In the ever-evolving landscape of home financing, pinning down the best mortgage rates near me can feel like chasing a moving target. Whether you’re eyeing the keys to your first home or negotiating the refinance dance, the quest for the best rate is a journey worth taking. So, roll up your sleeves and let’s sift through the world of mortgage rates—a terrain as complex and rewarding as any property hunt.

Finding the Best Mortgage Rates Near Me: A 2024 Comprehensive Guide

The map to mortgage savings is in your hands, folks, and it’s teeming with paths and shortcuts—if you know where to look.

How to Locate the Most Attractive Mortgage Rates in Your Area

Dive into the sea of online platforms which are the ultimate fishing rods for reeling in real-time rates. Websites like Mortgage Rater offer insights on the day’s mortgage rate today to keep you in the know.

Sometimes the treasure lies where the big maps don’t show. Local credit unions and community banks may offer rates that have the big guys playing catch-up, offering a hometown advantage for those who peek through their doors.

Rate maps are not just pretty pictures; they’re snapshots of the mortgage climate, allowing you to spot where the mortgage weather is sunny with low rates or storming with high interest.

| Lender Name | Product | Interest Rate (APR) | Points | Features | Benefits |

| Home Loan Bank | 30-year Fixed | 3.75% | 0.5 | – No prepayment penalty – Online account management |

– Stable monthly payments – Lock in rate to protect against hikes |

| Local Credit Union | 15-year Fixed | 3.25% | 1.0 | – Lower rates for members – In-person support and advice |

– Pay off loan faster – Less interest paid over loan term |

| National Mortgage | 5/1 ARM | 2.99% | 0.0 | – Rate adjusts after 5 years – Rate cap for protection |

– Lower initial payments – Flexibility for future refinancing |

| Trust Lending Corp | 20-year Fixed | 3.50% | 0.25 | – Online application process – Flexible payment options |

– Less interest than 30-year loans – Own your home sooner |

| Community Bank | 30-year FHA | 3.85% | 0.75 | – Low down payment options – Available to borrowers with lower credit scores |

– Easier qualification – Government-backed |

| Digital Mortgage Co. | 7/1 ARM | 3.10% | 1.25 | – Hybrid ARM with initial fixed period – Mobile app for payment and monitoring |

– Potential for lower rates if moving before the fixed period ends |

| Savings & Loan Assoc. | 10-year Fixed | 3.40% | 0.5 | – Quicker payoff period – Fixed-rate for those planning to stay short-term |

– Build equity fast – Less total interest cost |

| Online-Only Lender | Interest-Only | 4.00% | 2.0 | – Lower initial payments – Option to only pay interest for first 5-10 years |

