Navigating the mortgage landscape can be challenging, but a mortgage payback calculator is an invaluable tool to help you stay ahead. These calculators have become essential in 2024 due to rising interest rates and a rapidly changing housing market. They’re your best friend in crafting a solid repayment strategy, allowing you to pay off your mortgage faster and save significant money.

Why a Mortgage Payback Calculator is Essential in 2024

In today’s fast-paced financial environment, using a mortgage payback calculator can revolutionize how you manage your mortgage. Considering the rising interest rates and fluctuating housing markets in 2024, these tools provide a robust strategy for debt repayment. They offer precision and clarity to homeowners, enabling informed financial decisions daily.

Top 7 Mortgage Payback Calculators for Accelerating Your Mortgage Payoff

1. Bankrate Mortgage Payoff Calculator

Bankrate is a trusted name in personal finance, and their mortgage payoff calculator is an essential resource for homeowners. This calculator lets you experiment with additional payments and see how small increments can speed up your mortgage payoff schedule. It’s a fantastic tool for visualizing the long-term impacts of making extra contributions.

2. NerdWallet Mortgage Payoff Calculator

NerdWallet’s mortgage payoff calculator stands out with its user-friendly interface and detailed breakdowns. It allows you to input various scenarios, such as lump-sum payments and bi-weekly payments. These features let you clearly see how different payment strategies affect your timeline and interest savings.

3. Dave Ramsey’s Mortgage Calculator

Finance expert Dave Ramsey offers a mortgage calculator that aligns with his debt snowball methods. This tool is ideal for those subscribing to his financial peace principles. It highlights the benefits of aggressively paying down mortgage debt, aligning perfectly with Dave Ramsey’s philosophy of financial independence.

4. Zillow Mortgage Payoff Calculator

Zillow is synonymous with essential real estate tools, and their mortgage payoff calculator is perfect for current homeowners and prospective buyers. It integrates house value estimates to offer a comprehensive picture of your financial standing, making it excellent for those keen on understanding their mortgage better.

5. Mortgage Payoff Calculator by Wells Fargo

Wells Fargo’s mortgage payoff calculator not only aids in payoff planning but also integrates your current loan account for existing customers. It provides a seamless experience for those banking with Wells Fargo, making it easier to manage and strategize your mortgage payoff efforts.

6. U.S. Mortgage Calculator

The U.S. Mortgage Calculator surpasses basic figures, offering features like tax and insurance adjustments and amortization schedules. It’s a standout tool for those looking to delve into the intricate details of their mortgage payoff strategy, ensuring a thorough understanding.

7. Quicken Loans Extra Payment Calculator

Quicken Loans’ extra payment calculator is synonymous with efficiency, allowing you to see the impact of various extra payment strategies. The detailed visual breakdowns are beneficial for those who prefer visual data representation, making it easier to comprehend complex financial projections.

| Factor/Strategy | Description | Impact/Benefit |

| Increasing Monthly Payments | Paying more than the minimum required payment each month. | Reduces the total interest paid and shortens the loan term. |

| Bi-Weekly Payments | Making payments every two weeks instead of monthly. | This results in 26 payments per year, equivalent to 13 monthly payments, reducing overall interest. |

| Extra Principal Payments | Making additional payments specifically towards the principal balance. | Directly reduces the principal, leading to savings on interest and faster pay-off. |

| Cutting Expenses | Reducing daily and non-essential spending to free up more money for mortgage payments. | More funds available to make extra payments towards the mortgage. |

| Increasing Income | Taking on additional jobs or side gigs to boost income. | Provides extra funds that can be diverted to mortgage payments. |

| Lump Sum Payments | Utilizing windfalls like bonuses, tax refunds, or inheritances to make large one-time payments. | Significantly reduces loan principal and total interest paid. |

| 25% Post-Tax Model | Ensuring that your total monthly debt payments are 25% or less of your post-tax income. | Keeps mortgage payments manageable and aligns with financial health. |

