Understanding Mortgage Loan Calculators

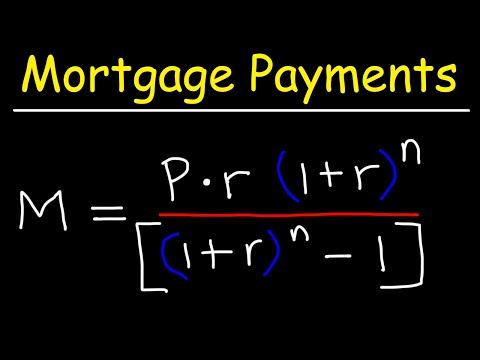

Mortgage loan calculators are indispensable tools for homebuyers, homeowners looking to refinance, or investors considering property purchases. These calculators help assess monthly payment amounts, the total interest paid over the life of the loan, and whether specific mortgage products fit individual financial situations. With so many options available, it’s crucial to understand which calculators offer the most accuracy, flexibility, and user-friendly experiences.

For instance, estimating monthly payments on a $500,000 mortgage assuming a 30-year loan term and an interest rate of about 7.1% amounts to approximately $3,360.16. But remember, variables like interest rates and loan terms can shift these payments to as little as $2,600 or as much as $4,900.

Top 7 Mortgage Loan Calculators for 2023

1. Bankrate Mortgage Calculator

Bankrate has long been a trusted name in the mortgage industry. Their mortgage calculator offers features like amortization schedules, extra payment inputs, and clear, visual representations of cost breakdowns. Customers appreciate the ease of use and detailed information breakdowns.

Unique Insight: As of 2023, Bankrate’s calculator integrates current market rates updated daily, providing users with the most accurate financial picture.

2. Zillow Mortgage Calculator

Zillow’s calculator stands out for its integration with Zillow property listings. Homebuyers can view estimated payments directly on property listings, making it easier to assess affordability without toggling between different websites.

Unique Insight: Zillow’s real-time data updates and integration with its vast property database make it unmatched for prospective buyers who want property-specific mortgage calculations.

3. NerdWallet Mortgage Calculator

NerdWallet is known for its comprehensive financial advice, and their mortgage calculator reflects this ethos. Besides the standard payment and interest calculations, it provides neighborhood-specific property tax and insurance estimates, which are crucial for accurately predicting total monthly payments.

Unique Insight: Their focus on local data for property taxes and insurance sets NerdWallet’s calculator apart from many competitors, offering a more precise financial forecast for potential homeowners.

4. Quicken Loans Mortgage Calculator

Quicken Loans, now known as Rocket Mortgage, offers a streamlined and visually engaging calculator. It breaks down monthly payments into principal, interest, taxes, and insurance, and includes options for different loan types like FHA, VA, and conventional loans.

Unique Insight: Rocket Mortgage’s integration with its application process can seamlessly transition users from calculating potential payments to beginning a loan application, making it a one-stop-shop for many users.

5. Redfin Mortgage Calculator

Redfin’s calculator is designed for user-friendly, quick calculations. However, it doesn’t sacrifice depth, providing detailed amortization schedules and options for refinancing scenarios.

Unique Insight: As part of the Redfin real estate platform, its mortgage calculator is perfect for those already using Redfin to browse properties, offering a seamless and integrated homebuying experience.

6. CalcXML Mortgage Calculator

CalcXML may not have the brand recognition of some other names on this list, but it excels in customization and depth. Users can adjust inputs for taxes, homeowner’s insurance, and private mortgage insurance (PMI), and it offers a side-by-side comparison of different loan terms and rates.

Unique Insight: It’s the flexibility in refining inputs that makes CalcXML a favorite for users with unique financial circumstances or those who want a granular level of detail in their calculations.

7. MortgageCalculator.org

This website offers one of the most robust calculators available, with adjustable settings for loan term, interest rates, property taxes, insurance, and PMI. It also features options for calculating bi-weekly payments and the impact of making extra payments.

Unique Insight: MortgageCalculator.org’s inclusion of various loan scenarios and payment schedules provides users with unparalleled flexibility and control over their financial planning.

| Aspect/Category | Details |

| Purpose | Helps estimate monthly mortgage payments, understand affordability, and compare loan terms & rates. |

| Key Features | – Loan amount input – Interest rate input – Loan term options – Property tax & insurance input – Additional costs input (HOA, PMI) |

| Benefits | – Simplifies financial planning – Provides quick and personalized estimates – Allows comparison of different scenarios |

| Affordability Example | Annual Salary Needed for $400K Home: $127,000 |

| Recent Housing Market Data | – Median Sales Price (Q4 2023): $417,700 – Peak Median Sales Price (Q4 2022): $479,500 |

| Example 1: $500K Mortgage | Monthly Payment (30-year term, 7.1%): $3,360.16 Range: $2,600 – $4,900 (based on term & rate) |

| Example 2: $600K Mortgage | Monthly Payment (30-year term, 7.00%): $3,992 Monthly Payment (15-year term, 7.00%): $5,393 |

Key Features to Look for in a Mortgage Loan Calculator

When searching for the ideal mortgage loan calculator, consider factors like user interface, customization, integration with real-time data, accuracy of tax and insurance estimations, and additional financial tools. Analyzing these features helps ensure you select a tool that meets your basic calculation needs but also aids in making well-informed financial decisions.

For instance, an online mortgage calculator should ideally incorporate real-time data for current rates and allow for detailed inputs such as property taxes, homeowners insurance, and PMI. These features ensure the calculations are as accurate and helpful as possible.

