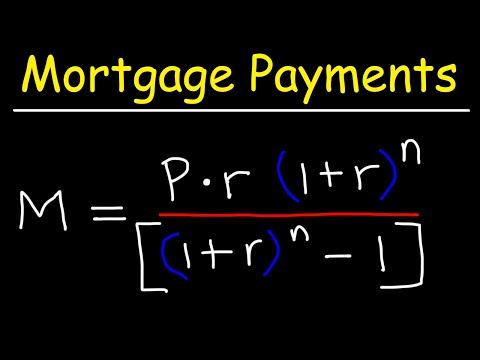

Understanding the Importance of a Mortgage Loan Payment Calculator

When you’re diving into home buying or refinancing, a mortgage loan payment calculator becomes your lifeline. This nifty tool helps forecast your monthly payments, compare different loan options, and plan out your budget effectively. As 2024 rolls in, the market is packed with numerous calculators, each boasting unique features. But, which ones truly stand up to the test? Let’s break it down.

Top 7 Mortgage Loan Payment Calculators of 2024

1. Bankrate Mortgage Calculator

Bankrate has long been a trusted name in financial calculations, and their mortgage calculator is no exception. It offers an intuitive interface with real-time interest rate updates. You can customize inputs for property taxes, insurance, and HOA fees. Plus, it provides detailed amortization schedules, which help you see your payment progress over time.

2. NerdWallet Mortgage Calculator

NerdWallet’s mortgage calculator is user-friendly and offers a comprehensive cost breakdown. Besides calculating the principal and interest, it also factors in property taxes, insurance, and PMI (Private Mortgage Insurance), giving you a precise monthly payment estimate. It stands out for its educational resources that guide users through the mortgage process, making it perfect for first-time homebuyers.

3. Zillow Mortgage Calculator

The Zillow mortgage calculator is your go-to tool if you’re looking for a quick yet detailed snapshot of your mortgage payments. Integrated with Zillow’s property listings and market trends, this calculator enables users to explore potential homes and real-time rates simultaneously. Its advanced filters allow for specific adjustments, ensuring accurate payment predictions.

4. Quicken Loans Mortgage Calculator

Powered by Rocket Mortgage, the Quicken Loans calculator is for those who prefer a streamlined process. It offers pre-qualification options right within the tool, making it easier for users to move forward with their mortgage application. The clear and concise breakdown of payment components provides a seamless user experience.

5. Chase Mortgage Calculator

The Chase mortgage calculator is tailored for clients already banking with Chase but serves the public equally well. It integrates with Chase’s broader financial services, providing personalized rate quotes. The calculator also highlights potential closing costs, giving users a comprehensive view of total borrowing expenses beyond monthly payments.

6. Wells Fargo Mortgage Calculator

Wells Fargo’s calculator stands out with its detailed input options, including variable interest rates and additional payment schedules. This flexibility allows users to simulate different financial scenarios and see the impacts of extra payments on their loan term. It’s an excellent tool for those considering lump sum payments or refinancing options.

7. Mortgage Professor’s Calculator Suite

A distinctive entry, the Mortgage Professor’s Calculator Suite is ideal for users seeking granular control over their mortgage calculations. Offering a range of calculators for different mortgage types, it allows for in-depth customization. Users can delve into comparative analyses of fixed versus adjustable rates, refinance options, and even bi-weekly payment plans.

| Criteria | Details |

| Mortgage Amount | $500,000 |

| Sample Monthly Payment | $3,360.16 |

| Loan Term | 30 years |

| Interest Rate | 7.1% |

| Payment Range | $2,600 – $4,900 (depending on term and interest rate) |

| Annual Salary for $300K House | $50,000 – $74,500 (varies based on credit score, debt-to-income ratio, loan type, term, and rate) |

| Home Price for $2,000/Month Budget | $250,000 – $300,000 (depending on other financial factors) |

| Additional Factors Impacting Payments | – Credit score – Debt-to-income ratio – Type of home loan – Loan term – Mortgage rate |

| Benefits of Using a Mortgage Calculator | – Provides estimated monthly payment – Helps set a realistic home budget – Assists in comparing loan options – Predicts how term and rate changes affect payment |

| Features of a Mortgage Calculator | – Loan term adjustment – Interest rate variation – Principal amount input – Payment schedule visualization – Additional costs (insurance, taxes) inclusion |

Analyzing Key Features and Benefits

Accuracy and Real-Time Data

Accurate projections are crucial. Tools like Bankrate and Zillow employ real-time interest rates and market conditions, ensuring their estimates reflect the current financial climate. This real-time data helps in making informed decisions without the risk of outdated information throwing off your calculations.

User Experience and Accessibility

A calculator’s interface determines its usability. NerdWallet and Quicken Loans emphasize simplicity and clarity, making them easy to navigate even for those new to mortgage terminologies. These calculators simplify complex financial scenarios, offering valuable insights without overwhelming users.

Customization and Flexibility

The ability to customize inputs is a big plus. Wells Fargo and Mortgage Professor’s calculators excel by offering flexibility in selecting variable interest rates, extra payment schedules, and more. Such features allow users to tailor their calculations to their financial situations, providing a personalized borrowing forecast.

The Significance of Amortization Schedules

Amortization schedules are essential yet often overlooked. They provide a detailed breakdown of each payment into principal and interest, showing how the loan balance reduces over time. This transparency helps users understand their equity growth and aids in financial planning. Calculators like Bankrate and Chase excel in providing comprehensive amortization schedules.

Emerging Trends in Mortgage Calculators

Integration with Financial Planning Tools

In 2024, there’s a clear trend of integrating mortgage calculators with broader financial planning tools. Chase does a stellar job leveraging its extensive banking services to offer a holistic view of a user’s financial health. This trend is about offering a unified platform for all financial needs.

