Navigating the mortgage landscape can be like trying to decode an ancient script. For many, understanding the mortgage formula is as mystifying as predicting the stock market’s next move. But don’t fret – it’s time to roll up our sleeves and unveil the mortar behind the bricks of this intimidating financial structure. Let’s dive deep into the realm of home loans and discover some surprising facts that might just tip the scales in your favor when managing your mortgage.

Decoding the Mortgage Formula: Understanding How It Works

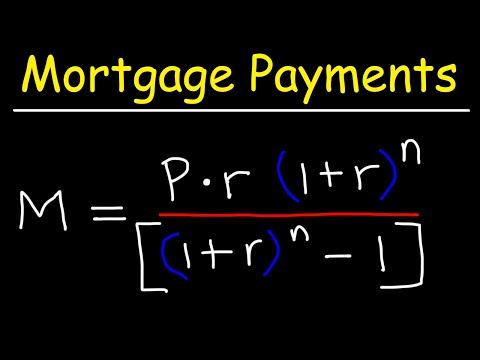

Every homeowner’s journey begins with the foundational knowledge of the mortgage formula. This mathematical marvel determines your monthly payment, which is crucial for budgeting your future.

The Building Blocks of the Mortgage Formula

To really get the hang of the mortgage formula, let’s chip away at its core components:

Understanding these elements is the first step in decoding the mortgage formula, which will lead to a clearer path towards homeownership.

The Mystery Behind Mortgage Interest Calculation

The way mortgage interest is calculated can be a puzzler for many, but let’s crack the code. If your annual interest rate is, say, 5 percent, we slice that rate into monthly bites. Divide it by 12 (for the months in a year) to get a monthly rate of 0.004167.

But not all interests are created equal. Fixed rates stay the same over the loan’s lifetime, offering stability, while variable rates can fluctuate with the market’s beat, like a wild riff from the Velvet Underground of finance.

Cracking the Code: The Simple Mortgage Calculator Formula

Now, put on your math hat! The simple mortgage calculator formula can be your guiding light. Let’s take a loan amount of $100,000 at a 6 percent interest rate. Divide that interest rate by 12 to get a monthly rate of 0.005 and multiply it by the loan to find your monthly payment of $500. Seems straightforward, but it’s always wise to confirm calculations using reliable tools, such as a mortgage payment calculator With extra Payments from MortgageRater.com.

The Unspoken Truth of Principal Payments

Hush-hush, let’s spill some tea on what is a principal payment. It’s the chunk of your payment that actually reduces your mortgage balance, not just appeasing the interest gods. Paying more towards your principal is a crafty move — it slashes the amount of interest you pay over time and can bring the end of your loan term into a closer horizon.

Best Time of Year to Buy Appliances – And Its Impact on Your Mortgage

Bet you didn’t think that snagging a dishwasher on sale could impact your mortgage, but it’s all connected! Timing appliance purchases for when prices take a dive can free up extra funds. Add those savings into your mortgage through extra payments and watch your loan shrink like cotton in hot water!

| Field | Description | Formula Component | Example Calculation |

|---|---|---|---|

| Principal | The amount of money borrowed or currently owed | P | $100,000 |

| Interest Rate (Annual) | The annual percentage charged for borrowing the money | r | 6% (0.06 as a decimal) |

| Monthly Interest Rate | The monthly percentage charged for borrowing the money | r / 12 | 0.06 / 12 = 0.005 |

| Number of Payments (Total) | The total number of payments to be made over the loan term | n | 30 years x 12 months/year = 360 payments |

| Monthly Payment | Amount paid monthly toward the loan, including principal and interest | (P * monthly interest rate) / (1 – (1 + monthly interest rate)^-n) | ($100,000 * 0.005) / (1 – (1 + 0.005)^-360) ≈ $599.55 |

| Taxes | Local property taxes factored into the monthly payment | T | Varies by location |

| Insurance | Homeowner’s insurance factored into the monthly payment | I | Varies by coverage needs |

| PITI | Total monthly mortgage payment including Principal, Interest, Taxes, and Insurance | Monthly Payment + T + I | If T = $200 and I = $100, then PITI ≈ $599.55 + $200 + $100 = $899.55 |

| Mortgage Payment Formula | The formula used to calculate the monthly mortgage payment | Monthly Payment = (P × r / 12) / (1 – (1 + r / 12)^-n) |

Shocking Fact #1: The Principle of Interest Front-Loading

Alright, brace yourself. In the early years of your loan, your hard-earned cash is mostly cozying up with the interest rather than reducing your balance. It’s a front-loaded affair that can leave you gobsmacked! Countering this requires an ace strategy — make additional payments early on and disrupt the system that’s a bit too infatuated with interest.