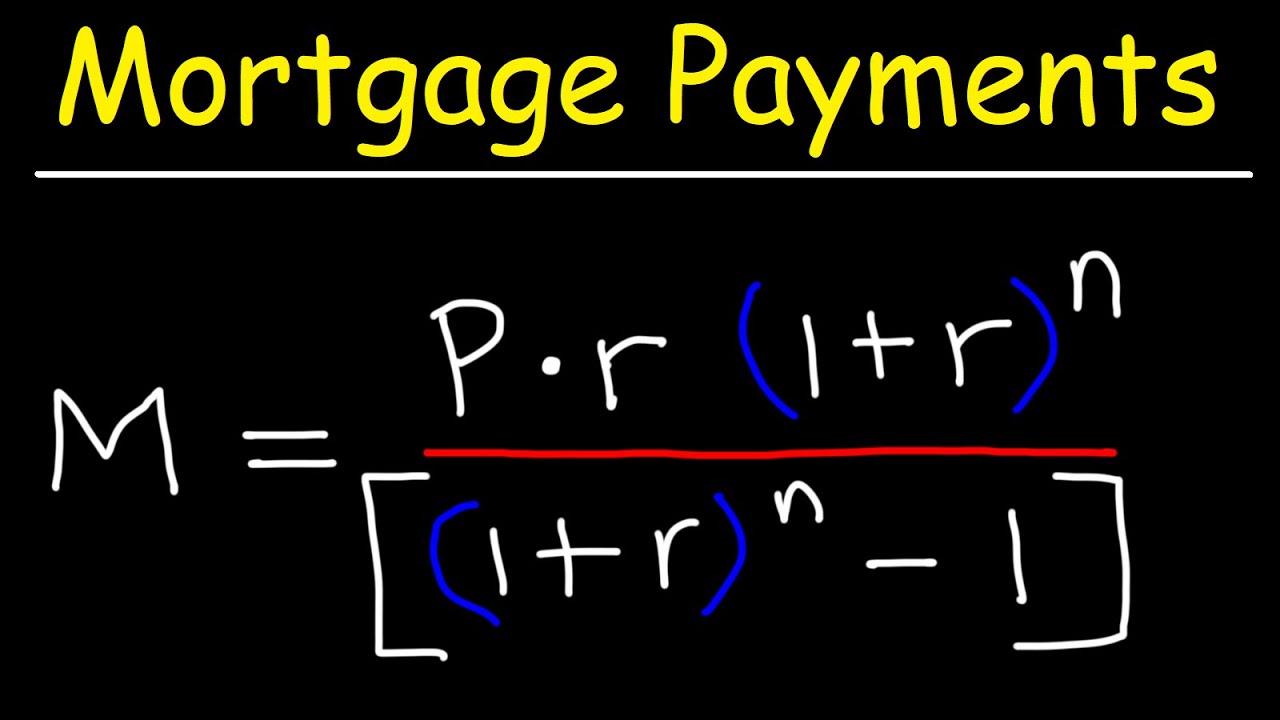

| Amortization | The process of gradually paying off a loan via regular payments. | Systematic reduction of debt, with initial payments going more towards interest. |

| Example Scenario | Paying an extra $500/month towards a mortgage. | Loan paid off in 17 years and 3 months instead of 25 years; saves $122,306 in interest. |

| Budget Fit | Ensuring extra payments fit within your financial plan. | Avoids financial stress while allowing mortgage acceleration. |

| Features of Mortgage Payback Calculator | Tool to input different payment strategies to visualize impact. | Helps in planning and decision-making for faster mortgage payoff. |

| Price | Typically available for free or as part of a paid financial planning toolset. | Access to sophisticated calculations for informed financial planning. |

| Benefits | Clear visualization of the impact of different payment strategies on mortgage pay-off timeline and interest savings. | Informed decisions, potential to save thousands in interest, and faster mortgage payoff. |