– Greater cash flow flexibility in early years |

Recognizing the Trends: What Shapes Mortgage Rates Around You

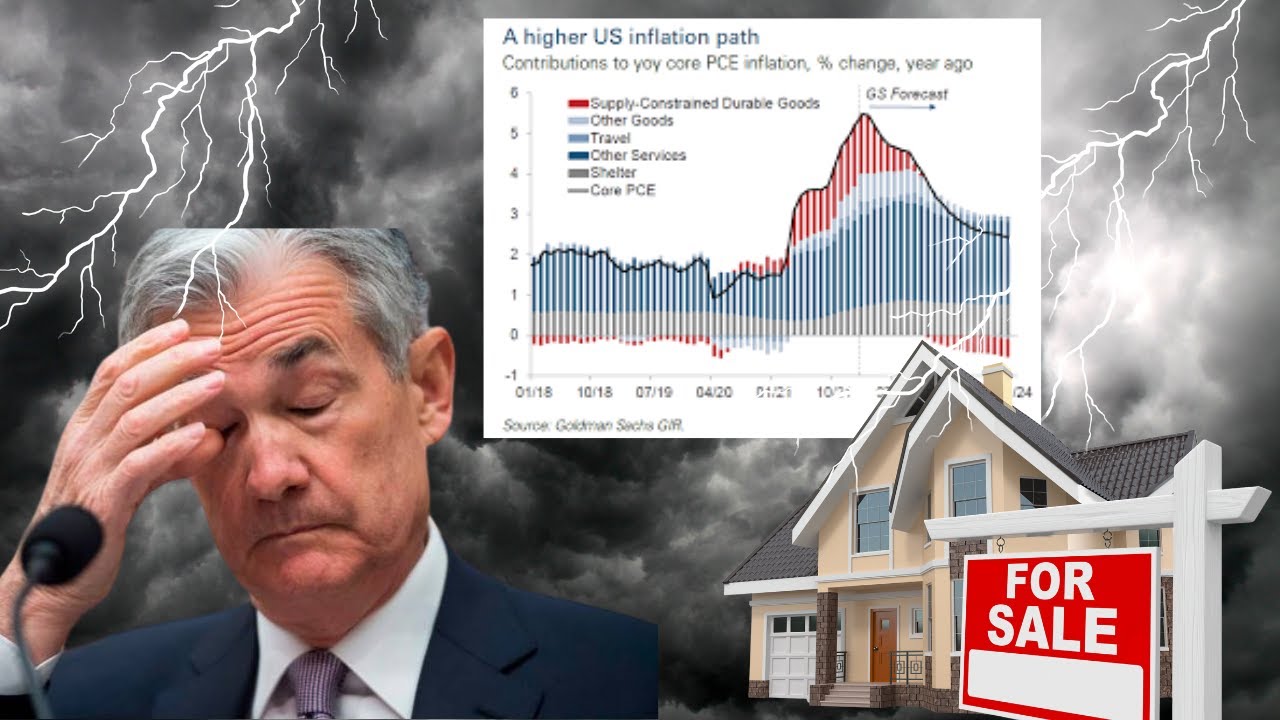

Mortgage rates today are influenced by complex factors in 2024. Your mission, should you choose to accept it, is to decode how jobs, inflation, and even global events impact the bottom line.

When the Federal Reserve tweaks policies, it’s like a game-changer in Monopoly. Understanding their strategies can ensure you’re not caught off-guard by sudden market shifts.

Your neighbourhood market has its own heartbeat, setting the rhythm for rates. A healthy, balanced market might mean better rates, while an overheated one could signal higher rates to cool things down.

The Steps to Securing a Lower Mortgage Rate Locally

Getting pre-approved is like having a VIP pass to rate negotiations. It tells sellers you mean business, and it tells lenders you’re ready to run the rate marathon.

A stellar credit score can get you to the head of the class in mortgage offers. Keep your financial report card polished to snag rates that might make others green with envy.

Who says you can’t haggle with lenders? Shopping around doesn’t just mean comparing numbers; it’s about negotiation. If you don’t ask, you don’t get.

Case Studies: The Impact of Location on Mortgage Rates

Crunched the numbers and you’ll find places where mortgage rates are as chill as the countryside or as elevated as city skylines. Certain zip codes cozy up to low rates due to economic cocktails that favor frugal financing.

Dive into why some cities, like the oft-cited example, boast historically low rates. Spoiler alert: it’s a mix of stable employment, robust growth, and sometimes just good fiscal karma.

There’s gold in them thar hills of anecdotes, where homebuyers struck it rich with low rates. Real-life victories can guide your own quest for mortgage savings glory.

A Deep Dive into Fixed-Rate Mortgages: Are They The Best Option Locally?

Fixed-rate mortgages are the comfort food of home loans—no surprises. In today’s economic weather, knowing your monthly payment will stay put can be a sigh of relief worth considering.

The likes of Wells Fargo and Quicken Loans might have fixed-rate mortgage offers that could stop traffic. Compare the best, but don’t just window shop—step in and negotiate.

Snagging the most attractive fixed rate sometimes feels like trying to catch a falling star. But stay vigilant: With the right timing and a bit of luck, you can grasp a rate that twinkles brightly for years to come.

Variable-Rate Mortgages: When Do They Make Sense in Your Market?

Variable-rate mortgages are the surfboards of the mortgage world—great when the waves (rates) are low, but you need to watch for the tide (market changes). They’re not for the faint of heart, but can be thrilling for the savvy surfer.

Chase and Bank of America don’t play hard to get—they flaunt their adjustable-rate mortgage offers like peacocks. Take a gander and see if their plumes of potential savings catch your eye.

Keeping a keen eye on market predictions for adjustable rates near you is like having a secret map to buried treasure. It pays to know the lie of the land and seascape of coming changes.

Expert Strategies to Take Advantage of Low Local Rates

An interview with the experts can be the trusty compass you need. They’ve trodden these paths many a time and can guide you through the wilds of local rate hinterlands.

Banking relationships can be just as meaningful as personal ones when they lead to rate discounts. It’s like having a friend in the rate race who’s willing to give you a leg up.

When rates are as volatile as a pot of boiling pasta, rate locks can be a safety net. Use them wisely, and you might avoid getting scalded by sudden spikes.

Technological Advancements: The Game Changer in Finding Local Mortgage Rates

These pioneers are reshaping the mortgage frontier, bringing you local rates with the click of a mouse or the tap of a screen. They’ve got the tech to make your hunt almost too easy.

Mobile apps from rocketeers like Rocket Mortgage suck the air out of old school rate comparisons. They put the power in your pocket, allowing you to swipe through options like a pro.

Stories abound of digital-native borrowers who’ve harnessed the might of mobile apps to snag rates that make the rest of us want to level up our tech game.

