cards, and other loans.

Can I afford a house making $2000 a month?

Making $2000 a month, affording a house becomes challenging as you’d aim to keep your housing costs under about $600 a month. This may limit you to very low-priced properties or require substantial savings for a down payment.

How do people afford a $600000 house?

Affording a $600,000 house typically means having a hefty income, strong financial profile, and minimal debt. You’d need an annual income of around $150,000 to $180,000, keeping monthly mortgage payments manageable.

Do I have to put 20 down on a house?

You don’t have to put 20% down on a house, though it’s common. Many lenders offer options as low as 3% down, but lower down payments usually mean higher monthly payments and possibly private mortgage insurance (PMI).

How much income do you need for a $500 000 mortgage?

For a $500,000 mortgage, you’d typically need an annual income in the ballpark of $120,000 to $140,000, depending on interest rates, debt load, and other factors lenders consider in approving loans.