Educational Resources

Educating users has become a priority. NerdWallet combines its calculators with extensive articles, guides, and tips, ensuring users are well-informed throughout their mortgage journey. This educational approach empowers users to make confident decisions, a huge advantage in today’s complex financial landscape.

Navigating Future Financial Landscapes with Confidence

Choosing the best mortgage loan payment calculator boils down to understanding your needs and preferences. Each calculator we’ve reviewed offers distinct advantages, whether it’s accuracy, customization, or educational resources. As financial landscapes change, the power of these calculators in guiding your mortgage decisions is undeniable. Embrace these tools to navigate your home-buying journey with confidence and clarity.

No matter where you are in the process—whether browsing at home real estate or exploring financial aspects like a balloon payment definition, these calculators provide the foundation you need to make smarter decisions. Dive into these resources and let the numbers lead you to your dream home.

So, folks, ready to take the plunge? Start exploring these calculators and see how they can transform your mortgage planning today! Visit our mortgage Loans calculator and mortgage monthly payment calculator for tools tailored to your needs. Happy house hunting!

Mortgage Loan Payment Calculator: Fun Trivia and Interesting Facts

Fun Mortgage Facts

Let’s dive into some fun and intriguing facts about using a mortgage loan payment calculator. Did you know it’s not just a handy tool for homeowners, but it can also throw up some unexpected surprises? For instance, while exploring different payment terms, users might find savings that could fund a small vacation or even an investment. Intrigued? See how this calculator can shift your financial perspective by trying it yourself, starting with a thorough mortgage payback calculator.

Historical Tidbits

Mortgage calculators have a rather fascinating history. Back in the old days, people had to manually crunch numbers and use table books to figure out their mortgage payments. It was a bit like sailing from the bustling Port Of Baltimore without a nautical chart—risky and error-prone. Today’s digital calculators eliminate the guesswork, providing precise figures at the click of a button.

Pop Culture References

Believe it or not, even the entertainment industry touches on mortgage calculators. In various comic book storylines like Radiant Black, characters often tackle real-life issues like mortgages and debts. These references resonate with readers, making the topic more relatable and slightly less intimidating.

Unexpected Connections

Here’s an intriguing connection: professional athletes sometimes use mortgage calculators too. Take, for example, football players like Jaelyn Duncan, who needs to manage their multimillion-dollar earnings wisely. By leveraging mortgage calculators, they ensure they’re making savvy investments in property and minimizing wasted capital.

Next time you fire up a mortgage loan payment calculator, remember, you’re not just calculating numbers. You’re tapping into a tool with a rich history, a sprinkle of pop culture, and even a pinch of sport! Happy calculating!

How much would a $500000 mortgage cost per month?

For a $500,000 mortgage with a 30-year term at an interest rate of 7.1%, your estimated monthly payment would be $3,360.16. But this can swing from $2,600 to $4,900 depending on the loan term and interest rate.

What is the payment on a $300 000 mortgage?

For a $300,000 mortgage, your monthly payment will vary depending on the loan term and interest rate. Generally, for a 30-year mortgage with around 7% interest, you might expect to pay close to $2,000 per month.

How much money do I need to make to qualify for a 300 000 mortgage?

To qualify for a $300,000 mortgage, you’d typically need an annual income between $50,000 and $74,500. Factors like your credit score, debt-to-income ratio, loan type, and mortgage rate also play a role.

How big of a mortgage is $2,000 a month?

If you can afford $2,000 a month for your mortgage payment, you might be looking at a home priced between $250,000 and $300,000. Keep in mind, other financial factors like property taxes, insurance, and debt will influence this range.

What income do you need for a $500000 mortgage?

For a $500,000 mortgage, you generally need an annual income of around $100,000 to $150,000, depending on other debts and your overall financial situation. This helps ensure that the mortgage payments are a comfortable part of your budget.

How much is a 150K mortgage payment?

A $150,000 mortgage would typically have monthly payments of around $1,000 to $1,200, depending on the interest rate and loan term.

What is a good FICO score to buy a house?

A good FICO score to buy a house usually starts at around 620, but having a score above 700 can get you better interest rates and loan terms.

How much house can I afford if I make $70,000 a year?

If you make $70,000 a year, you could afford a house priced between $200,000 and $300,000, depending on your down payment, debt, and other financial obligations.

What credit score is needed to buy a $300K house?

To buy a $300,000 house, a credit score of at least 620 is often required, but having a higher score will make it easier and likely cheaper with better interest rates.

How much house can I afford if I make $36,000 a year?

With an annual income of $36,000, you could afford a house in the range of $100,000 to $150,000, depending on your down payment, debt, and other expenses.

Can I afford a house on 40k a year?

With an annual income of $40,000, you might afford a house priced between $120,000 and $160,000, provided your debt is low and you have a decent down payment.

Can I afford a 300k house on a 60k salary?

If you make $60,000 a year, you could afford a $200,000 to $300,000 house, depending on your financials, including down payment and debt.

Will interest rates go down in 2024?

Predictions can be tricky, but some experts do expect interest rates to fluctuate or potentially lower in 2024. However, it’s best to consult with financial advisors for the latest trends.

What is the 28/36 rule?

The 28/36 rule is a guideline for homebuyers which suggests that you should spend no more than 28% of your gross monthly income on housing costs, and no more than 36% on total debt, including your mortgage.

What happens if I pay two extra mortgage payments a year?

Paying two extra mortgage payments a year can significantly reduce the principal balance of your loan, thereby decreasing the amount of interest you’ll pay over the life of the loan, and can also help you pay off your mortgage earlier.