The Future of Mortgage Rates: Predictions and Local Market Forecasts

Expert opinions are worth their weight in gold when it comes to mortgage rate trends. Take their forecasts, mix with your own research, and gaze into your financial future.

Rates might swing like a pendulum across locales, so understanding the rhythm can keep you in sync with the best time to hit that rate sweet spot.

Being prepared is not just for scouts. Arm yourself with knowledge, and when rates shift, you’ll be ready to march to the front lines of the mortgage battleground.

Maximizing Savings While Navigating the Terrain of Local Mortgage Rates

Mortgage points aren’t just boring dots; they’re potential savings sprinkled across your loan’s lifetime. Grab those opportunities in your local market like they’re going out of style.

Strategies to cut down overall interest payments can turn your mortgage from a hulking beast into a manageable pet. Tame those rates with local know-how and save big.

Finding the best mortgage rate near you is like hitting a high note in your financial opera. The echoes of that victory can resonate through your financial future, bringing sweet harmony to your wallet.

A Smart Savers Round-Up: Cementing Your Knowledge on Local Mortgage Rates

Remember, folks, it’s a rate jungle out there, and being equipped with tricks of the trade is key to conquering it.

Never rest on your laurels—mortgage rates are as ever-changing as fashion trends. Continuous education keeps you sharp and ready to pounce on opportunities.

Like checking your smoke detector batteries, frequent rate checks and a strong credit rating are proactive measures that keep your home loan from going up in flames.

By offering a thorough examination of the complexities and strategies surrounding local mortgage rates, this article aims to equip you with the knowledge you need to find the best mortgage rates near you and maximize your savings potential. From expert advice to trend analysis, and real-life examples, homeowners and buyers can navigate this challenging landscape with confidence and financial savvy. With terms like wholesale real estate contract transforming the way buyers and sellers negotiate, and with the based on a true story cast of real-life financial stories adding depth to understanding, this guide is a treasure trove for securing your best mortgage rate in 2024. So whether you’re rocking Abercrombie Kids styles while home shopping, or discussing the latest Minecraft movie developments, this guide will ensure that finding the best “mortgage rates near me” will be a rewarding subplot in your story of financial success. And remember, chase those savings like happy Wheels Unblocked, moving fast, free, and informed into your financial future.

Exploring the Best Mortgage Rates Near Me

Well, aren’t you the savvy shopper, always on the hunt for deals that have folks going “Wow, you snagged that rate?” But before you don your detective hat to sleuth out the best mortgage rates near me, let’s sprinkle in a bit of fun trivia to lighten the mood, shall we? Now buckle up, because we’re about to dive into a world where numbers can be as exhilarating as a double-shot espresso on a Monday morning.

So, get this – while you’re checking the mortgage rate today, someone across town might have locked in a rate that’s as different as coffee and tea. Isn’t that a hoot? It’s all because rates can vary by lender, location, and just because the wind’s blowing east. Rates are a lot like fingerprints; no two are exactly the same. But that’s what makes finding “mortgage rates near me” sort of an adventure, right?

Mortgage Rates: Not Just Numbers, But Stories

Moving on to another tidbit – did you know that “mortgage” comes from the French words meaning “death pledge”? Sounds ominous, I know, but it’s actually quite the melodramatic way of saying you’re committed until it’s paid off – and no, not “til death do us part.” And if you think that’s interesting, chew on this: when you’re peeking at the mortgage rates as Of today, you’re actually looking at a number that’s influenced by the whole economy. It’s not just a rate; it’s like the pulse of the financial world!

And who could forget when everyone and their mom were refinancing because the rates had dropped lower than my grandma’s apple pie on a windowsill? If your neighbor brags about their low rate, it’s totally okay to be a bit jelly. Just hop onto your computer, and find out the mortgage rates For today because, honestly, today might just be your lucky day. Now, don’t just sit there – go on, give your future self a pat on the back for being so on top of it!

In the end, finding “mortgage rates near me” is more than just a hunt; it’s a journey through history, economics, and personal triumph. Every rate tells a story, and your mission is to find the one that leads to your happy ending. Keep those trivia gems in your pocket, and they’ll make for great conversation starters at your housewarming party. Happy rate hunting!

What lender has the lowest mortgage rates right now?

– Ah, the quest for the lowest mortgage rates, right? Well, it’s a bit of a moving target, but at this very moment, online lenders and small credit unions are duking it out for bragging rights to the title. Keep in mind that rates can vary by credit score, location, and market conditions, so grab a quote from a few different lenders to get the lay of the land!

What is a mortgage interest rate at right now?

– Currently, mortgage interest rates are doing the tango with the market, shuffling up and down regularly. To catch the most up-to-date rates, you’ve gotta check lenders’ websites or financial news outlets—like right now, for instance. But remember, those rates like to keep you on your toes!