Shocking Fact #2: The Hidden Impact of Amortization on Mortgage Payments

Amortization is that snake in the grass you didn’t see coming. It’s the process dictating the proportion of interest to principal in each payment. Initially, it’s skewed heavily towards interest, leaving many homeowners like Ryan Ohearn at the plate, ready to swing at a pitch that’s curving differently than expected.

Shocking Fact #3: The Transformation of Your Mortgage Over Time

Here’s a plot twist — as time marches on, the composition of your mortgage payment shifts like sand in an hourglass. You hit a tipping point where your payments are more about chipping away at the principal than feeding the interest. Visual representation can highlight this transition and it’s a sight to behold!

Shocking Fact #4: How Extra Payments Disrupt the Standard Formula

If you’re looking to buck the standard, throw some extra payments into the mix. Every additional dime can feel like you’ve hit the mortgage jackpot, shortening your loan’s lifespan and saving you a considerable amount of interest. It’s like finding a Casio watch that doesn’t just tell time, it also tracks your steps to financial freedom.

Shocking Fact #5: The Geographical Dilemma in Mortgage Calculations

Your ZIP code affects your mortgage? You betcha! Geography matters in real estate and your mortgage is no exception. The costs of taxes, insurance, and sometimes even interest rates can vary wildly from place to place. It’s a real estate roller coaster that can make mortgage payments across different areas look like siblings who don’t quite resemble each other.

Innovative Strategies Utilizing the Mortgage Formula

Now, combining the nimbleness of Suze Orman’s financial savvy with Robert Kiyosaki’s practical edge, let’s delve into some avant-garde methods to make the mortgage formula work harder for you:

Our experts aren’t magicians, but they might as well be. They emphasize how tailoring the mortgage formula to your personal financial situation is as important as personalized nutrition is to fitness.

Conclusion: Harnessing the Power of the Mortgage Formula

Squaring up the mountain of information in ‘Mortgage Formula Unveiled: 5 Shocking Facts,’ we’ve woven through a labyrinth that often ensnares the average borrower. Remember, it’s not about outsmarting the system; it’s about understanding it well enough to make it work for you, optimally and efficiently.

So, dust off any passive disinterest in the nuts and bolts of your mortgage and engage actively with these insights. Wrestle down the front-loading interest, dance around the geographical variations, and, hey – why not buy a blender in November if it’ll help pay off your house quicker? With this knowledge, managing your mortgage isn’t just a necessity; it’s a superpower.

The Intriguing World of the Mortgage Formula

You thought cracking the code to your high school locker was tough? Try grappling with the mortgage formula! This little mathematical concoction is like the secret sauce that gives your mortgage its unique flavor. Let’s dish out some trivia and lesser-known nuggets about this financial wizardry!

Did You Know? The Mortgage Formula Has a Twin!

Bet you didn’t see this one coming! Like the mysterious M523 particle that has physicists scratching their heads, the mortgage formula has a lesser-known counterpart that’s not quite as famous. While it’s the tried and true method for figuring out your monthly payments, there’s also a version used for calculating interest on reverse mortgages and other unique loan types. Mind-boggling, right? A quick dive into the principles of the m523 could give you a vague glimpse at how even the most solid formulas have their enigmatic siblings.

Caution: Breaking Free Could Cost You

Here’s a spicy tidbit: chomping at the bit to pay off mortgage early? Cool your jets, hotshot! You might get slapped with a prepayment penalty, which is exactly what it sounds like – a financial sting for being an overachiever. It’s the lender’s way of saying “Hey, we had a deal! So before you dump your lottery winnings into your mortgage, make sure sneaky fees aren’t lurking in the shadows!

The Amortization Secrets

Psst, lean in. Not everyone knows this, but the mortgage formula has a stealthy sidekick named amortization. This dude’s job is to skew the numbers so you pay more interest than principal in the early years. Why? Well, it’s the banks’ sneaky way of making sure they get their chunk of cheese before you might bolt. If you’re banking on seeing a rapid dip in your principal, you might need to strap on some patience, partner.

A Little Change Makes a Huge Difference

Alright, let’s lay it on thick: messing with numbers in your mortgage formula can shake things up big time! Call it financial butterfly effect or whatever, but a smidge too high on the ol’ interest rate, and you’re doling out extra dough over the years. And guess what? Slashing your interest rate by even a fraction can save you a wallet-full of cash. Just like dieting, sometimes the little things pack the biggest punch!

Prepayment Can Be Your Secret Weapon

OK, here’s the scoop—if you can dodge that prepayment penalty, making extra payments on your mortgage could turn you into a financial ninja. Tossing a few extra bucks at your principal each month is like hitting fast forward on your mortgage. It’s all about playing it smart and finding the wiggle room in your budget. Get this right, and you’ll be shrugging off that mortgage like it’s last year’s fashion trend. Just make sure you’re not stepping into a money pit with those prepayment fees.