Leveraging Mortgage Calculators for Better Financial Planning

Mortgage calculators offer more than just monthly payment estimates. They empower users by:

Final Thoughts on the Best Mortgage Loan Calculators of 2023

These top mortgage loan calculators go beyond basic calculations, integrating features that cater to a range of needs and financial situations. They provide a tailored and interactive experience essential for anyone’s homebuying journey or refinancing plans. By leveraging the advanced capabilities of these tools, users can navigate the intricacies of mortgage planning with confidence and precision. As the market evolves, having access to accurate, comprehensive mortgage loan calculators remains a cornerstone of sound financial planning.

Now, if you’re looking to dive deeper or apply your newfound understanding, check out our own mortgage home loan calculator and mortgage rates calculator on Mortgage Rater. Dive in and get a clear vision of your financial future.

Fun Trivia and Interesting Facts About Mortgage Loan Calculators

The Unexpected Origins

Mortgage loan calculators have an interesting history. Did you know that their origins can be traced back to the 1970s? These early versions were much more basic and often required the input of all financial data manually. They’ve come a long way since then, harnessing the power of technology to simplify home-buying decisions. Modern calculators can help you navigate the gnarly details of Homes For sale by owner and factor in specifics like loan terms and interest rates with just a few clicks.

Beyond Just Numbers

On the surface, mortgage loan calculators might seem like just another online tool—but they offer more than meets the eye. Essentially, these calculators allow homebuyers to get a snapshot of their potential monthly payments and overall loan costs. What’s truly fascinating is how they’ve evolved to include various types, from simple payment calculators to intricate affordability and refinancing ones. This becomes even more interesting when you consider their utility in predicting long-term commitments like a 30-year mortgage.

Strange Tidbits

Here’s a quirky fact: while mortgage loan calculators generally deal with homes, some people humorously query unrelated terms, such as “calculate the cost for a Demon Slayer box set. Although this might seem amusing, it highlights how integral these calculators have become in everyday financial planning tools beyond their initial purpose.

Real-World Impact

The impact of mortgage loan calculators goes beyond numbers—they can literally change lives. Consider, for instance, the story of Carson Ehde, whose financial planning was greatly aided by effective use of online financial tools. As these tools become more advanced, they help many better prepare for the unexpected and make informed decisions, easing the way their mortgage journey. Even looking through The public opinion Obituaries showcases how financial planning can drastically influence lives, illustrating the profound significance of accessible financial tools.

In essence, these mortgage loan calculators provide deeper insights and add tremendous value to the home-buying experience. Being equipped with accurate, real-time data enables homebuyers to make smarter choices, turning what initially seems like a complex process into something manageable and straightforward.

How much would a $500000 mortgage cost per month?

Your monthly payment for a $500,000 mortgage would be around $3,360.16 if you’ve got a 30-year loan term with a 7.1% interest rate. Of course, this amount might swing between $2,600 and $4,900 depending on other factors like the loan term and interest rate.

How much would your mortgage be for a $400000 home?

To afford a $400,000 home, you’d likely need an annual salary around $127,000. This estimate ensures that mortgage payments fit comfortably within your budget.

What is the monthly payment on a $600000 mortgage?

For a $600,000 mortgage, monthly payments at a 7.00% fixed interest rate would be about $3,992 on a 30-year loan. If you go for a 15-year loan, expect to pay closer to $5,393 per month.

How much is a mortgage on a 300k house?

The monthly mortgage on a $300,000 house can vary, but with a 30-year term and a modest interest rate, you’re looking at something in the ballpark of $1,500 to $2,000 per month.

How much income do you need for a 350K house?

To afford a $350K house, you generally need an annual income that covers the monthly mortgage payment, which could be around $110,000, depending on your other debts and financial commitments.

What income do you need for a $500000 mortgage?

For a $500,000 mortgage, an annual income of roughly $160,000 to $180,000 would be a safe bet. This helps ensure the monthly payments won’t stretch your budget too thin.

Can I afford a 400k house on 100k salary?

Affording a $400k house on a $100k salary might be tight. While it’s possible, especially if you have minimal debt, it’s important to consider other living expenses before jumping in.

How much house can I afford if I make $70,000 a year?

With a $70,000 annual salary, you might afford a house valued at around $200,000 to $250,000. This keeps your mortgage payments manageable and aligns with common lending rules.

How much income do you need to qualify for a $400000 mortgage?

To qualify for a $400,000 mortgage, your annual income likely needs to be around $127,000. This makes sure you can handle the monthly payments comfortably.

How much house can I afford if I make $36,000 a year?

If you make $36,000 a year, affording a house can be challenging. You’d be in the market for a home price well below $150,000 to keep payments manageable.

How do people afford a $600000 house?

Affording a $600,000 house generally requires a healthy income, probably around $180,000 to $200,000 per year, along with a good credit score and low debt-to-income ratio.

Is the 28/36 rule realistic?

The 28/36 rule is pretty realistic for most people. It suggests spending no more than 28% of your gross income on housing costs and 36% on total debts, which keeps your finances balanced.

Can I afford a 300K house on a 60k salary?

On a $60k salary, affording a $300k house might be a stretch. You’d likely need additional income sources or a significant down payment to make it feasible without overextending yourself.

How much income do you need to be approved for a 300K mortgage?

To get approved for a $300K mortgage, an annual income around $75,000 to $80,000 would be helpful. This ensures your monthly payments fit within lending guidelines.

What credit score is needed for a 300K house?

A good credit score for a $300K house is typically at least 620. But, a higher score can get you better interest rates and terms, making your payments more affordable.