How Mortgage Payback Calculators Ensure Faster Mortgage Payoff

Insight into Extra Payments

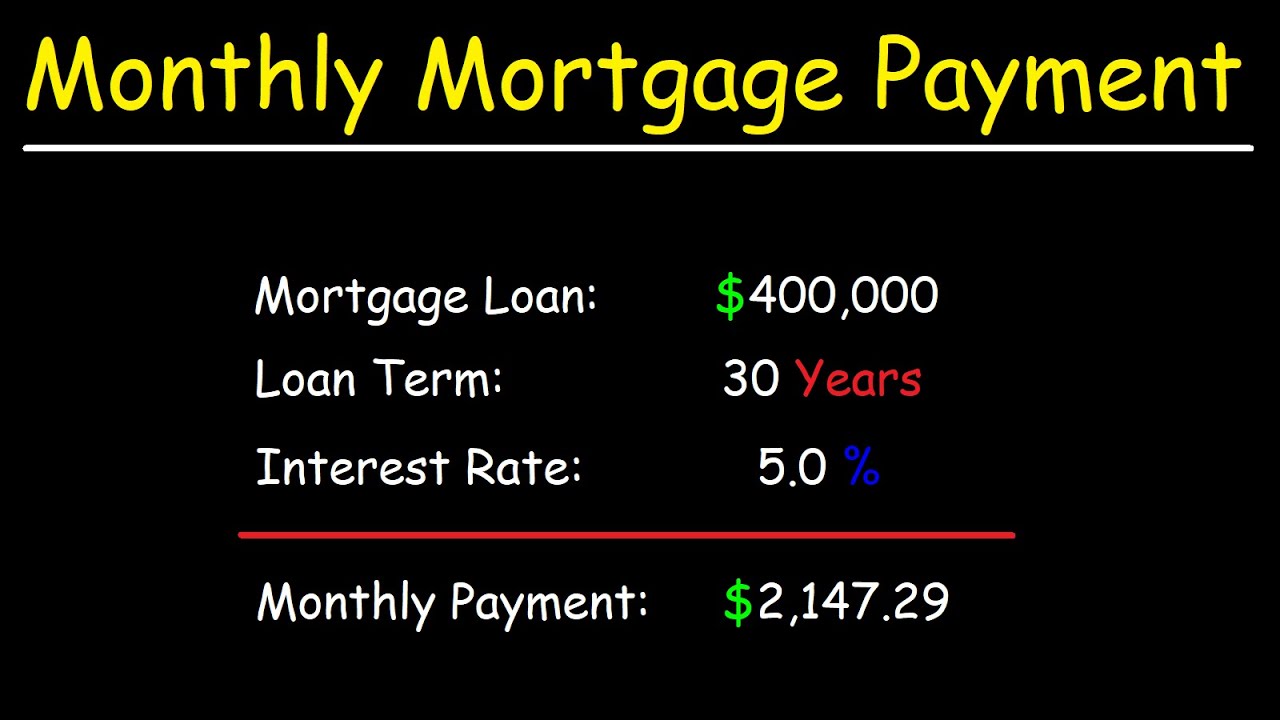

A significant feature of mortgage payback calculators is their ability to simulate extra payments. These tools provide projections on how even minor additional payments can dramatically shorten the loan term and reduce total interest payments. For instance, using Bankrate’s calculator, you can see how adding just $100 extra per month impacts your payoff timeline and interest paid.

Exploring Different Repayment Strategies

Tools like NerdWallet’s calculator enable comparisons between various repayment strategies, such as bi-weekly versus monthly payments. This granular insight allows homeowners to make informed decisions that align with their financial goals and capacity, optimizing their mortgage payoff strategy.

Real-Time Market Data Integration

Top-tier calculators like those from Zillow and Wells Fargo pull real-time data on interest rates and housing market valuations. This feature ensures that projections are grounded in current market trends, giving users the most accurate and timely financial planning tools.

The Data Behind the Calculators: How Accuracy is Ensured

Personalized Financial Assessments

Many mortgage payback calculators—such as Quicken Loans’—allow you to input personalized data, including specific loan terms, interest rates, and payment schedules. This personalization ensures the output is tailored to your financial situation, providing precise and actionable insights.

Leveraging Technology for Enhanced Financial Planning

User Experience and Accessibility

In 2024, user experience is paramount. The intuitive interfaces of these calculators, like the U.S. Mortgage Calculator and Dave Ramsey’s calculator, make complex financial projections accessible to everyone, regardless of financial literacy levels. This democratization of information empowers homeowners to take charge of their mortgage payoff strategies.

Multi-Device Compatibility

With mobile devices’ prevalence, many calculators offer seamless multi-device compatibility. This feature ensures you can plan your mortgage payoffs on the go, maintaining flexibility and responsiveness to life’s changes.

Transform Your Mortgage Journey

Owning your home outright faster than you imagined is possible with the right tools. The top mortgage payback calculators offer more than just numbers; they provide a blueprint for financial freedom. By making small, informed adjustments to your repayment strategy, you can save significant amounts of money and time, ultimately giving you greater control over your financial future.

Imagine the freedom of a mortgage-free life—these calculators can turn that vision into reality. Empower yourself with clarity, strategy, and precision, and transform your mortgage journey today.

Don’t forget to check out our mortgage loan payment calculator and mortgage Loans calculator for more detailed insights. For those living in Annapolis, be sure to find relevant data such as the Annapolis zip code.

With these tools and strategies, paying off your mortgage faster in 2024 is within reach. Don’t wait—start today and make your dream of a mortgage-free home a reality.

Mortgage Payback Calculator

Know Your Numbers

Curious about how your favorite football teams can relate to mortgages? Imagine Fc Barcelona Vs Man united Lineups – just as a coach analyzes player stats to strategize a game, you should understand your financial data to plan a faster mortgage payoff. A good mortgage payback calculator can help you make sense of terms like net monthly income and break down numbers into actionable plans. Dialing in your monthly payments isn’t just about grinding through numbers; it can feel like winning a strategic game.

Unexpected Facts

Wondering how a mortgage calculator could be as interesting as a quirky character in a video game? Think of it like using a mortgage monthly payment calculator – it’s almost like making sense of Kokichi Omas playful antics in his games. With the right tools, managing your mortgage can go from confusing to clear in minutes. In fact, a quick tweak in your extra payments could make a huge difference, saving you thousands in interest.