So there you have it! Whether you’re a math aficionado or not, these juicy facts about the mortgage formula show there’s more than meets the eye. It’s not just a formula; it’s a maze of numbers with hidden traps and treasures. Gear up and navigate wisely—you’ve got this!

What is the formula to calculate mortgage?

Sure thing, here we go:

How are mortgages calculated?

– Want to crack the code on your mortgage payments? Here’s the secret formula: Mortgage Payment = P[r(1+r)^n]/[(1+r)^n-1]. Just plug in your loan amount for P, your monthly interest rate for r, and the number of payments for n. Voilà, you’ve got your monthly payment!

How is my mortgage rate calculated?

– So, how do mortgages really shake out? Well, your monthly payment is calculated using the principal amount, interest rate, and term length of the loan. This trifecta determines how much you’ll fork over every month. Remember, it’s a mix of paying back what you borrowed and the interest, so the longer the term, the more interest you’ll pay.

What is the formula for the monthly loan payment?

– Oh, the mystery of mortgage rates! They’re like a secret sauce with lots of ingredients—credit score, loan term, home price, down payment, and the market’s twists and turns. Lenders blend these up to serve you your personalized rate. It’s like they’ve got a crystal ball, but really, it’s just math and economics!

Why does it take 30 years to pay off $150000 loan even though you pay $1000 a month?

– Need to find out your monthly loan payment without breaking a sweat? Use this trusty formula: Monthly Payment = P[r(1+r)^n]/[(1+r)^n-1]. Replace P with the loan amount, r with the monthly interest rate, and n with the total number of payments. Easy as pie!

Is there a mortgage formula in Excel?

– Ah, the classic 30-year mortgage puzzle. You’d think $1,000 a month would slice through that $150,000 loan like a hot knife through butter, right? But don’t forget, the bank’s got a sweet tooth for interest. That chunk of change you’re paying? It’s mostly interest in the early years—so it takes a while before you’re really chipping away at the principal.

What is the rule of thumb for calculating mortgage?

– Excel at your mortgage game with a simple formula! Just input your numbers into the PMT function: =PMT(rate, nper, pv). “Rate” is your monthly interest rate, “nper” is the total number of payments, and “pv” represents the loan amount. Excel’s got your back!

How much is a 100k mortgage over 15 years?

– Lookin’ for a ballpark figure on your mortgage payment? Here’s a handy rule of thumb: multiply your gross monthly income by 28%. This quick trick gives you an estimate of what you can afford each month. It’s not set in stone, but it can point you in the right direction.

How much is a 100k mortgage per month?

– Dreaming of a $100k mortgage over 15 years? If you snag an average interest rate, you might be looking at monthly payments somewhere between $700 to $900. Remember, exact amounts depend on the rate you lock in, so keep an eye on those rates!

What is the formula for interest?

– A $100k mortgage on your mind? Picture this: at a typical interest rate, your monthly chunk of change might be in the ballpark of $800 to $1000. Don’t forget, this is no crystal ball—it all hinges on the rates you nab.

What is 6 interest on a $30000 loan?

– The formula for interest—short and sweet—is: Interest = Principal x Rate x Time. It’s the backbone of figuring out how much extra dough you’re tossing into the lender’s pockets over the life of the loan.

How much house can I afford for $5000 a month?

– Six percent interest on a $30,000 loan feels like a riddle, but it’s simple math. For just one year, you’re looking at $1,800 in interest. But hey, if you’re spreading payments over more time, remember that compounding interest will bump that number up.

How much would a 5000 loan cost per month?

– If you’ve got $5,000 a month in your housing budget, you might be playing in the big leagues. Depending on your down payment and interest rate, you could be dancing in a house worth up to about a million dollars. But careful, don’t let those dollar sings in your eyes overshadow other homeownership costs!

What are the 4 C’s of lending?

– So, you want to borrow $5,000, huh? Well, depending on your APR and term, your monthly hit can range widely. Over a year with a decent rate, you could be looking at somewhere around $430 to $450 a month. But remember: the devil’s in the details of your loan terms!

How to calculate amortization?

– The 4 C’s of lending are like the Four Horsemen for your loan approval: Credit, Capacity, Capital, and Collateral. Lenders give ‘em a long, hard look to decide if you’re good for the money. Keep ’em all in tip-top shape to pass muster.

Which formula should be used to correctly calculate the monthly mortgage payment?

– To calculate amortization, you need to chart out a schedule of all those monthly payments over the life of your loan. Each payment is part interest, part principal, and the ratio shifts over time. There’s even software and calculators that can map this out for you—thank goodness for technology, right?

How do you calculate interest on 30 years?

– The formula you’ll reach for to calculate that monthly mortgage payment is none other than: MP = P[r(1+r)^n]/[(1+r)^n-1]. This lovely piece of math tells the story of how each monthly payment is divided between principal and interest for as long as you’re paying off that loan.