What are typical mortgage rates now?

– “Typical” is a tricky word when it comes to mortgage rates, since they’re as unpredictable as a toddler with a marker. But, just between us, rates have been hovering around a certain percentage lately. Call it a ballpark figure. Swing by some lenders’ sites to get the latest numbers.

Are mortgage rates going down in 2024?

– Peering into the crystal ball for 2024, are we? While I’m no fortune-teller, some whispers and hunches suggest rates might decrease. But hey, take it with a grain of salt—economic forecasts change faster than fashion trends.

Are mortgage rates expected to drop?

– Expected to drop? Well, wouldn’t we all like to know! Some experts are rubbing their chins, nodding slowly, and thinking, “Maybe, just maybe.” But, as with weather forecasting, predicting mortgage rates can be a bit—if you’ll pardon the pun—hit or miss.

Are mortgage rates going to go down?

– Go down, you say? If only I had a crystal ball! Seriously though, they might—economic experts often squint at their charts and say so—but then again, they might play hard to get. It’s a tricky business, predicting rates. Sort of like trying to guess what your cat’s thinking.

Can you negotiate a better mortgage rate?

– Can you negotiate a better mortgage rate? You betcha! It’s like haggling at a flea market—only with better air conditioning. Boost your credit score, shop around, and then schmooze your lender. It’s about showing you’re the cream of the crop, financially speaking.

Which Bank has the lowest interest rate?

– As for which bank has the lowest interest rate, it’s like asking who’s got the best apple pie—it can depend on the day. Usually, online banks and credit unions strut their stuff rate-wise, but the winner’s podium changes regularly. Scour those banks—or better yet, let a comparison site do the legwork.

What is the interest rate for a 700 credit score FHA loan?

– Holding a 700 credit score? Well, hats off to you! FHA loans might tip their hats with a decent rate, though it’s not set in stone. Each lender’s got a different idea of ‘decent,’ so do a little window-shopping to see who’s offering the most bang for your buck.

Why are mortgage rates so high?

– Mortgage rates are high? Yikes! It’s often caused by economic shenanigans—like inflation having a field day, or the Federal Reserve playing hardball with interest rates. Basically, it’s a ripple effect, and unfortunately, we’re the boats.

Is a 3.75 mortgage rate good?

– A 3.75% mortgage rate? Back in the day, that was the bee’s knees! But with rates doing the cha-cha these days, you need to compare it with the current average. If it’s below that magical number, then yeah, you might just be sitting pretty!

Is it worth overpaying on your mortgage?

– Overpaying on your mortgage can be a savvy move if you’ve got cash to spare. It’s like feeding your piggy bank steroids—over time, it can seriously beef up your financial fitness by cutting down on interest payments. So if you’ve got the dough, it could be a shrewd play.

Will 2024 be a better time to buy a house?

– Buying a house in 2024 sounds like a great idea—on paper. But will it be the ‘right time’? That’s as tough to call as a game of 3D chess. Keep an eye on market trends, save a nice nest egg, and who knows, the stars might align for you.

How low will mortgage rates go in 2025?

– 2025 is a bit like the Wild West right now, but if we’re placing bets, mortgage rates could slide down or take off like a rocket. It’s a waiting game where the rules are made up and the points don’t matter—like an economic version of “Whose Line Is It Anyway?”

What will mortgage rates be in May 2024?

– May 2024? Goodness, that’s a specific date! Predicting rates is a gamble, so it’s pretty hard to pin down. Your best bet is to stay tuned to financial forecasts, and cross your fingers for a bit of that good ol’ luck.

What is the lowest 30 year fixed mortgage rate now?

– The lowest 30-year fixed mortgage rate? Now that’s a hot ticket item, and it’s always in flux. You’ll find the best rates are flaunted by competitive lenders like they’re flashing lights on a Vegas strip—just keep your eyes peeled for the latest glitzy offering.

What credit score do you need for the lowest mortgage rate?

– The golden ticket for the lowest mortgage rate usually goes to those with stellar credit—a score that’s shining brighter than the North Star. We’re talking 760 and up to get the VIP treatment, but remember, lenders have other criteria too, so keep your financial house in order.

How do I qualify for the lowest mortgage rate?

– Qualifying for the lowest mortgage rate is like making it onto a game show—you gotta have the right stuff. Start by buffing up your credit score until it gleams, then stash some serious cash for a hefty down payment, and don’t forget to document your steady income.

How to get the lowest monthly mortgage rate?

– The trick to getting the lowest monthly mortgage rate is to think like a chess master—strategic and a few moves ahead. Snagging a great rate often means beefing up your credit score, shopping lenders like it’s Black Friday, and schmoozing them with your best financial foot forward.