Fun Comparisons

Is comparing mortgage lenders in different states on your to-do list? Imagine the difference between Lenders in California and checking out rival football teams’ stats. Just like you’d study those stats to know which team might have an edge, understanding various lenders can give you valuable insights. Diving into these comparisons isn’t just about finding any deal—it’s about unearthing the best match for your financial game plan.

How to pay off a $500,000 mortgage in 5 years?

To pay off a $500,000 mortgage in 5 years, you’d need to make significantly higher monthly payments than usual. This could mean increasing your income, cutting expenses, and making large lump-sum payments whenever possible. You might also consider refinancing to a shorter loan term with higher monthly payments.

What is the 25 percent rule for mortgage payments?

The 25% post-tax model recommends that your total monthly debt, including your mortgage, shouldn’t exceed 25% of your post-tax income. For instance, if your take-home pay is $5,000 per month, you shouldn’t spend more than $1,250 on your mortgage payment.

How much faster will I pay off my mortgage if I pay an extra $500 a month?

If you pay an extra $500 a month, you can pay off your mortgage 7 years and 9 months earlier than scheduled, resulting in substantial interest savings. Specifically, you could save around $122,306 in interest payments over the life of the loan.

What happens if I pay 3 extra mortgage payments a year?

Making 3 extra mortgage payments a year can significantly reduce your loan term and the total interest you’ll pay. Depending on the loan’s specifics, this might shorten your mortgage by several years.

What happens if I pay an extra $1000 a month on my mortgage?

Paying an extra $1,000 a month on your mortgage considerably decreases your loan’s payoff time and saves you a hefty amount in interest. This can dramatically accelerate the repayment process, potentially cutting down your mortgage by many years.

What happens if I pay an extra $2 000 a month on my mortgage?

Paying an extra $2,000 a month on your mortgage would fast-track your loan payoff and yield even greater savings in interest payments. This method would shorten the repayment period by many years more than smaller extra payments.

What is the 3 7 3 rule in mortgage?

The 3-7-3 rule in mortgage underwriting means that a lender should give a preliminary loan estimate within 3 days of application, the borrower has 7 days to review the closing disclosure before closing, and there’s a 3-day right of rescission period after closing for refinances.

What is the 2 2 2 rule for mortgage?

The 2-2-2 rule for mortgages isn’t a widely recognized or standard rule in the industry.

Is 40% of income on a mortgage too much?

Spending 40% of your income on a mortgage is on the higher end and can be risky. It may leave you short on funds for other necessary expenses and savings. Generally, it’s better to aim for a mortgage that consumes less of your income.

Do extra payments automatically go to principal?

Extra payments don’t automatically go to the principal unless you specify this to your lender. You’ll need to instruct your lender that additional payments should be applied toward the principal balance.

What happens if I pay an extra $200 a month on my mortgage principal?

Paying an extra $200 a month on your mortgage principal can reduce your loan term and the total interest paid. Even relatively small extra payments can have a significant impact over the life of a loan.

What happens if I pay an extra $300 a month on my 30-year mortgage?

An extra $300 a month on your 30-year mortgage can trim several years off your loan term and reduce total interest payments. The exact amount of time and interest you’ll save depends on your loan specifics.

How many years will a 2 extra mortgage payment take off?

Making two extra mortgage payments a year can potentially shave off several years from your loan period. Each extra payment directly reduces your principal, which reduces the overall interest you’ll pay and speeds up the payoff timeline.

How do I pay off a 30 year mortgage in 15 years?

To pay off a 30-year mortgage in 15 years, you could make larger monthly payments, switch to bi-weekly payments, or make extra payments specifically toward your principal. Refinancing to a 15-year loan to lock in higher payments might also help.

How to pay off a 250k mortgage in 5 years?

Paying off a $250,000 mortgage in 5 years requires much larger payments each month. This might involve drastically cutting expenses, increasing your income, and making substantial lump-sum payments whenever possible.

What is the monthly payment on a mortgage of $500000?

The monthly payment on a $500,000 mortgage will vary based on the interest rate and loan term. On a 30-year loan with a 4% interest rate, the payment could be around $2,387, not including taxes and insurance.

What income do you need for a $500000 mortgage?

For a $500,000 mortgage, the required income will depend on factors like the interest rate, your other debts, and the loan term. Using the 25% post-tax model, you’d need a post-tax monthly income of around $5,000 to support such a mortgage.

How to aggressively pay off a mortgage?

Aggressively paying off a mortgage involves making extra principal payments whenever possible, increasing your monthly payment amount, refinancing to a shorter term, or using windfalls and bonuses to make lump-sum payments.

How many years do two extra mortgage payments take off?

Two extra mortgage payments a year can accelerate your payoff by several years, depending on your loan details. Extra payments reduce the principal balance, leading to less interest accrued and a faster payoff timeline.